April, 01 2009, 02:05pm EDT

For Immediate Release

Contact:

Travis Plunkett, CFA, 202-387-6121

David Butler, Consumers Union, 202-462-6262

Ilicia Balaban, ConnPIRG, 860-805-5760

Lauren Saunders, NCLC, 202-452-6252

Linda Sherry, Consumer Action. 202-544-3088

Senate Committee Passes Landmark Credit Card Bill

Consumer Groups Praise Senator Dodd for Progress on Bill to Curb Unfair Practices

WASHINGTON

Leaders of national and Connecticut-based consumer organizations today

lauded comprehensive legislation passed by the Senate Banking Committee to curb predatory credit

card lending practices. The groups praised committee Chairman and bill sponsor Christopher Dodd

for his strong efforts to enact the legislation.

Introduced by Chairman Dodd and 18 co-sponsors, the Credit Card Accountability

Responsibility and Disclosure (CARD) Act would ban a number of practices that credit card issuers

have used to unjustifiably increase interest rates, fees and other charges. It passed the Senate

Banking Committee yesterday, moving to the Senate Floor for a final vote.

"This is the first time ever the Senate has moved legislation to rein in abusive credit card

practices," said Travis Plunkett, legislative director of the Consumer Federation of America. "We

applaud Senator Dodd for his efforts to pass this sweeping bill in the face of strong opposition from

the credit card industry."

"The CARD Act recognizes that credit card companies target unsuspecting college students

for overpriced credit cards even when they don't have jobs or an ability to repay," said Ilicia

Balaban of ConnPIRG. "The bill requires them to treat students like they are supposed to treat other

consumers, fairly."

The Federal Reserve Board issued rules to stop unfair credit card practices, giving the

industry until July 1, 2010, to implement the new practices. A number of major card issuers are now increasing fees and interest rates on millions of Americans before the new rules take effect.

The House of Representatives passed legislation last year that was similar to the Federal Reserve

Rules and is likely to do so again this year.

The Credit CARD Act has a number of protections that extend beyond those of the Federal

Reserve rules and House legislation. It requires credit card companies to stop:

o Applying unfair interest rate hikes retroactively to balances incurred under the old rate.

o Hitting consumers with high penalty fees that are not related to the costs that credit card

companies incur.

o Assessing hidden and unjustified interest charges on balances already paid off.

o Piling on the debt that consumers owe by requiring them to pay off balances with lower

interest rates before those with higher rates.

o Offering credit to students and young consumers without considering their ability to repay

the loan.

"Senator Dodd's bill picks up where the Fed's rules leave off, protecting all Americans from

unjustified or excessive fees and stopping retroactive interest rate hikes that only bury struggling

families in insurmountable debt," said Lauren Saunders, Managing Attorney at the National

Consumer Law Center.

"This bill will put the force of law behind the Federal Reserve's new rules, and will protect

consumers by strengthening these reforms," said Pam Banks, senior attorney for Consumers Union.

"Credit card lenders are trying to take advantage of the fact that the Federal Reserve's rules don't go

into effect until 2010 by maximizing short-term income from credit card interest payments, even if

the consequences are harmful to their own customers."

"We know that there is a battle ahead to preserve the strong consumer protection standards

in this legislation, but we are ready for the challenge and grateful that Senator Dodd is with us in

fighting the unfair, anti-consumer practices of credit card companies," said Linda Sherry, director of

national priorities for Consumer Action.

For more information about credit card reform, visit the Consumers Union website

www.CreditCardReform.org.

LATEST NEWS

Mitt "47%" Romney's Post-Career Call to Tax the Rich Met With Kudos and Criticism

"When Romney had real power," noted journalist David Sirota, "he fortified the rigged tax system that he's only now criticizing from the sidelines."

Dec 19, 2025

In a leaked fundraiser footage from the 2012 US presidential campaign, Republican candidate Mitt Romney infamously claimed that 47% of Americans are people "who believe that they are victims, who believe that government has a responsibility to care for them, who believe that they are entitled to healthcare, to food, to housing, to you name it." On Friday, the former US senator from Utah published a New York Times opinion piece titled, "Tax the Rich, Like Me."

"In 2012, political ads suggested that some of my policy proposals, if enacted, would amount to pushing grandma off a cliff. Actually, my proposals were intended to prevent that very thing from happening," Romney began the article, which was met with a range of reactions. "Today, all of us, including our grandmas, truly are headed for a cliff: If, as projected, the Social Security Trust Fund runs out in the 2034 fiscal year, benefits will be cut by about 23%."

"Typically, Democrats insist on higher taxes, and Republicans insist on lower spending. But given the magnitude of our national debt as well as the proximity of the cliff, both are necessary," he argued. "On the spending-cut front... Social Security and Medicare benefits for future retirees should be means-tested—need-based, that is to say—and the starting age for entitlement payments should be linked to American life expectancy."

