SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Protesters are pictured spelling out #TaxTheRich at Times Square on March 4, 2021.

Lawmakers seeking fair tax systems based on the ability to pay have many options.

While many state lawmakers have spent the past few years debating deep and damaging tax cuts that disproportionately help the rich, more forward-thinking lawmakers have improved tax equity by raising new revenue from the well-off and creating or expanding refundable tax credits for low- and moderate-income families.

Many of these positive developments are quantified in the appendices of the Institute on Taxation and Economic Policy’s (ITEP) recent Who Pays? report, where we created alternative analyses to show the distribution of a state’s tax system before and after certain policy changes.

As the transformations below illustrate, upside-down state and local tax codes are not a given. Lawmakers seeking equitable tax systems based on the ability to pay have many options.

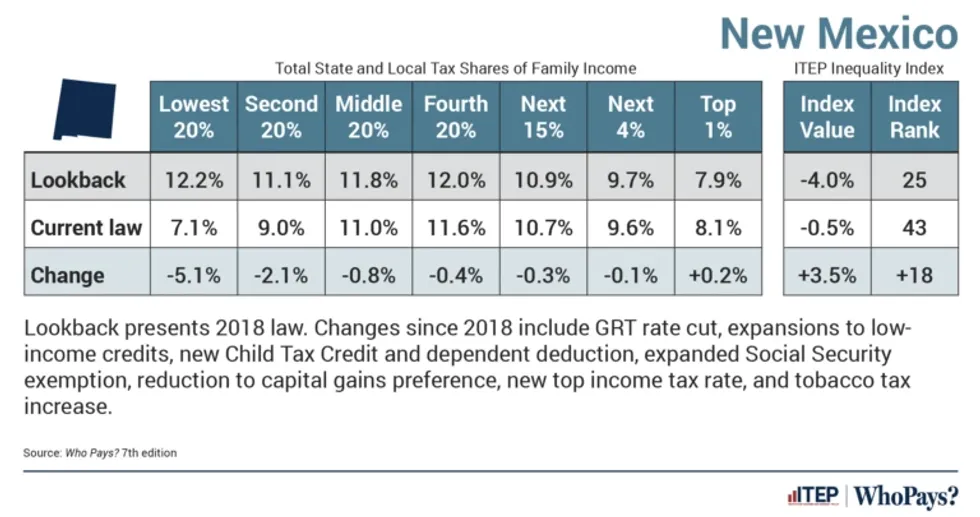

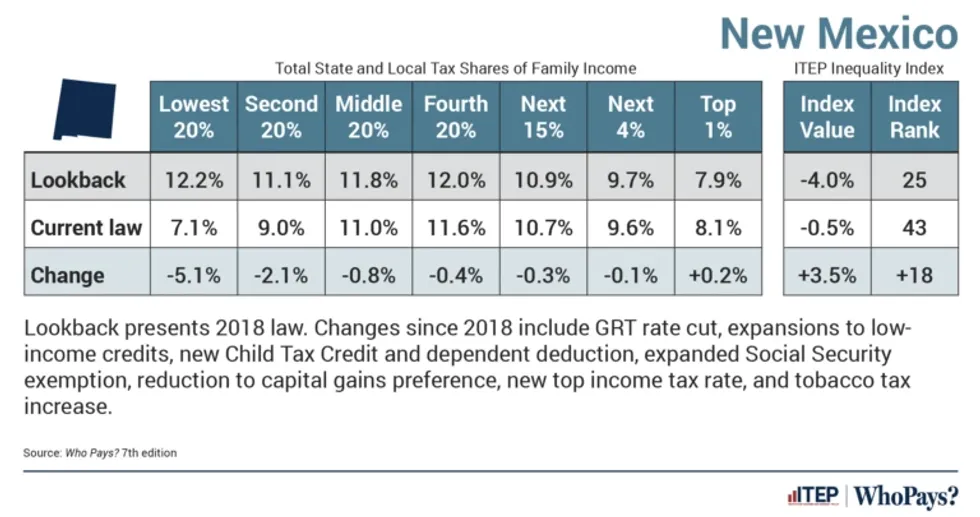

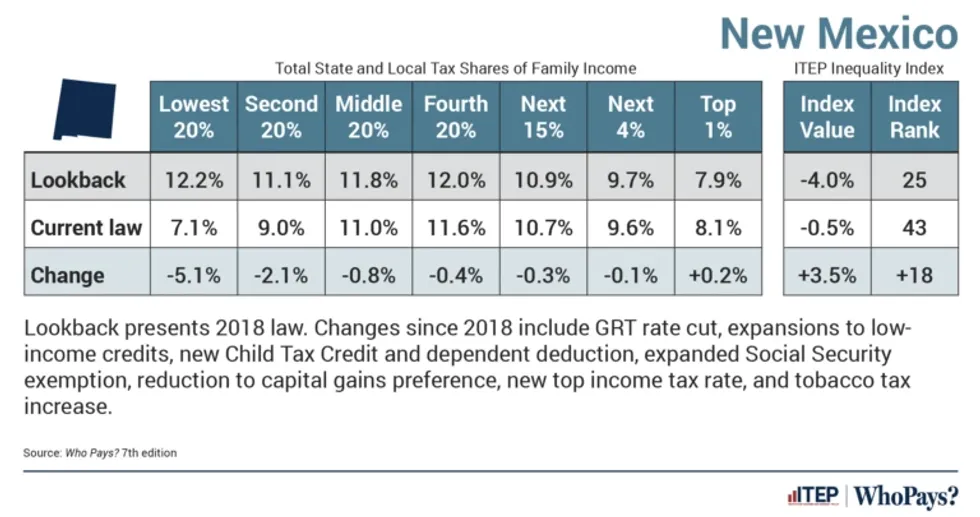

Tax changes made in New Mexico since 2018 led the state to jump 18 spots in ITEP’s Tax Inequality Index to the No. 9 least regressive tax code, the biggest positive change of all the states. These policy changes included the expansion of low-income credits like the Earned Income Tax Credit, the creation of a new Child Tax Credit, and tax increases on investment income and high-earning residents. Without those and other changes made since 2018, New Mexico would currently have the 25th most regressive tax system in the country.

