September, 12 2012, 03:08pm EDT

For Immediate Release

Contact:

Michelle Bazie,202-408-1080,bazie@cbpp.org

Statement of Robert Greenstein, President, on Census' 2011 Poverty, Income, and Health Insurance Data

Today's Census data contained the good, the fair, and the ugly. The good news is that the number of uninsured Americans dropped by 1.3 million and the share of Americans without insurance fell by more than in any year since 1999; the fair news is that the poverty rate stayed flat after rising in the previous three years and seven of the previous 10; and the ugly news is that median household income fell by 1.5 percent after adjusting for inflation while income inequality widened significantly.

WASHINGTON

Today's Census data contained the good, the fair, and the ugly. The good news is that the number of uninsured Americans dropped by 1.3 million and the share of Americans without insurance fell by more than in any year since 1999; the fair news is that the poverty rate stayed flat after rising in the previous three years and seven of the previous 10; and the ugly news is that median household income fell by 1.5 percent after adjusting for inflation while income inequality widened significantly.

The drop in income of the median household -- the household exactly in the middle of the income distribution -- was tied to a substantial rise in income inequality. Put simply, household incomes fell in the middle and rose at the top as income gains from the economic recovery were very unevenly shared. For the 20 percent of households in the middle, average household income fell 1.7 percent, or $876. For the top 20 percent, average income rose 1.9 percent, or $3,286. For the top 5 percent of households, average income rose 5.1 percent, or $15,184. Incomes fell for the bottom four fifths of American households, while rising only for the top fifth.

Economic Improvement and Unemployment Insurance Benefit Declines Offset Each Other, Leaving Poverty Flat

The Census data indicate that modest but significant improvement in the economy put downward pressure on poverty, while a large drop in unemployment insurance (UI) benefits that substantially exceeded the decline in unemployment exerted upward pressure.

