SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

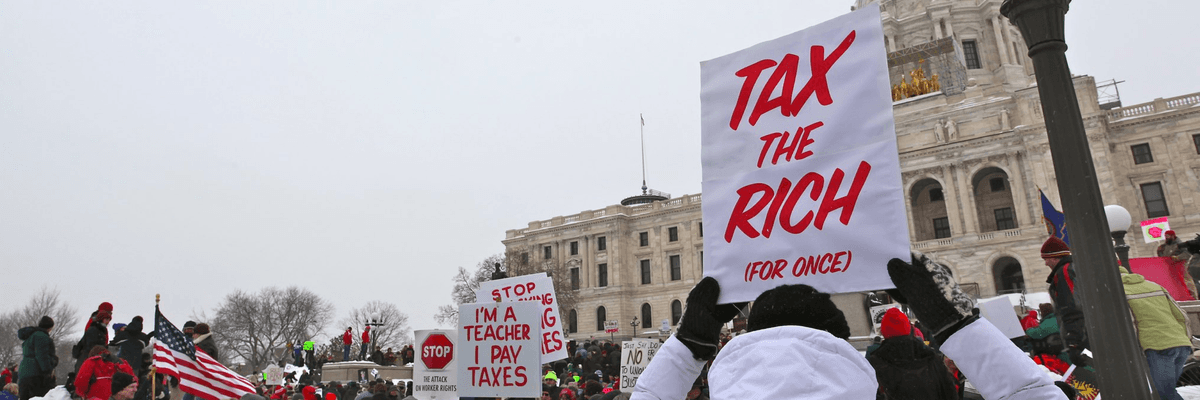

Advocates attend a protest to demand a fair tax code.

"Congress cannot simply tinker around the edges of our tax code in 2025—it must reject the failed approach of the Bush and Trump tax cuts and use this opportunity to produce a fairer tax code," said one advocate.

Highlighting the massive investments the federal government could make if legislators pass bold new tax reforms following next year's expiration of the Trump-era tax cuts, more than 100 public interest groups on Tuesday wrote to congressional leaders and urged them to correct the "large and costly mistake" that Republicans pushed through in 2017 over the objections of the public.

Nearly seven years after the passage of the Tax Cuts and Jobs Act (TCJA), said the coalition led by Groundwork Collaborative, the law has been proven to be "a failure on its own terms," with the average worker seeing none of the financial benefits promised by Republican Party and former President Donald Trump, who is running for the White House again.

"The Trump administration claimed that the TCJA's corporate tax cuts would lead to significantly higher wages for typical workers, but in reality, workers who earned less than $114,000—the overwhelming majority of Americans—did not experience any increase in earnings from the TCJA while the compensation of top corporate executives skyrocketed," wrote the groups, including Americans for Tax Fairness, Children's Defense Fund, and the National Domestic Workers Alliance.

The groups outlined three concrete goals that must be included in any tax reform considered by Congress in 2025:

Before the passage of the TCJA, the letter reads, the tax code "did not generate enough revenue to support pro-growth investments and fiscal responsibility; it reinforced economic, gender, and racial disparities; and it asked too little of the very wealthy and large corporations."

The TCJA "made those problems worse," the letter continues, with "massive and permanent cuts to corporate taxes and temporary cuts to individual and estate taxes that have largely benefited the wealthy and eroded tax revenues even further."

The letter was sent two weeks after the Congressional Budget Office released an analysis showing that extending the individual and real estate tax cuts in the TCJA past their 2025 expiration date would add $4.6 trillion to the national deficit.

The cost of "true pro-growth tax reform that supports public investments," said former National Economic Council deputy director Bharat Ramamurti on a press call about the letter, pales in comparison to the price of continuing the Trump tax cuts.

"You look at some of the things that historically Congress has been considering—when it comes to housing affordability, that's a few hundred billion dollars. Childcare affordability, a few hundred billion dollars," said Ramamurti, who helped coordinate the letter. "It's a fraction of the cost... It just reinforces the enormous scale of these tax benefits that have gone primarily to very wealthy individuals and to corporations."

Citing an economic analysis by the Center for American Progress, the letter notes that without the tax cuts enacted by Trump and former President George W. Bush, "the national debt, as a percent of GDP [gross domestic product], would be on a permanent downward trajectory today."

"The pre-TCJA tax code was expected to generate roughly 18% of GDP, but even that level is ultimately below what is needed to ensure adequate investments in our children, reduce poverty, address racial and gender disparities, fulfill our commitments to America's seniors, veterans, and people with disabilities—and support our continued growth and prosperity as a country," wrote the groups. "That is why the 2025 tax reform must generate substantially more revenue than simply letting all of the temporary provisions in the TCJA expire."

Under the Biden administration, they noted, economic policies that civil society groups have strongly pushed for have demonstrated how "investments in everyday people are the real key to economic growth." The groups pointed to the child tax credit, which slashed childhood poverty nearly in half when it was in place in 2021, and to climate investments in the Inflation Reduction Act, which cut energy costs for families and strengthened supply chains.

