SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

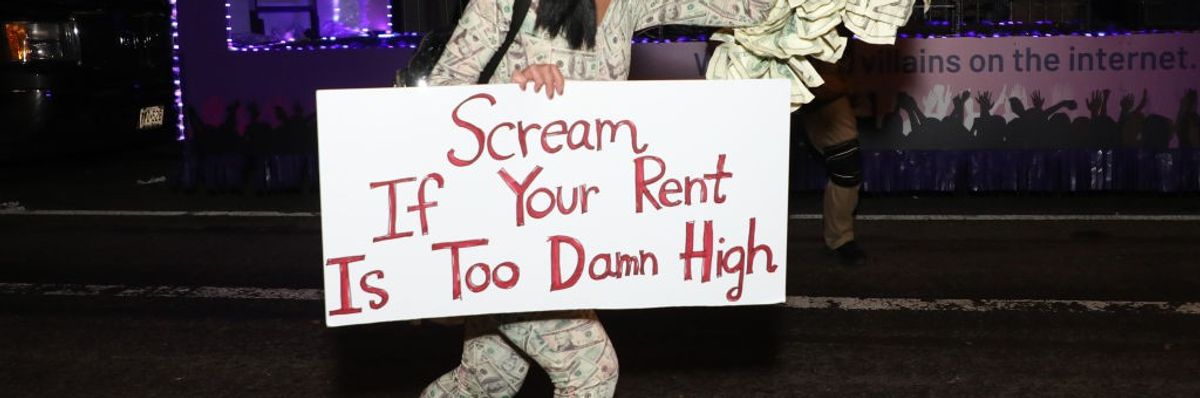

A reveler roller skates with a sign reading, “Scream If Your Rent Is Too Damn High” at the 2022 Halloween Parade on October 31, 2022, in New York City.

Millions of people simply do not make enough money to consistently afford market-rate housing.

A few weeks ago, I drove through my hometown of Indianapolis to a court session which had nearly 200 eviction cases set on the docket. On the way, I passed multiple construction projects, several of them building apartments or other housing.

Contrary to popular belief, all that construction won’t help the hundreds of families I saw facing eviction. Nor will it be of any benefit to almost any of the 13 million other households currently behind on their rent or mortgage or the 600,000 people who are homeless in this country.

You wouldn’t know that from listening to the Biden administration, state governors, and think tanks, all of whom trumpet the virtues of building more housing. The New York Times diagnoses homelessness as a simple “supply-and-demand problem.”

Schwartz and McClure put it plainly: “Nationally, there is no shortage of housing, and adding to the surplus won’t resolve the nation’s affordability problems.”

The Atlantic writes that “The Obvious Answer to Homelessness” is, you guessed it, building more housing. Earlier this summer, when tenants brought their concerns about high rents to the National Multifamily Housing Council, the largest corporate landlord lobby in the country, they too were told that their struggles to afford rising rents could be solved if we just build additional housing.

How did such a powerful consensus come together? As the saying goes, follow the money. Government subsidies and tax breaks for housing construction makes real estate developers fabulously wealthy. Banks, realtors, and corporate builders prosper from new construction, too. These industries’ fingerprints are all over the reams of reports and articles claiming that we must build our way out of the housing crisis. As Politico reported in November, “Lobbyists are scrambling to get help from Washington to goose the housing market.”

Maybe we should listen instead to the housing experts whose bank accounts don’t get a boost every time a crane goes up. Take Alex Schwartz and Kirk McClure. Schwartz, a professor at the New School, literally wrote the book on U.S. housing, Housing Policy in the United States, now in its fourth edition from Routledge Press. McClure is professor emeritus in urban planning at the University of Kansas. Like Schwartz, he is a widely-published, highly-decorated expert on housing markets.

In a recent Barron’s article, Schwartz and McClure decided to look past the housing-supply hype and crunch the numbers. Those numbers show that 21st century housing construction has produced a surplus of 3.5 million units, including a surplus in virtually every metropolitan area. New York, for example, has a quarter-million more units than are needed to house its population.

