February, 26 2009, 02:09pm EDT

For Immediate Release

Contact:

Michelle Bazie,202-408-1080,bazie@cbpp.org

Statement by Robert Greenstein, Executive Director, on The President's 2010 Budget Proposal

WASHINGTON

The President's budget represents a bold and

courageous proposal to make progress in restoring fiscal discipline while

addressing two central problems of our time - a broken health care system and

the threat of catastrophic global warming - and other national needs.

Particularly courageous are several proposals that take on vested interests to

fully pay for the costs of health care reform and tackling global warming,

including:

- Instituting major cost-saving reforms in Medicare that also hold promise for

slowing private-sector health care costs and are consistent with

recommendations of Congress' expert advisory body, the Medicare Payment

Advisory Commission. Faced with intense opposition from insurance companies

and other interests, Congress has shied away from such proposals, but the new

Administration has embraced them. The budget also includes a sound,

longstanding Republican proposal - to increase the premiums that affluent

Medicare beneficiaries pay for the prescription drug benefit that Medicare

provides them.

- Limiting various tax subsidies to the most affluent Americans to 28 cents on

the dollar. Currently, middle-income Americans receive a tax subsidy equal to

10 cents or 15 cents for each dollar of their deductible expenses (if they

itemize deductions at all), while affluent Americans get a subsidy of 35 cents

for each dollar of the same expenses. The budget would cap the subsidy at 28

cents on the dollar for those with incomes over $250,000, the same rate at

which those expenses could be deducted in the final Reagan years, when the top

tax rates were lower. As a result, incentives to incur those expenses would be

the same as under President Reagan.

- Auctioning all emissions permits under the Administration's proposed

cap-and-trade system to address global warming, rather than conferring

windfall profits on energy companies and others that pollute by giving them

tens of billions of dollars' worth of permits for free. The proposal would

then use auction proceeds to offset the impact on working families of the

resulting increases in energy prices, by extending the Making Work Pay tax

cut. (This tax cut is similar to tax-reduction proposals of recent years by a

number of analysts, including those here at CBPP, to efficiently provide

middle-income consumers with relief from the increased energy costs that an

emissions cap would trigger.) Additional measures will be required to provide

adequate relief to low-income consumers; the budget envisions using some of

the remaining auction proceeds for that.

The budget also makes a significant commitment to restoring fiscal

responsibility while meeting high priority national needs, by:

- Reducing deficits to 3 percent of the Gross Domestic Product by 2013, about

the level needed to keep the federal debt from rising much faster than the

economy and thus leading to an explosion of debt that swamps the budget and

the economy.

- Pledging to offset the costs over the next ten years of health care reforms

that initially will raise costs by providing universal coverage but that will

set the stage for reducing public- and private-sector health care costs in

subsequent decades by gradually slowing the rate at which those costs grow.

The high rate of growth of health-care costs is at the root of the nation's

long-term fiscal problem.

By themselves, these budget proposals would prove insufficient to keep

deficits at 3 percent of GDP indefinitely. Policymakers will need to take

additional steps in subsequent years, as President Obama noted at his "fiscal

summit" on Monday.

The budget also deserves high marks for transparency and honesty. Gone are the

gimmicks that have been an annual feature of both Presidential and

Congressional budgets, under which policymakers pretended to reduce deficits

markedly over time by omitting costs in the "out years" for operations in Iraq

and Afghanistan, natural disasters, and continued relief from the Alternative

Minimum Tax and the scheduled reductions in Medicare fees for doctors - and by

printing in the budget numbers for the costs of discretionary programs in the

out years that everyone knew were unrealistically low.

Those gimmicks, sleights-of-hand, and convenient omissions are absent from

this budget. Its greater realism and transparency makes the President's pledge

to cut the deficit in half in four years a meaningful one; we will now know

each year whether we are on course to meet that goal.

The budget also provides needed investments in key areas for long-term

economic growth, such as energy efficiency and early childhood education. And

it proposes savings from lower priority programs such as bloated agricultural

subsidies and from unwarranted tax breaks, such as one that millionaire equity

fund managers have exploited to pay taxes at lower rates than many

middle-income families and others that benefit oil companies. The budget also

follows in the tradition of the 1990 and 1993 deficit-reduction laws in both

shrinking the deficit and reducing poverty, which is higher in the United

States than in other Western nations.

Predictable but Unfounded Criticisms

The budget already is facing several lines of attack that rest on inaccurate

or misleading charges. Chief among them is the claim that the tax increases

for people who make over $250,000 will seriously injure small businesses.