"And on the tax front, it's time for rich people like me to pay more," wrote Romney, whose estimated net worth last year, when he announced his January 2025 retirement from the Senate, was $235 million. "I long opposed increasing the income level on which FICA employment taxes are applied (this year, the cap is $176,100). No longer; the consequences of the cliff have changed my mind."

"The largest source of additional tax revenues is also probably the most compelling for fairness and social stability. Some call it closing tax code loopholes, but the term 'loopholes' grossly understates their scale. 'Caverns' or 'caves' would be more fitting," he continued, calling for rewriting capital gains tax treatment rules for "mega-estates over $100 million."

"Sealing the real estate caverns would also raise more revenue," Romney noted. "There are more loopholes and caverns to be explored and sealed for the very wealthy, including state and local tax deductions, the tax rate on carried interest, and charity limits on the largest estates at death."

Some welcomed or even praised Romney's piece. Iowa state Rep. JD Scholten (D-1), a progressive who has previously run for both chambers of Congress, declared on social media: "Tax the rich! Welcome to the coalition, Mitt!"

US House Committee on the Budget Ranking Member Brendan Boyle (D-Pa.), who is part of the New Democrat Coalition, said: "I welcome this op-ed by Mitt Romney and encourage people to read it. As the next chair of the House Budget Committee, increasing revenue by closing loopholes exploited by the wealthiest Americans will be a top priority."

Progressive Saikat Chakrabarti, who is reportedly worth at least $167 million and is one of the candidates running to replace retiring former House Speaker Nancy Pelosi (D-Calif.), responded: "Even Mitt Romney now agrees that we need to tax the wealthiest. I call for a wealth tax on our billionaires and centimillionaires."

Michael Linden, a senior policy fellow at the Washington Center for Equitable Growth, said: "Kudos to Mitt Romney for changing his mind and calling for higher taxes on the rich. I'm not going to nitpick his op-ed (though there are a few things I disagree with), because the gist of it is right: We need real tax reform to make the rich pay more."

Others pointed to Romney's record, including the impactful 47% remarks. The Lever's David Sirota wondered, "Why is it that powerful people typically wait until they have no power to take the right position and effectively admit they were wrong when they had more power to do something about it?"

According to Sirota:

The obvious news of the op-ed is that we've reached a point in which even American politics' very own Gordon Gekko—a private equity mogul-turned-Republican politician—is now admitting the tax system has been rigged for his fellow oligarchs.

And, hey, that's good. I believe in the politics of addition. I believe in welcoming converts to good causes in the spirit of "better late than never." I believe there should be space for people to change their views for the better. And I appreciate Romney offering at least some pro forma explanation about what allegedly changed his thinking (sidenote: I say "allegedly" because it's not like Romney only just now learned that the tax system was rigged—he was literally a co-founder of Bain Capital!).

"And yet, these kinds of reversals (without explicit apologies, of course) often come off as both long overdue but also vaguely inauthentic, or at least not as courageous and principled as they seem," Sirota continued, stressing that "when Romney had real power, he fortified the rigged tax system that he's only now criticizing from the sidelines."

Keep ReadingShow Less

Elon Musk Is Vowing Utopia Driven by AI and Robotics. Bernie Sanders Has a Few Questions

"I look forward to hearing about how you and your other oligarch friends are going to provide working people with a magnificent life that you promise," the Vermont senator said in a sardonic video.

Dec 19, 2025

The world's richest man, Elon Musk, continues to insist that the artificial intelligence technology he profits from will create an economic utopia free from poverty, where work is optional and saving money is unnecessary.

But at a time of unprecedented wealth inequality that the Trump administration Musk supports has helped to accelerate, Sen. Bernie Sanders (I-Vt.) expressed incredulity about how Musk envisions such a future coming about.

Musk, the CEO of SpaceX and Tesla, made his comments on his social media app X, in response to billionaire investor Ray Dalio, who'd announced that he and his wife were contributing to an initiative backed by the Trump administration to create savings accounts for children born between 2025 and 2028.

Dalio mentioned that the computer billionaire Michael Dell and his wife had also pledged $6.25 billion to the effort.

Unprompted, Musk responded: "It is certainly a nice gesture of the Dells, but there will be no poverty in the future, and so no need to save money. There will be universal high income."

It's a theory that Musk has proposed repeatedly of late. Last month, while on a podcast, he suggested that thanks to rapidly accelerating AI and robot technology, all labor will soon be automated, making the need for wages obsolete: "In less than 20 years, working will be optional. Working at all will be optional. Like a hobby."

Earlier this week, he postulated—in almost Marxian fashion—that automation would do away with the need for money as a store of value.