Schwartz and McClure put it plainly: “Nationally, there is no shortage of housing, and adding to the surplus won’t resolve the nation’s affordability problems.”

Past the profit-focused cacophony insisting on building more housing, Schwartz’s and McClure’s warning is being repeated by others. Allan Mallach, a senior fellow at the Center for Community Progress and the National Housing Institute, concurred in large part with Schwartz and McClure in a Shelterforce article earlier this year. While Mallach does think building modestly-priced housing will help middle-income families, he rejected out of hand the notion that housing construction will solve the crisis experienced by the very low-income people who are homeless or housing insecure.

New construction’s impact is even more limited considering that the a great deal of new housing construction is luxury priced. The idea that production of higher-end housing expands the supply in a way that allows other housing to become affordable is known as “filtering.” But, among the several reasons this theory is unsupported by evidence is that it does not account for the millions of wealthy institutions and individuals keeping units vacant in lieu of renting them for lower prices. Empty condos in cities are sometimes known as “safe deposit boxes in the sky.” They are so plentiful that, in some U.S cities, there are more vacant units than there are homeless persons.

So, if a lack of supply is not the problem, what is causing our housing crisis? Schwartz, McClure, Mallach, and others offer the straightforward explanation that is also reported annually by the National Low-Income Housing Coalition’s Out of Reach reports, which is the same explanation our clients tell us time after time: Millions of people simply do not make enough money to consistently afford market-rate housing. We routinely represent people who fell behind on rent because it amounted to 80% and more of their entire incomes from low-wage work or disability checks. As the title of a 2019 Mallach article pointed out, “Rents Will Only Go So Low, No Matter How Much We Build.”

New construction won’t fix that problem. But other approaches will, including expanded and improved public housing and rent control. (The well-documented neglect of U.S. public housing maintenance and the enormous unmet demand for subsidized units make new public housing an exception to the rule that new construction won’t help those most in need.)

Schwartz, McClure, Mallach, and others call for universal housing vouchers, a fast, straightforward remedy for the shameful fact that 3 of every 4 eligible households are blocked from transformative housing subsidies simply because we don’t fund the program adequately. Universal vouchers, featured in President Joe Biden’s 2020 campaign platform, should be an interim step on the path to social housing freed of the for-profit market. And voucher expansion must be accompanied by laws prohibiting landlords from discriminating against voucher holders.

There may be great value in boosting housing construction, including creating good-paying jobs and providing more options for middle-income households. But let’s stop pretending that it will solve the affordability crisis faced by our clients and millions of other low-income Americans.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A few weeks ago, I drove through my hometown of Indianapolis to a court session which had nearly 200 eviction cases set on the docket. On the way, I passed multiple construction projects, several of them building apartments or other housing.

Contrary to popular belief, all that construction won’t help the hundreds of families I saw facing eviction. Nor will it be of any benefit to almost any of the 13 million other households currently behind on their rent or mortgage or the 600,000 people who are homeless in this country.

You wouldn’t know that from listening to the Biden administration, state governors, and think tanks, all of whom trumpet the virtues of building more housing. The New York Times diagnoses homelessness as a simple “supply-and-demand problem.”

Schwartz and McClure put it plainly: “Nationally, there is no shortage of housing, and adding to the surplus won’t resolve the nation’s affordability problems.”

The Atlantic writes that “The Obvious Answer to Homelessness” is, you guessed it, building more housing. Earlier this summer, when tenants brought their concerns about high rents to the National Multifamily Housing Council, the largest corporate landlord lobby in the country, they too were told that their struggles to afford rising rents could be solved if we just build additional housing.

How did such a powerful consensus come together? As the saying goes, follow the money. Government subsidies and tax breaks for housing construction makes real estate developers fabulously wealthy. Banks, realtors, and corporate builders prosper from new construction, too. These industries’ fingerprints are all over the reams of reports and articles claiming that we must build our way out of the housing crisis. As Politico reported in November, “Lobbyists are scrambling to get help from Washington to goose the housing market.”

