SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

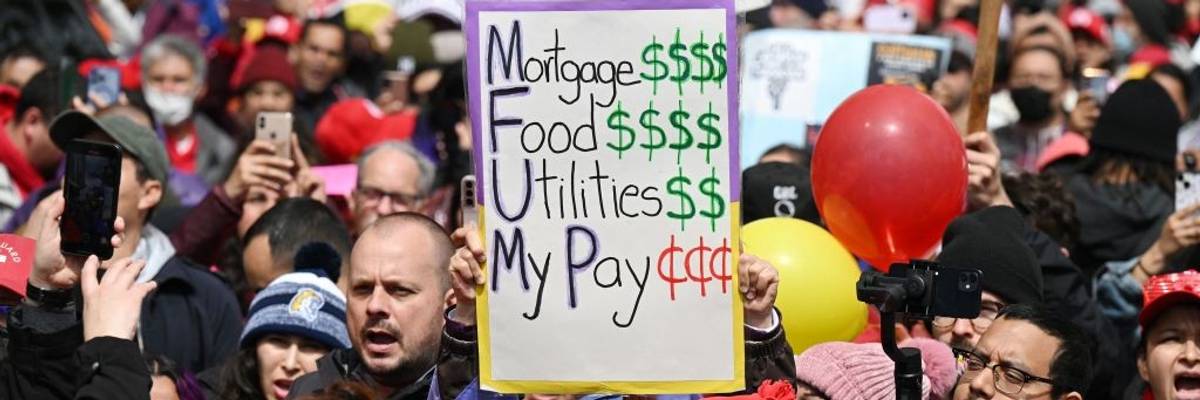

It might be wise to stop hyping how wonderful the economy is for working people who know one thing better than any so-called expert: the economic strain they and their families feel each day.

The pundits are at it again, fretting over the latest poll numbers showing that President Biden is losing in the key swing states, especially those like Michigan, Pennsylvania, and Wisconsin, with heavy concentrations of working-class voters. With inflation down, unemployment at record lows, wages up, and infrastructure projects popping up across the country, the pundits wonder why aren’t these workers thrilled with the economy?

The not-so-subtle implication is that American workers are too dumb to realize that wages are rising faster than the higher prices they see all around them. Even Robert Reich, who I truly admire and hate to call out, recently wrote in his Substack that “wages are rising for American workers,” and he means real wages—wages after taking inflation into account.

Unfortunately for workers, Reich is wrong, as are so many other pundits who keep repeating the same erroneous point.

The St. Louis Federal Reserve has the go-to database that tracks the average weekly earnings of private sector production and nonsupervisory employees. These workers make up 82.2 percent of the total U.S. full-time workforce, and 65.4 percent of all civilian employment, full and part time. If wages are going up for American workers, they should be going up for this very large segment of the working class.

But wages, after inflation, have gone down, not up, since 2020.

Let’s do the math.

The “Actual Wages” column shows the average weekly wages (from the FED data base) that workers received each year, not counting the impact of inflation.

The “Inflated Dollars” column shows those same weekly wages recalculated into April 2024 dollars. (This column is created by plugging the actual wages into the Bureau of Labor Statistics CPI Inflation Calculator.) The rate of inflation in 2020 was only 1.2 percent. In 2021, it jumped to 4.7 percent, then 8.0 percent in 2022, and 4.1 percent in 2023. It took it’s toll on the buying power of wages.

Inflated Dollars shows how much money it would take today to match what the average weekly wage could purchase back then.

For example, in December 2020, it would take $1,035.80 in today’s money to buy what $860.47 bought then. As wages go up year by year, what those wages can buy changes based on how much prices are rising (or, we wish, going down).

If wages were going up faster than inflation, then April 2024’s actual dollars earned would be greater than December 2020’s inflated dollars earned. But, in fact, the actual buying power of worker wages dropped from $1,035.80 in 2020 to $1,005.27 this past April.

Inflation is cruel. You get a raise, you have more money in your pocket, and inflation takes it away, and then some. Since the end of 2020, average weekly wages jumped by 18.8 percent—from $860.47 to $1,005.27. But for the average worker that was a mirage. In terms of buying power, which is what really matters, wages after inflation actually fell by 2.9 percent.

Hmmm. Maybe those workers who complain about inflation aren’t so dumb after all.

Unemployment is low, and new jobs are being created in record numbers, but that’s only half of the jobs story. The other half concerns layoffs, lots and lots of them, as Wall Street destroys millions of jobs to pay for stock buybacks, leveraged buyouts, and mergers.