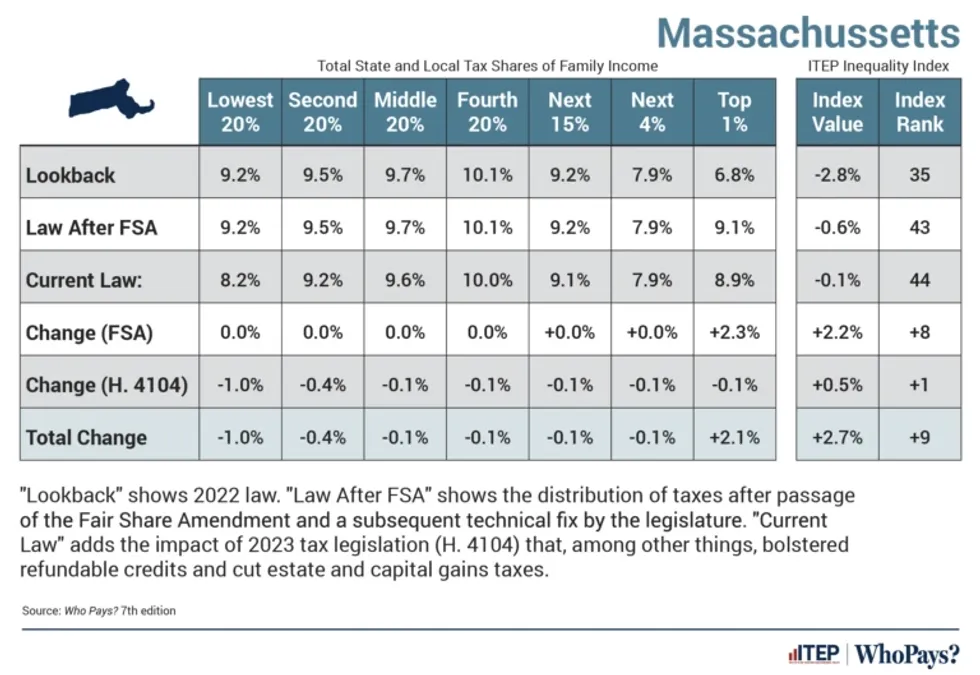

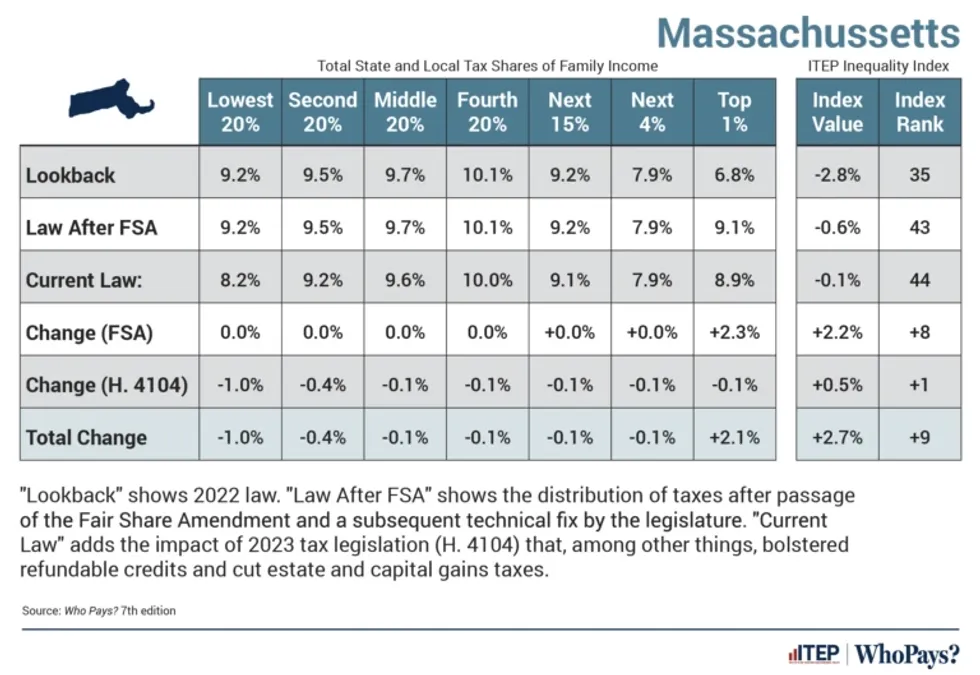

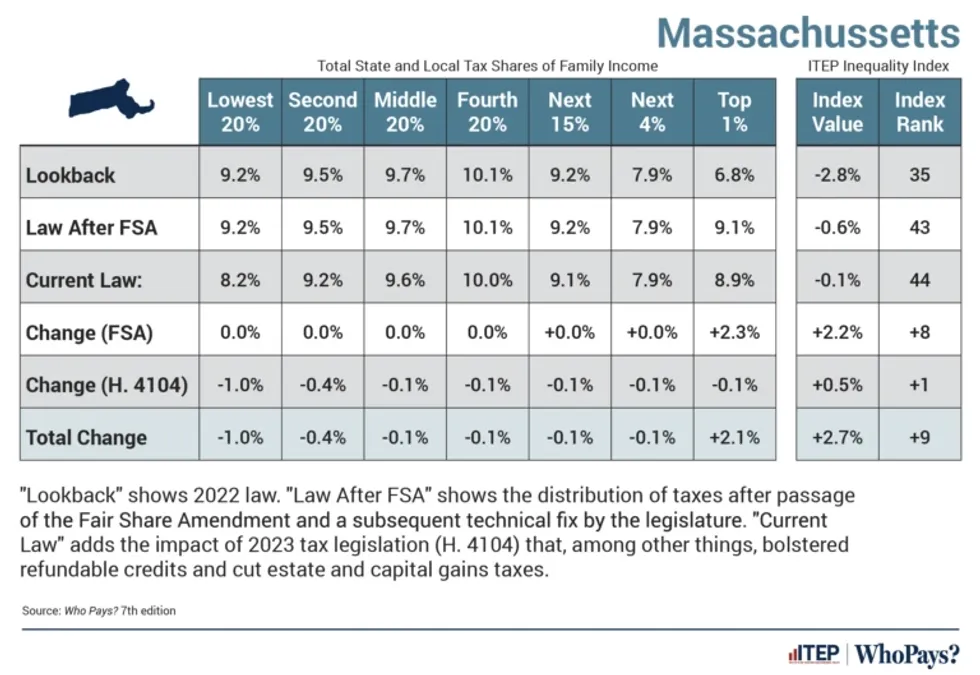

Tax changes made in Massachusetts since 2022 led the state to jump nine spots in ITEP’s Tax Inequality Index to the No. 8 least regressive tax system. These policy changes included 2022 voter approval of the Fair Share Amendment, which created a 4% surcharge on income over $1 million to fund education and transportation projects, as well as legislation in 2023 that among other things, bolstered the state’s refundable credits (which improved equity) and cut estate and capital gains taxes (which detracted from equity but not enough to erase the impact of the other equity-increasing policies). Without all these changes, Massachusetts would currently have the 35th most regressive tax code in the country.