Maybe we should listen instead to the housing experts whose bank accounts don’t get a boost every time a crane goes up. Take Alex Schwartz and Kirk McClure. Schwartz, a professor at the New School, literally wrote the book on U.S. housing, Housing Policy in the United States, now in its fourth edition from Routledge Press. McClure is professor emeritus in urban planning at the University of Kansas. Like Schwartz, he is a widely-published, highly-decorated expert on housing markets.

In a recent Barron’s article, Schwartz and McClure decided to look past the housing-supply hype and crunch the numbers. Those numbers show that 21st century housing construction has produced a surplus of 3.5 million units, including a surplus in virtually every metropolitan area. New York, for example, has a quarter-million more units than are needed to house its population.

Schwartz and McClure put it plainly: “Nationally, there is no shortage of housing, and adding to the surplus won’t resolve the nation’s affordability problems.”

Past the profit-focused cacophony insisting on building more housing, Schwartz’s and McClure’s warning is being repeated by others. Allan Mallach, a senior fellow at the Center for Community Progress and the National Housing Institute, concurred in large part with Schwartz and McClure in a Shelterforce article earlier this year. While Mallach does think building modestly-priced housing will help middle-income families, he rejected out of hand the notion that housing construction will solve the crisis experienced by the very low-income people who are homeless or housing insecure.

New construction’s impact is even more limited considering that the a great deal of new housing construction is luxury priced. The idea that production of higher-end housing expands the supply in a way that allows other housing to become affordable is known as “filtering.” But, among the several reasons this theory is unsupported by evidence is that it does not account for the millions of wealthy institutions and individuals keeping units vacant in lieu of renting them for lower prices. Empty condos in cities are sometimes known as “safe deposit boxes in the sky.” They are so plentiful that, in some U.S cities, there are more vacant units than there are homeless persons.

So, if a lack of supply is not the problem, what is causing our housing crisis? Schwartz, McClure, Mallach, and others offer the straightforward explanation that is also reported annually by the National Low-Income Housing Coalition’s Out of Reach reports, which is the same explanation our clients tell us time after time: Millions of people simply do not make enough money to consistently afford market-rate housing. We routinely represent people who fell behind on rent because it amounted to 80% and more of their entire incomes from low-wage work or disability checks. As the title of a 2019 Mallach article pointed out, “Rents Will Only Go So Low, No Matter How Much We Build.”

New construction won’t fix that problem. But other approaches will, including expanded and improved public housing and rent control. (The well-documented neglect of U.S. public housing maintenance and the enormous unmet demand for subsidized units make new public housing an exception to the rule that new construction won’t help those most in need.)

Schwartz, McClure, Mallach, and others call for universal housing vouchers, a fast, straightforward remedy for the shameful fact that 3 of every 4 eligible households are blocked from transformative housing subsidies simply because we don’t fund the program adequately. Universal vouchers, featured in President Joe Biden’s 2020 campaign platform, should be an interim step on the path to social housing freed of the for-profit market. And voucher expansion must be accompanied by laws prohibiting landlords from discriminating against voucher holders.

There may be great value in boosting housing construction, including creating good-paying jobs and providing more options for middle-income households. But let’s stop pretending that it will solve the affordability crisis faced by our clients and millions of other low-income Americans.

A few weeks ago, I drove through my hometown of Indianapolis to a court session which had nearly 200 eviction cases set on the docket. On the way, I passed multiple construction projects, several of them building apartments or other housing.

Contrary to popular belief, all that construction won’t help the hundreds of families I saw facing eviction. Nor will it be of any benefit to almost any of the 13 million other households currently behind on their rent or mortgage or the 600,000 people who are homeless in this country.

You wouldn’t know that from listening to the Biden administration, state governors, and think tanks, all of whom trumpet the virtues of building more housing. The New York Times diagnoses homelessness as a simple “supply-and-demand problem.”

Schwartz and McClure put it plainly: “Nationally, there is no shortage of housing, and adding to the surplus won’t resolve the nation’s affordability problems.”