The super-rich get richer by laying off workers and nothing is being done about it. (See Wall Street’s War on Workers for all the gory details.)

Jobs are being destroyed even in the booming high-tech sector. In 2022, according to the website Layoffs.fyi, a total of165,269 workers were laid off. In 2023, the high-tech layoffs jumped to 263,180, and so far this year another 84,060 have been let go.

Overall, Challenger, Gray & Christmas, a job search and career coaching firm, report 554,100 layoffs in the last 9 months (August 2023- April 2024). That’s a lot of unhappy workers who have gone through the hell of losing their jobs. They are not likely to praise the economy or the politicians trying to take credit for it.

It might be wise to stop hyping how wonderful the economy is for working people. Macro numbers, even when they tell a better story than the adjusted wage data, don’t cut it for workers who know that wages aren’t keeping up with prices and that losing a job is an awful experience.

This is not an argument to vote Republican. Rather it’s an argument to face up to the truth about our political and economic system. It’s rigged against working people, and they know it, even if the pundits don’t.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Les Leopold is the executive director of the Labor Institute and author of the new book, “Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It." (2024). Read more of his work on his substack here.

The pundits are at it again, fretting over the latest poll numbers showing that President Biden is losing in the key swing states, especially those like Michigan, Pennsylvania, and Wisconsin, with heavy concentrations of working-class voters. With inflation down, unemployment at record lows, wages up, and infrastructure projects popping up across the country, the pundits wonder why aren’t these workers thrilled with the economy?

The not-so-subtle implication is that American workers are too dumb to realize that wages are rising faster than the higher prices they see all around them. Even Robert Reich, who I truly admire and hate to call out, recently wrote in his Substack that “wages are rising for American workers,” and he means real wages—wages after taking inflation into account.

Unfortunately for workers, Reich is wrong, as are so many other pundits who keep repeating the same erroneous point.

The St. Louis Federal Reserve has the go-to database that tracks the average weekly earnings of private sector production and nonsupervisory employees. These workers make up 82.2 percent of the total U.S. full-time workforce, and 65.4 percent of all civilian employment, full and part time. If wages are going up for American workers, they should be going up for this very large segment of the working class.

But wages, after inflation, have gone down, not up, since 2020.

Let’s do the math.

The “Actual Wages” column shows the average weekly wages (from the FED data base) that workers received each year, not counting the impact of inflation.

The “Inflated Dollars” column shows those same weekly wages recalculated into April 2024 dollars. (This column is created by plugging the actual wages into the Bureau of Labor Statistics CPI Inflation Calculator.) The rate of inflation in 2020 was only 1.2 percent. In 2021, it jumped to 4.7 percent, then 8.0 percent in 2022, and 4.1 percent in 2023. It took it’s toll on the buying power of wages.

Inflated Dollars shows how much money it would take today to match what the average weekly wage could purchase back then.

For example, in December 2020, it would take $1,035.80 in today’s money to buy what $860.47 bought then. As wages go up year by year, what those wages can buy changes based on how much prices are rising (or, we wish, going down).

If wages were going up faster than inflation, then April 2024’s actual dollars earned would be greater than December 2020’s inflated dollars earned. But, in fact, the actual buying power of worker wages dropped from $1,035.80 in 2020 to $1,005.27 this past April.

Inflation is cruel. You get a raise, you have more money in your pocket, and inflation takes it away, and then some. Since the end of 2020, average weekly wages jumped by 18.8 percent—from $860.47 to $1,005.27. But for the average worker that was a mirage. In terms of buying power, which is what really matters, wages after inflation actually fell by 2.9 percent.

Hmmm. Maybe those workers who complain about inflation aren’t so dumb after all.

Unemployment is low, and new jobs are being created in record numbers, but that’s only half of the jobs story. The other half concerns layoffs, lots and lots of them, as Wall Street destroys millions of jobs to pay for stock buybacks, leveraged buyouts, and mergers.

The super-rich get richer by laying off workers and nothing is being done about it. (See Wall Street’s War on Workers for all the gory details.)

Jobs are being destroyed even in the booming high-tech sector. In 2022, according to the website Layoffs.fyi, a total of165,269 workers were laid off. In 2023, the high-tech layoffs jumped to 263,180, and so far this year another 84,060 have been let go.