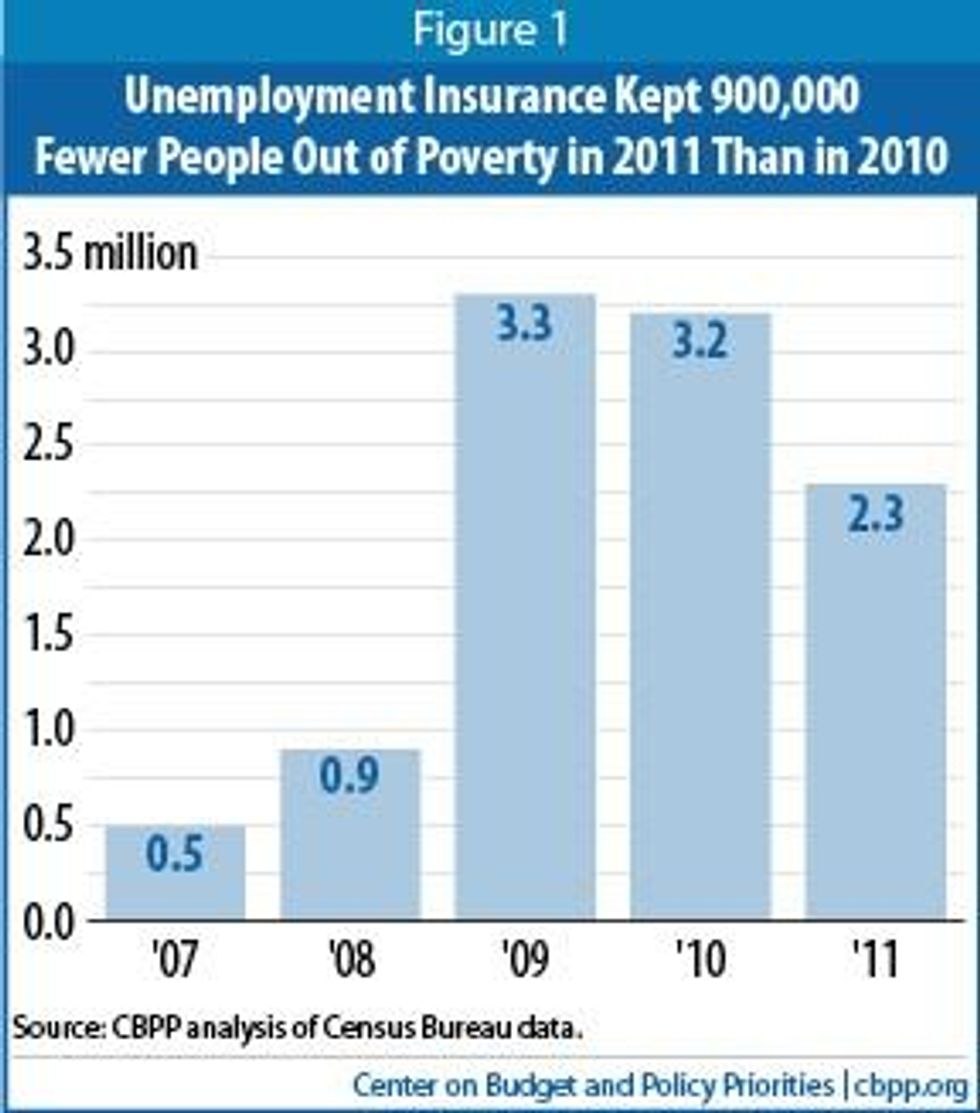

UI income fell by $36 billion -- about a quarter -- in 2011, while the number of unemployed workers fell 7 percent and the number of long-term unemployed (those out of work for over half a year and still looking for a job) fell 6 percent. The Census data show that UI benefits lifted 3.2 million Americans out of poverty in 2010, but 2.3 million in 2011 -- a reduction of more than one-fourth (see Figure 1).

UI benefits fell because a temporary benefit increase from 2009 expired, many jobless Americans exhausted their benefits before they found jobs, and (on a positive note) the unemployment rate edged down. The large decline in UI benefit income, combined with the slow recovery, meant lower incomes for many families with workers who still couldn't find employment. The Census data released today suggest that the UI decline added 0.3 percentage points to the poverty rate last year.

The economy showed modest improvement in 2011, with an increase of 1.7 percent or 1.9 million in the number of private-sector jobs, although average weekly wages for nonsupervisory workers edged down by 0.3 percent after adjusting for inflation. These gains and their impact in easing poverty were reduced, however, by the loss of 386,000 public-sector jobs, primarily at the local and state level, as well as by the decline in UI income. (The shrinkage in state and local government jobs included the loss of 110,000 jobs for teachers and other school employees.)

These data suggest that in the absence of the disproportionate decline in UI benefits and loss of state and local government jobs, poverty likely would have fallen modestly in 2011.

The data do show statistically significant declines in poverty for some groups. Poverty fell for Hispanics (from 26.5 percent in 2010 to 25.3 percent in 2011) and for men (from 14.0 percent to 13.6 percent). Poverty also fell in the South (from 16.8 percent to 16.0 percent) and in the suburbs (from 11.9 percent to 11.3 percent). The poverty rate remained statistically unchanged for most other groups and regions.

Gains in Health Insurance Coverage

The main positive news in today's report is the fall in the share of Americans who are uninsured, from 16.3 percent in 2010 to 15.7 percent in 2011, the largest annual improvement since 1999. That improvement was driven in part by gains in coverage among young adults, which appear largely due to a provision of the health reform law allowing them to remain on their parent's health plan until they reach age 26. Forty percent of the decline in the number of uninsured people came among individuals aged 19-25. Some 539,000 fewer 19-25-year-olds were uninsured in 2011 than in 2010.

Largely because more young adults were covered under their parents' employer-based health plans, the overall percentage of non-elderly people with private coverage remained steady, rather than declining, for the first time in 10 years. Private coverage rose among those under 25 while falling among those aged 25-64, with the two effects offsetting each other.