“I think money disappears as a concept, honestly,” he told another podcast. “It’s kind of strange, but in a future where anyone can have anything, you no longer need money as a database for labor allocation. If AI and robotics are big enough to satisfy all human needs, then money is no longer necessary. Its relevance declines dramatically.”

Social media users have had a field day with Musk's fanciful predictions. One noted that it was a bit strange that a person who believed money would soon lose all value recently strong-armed Tesla shareholders into giving him a nearly $1 trillion pay package, the biggest corporate compensation plan in history. Another simply asked, "Are you high on ketamine?"

But perhaps the most blistering reaction came from Sanders, one of Musk's most steadfast adversaries, who posted a sardonic response video on Thursday.

"I was delighted to hear that through the rapid advancement in artificial intelligence and robotics that you are funding, you will be bringing about utopia to the world," the senator said. "You have told us that poverty will be wiped out, work will be optional, there will be universal high income, and that everyone will have the best medical care, food, home, transport, and everything else. That is wonderful news."

"I just have a couple of questions. How will this utopia come about?" he continued. "If young people can't find the entry-level jobs that used to exist, and they are unemployed without income, when are they going to get the free housing you talk about? If manufacturing workers lose their jobs because robots take their place, when are they going to get the free healthcare you promise? If a young nurse with kids loses her job, how is she going to get the food she needs to feed her family?"

Sanders then turned his attention to the fact that Musk spent an unprecedented amount of more than $270 million to help elect President Donald Trump, who earlier this year enacted historic cuts to the social safety net to fund tax breaks that overwhelmingly benefit the rich, in what has been described as the greatest upward transfer of wealth in US history.

"I look forward to hearing about how you and your other oligarch friends are going to provide working people with a magnificent life that you promise," he continued. "Because let's not forget, Donald Trump, the guy you got elected, is kicking 15 million people off their healthcare, doubling insurance premiums for more than 20 million, and is making massive cuts to nutrition assistance and education for kids across the country."

Sanders concluded, "With that track record, I can't wait to hear how your plan to provide universal high income for every American is going to be implemented."

Keep ReadingShow Less

'An Absolute Joke': Trump DOJ Partially Releases Epstein Files, Many Heavily Redacted

“Trump’s failure to release the Epstein files is an insult to survivors and a further stain on an administration that continuously bends over backwards to protect abusers," said one critic.

Dec 19, 2025

The US Department of Justice on Friday released a massive—but incomplete—trove containing hundreds of thousands of records related to the late convicted sex offender Jeffrey Epstein, a move that came as Democratic lawmakers vowed to pursue "all legal options" after the Trump administration blew a deadline to disclose all of the files.

The DOJ uploaded the files—which can be viewed here in the section titled "Epstein Files Transparency Act"—to its website on Friday. Earlier in the day, Deputy US Attorney General Todd Blanche said that the agency would not release all the Epstein files on Friday, as required by the transparency law signed last month by President Donald Trump.

Friday's release includes declassified files, many of them heavily redacted and some of which were already publicly available via court filings, records requests, and media reporting. Files include flight logs and masseuse lists. One document contains nothing but 100 fully redacted pages.

Curiously, a search for the words "Trump" and "Epstein" in the posted documents returned no results.

The progressive media site MeidasTouch said, "This Epstein files 'release' is the most disgusting cover up in American history."

Journalist Aaron Parnas accused the DOJ of "engaging in a cover up."

"Most of the files are heavily redacted, with very few fully released," he noted. "There are disturbing images of Epstein with victims. There are images of Michael Jackson, Bill Clinton, and others. Donald Trump is not in any of the ones I've reviewed."