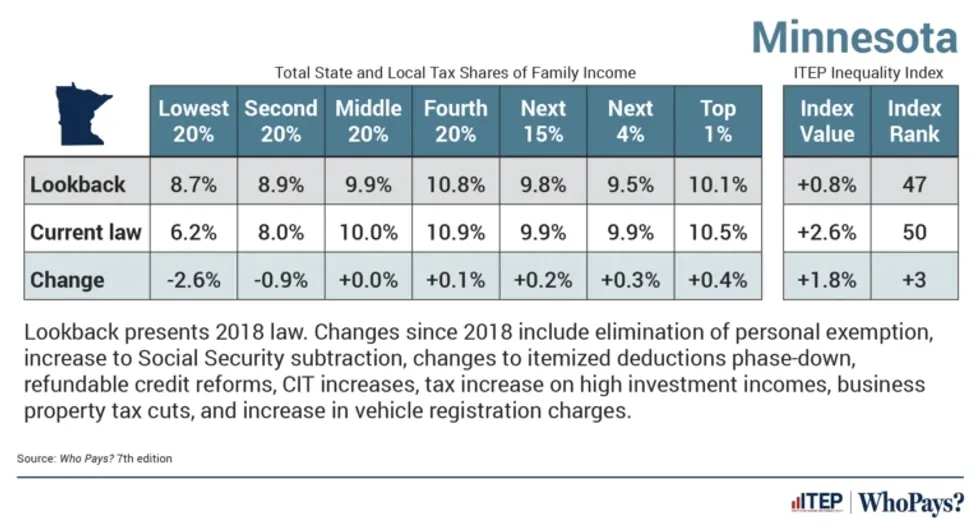

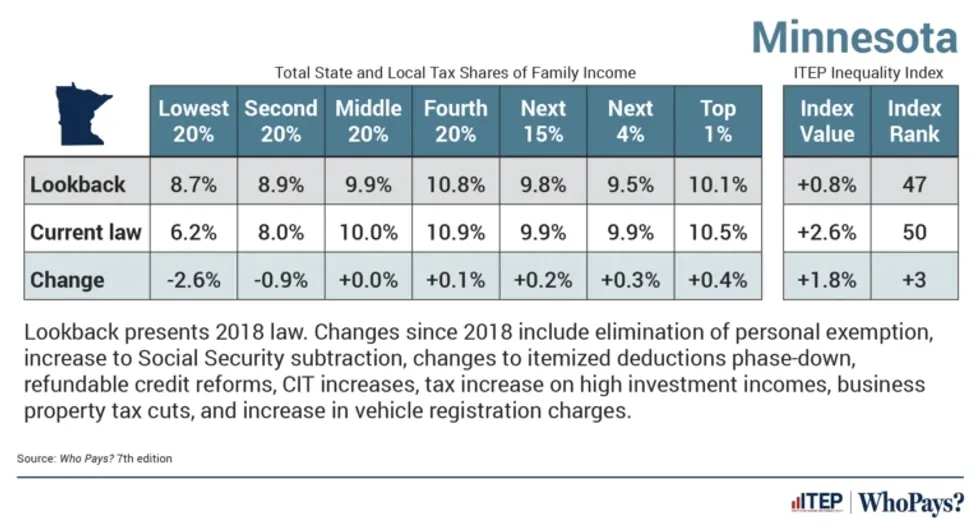

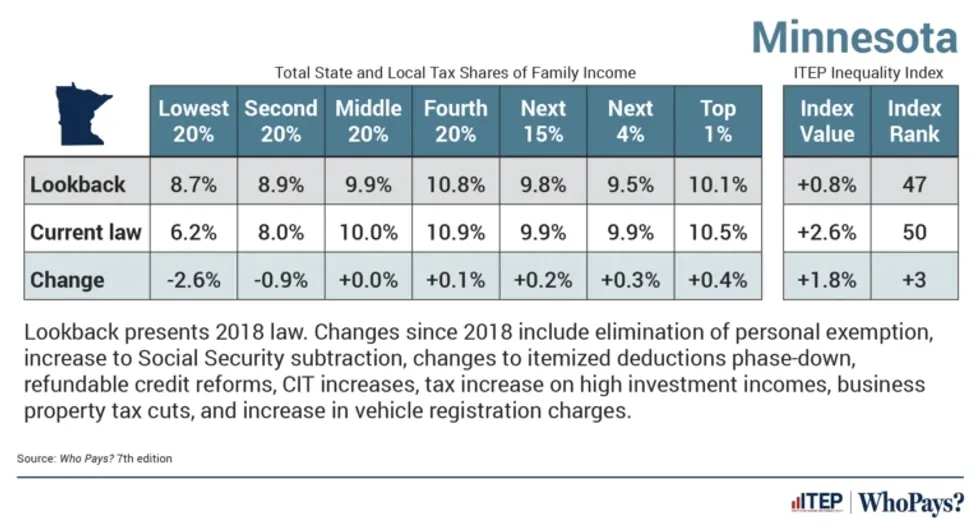

Minnesota was already a national leader on tax fairness. But tax changes made in Minnesota since 2018 led the state to rise three spots in ITEP’s Tax Inequality Index to the No. 2 least regressive tax code, behind only Washington, D.C. These policy changes included the creation of a new, robust Child Tax Credit coupled with tax increases on high investment incomes and some corporations. Without these and other changes made since 2018, Minnesota would currently have the No. 5 least regressive tax system in the country.