The improvement in health coverage reflected, as well, a significant increase in the number and percentage of Americans with public health insurance -- principally through Medicare, Medicaid, or the Children's Health Insurance Program (CHIP). More people became eligible for these programs as the population aged and employer-based coverage continued to erode among those aged 25-64. A requirement of health reform that states maintain their Medicaid and CHIP eligibility levels and enrollment procedures also played a role.

Much larger reductions in the number of uninsured are expected in 2014, when the major coverage expansions of health reform take effect. The Congressional Budget Office estimates that, eventually, 30 million people who otherwise would be uninsured will gain coverage as a result of health reform.

Poverty Looking Backward and Forward

The continuing high level of poverty continues a trend that dates back to the unusually weak economic recovery that started in 2001. That recovery, which lasted until the Great Recession began in late 2007, marked the first sustained expansion on record in which growth was so weak, and income gains so unevenly shared, that poverty was higher by the end of it than at the beginning. (See Figure 2.)

The poverty rate is likely to start falling in 2012. Key labor market data -- particularly the strength of private, non-farm job creation and the drop in the number of unemployed workers -- are more positive so far in 2012 than they were in 2011.

Nevertheless, falling UI payments could place upward pressure on poverty again in 2012 -- and especially in 2013, depending on actions that policymakers take in coming months. The new Census data on the role of UI benefits in reducing poverty underscore the importance of action to prevent federal UI benefits from ending entirely less than four months from now, on December 31 -- as they will if policymakers do not act. At no time since 1958, when policymakers first created federal UI benefits, have policymakers allowed such benefits to expire when the unemployment rate remained above 7.2 percent.

Today's data also underscore the need for those at the top to share in the sacrifices that lie ahead, as the nation moves to address unhealthy mid-term and long-term deficits. Given the need for substantial sacrifice and the skewing of income gains to those at the top, it is difficult to justify extending the rather lavish tax cuts for high-income individuals that policymakers enacted in 2001 and 2003, which average $129,000 a year for people who make over $1 million a year, according to the Urban-Brookings Tax Policy Center.

Impact of the Safety Net

As noted, the Census data show that UI kept 2.3 million people above the poverty line last year. Social Security kept 21.4 million people out of poverty.