In fact, small businesses would win under this budget. Tax Policy Center data

show that only 3 percent of people with small business income have incomes

over $250,000, the only group that faces higher taxes under this budget. The

vast majority of small business owners are middle-income individuals who would

receive tax cuts under the budget; many of them would also benefit from its

universal coverage and health care cost containment reforms.

To be sure, many will oppose various proposals to close tax loopholes, the

Medicare and agricultural subsidy reforms, and the cap on itemized deductions

for the most affluent Americans - while saying that they, too, favor universal

health coverage, curbing global warming, improvements in education, and the

like. This budget challenges them to propose their own ways to finance such

measures.

The Center on Budget and Policy Priorities is one of the nation's premier policy organizations working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals.

LATEST NEWS

As Trump Claims He's Slashing Costs, Big Pharma Jacks Up Prices on 350 Drugs

One critic charged that Trump's earlier deals with pharmaceutical companies "just nibble around the margins in terms of what is really driving high prices for prescription drugs in the US."

Dec 31, 2025

President Donald Trump in recent months has made ludicrously false claims about his administration slashing prescription drug prices in the US by as much as 600%, which would entail pharmaceutical companies paying people to use their products.

In reality, reported Reuters on Wednesday, drugmakers are planning to raise prices on hundreds of drugs in 2026.

Citing data from healthcare research firm 3 Axis Advisors, Reuters wrote that at least 350 branded medications are set for price hikes next year, including "vaccines against COVID, RSV, and shingles," as well as the "blockbuster cancer treatment Ibrance."

The total projected number of drugs seeing price increases next year is significantly higher than in 2025, when 3 Axis Advisors estimated that pharmaceutical companies raised prices on 250 medications.

The median price increase for drugs next year is projected at 4%, roughly the same as in 2025.

Reuters also found that some of the companies raising prices on their drugs are the same ones who struck deals with Trump to lower the costs of a limited number of prescriptions earlier this year, including Novartis, Pfizer, Boehringer Ingelheim, and GSK.

In announcing the deals with the pharmaceutical companies, Trump declared that "starting next year, American drug prices will come down fast and furious and will soon be the lowest in the developed world."

But Dr. Benjamin Rome, a health policy researcher at Brigham and Women's Hospital in Boston, told Reuters that the projected savings for Americans under the Trump deals are a drop in the bucket compared with the continued price hikes on other drugs.

"These deals are being announced as transformative when, in fact, they really just nibble around the margins in terms of what is really driving high prices for prescription drugs in the US," Rome explained.

Merith Basey, CEO of Patients For Affordable Drugs Now, a patient advocacy organization focused exclusively on lowering the cost of medications, also said she was unimpressed by Trump's deals with drugmakers.

"Voluntary agreements with drug companies—especially when key details remain undisclosed—are no substitute for durable, system-wide reforms," she said earlier this month. "Patients are overwhelmingly calling on Congress to do more to lower prescription drug prices by holding Big Pharma accountable and addressing the root causes of high drug prices, because drugs don’t work if people can’t afford them."

Keep ReadingShow Less

Critics Warn Israeli Ban on Aid Groups in Gaza 'Will Cost the Lives of Palestinians'

"Such arbitrary suspensions make an already intolerable situation worse for the people of Gaza," said the United Nations human rights chief.

Dec 31, 2025

Human rights defenders warned Wednesday that a new Israeli ban on dozens of international humanitarian groups from operating in Gaza will have a "catastrophic" impact on Palestinians already reeling from more than two years of Israel's genocidal war and siege.

The government of fugitive Israeli Prime Minister Benjamin Netanyahu—who is wanted by the International Criminal Court (ICC) for alleged war crimes and crimes against humanity in Gaza—announced Tuesday that 25 humanitarian groups would be suspended from operating in Gaza starting January 1 if they did not comply with new requirements including providing detailed information on their staff, funding, and operations.

Israeli authorities say, largely without evidence, that the new rules are needed because some humanitarian workers are terrorists, and because Hamas is diverting aid—a claim refuted by Israeli military officials.

By Wednesday, the number of banned groups increased to 37. Targeted groups include ActionAid, Handicap International, Doctors Without Borders sections from six European countries, two Oxfam chapters, International Rescue Committee, American Friends Service Committee, World Vision International, Norwegian Refugee Council, Mercy Corps, Defense for Children International, two Caritas branches, and CARE.