The Atlantic writes that “The Obvious Answer to Homelessness” is, you guessed it, building more housing. Earlier this summer, when tenants brought their concerns about high rents to the National Multifamily Housing Council, the largest corporate landlord lobby in the country, they too were told that their struggles to afford rising rents could be solved if we just build additional housing.

How did such a powerful consensus come together? As the saying goes, follow the money. Government subsidies and tax breaks for housing construction makes real estate developers fabulously wealthy. Banks, realtors, and corporate builders prosper from new construction, too. These industries’ fingerprints are all over the reams of reports and articles claiming that we must build our way out of the housing crisis. As Politico reported in November, “Lobbyists are scrambling to get help from Washington to goose the housing market.”

Maybe we should listen instead to the housing experts whose bank accounts don’t get a boost every time a crane goes up. Take Alex Schwartz and Kirk McClure. Schwartz, a professor at the New School, literally wrote the book on U.S. housing, Housing Policy in the United States, now in its fourth edition from Routledge Press. McClure is professor emeritus in urban planning at the University of Kansas. Like Schwartz, he is a widely-published, highly-decorated expert on housing markets.

In a recent Barron’s article, Schwartz and McClure decided to look past the housing-supply hype and crunch the numbers. Those numbers show that 21st century housing construction has produced a surplus of 3.5 million units, including a surplus in virtually every metropolitan area. New York, for example, has a quarter-million more units than are needed to house its population.

Schwartz and McClure put it plainly: “Nationally, there is no shortage of housing, and adding to the surplus won’t resolve the nation’s affordability problems.”

Past the profit-focused cacophony insisting on building more housing, Schwartz’s and McClure’s warning is being repeated by others. Allan Mallach, a senior fellow at the Center for Community Progress and the National Housing Institute, concurred in large part with Schwartz and McClure in a Shelterforce article earlier this year. While Mallach does think building modestly-priced housing will help middle-income families, he rejected out of hand the notion that housing construction will solve the crisis experienced by the very low-income people who are homeless or housing insecure.

New construction’s impact is even more limited considering that the a great deal of new housing construction is luxury priced. The idea that production of higher-end housing expands the supply in a way that allows other housing to become affordable is known as “filtering.” But, among the several reasons this theory is unsupported by evidence is that it does not account for the millions of wealthy institutions and individuals keeping units vacant in lieu of renting them for lower prices. Empty condos in cities are sometimes known as “safe deposit boxes in the sky.” They are so plentiful that, in some U.S cities, there are more vacant units than there are homeless persons.

So, if a lack of supply is not the problem, what is causing our housing crisis? Schwartz, McClure, Mallach, and others offer the straightforward explanation that is also reported annually by the National Low-Income Housing Coalition’s Out of Reach reports, which is the same explanation our clients tell us time after time: Millions of people simply do not make enough money to consistently afford market-rate housing. We routinely represent people who fell behind on rent because it amounted to 80% and more of their entire incomes from low-wage work or disability checks. As the title of a 2019 Mallach article pointed out, “Rents Will Only Go So Low, No Matter How Much We Build.”

New construction won’t fix that problem. But other approaches will, including expanded and improved public housing and rent control. (The well-documented neglect of U.S. public housing maintenance and the enormous unmet demand for subsidized units make new public housing an exception to the rule that new construction won’t help those most in need.)

Schwartz, McClure, Mallach, and others call for universal housing vouchers, a fast, straightforward remedy for the shameful fact that 3 of every 4 eligible households are blocked from transformative housing subsidies simply because we don’t fund the program adequately. Universal vouchers, featured in President Joe Biden’s 2020 campaign platform, should be an interim step on the path to social housing freed of the for-profit market. And voucher expansion must be accompanied by laws prohibiting landlords from discriminating against voucher holders.

There may be great value in boosting housing construction, including creating good-paying jobs and providing more options for middle-income households. But let’s stop pretending that it will solve the affordability crisis faced by our clients and millions of other low-income Americans.