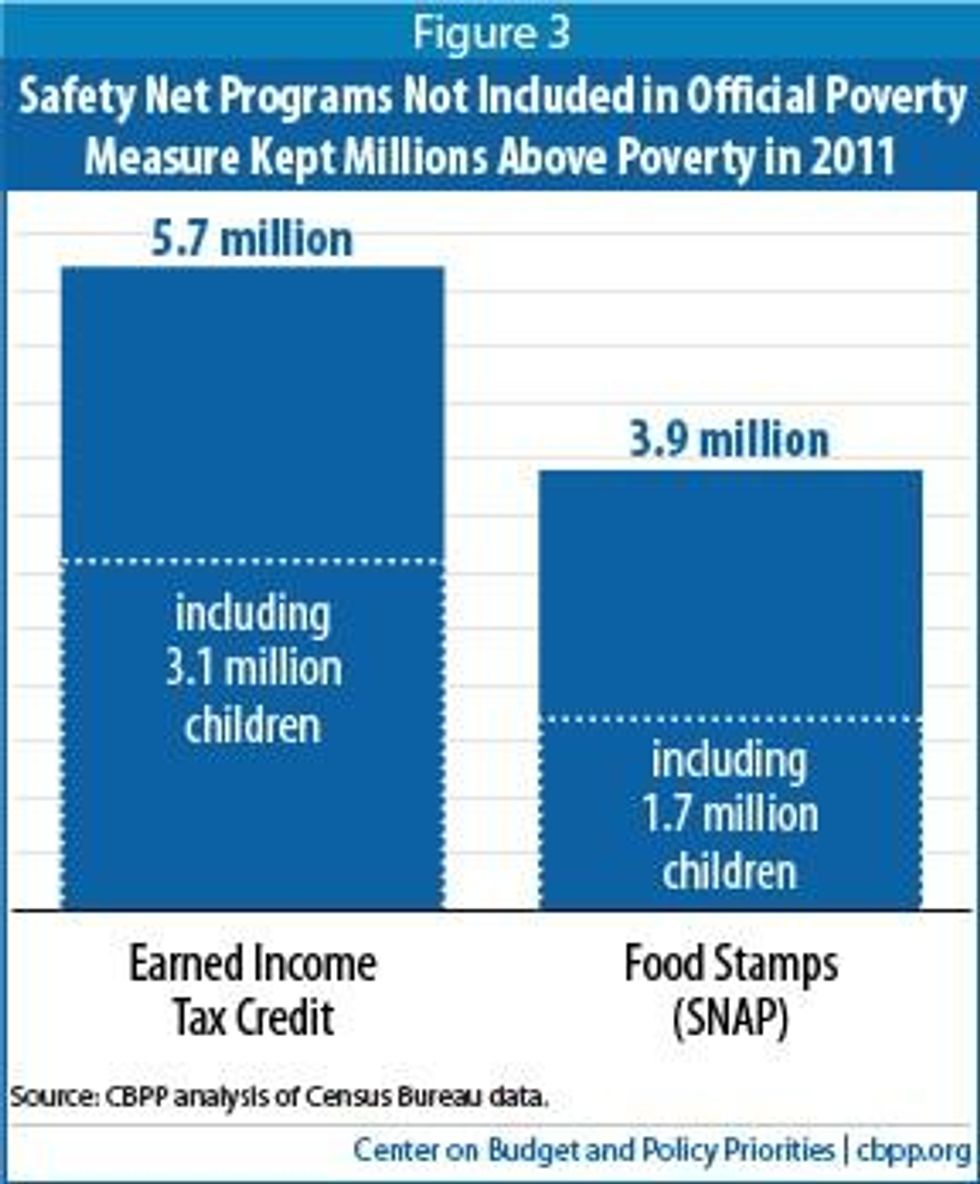

The Census data also show how many fewerpeople would be considered poor if two benefits that are not counted in the official poverty data -- the Earned Income Tax Credit (EITC) and SNAP (formerly known as the Food Stamp Program) -- are counted, as many analysts across the political spectrum believe they should be. Census officials said that if counted, the EITC would be seen to have lifted 5.7 million people -- including 3.1 million children -- out of poverty in 2011, and SNAP to have lifted out 3.9 million people, including 1.7 million children. (See Figure 3.)

Under an alternative, more comprehensive measure of poverty that's based on recommendations of a National Academy of Sciences (NAS) panel and that counts a fuller range of benefits -- including the EITC, SNAP, low-income housing assistance, school lunches, and others -- the increase in poverty was strikingly modest from 2007 to 2010 despite the Great Recession. Later this year, the Census Bureau will release data under this measure for 2011. Using the NAS-based measure, a Center on Budget and Policy Priorities analysis found that six temporary income-assistance provisions that policymakers enacted in 2009 and 2010 -- including emergency UI benefits, a SNAP benefit increase, and working-family tax credits -- kept an estimated 6.9 million people above the poverty line in 2010.

These Census data also highlight the impact that sharp cuts in such programs could have on poverty. The House-passed budget of last spring would cut SNAP by more than $133 billion over ten years and convert it to a block grant under which the program would no longer expand automatically when the economy turns down and contract automatically when the economy is again growing robustly. The House budget also would let the 2009 improvements in tax credits for low-income working families -- as well as federal UI benefits -- expire at the end of 2012, even as it would make permanent all expiring tax cuts that benefit high-income households. Such steps could significantly boost poverty rates in future years, especially during times of economic weakness, and exacerbate after-tax income inequality.

Efforts to reduce poverty need not conflict with efforts to reduce budget deficits. The three largest deficit-reduction packages of the last two decades -- those enacted in 1990, 1993, and 1997 -- reduced poverty and hardship even as they reduced deficits, due to increases that those packages included in the EITC (in 1990 and 1993) and food stamps (in 1993) and the creation of CHIP (in 1997).

The Center on Budget and Policy Priorities is one of the nation's premier policy organizations working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals.