Overall, Challenger, Gray & Christmas, a job search and career coaching firm, report 554,100 layoffs in the last 9 months (August 2023- April 2024). That’s a lot of unhappy workers who have gone through the hell of losing their jobs. They are not likely to praise the economy or the politicians trying to take credit for it.

It might be wise to stop hyping how wonderful the economy is for working people. Macro numbers, even when they tell a better story than the adjusted wage data, don’t cut it for workers who know that wages aren’t keeping up with prices and that losing a job is an awful experience.

This is not an argument to vote Republican. Rather it’s an argument to face up to the truth about our political and economic system. It’s rigged against working people, and they know it, even if the pundits don’t.

Les Leopold is the executive director of the Labor Institute and author of the new book, “Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It." (2024). Read more of his work on his substack here.

The pundits are at it again, fretting over the latest poll numbers showing that President Biden is losing in the key swing states, especially those like Michigan, Pennsylvania, and Wisconsin, with heavy concentrations of working-class voters. With inflation down, unemployment at record lows, wages up, and infrastructure projects popping up across the country, the pundits wonder why aren’t these workers thrilled with the economy?

The not-so-subtle implication is that American workers are too dumb to realize that wages are rising faster than the higher prices they see all around them. Even Robert Reich, who I truly admire and hate to call out, recently wrote in his Substack that “wages are rising for American workers,” and he means real wages—wages after taking inflation into account.

Unfortunately for workers, Reich is wrong, as are so many other pundits who keep repeating the same erroneous point.

The St. Louis Federal Reserve has the go-to database that tracks the average weekly earnings of private sector production and nonsupervisory employees. These workers make up 82.2 percent of the total U.S. full-time workforce, and 65.4 percent of all civilian employment, full and part time. If wages are going up for American workers, they should be going up for this very large segment of the working class.

But wages, after inflation, have gone down, not up, since 2020.

Let’s do the math.

The “Actual Wages” column shows the average weekly wages (from the FED data base) that workers received each year, not counting the impact of inflation.

The “Inflated Dollars” column shows those same weekly wages recalculated into April 2024 dollars. (This column is created by plugging the actual wages into the Bureau of Labor Statistics CPI Inflation Calculator.) The rate of inflation in 2020 was only 1.2 percent. In 2021, it jumped to 4.7 percent, then 8.0 percent in 2022, and 4.1 percent in 2023. It took it’s toll on the buying power of wages.

Inflated Dollars shows how much money it would take today to match what the average weekly wage could purchase back then.

For example, in December 2020, it would take $1,035.80 in today’s money to buy what $860.47 bought then. As wages go up year by year, what those wages can buy changes based on how much prices are rising (or, we wish, going down).

If wages were going up faster than inflation, then April 2024’s actual dollars earned would be greater than December 2020’s inflated dollars earned. But, in fact, the actual buying power of worker wages dropped from $1,035.80 in 2020 to $1,005.27 this past April.

Inflation is cruel. You get a raise, you have more money in your pocket, and inflation takes it away, and then some. Since the end of 2020, average weekly wages jumped by 18.8 percent—from $860.47 to $1,005.27. But for the average worker that was a mirage. In terms of buying power, which is what really matters, wages after inflation actually fell by 2.9 percent.

Hmmm. Maybe those workers who complain about inflation aren’t so dumb after all.

Unemployment is low, and new jobs are being created in record numbers, but that’s only half of the jobs story. The other half concerns layoffs, lots and lots of them, as Wall Street destroys millions of jobs to pay for stock buybacks, leveraged buyouts, and mergers.

The super-rich get richer by laying off workers and nothing is being done about it. (See Wall Street’s War on Workers for all the gory details.)

Jobs are being destroyed even in the booming high-tech sector. In 2022, according to the website Layoffs.fyi, a total of165,269 workers were laid off. In 2023, the high-tech layoffs jumped to 263,180, and so far this year another 84,060 have been let go.

Overall, Challenger, Gray & Christmas, a job search and career coaching firm, report 554,100 layoffs in the last 9 months (August 2023- April 2024). That’s a lot of unhappy workers who have gone through the hell of losing their jobs. They are not likely to praise the economy or the politicians trying to take credit for it.

It might be wise to stop hyping how wonderful the economy is for working people. Macro numbers, even when they tell a better story than the adjusted wage data, don’t cut it for workers who know that wages aren’t keeping up with prices and that losing a job is an awful experience.

This is not an argument to vote Republican. Rather it’s an argument to face up to the truth about our political and economic system. It’s rigged against working people, and they know it, even if the pundits don’t.