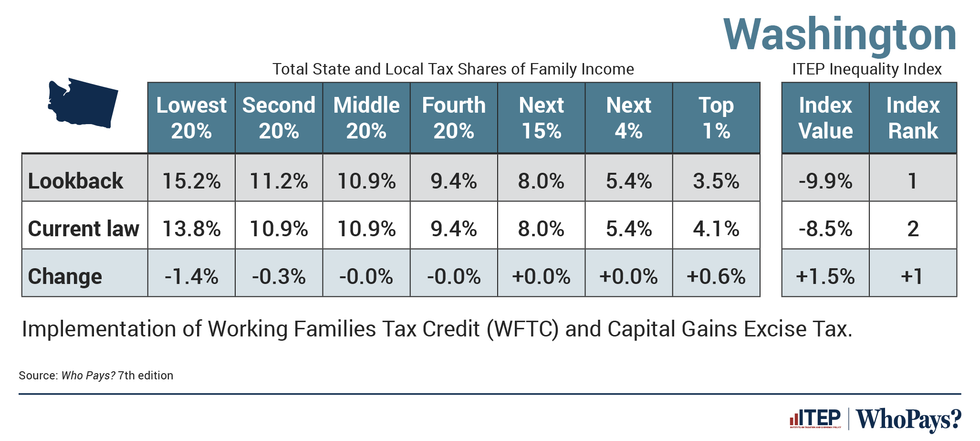

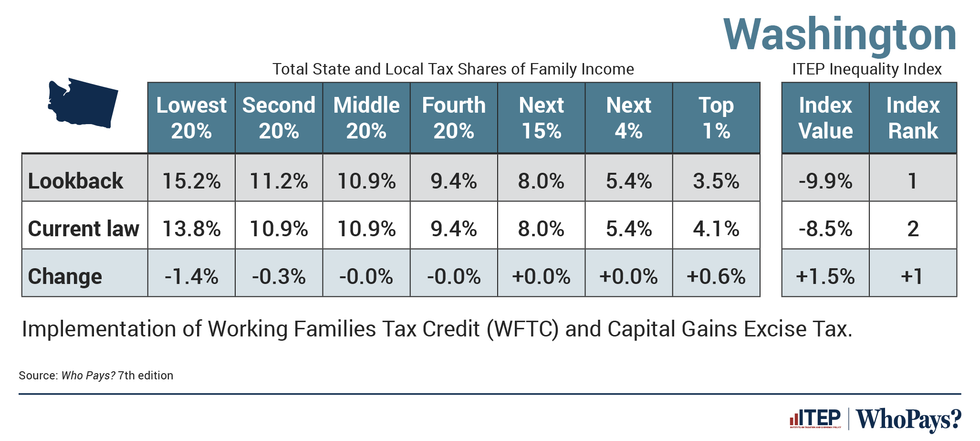

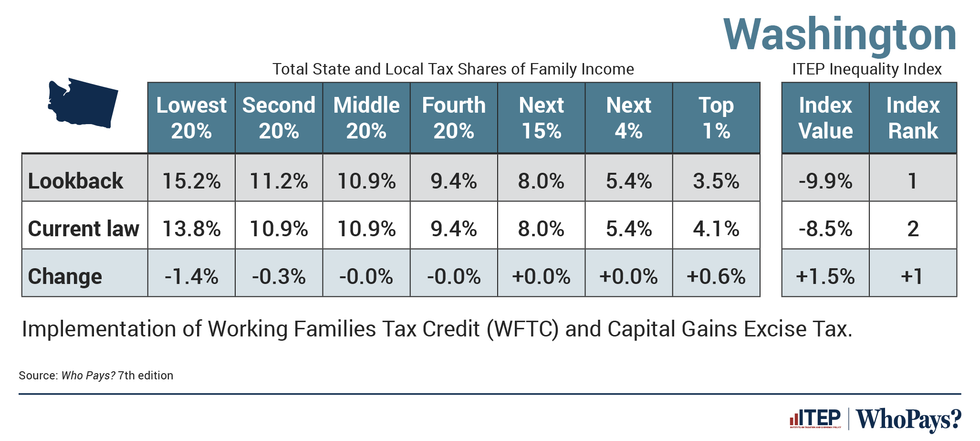

Washington had long been home to the most regressive tax code in the nation due to its lack of an income tax and heavy reliance on sales and excise taxes. But changes made by state lawmakers in the past few years helped Washington shed that dubious distinction and rise one spot on ITEP’s Tax Inequality Index. The state now has the No. 2 most regressive tax system in the country. The small but important move up the rankings was driven by two policy changes: the creation of the state’s Working Families Tax Credit, which functions much like an Earned Income Tax Credit, and the creation of a new Capital Gains Excise Tax.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

While many state lawmakers have spent the past few years debating deep and damaging tax cuts that disproportionately help the rich, more forward-thinking lawmakers have improved tax equity by raising new revenue from the well-off and creating or expanding refundable tax credits for low- and moderate-income families.

Many of these positive developments are quantified in the appendices of the Institute on Taxation and Economic Policy’s (ITEP) recent Who Pays? report, where we created alternative analyses to show the distribution of a state’s tax system before and after certain policy changes.

As the transformations below illustrate, upside-down state and local tax codes are not a given. Lawmakers seeking equitable tax systems based on the ability to pay have many options.

Tax changes made in New Mexico since 2018 led the state to jump 18 spots in ITEP’s Tax Inequality Index to the No. 9 least regressive tax code, the biggest positive change of all the states. These policy changes included the expansion of low-income credits like the Earned Income Tax Credit, the creation of a new Child Tax Credit, and tax increases on investment income and high-earning residents. Without those and other changes made since 2018, New Mexico would currently have the 25th most regressive tax system in the country.