LATEST NEWS

Infant Death Rate 3 Times Higher Near PFAS-Contaminated Sites in New Hampshire: Study

One scientist said the new research "provides rare causal evidence" and "not just a correlation" of the dangers posed by forever chemicals to infants.

Dec 09, 2025

Infants born to mothers who drank water from wells downstream of sites contaminated by so-called "forever chemicals" in New Hampshire suffered nearly three times the baseline death rate, more premature births, and lower birth weights, a study published Monday revealed.

Researchers at the University of Arizona tracked 11,539 births occurring within 3.1 miles of sites in the New England state known to be contaminated with per- and polyfluoroalkyl substances (PFAS)—commonly called forever chemicals because they do not biodegrade and accumulate in the human body. They found a 191% increase in first-year deaths among infants born to "mothers receiving water that had flowed beneath a PFAS-contaminated site, as opposed to comparable mothers receiving water that had flowed toward a PFAS-contaminated site."

Mothers in the study zone also experienced a 20% increase in preterm births and a 43% higher incidence of low birth weight. Out of every 100,000 births, this equates to 611 additional deaths by age 1, as well as 2,639 extra underweight births and 1,475 additional preterm births.

Extrapolating to the 48 contiguous US states and the District of Columbia, the study's authors also found that "PFAS contamination imposes annual social costs of approximately $8 billion."

"These health costs are substantially larger than current outside estimates of the cost of removing PFAS from the public water supply," the publication states.

As study authors Derek Lemoine, Ashley Langer, and Bo Guo noted:

PFAS from contaminated sites slowly migrate down through soil into groundwater, where they move downstream with the groundwater’s flow. This created a simple but powerful contrast: Pregnant women whose homes received water from wells that were downstream, in groundwater terms, from the PFAS source were likely to have been exposed to PFAS from the contaminated site, but those who received water from wells that were upstream of those sites should not have been exposed.

Previous research has shown the link between PFAS exposure and reduced birth weight, as well as changes in fetal and newborn metabolism.

Forever chemicals are used in a broad range of products, from nonstick cookware to waterproof clothing and firefighting foam. Bills to limit PFAS have died in Congress under intense lobbying from the chemical industry, which has long known—and tried to conceal—the health and environmental dangers of forever chemicals.

More than 95% of people in the United States have PFAS in their blood, according to the US Centers for Disease Control and Prevention. Around 172 million Americans are believed to consume PFAS in their drinking water.

Forever chemicals have been linked to cancers of the kidneys and testicles, low infant weight, suppressed immune function, and other adverse health effects.

Responding to the new research, Duke University associate research professor in environmental sciences Kate Hoffman told the Washington Post that the study "provides rare causal evidence" and "not just a correlation" of the dangers posed by forever chemicals to infants.

While experts say the study demonstrates the importance of more robust federal regulation of PFAS, the Trump administration's Environmental Protection Agency (EPA) is seeking to lift current limits that protect drinking water from four types of forever chemicals.

“This is a betrayal of public health at the highest level," Environmental Working Group president Ken Cook said earlier this year in response to the Trump administration's efforts to roll back PFAS protections. "The EPA is caving to chemical industry lobbyists and pressure by the water utilities, and in doing so, it’s sentencing millions of Americans to drink contaminated water for years to come.”

Keep ReadingShow Less

Israel Named Leading Killer of Journalists in 2025 for Third Straight Year

Nearly half of the worldwide reporters who lost their lives on the job this year were killed by the Israel Defense Forces in Gaza, according to Reporters Without Borders.

Dec 09, 2025

The report released Tuesday by the global press freedom group Reporters Without Borders provides an accounting of the killing of dozens of journalists across the globe in 2025, but nearly half of the people whose deaths are included were killed by the same group: the Israel Defense Forces.

For the third year running, as Israel's attacks on Gaza and the West Bank continue despite a ceasefire agreement reached in October in Gaza, the country was named as the top killer of journalists and media workers, having killed at least 29 Palestinian reporters this year.