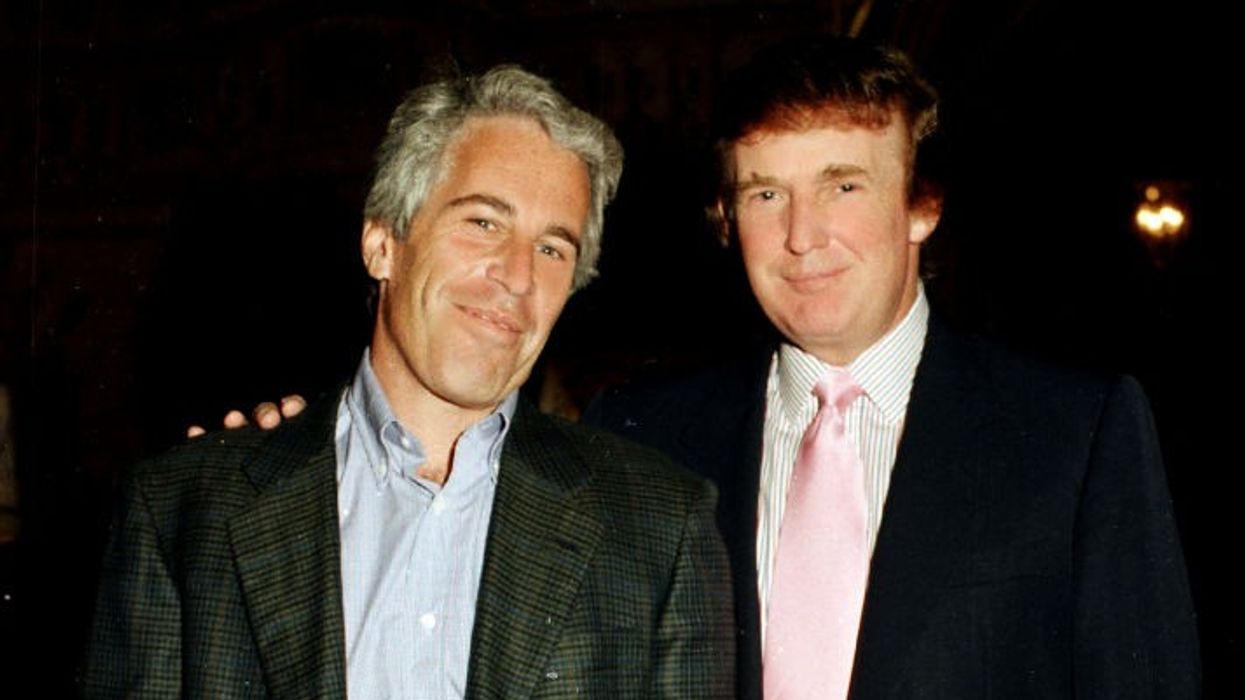

While not accused of any wrongdoing, Trump was a former close friend of Epstein, who faced federal sex trafficking charges at the time of his suspicious 2019 death in a New York City jail cell.

White House spokesperson Abigail Jackson released a statement Friday afternoon, which read in part:

The Trump administration is the most transparent in history. By releasing thousands of pages of documents, cooperating with the House Oversight Committee’s subpoena request, and President Trump recently calling for further investigations into Epstein’s Democrat friends, the Trump administration has done more for the victims than Democrats ever have.

Senate Minority Leader Chuck Schumer (D-NY) noted in a statement following the DOJ document dump, noting that the Epstein Files Transparency Act passed by Congress and signed by Trump "calls for the complete release of the Epstein files so that there can be full transparency."

"This set of heavily redacted documents released by the Department of Justice today is just a fraction of the whole body of evidence," Schumer continued. “Simply releasing a mountain of blacked out pages violates the spirit of transparency and the letter of the law. For example, all 119 pages of one document were completely blacked out. We need answers as to why."

“Senate Democrats are working to assess the documents that have been released to determine what actions must be taken to hold the Trump administration accountable," he added. "We will pursue every option to make sure the truth comes out.”

Schumer's remarks followed vows by congressional Democrats including Rep. Ro Khanna (D-Calif.)—who, along with Rep. Thomas Massie (R-Ky.) introduced the Epstein Files Transparency Act—to hold Trump administration officials accountable for violating the law.

Responding to the DOJ's document release and delay in fully disclosing the files, Elisa Batista, campaign director at UltraViolet Action, said in a statement that “if the Trump administration had its way, they would undo the sacrifice of survivors who came forward to demand transparency and accountability, as well as all those abused by Epstein who were unable to."

“Trump’s failure to release the Epstein files is an insult to survivors and a further stain on an administration that continuously bends over backwards to protect abusers—and just violated the Epstein Files Transparency Act to do so," Batista added. "We will continue to fight alongside the brave survivors—many of whom were young girls when they were abused by Epstein—who took great risk to reveal Epstein’s globe-spanning sex trafficking network.”

Britt Jacovich, a spokesperson for the progressive political action group MoveOn, said following Friday's release that “President Trump’s Department of Justice is breaking the law by holding all of the Epstein files hostage, and yet again, Trump is doing absolutely nothing."

"Trump doesn’t care about the victims or the millions of Americans calling for justice," Jacovich added. "He only cares about protecting the rich and powerful, even those who abuse young women and children. Every single person named in the Epstein files and involved in the cover-up should face accountability, regardless of their political party. No more delays, no more obstruction.”

Yasmine Meyer, an attorney who represents multiple alleged victims of Epstein, told CBS News that while "we are glad that... we are seeing some documents finally being released," the "heavy redactions" in many of the documents are "troubling."

"Every single time that there has been a promise to deliver some meaningful material, the survivors cannot help but get their hopes up... and every single time, that door slams back shut in their faces and retraumatized them all over again," she added.

Keep ReadingShow Less

Most Popular