Tax changes made in Massachusetts since 2022 led the state to jump nine spots in ITEP’s Tax Inequality Index to the No. 8 least regressive tax system. These policy changes included 2022 voter approval of the Fair Share Amendment, which created a 4% surcharge on income over $1 million to fund education and transportation projects, as well as legislation in 2023 that among other things, bolstered the state’s refundable credits (which improved equity) and cut estate and capital gains taxes (which detracted from equity but not enough to erase the impact of the other equity-increasing policies). Without all these changes, Massachusetts would currently have the 35th most regressive tax code in the country.

Minnesota was already a national leader on tax fairness. But tax changes made in Minnesota since 2018 led the state to rise three spots in ITEP’s Tax Inequality Index to the No. 2 least regressive tax code, behind only Washington, D.C. These policy changes included the creation of a new, robust Child Tax Credit coupled with tax increases on high investment incomes and some corporations. Without these and other changes made since 2018, Minnesota would currently have the No. 5 least regressive tax system in the country.

Washington had long been home to the most regressive tax code in the nation due to its lack of an income tax and heavy reliance on sales and excise taxes. But changes made by state lawmakers in the past few years helped Washington shed that dubious distinction and rise one spot on ITEP’s Tax Inequality Index. The state now has the No. 2 most regressive tax system in the country. The small but important move up the rankings was driven by two policy changes: the creation of the state’s Working Families Tax Credit, which functions much like an Earned Income Tax Credit, and the creation of a new Capital Gains Excise Tax.

While many state lawmakers have spent the past few years debating deep and damaging tax cuts that disproportionately help the rich, more forward-thinking lawmakers have improved tax equity by raising new revenue from the well-off and creating or expanding refundable tax credits for low- and moderate-income families.

Many of these positive developments are quantified in the appendices of the Institute on Taxation and Economic Policy’s (ITEP) recent Who Pays? report, where we created alternative analyses to show the distribution of a state’s tax system before and after certain policy changes.

As the transformations below illustrate, upside-down state and local tax codes are not a given. Lawmakers seeking equitable tax systems based on the ability to pay have many options.

Tax changes made in New Mexico since 2018 led the state to jump 18 spots in ITEP’s Tax Inequality Index to the No. 9 least regressive tax code, the biggest positive change of all the states. These policy changes included the expansion of low-income credits like the Earned Income Tax Credit, the creation of a new Child Tax Credit, and tax increases on investment income and high-earning residents. Without those and other changes made since 2018, New Mexico would currently have the 25th most regressive tax system in the country.

Tax changes made in Massachusetts since 2022 led the state to jump nine spots in ITEP’s Tax Inequality Index to the No. 8 least regressive tax system. These policy changes included 2022 voter approval of the Fair Share Amendment, which created a 4% surcharge on income over $1 million to fund education and transportation projects, as well as legislation in 2023 that among other things, bolstered the state’s refundable credits (which improved equity) and cut estate and capital gains taxes (which detracted from equity but not enough to erase the impact of the other equity-increasing policies). Without all these changes, Massachusetts would currently have the 35th most regressive tax code in the country.

Minnesota was already a national leader on tax fairness. But tax changes made in Minnesota since 2018 led the state to rise three spots in ITEP’s Tax Inequality Index to the No. 2 least regressive tax code, behind only Washington, D.C. These policy changes included the creation of a new, robust Child Tax Credit coupled with tax increases on high investment incomes and some corporations. Without these and other changes made since 2018, Minnesota would currently have the No. 5 least regressive tax system in the country.

Washington had long been home to the most regressive tax code in the nation due to its lack of an income tax and heavy reliance on sales and excise taxes. But changes made by state lawmakers in the past few years helped Washington shed that dubious distinction and rise one spot on ITEP’s Tax Inequality Index. The state now has the No. 2 most regressive tax system in the country. The small but important move up the rankings was driven by two policy changes: the creation of the state’s Working Families Tax Credit, which functions much like an Earned Income Tax Credit, and the creation of a new Capital Gains Excise Tax.