Out of 67 reporters killed while doing their jobs in the past year, 43% were killed in Gaza by the IDF—called "the worst enemy of journalists" in 2025.

"Journalists do not just die—they are killed," said Reporters Without Borders, also known by its French name, Reporters sans Frontières (RSF), as it released its 2025 Round-up. "The number of murdered journalists has risen again, due to the criminal practices of military groups—both regular and paramilitary—and organized crime."

In 2025, the number of journalists killed on the job rose by one compared to 2024.

#RSFRoundUp 2025: Journalists don't die, they are killed. In 2025, the number of journalists killed rose once more.Let's continue to count, name, denounce, investigate, and ensure that justice is done. Impunity must never prevail.Watch our #RSFRoundUp2025 ⬇️

[image or embed]

— RSF (@rsf.org) December 9, 2025 at 3:10 AM

The government of Israeli Prime Minister Benjamin Netanyahu was named in RSF's report as one of the world's "Press Freedom Predators," along with Myanmar's State Security and Peace Commission—the country's de facto military government—and the Jalisco New Generation Cartel in Mexico, where at least three journalists were killed this year while they were covering drug trafficking in areas where the cartel is influential.

In the case of Netanyahu's government, reads the report "the Israeli army has carried out a massacre—unprecedented in recent

history—of the Palestinian press. To justify its crimes, the Israeli military has mounted a global propaganda campaign to spread baseless accusations that portray Palestinian journalists as terrorists."

The 29 reporters killed in Gaza this year are among more than 200 journalists killed by the IDF since it began its assault on the exclave in October 2023 in retaliation for a Hamas-led attack. According to RSF, 65 of those killed were "murdered due to their profession," and others were killed in military attacks.

The report notes the "particularly harrowing case" of two strikes that targeted a building in the al-Nasser medical complex which was "known to house a workspace for journalists" on August 25.

Reuters photographer Hossam al-Masri was killed in the first strike, and a second strike eight minutes later killed Mariam Abu Dagga of the Independent Arabia and the Associated Press, freelancer Moaz Abu Taha, and Al Jazeera photograher Mohamad Salama.

The journalists had been covering rescue operations and the impacts of other airstrikes. They were killed two weeks after an IDF strike killed five other Al Jazeera reporters and an independent journalist while they were in their tent outside al-Shifa Hospital in Gaza City.

Israel claimed one of the reporters, Anas al-Sharif, was "the head of a Hamas terrorist cell"—an allegation that was denied in independent assessments by United Nations experts, the New York-based Committee to Protect Journalists, and RSF.

The killing of the reporters and dozens of others around the world, said RSF director general Thibaut Bruttin on Tuesday, "is where the hatred of journalists leads!"

"They weren’t collateral victims," said Bruttin. "They were killed, targeted for their work. It is perfectly legitimate to criticize the media—criticism should serve as a catalyst for change that ensures the survival of the free press, a public good. But it must never descend into hatred of journalists, which is largely born out of—or deliberately stoked by—the tactics of armed forces and criminal organizations."

Palestine was named as by far the most dangerous place in the world for journalists this year, while Mexico was identified as the second-most dangerous, with nine reporters killed despite "commitments" President Claudia Sheinbaum made to RSF.

The journalists "covered local news, exposed organized crime and its links to politicians, and had received explicit death threats," reported RSF. "One of them, Calletano de Jesus Guerrero, was even under government protection when he was murdered."

Bruttin warned that "the failure of international organizations that are no longer able to ensure journalists’ right to protection in armed conflicts is the consequence of a global decline in the courage of governments, which should be implementing protective public policies."

Three journalists were killed in Ukraine in one month, targeted by Russian drone attacks even as they wore helmets and bulletproof vests that clearly identified them as members of the press. Two reporters were killed in Bangladesh in apparent retaliation for their reporting on crimes.

The report also notes that 503 journalists are detained around the world, with Israel the second-biggest jailer of foreign journalists after Russia. Twenty Palestinian reporters are currently detained by Israel, including 16 who were arrested over the past two years in the West Bank and Gaza. Just three—Alaa al-Sarraj, Emad Zakaria Badr al-Ifranji, and Shady Abu Sedo—where released as part of the ceasefire agreement in October after having been "unlawfully arrested by Israeli forces" in Gaza.