"Israel’s suspension of numerous aid agencies from Gaza is outrageous," United Nations human rights chief Volker Türk said Wednesday in Geneva. "This is the latest in a pattern of unlawful restrictions on humanitarian access, including Israel’s ban on UNRWA, the UN Relief and Works Agency for Palestinian Refugees in the Near East, as well as attacks on Israeli and Palestinian NGOs amid broader access issues faced by the UN and other humanitarians."

"I urge all states, in particular those with influence, to take urgent steps and insist that Israel immediately allows aid to get into Gaza unhindered," Türk continued. "Such arbitrary suspensions make an already intolerable situation even worse for the people of Gaza."

"I remind the Israeli authorities of their obligation under international law to ensure the essential supplies of daily life in Gaza, including by allowing and facilitating humanitarian relief," he added.

European Commissioner for Equality, Preparedness, and Crisis Management Hadja Lahbib said Wednesday that Israel's move "means blocking life-saving aid."

"The [European Union] has been clear: The NGO registration law can not be implemented in its current form," Lahbib added. "All barriers to humanitarian access must be lifted."

British Member of Parliament Andrew Pakes (Labour-Peterborough) said on social media that "the Israeli government banning desperately needed aid from Gaza is not a sign of a working ceasefire."

"This, at a time of extreme weather and lack of shelter," he added. "We need accountability more than ever. And immediate help to save lives."

Doctors Without Borders—which also goes by its French acronym, MSF—told Reuters Tuesday that "if MSF is prevented from working in Gaza, it will deprive hundreds of thousands of people from accessing medical care."

Norwegian Refugee Council spokesperson Shaina Low said, "At a time when needs in Gaza far exceed the available aid and services, Israel has and will continue to block life-saving aid from entering."

British emergency physician Dr. James Smith—a health activist with Medact and the People's Health Movement and member of the Global Sumud Flotilla—told Al Jazeera Wednesday that many of the proscribed groups "have been working in Gaza for decades."

Smith noted that Doctors Without Borders this year "managed more than 22,000 operations," adding that "if international NGOs were de-registered, then approximately a third of healthcare facilities" in Gaza "would be forced to immediately close."

This, after Gaza's healthcare infrastructure has been systematically obliterated by Israel's assault and siege.

"It's going to be catastrophic," warned Smith. "A situation that is already horrific will be made more horrific. The changes will be immediate, and they will be ruthless."

Smith called the aid group ban "an extension of Israel's longstanding strategy of titrating humanitarian access and humanitarian services as a core pillar of the occupation and of the genocide."

Since 2007, Israel has maintained a blockade of Gaza, severely limiting the entry and exit of people and goods into the Palestinian exclave. The blockade was tightened even further when Israel imposed a "complete siege" on the strip following the Hamas-led attack of October 7, 2023.

According to UN data, Israeli forces have killed at least 579 aid workers—including nearly 400 UNRWA staffers—since October 2023. Israeli bombs and bullets have also killed over 1,700 health and medical workers, upward of 140 civil defense personnel, and more than 250 journalists.

Overall, Israel's war and siege have left more than 250,000 Palestinians dead, wounded, or missing in Gaza, and most Gazans forcibly displaced, starved, or sickened.

In recent weeks, more than a dozen Palestinians, including numerous children and infants, have died of hypothermia.

On Tuesday, Red Crescent Society in Gaza warned of a growing outbreak of hepatitis A and gastroenteritis caused by contaminated drinking water.

The International Court of Justice—which is currently weighing a genocide case against Israel filed by South Africa—last year issued a provisional ruling ordering Israel to allow humanitarian aid into Gaza and affirming an earlier order to prevent genocidal acts. Israel has been accused of ignoring these and other ICJ orders.

Responding to the Israeli ban, Refugees International vice president for programs and policy Hardin Lang said in a statement Tuesday that "this action will cost the lives of Palestinians."

"Gaza is in the heart of winter, with hundreds of thousands of people living in makeshift shelters, damaged buildings, or the open air after repeated displacement," Lang noted. "Removing these humanitarian organizations now will deepen exposure, illness, and preventable deaths. The targeted organizations provide much of the core relief capacity in Gaza, particularly on healthcare services."

"The suspension is not motivated by a sincere desire to prevent diversion of aid; it is a pretext to further restrict aid to Gaza while silencing independent aid organizations," he continued. "The Israeli government’s broad claims about systemic aid diversion have never been backed up with credible evidence—as even senior US government officials have publicly acknowledged."

"Under US and international law, parties to a conflict must allow and facilitate the rapid and unimpeded passage of impartial humanitarian relief," Lang added.

Keep ReadingShow Less

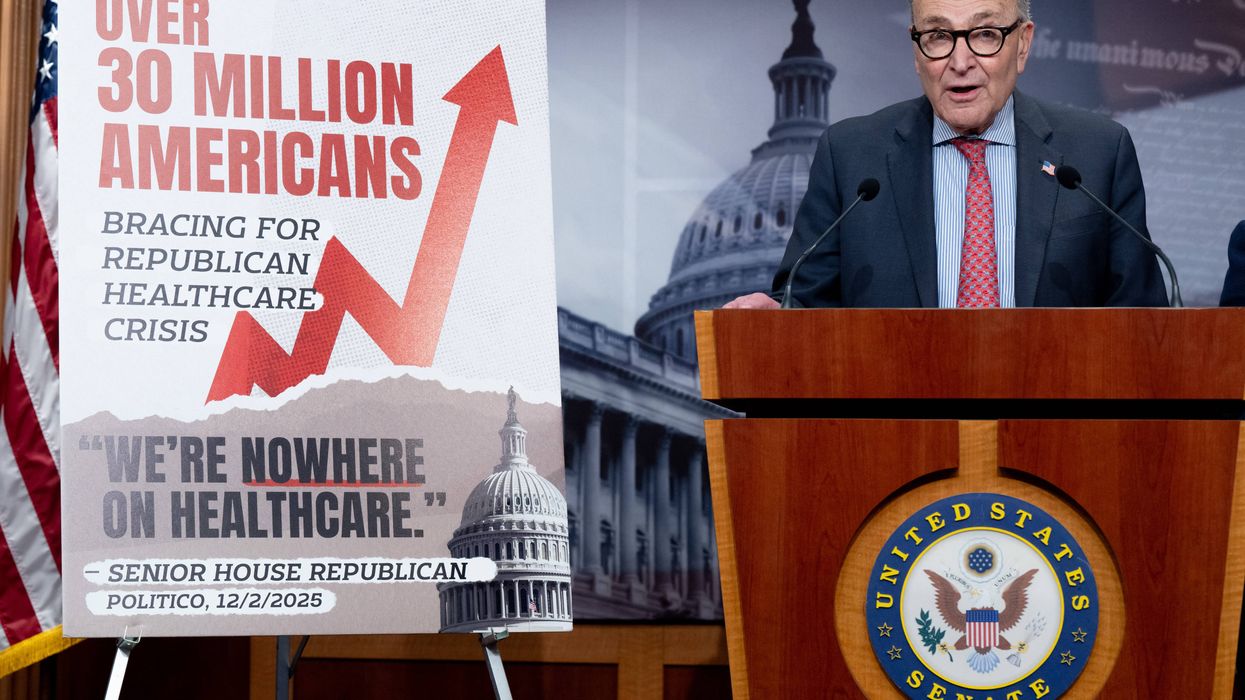

Republicans in Congress Ripped for 'Entirely Preventable' 2026 Healthcare Crisis

"Working families simply can't afford to pay more money for worse care. We need to extend ACA tax credits to lower costs."

Dec 31, 2025

With millions of Americans facing health insurance premium hikes and Affordable Care Act tax credits expiring at midnight, critics, including congressional Democrats, called out Republicans on Capitol Hill for kicking off 2026 with a nationwide healthcare crisis.

"When the clock strikes midnight, the fallout of the GOP's premium hikes will ripple throughout the nation," Protect Our Care chair Leslie Dach said in a Wednesday statement. "This new year brings a healthcare catastrophe unlike anything this nation has ever seen. Hardworking Americans will be sent into crippling medical debt, emptying out their savings just to see a doctor. Others will be forced to live without the life-saving coverage they need. Untold tens of thousands will die from preventable causes."

"And hundreds of hospitals, nursing homes, and maternity wards will shutter or be at risk of disappearing out of thin air," Dach warned. "When the American people go to the ballot box in November, they won't forget who's responsible for all of this chaos and carnage. They won't forget who's responsible for their skimpier coverage, sky-high premiums, and vanishing hospitals."

Republican lawmakers declined to extend ACA subsidies in their so-called One Big Beautiful Bill Act (OBBBA), which is also expected to slash an estimated $1 trillion in Medicaid spending over the next decade, leading to health clinic closures, while giving more tax breaks to the ultrawealthy. Even the longest federal government shutdown in history—which a handful of moderate Senate Democrats ultimately ended without any real concessions—couldn't convince the GOP to extend the expiring tax credits.