"It is our responsibility to stand alongside those who uphold our collective right to reliable information. We owe them that," wrote Bruttin. "As key witnesses to history, journalists have gradually become collateral victims, inconvenient observers, bargaining chips, pawns in diplomatic games, men and women to be eliminated. Let us be wary of false notions about reporters: No one gives their life for journalism—it is taken from them."

Keep ReadingShow Less

Military Budget Bill Would Ramp Up Israel Aid to Fill In 'Gaps' When Other Countries Impose Embargoes Over Genocide

The House Armed Services Committee said in September that the measure "combats antisemitism."

Dec 09, 2025

A little-reported provision of the latest military spending bill would direct the US to create a plan to fill the "gaps" for Israel whenever other nations cut off arms shipments in response to its acts of genocide in Gaza.

As Prem Thakker reported Monday for Zeteo, the measure is "buried" more than 1,000 pages into the more than 3,000-page National Defense Authorization Act (NDAA), which is considered by lawmakers to be “must-pass" legislation and contains a record $901 billion in total spending.

Republicans are shepherding the bill through the US House of Representatives, where—as is the case with most NDAAs—it is expected to pass on Wednesday with Democratic support, even as some conservative budget hardliners refuse to back it, primarily over its $400 million in military assistance to Ukraine.

Since the genocide began following Hamas' attack on October 7, 2023, the US has provided more than $21.7 billion to Israel, including hundreds of millions that have been supplied through NDAAs.

The new NDAA includes at least another $650 million to Israel, an increase of $45 million from the previous one, even though this is the first such bill to be introduced since the "ceasefire" that went into effect in October. This aid from the Pentagon comes on top of the $3.3 billion already provided through the State Department budget.

But this NDAA also contains an unprecedented measure. It calls for the “continual assessment of [the] impact of international state arms embargoes on Israel and actions to address defense capability gaps."

The NDAA directs Secretary of Defense Pete Hegseth, Secretary of State Marco Rubio, and Director of National Intelligence Tulsi Gabbard to assess “the scope, nature, and impact on Israel’s defense capabilities of current and emerging arms embargoes, sanctions, restrictions, or limitations imposed by foreign countries or by international organizations,” and “the resulting gaps or vulnerabilities in Israel’s security posture.”

As Drop Site News explains, "this means the US would explicitly use federal law to step in and supply weapons to Israel whenever other countries cut off arms to halt Israel’s ongoing violations across the region."

"The point of this assistance, to be clear, is to make up for any identified insufficiencies Israel may have due to other countries' embargoing it as a result of its ongoing genocide in Palestine," Thakker wrote.

A similar provision appeared in a September version of the NDAA, which the House Armed Services Committee praised because it supposedly “combats antisemitism"—explicitly conflating a bias against Jewish people with weapons embargoes that countries have imposed to stop Israel from continuing its routine, documented human rights violations in Gaza.

Among the nations that have cut off weapons sales to Israel are Japan, Canada, France, Italy, and Spain. Meanwhile, other major backers, such as the United Kingdom and Germany, have imposed partial freezes on certain weaponry.

While official estimates from the Gaza Ministry of Health place the number of dead from Israel's military campaign at over 70,000, with more than 170,000 wounded, an independent assessment last month from the Max Planck Institute for Demographic Research in Germany and the Center for Demographic Studies in Spain found that the death toll “likely exceeds 100,000." This finding mirrored several other studies that have projected the true death toll to be much higher than what official estimates show.

Embargoes against Israel have been called for by a group of experts mandated by the United Nations Human Rights Council, including Francesca Albanese, the UN Special Rapporteur on the occupied Palestinian territories. Meanwhile, numerous human rights organizations, including the leading Israeli group B’Tselem, have said Israel’s campaign in Gaza has amounted to genocide.

Keep ReadingShow Less

Most Popular