Senate Minority Leader Chuck Schumer (D-NY), who has faced calls to step down over his handling of both shutdowns this year, stressed in a Wednesday statement that the healthcare crisis beginning Thursday "was entirely preventable—caused by Republican obstruction and total inaction."

"Millions of Americans will lose their healthcare, and millions more will see their costs spike by thousands of dollars," he continued. "Millions of hardworking families, small business owners and employees, older Americans, and farmers and ranchers will face impossible choices."

Specifically, about 22 million people who receive subsidies face higher premiums next year, and experts warn nearly 5 million people could become uninsured if the tax credits aren't extended. That's on top of the at least 10 million people expected to lose Medicaid coverage over the next decade, thanks to the OBBBA that President Donald Trump signed into law this summer.

Noting that the expiring subsidies are set to leave millions of Americans without health insurance, House Minority Leader Hakeem Jeffries (D-NY) declared on social media Wednesday, "Republicans don't give a damn."

The Chicago Tribune on Wednesday shared the story of Eleanor Walsh, of St. John, Indiana. She and her husband, who are both self-employed, paid around $9,100 for health insurance this year. In 2026, it will increase to $23,400. To save money, they are going with another plan, which has a $10,130 deductible for each of them, she told the newspaper.

"We're going through every expense we have," said Walsh, whose family has over $10,000 in medical debt from her husband's recent open-heart surgery. "It's going to be a rough year."

In Alta, Wyoming, Stacy Newton and her husband similarly run small businesses and buy health insurance through the ACA marketplace. She was diagnosed with chronic leukemia last year. The cheapest option to cover the couple and their teenage kids next year includes a $3,573 monthly premium, or nearly $43,000 for the year, with a $21,200 deductible.

"It's terrifying... We're not rich, we're not poor. We're a standard, middle-class family, and somehow now I can't afford health insurance," Newton told the Washington Post. "If my leukemia acts up, I'm up a creek... I just don't have a solution yet."

"I just officially canceled my ACA marketplace insurance for 2026," she told the paper earlier this week. "How on Earth is this going to unfold for millions of people in America?"

While Americans are forced to make coverage decisions before open enrollment ends in mid-January, without any promise of the subsidies returning, Schumer signaled that Democrats are still fighting for a fix in Washington, DC.

"Senate Republicans had multiple chances to work with Democrats to stop premiums from skyrocketing—and every time, they blocked action," he said. "While Republicans chose to do nothing and ignore the pain families will feel starting tomorrow, Senate Democrats are fighting to lower costs, protect coverage, and make life more affordable—not harder—for American families."

Four Republicans in the House of Representatives have signed on to a discharge petition to force a January vote on Democratic legislation to extend the credits for three years. Roll Call reported Tuesday that "with the knowledge that a procedural vote on a similar bill was rejected in the Senate, a bipartisan group of senators is working on a compromise to extend the credits."

However, as the outlet also pointed out, Senate Majority Leader John Thune (R-SD) has called Democrats' three-year extension of the tax credits a "waste of money."

Sen. Chris Van Hollen (D-Md.)—one of the lawmakers who has used the current healthcare debate to renew demands for Medicare for All—took aim at Thune on social media Monday.

Other lawmakers have kept up the battle for universal healthcare this week. Sen. Jeff Merkley (D-Ore.) said Tuesday that "everyone in America—no matter what their ZIP code is—should have access to the quality healthcare they need, when they need it. That's why I'm fighting to put us on the path to Medicare for All."

Sen. Bernie Sanders (I-Vt.)—who reintroduced the Medicare for All Act in April with Democratic Reps. Pramila Jayapal (Wash.) and Debbie Dingell (Mich.)—highlighted Sunday that "millions of Americans remain at jobs they hate for one reason: the health insurance they receive."

"That's absurd," he said. "Universal healthcare will give Americans the freedom to choose the work they want without worrying about healthcare coverage. Another reason for Medicare for All."

Absent any real progress on the ACA, let alone Medicare for All, in DC, "at least a dozen states are working to shield people from soaring health insurance costs following Congress' failure to extend Obamacare subsidies for tens of millions of Americans," Politico reported Monday.

Elected officials are taking action in states including California, Colorado, Connecticut, Maryland, and New Mexico, the last of which is the only one so far to cover all expiring subsidies, according to the outlet.

"We can carry the cost for a little bit, but at some point, we will need Congress to act," said the speaker of New Mexico House of Representatives, Javier Martínez (D-11). "No state can withstand to plug in every single budget hole that the Trump administration leaves behind."

Keep ReadingShow Less

Most Popular