"This broad coalition is making clear that Congress cannot simply tinker around the edges of our tax code in 2025—it must reject the failed approach of the Bush and Trump tax cuts and use this opportunity to produce a fairer tax code that supports necessary investments and fuels faster and more inclusive growth," said Ramamurti in a statement. "The Trump tax bill was a bad law and 2025 is Congress' chance to replace it with something a lot better."

The coalition said Congress should view the expiration of the 2017 tax cuts as an opportunity "to address long-standing problems with our tax code" and to answer the call of a majority of Americans who believe the wealthiest households and corporations should pay more in taxes to contribute to investments in sectors of the economy such as caregiving.

Amy Matsui, director of income security and senior counsel at the National Women's Law Center, said on the press call Tuesday that the group conducted a survey earlier this year on tax reform and investments in childcare, paid family medical leave, and aging and disability care.

"What we found is that there is extremely strong public support, across demographics, among caregivers, across political affiliations... for making the tax system fairer and using the revenues that are raised to invest in care," said Matsui. "And more specifically we found that over two-thirds of respondents supported allowing the 2017 tax cuts for the wealthiest to expire. So we think that this demonstrates that people understand very clearly that the way our tax system is structured directly affects the investments that we can make as a nation that are central to families' lives."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Highlighting the massive investments the federal government could make if legislators pass bold new tax reforms following next year's expiration of the Trump-era tax cuts, more than 100 public interest groups on Tuesday wrote to congressional leaders and urged them to correct the "large and costly mistake" that Republicans pushed through in 2017 over the objections of the public.

Nearly seven years after the passage of the Tax Cuts and Jobs Act (TCJA), said the coalition led by Groundwork Collaborative, the law has been proven to be "a failure on its own terms," with the average worker seeing none of the financial benefits promised by Republican Party and former President Donald Trump, who is running for the White House again.

"The Trump administration claimed that the TCJA's corporate tax cuts would lead to significantly higher wages for typical workers, but in reality, workers who earned less than $114,000—the overwhelming majority of Americans—did not experience any increase in earnings from the TCJA while the compensation of top corporate executives skyrocketed," wrote the groups, including Americans for Tax Fairness, Children's Defense Fund, and the National Domestic Workers Alliance.

The groups outlined three concrete goals that must be included in any tax reform considered by Congress in 2025:

Before the passage of the TCJA, the letter reads, the tax code "did not generate enough revenue to support pro-growth investments and fiscal responsibility; it reinforced economic, gender, and racial disparities; and it asked too little of the very wealthy and large corporations."

The TCJA "made those problems worse," the letter continues, with "massive and permanent cuts to corporate taxes and temporary cuts to individual and estate taxes that have largely benefited the wealthy and eroded tax revenues even further."

The letter was sent two weeks after the Congressional Budget Office released an analysis showing that extending the individual and real estate tax cuts in the TCJA past their 2025 expiration date would add $4.6 trillion to the national deficit.

The cost of "true pro-growth tax reform that supports public investments," said former National Economic Council deputy director Bharat Ramamurti on a press call about the letter, pales in comparison to the price of continuing the Trump tax cuts.

"You look at some of the things that historically Congress has been considering—when it comes to housing affordability, that's a few hundred billion dollars. Childcare affordability, a few hundred billion dollars," said Ramamurti, who helped coordinate the letter. "It's a fraction of the cost... It just reinforces the enormous scale of these tax benefits that have gone primarily to very wealthy individuals and to corporations."

Citing an economic analysis by the Center for American Progress, the letter notes that without the tax cuts enacted by Trump and former President George W. Bush, "the national debt, as a percent of GDP [gross domestic product], would be on a permanent downward trajectory today."

"The pre-TCJA tax code was expected to generate roughly 18% of GDP, but even that level is ultimately below what is needed to ensure adequate investments in our children, reduce poverty, address racial and gender disparities, fulfill our commitments to America's seniors, veterans, and people with disabilities—and support our continued growth and prosperity as a country," wrote the groups. "That is why the 2025 tax reform must generate substantially more revenue than simply letting all of the temporary provisions in the TCJA expire."

Under the Biden administration, they noted, economic policies that civil society groups have strongly pushed for have demonstrated how "investments in everyday people are the real key to economic growth." The groups pointed to the child tax credit, which slashed childhood poverty nearly in half when it was in place in 2021, and to climate investments in the Inflation Reduction Act, which cut energy costs for families and strengthened supply chains.

"This broad coalition is making clear that Congress cannot simply tinker around the edges of our tax code in 2025—it must reject the failed approach of the Bush and Trump tax cuts and use this opportunity to produce a fairer tax code that supports necessary investments and fuels faster and more inclusive growth," said Ramamurti in a statement. "The Trump tax bill was a bad law and 2025 is Congress' chance to replace it with something a lot better."

The coalition said Congress should view the expiration of the 2017 tax cuts as an opportunity "to address long-standing problems with our tax code" and to answer the call of a majority of Americans who believe the wealthiest households and corporations should pay more in taxes to contribute to investments in sectors of the economy such as caregiving.

Amy Matsui, director of income security and senior counsel at the National Women's Law Center, said on the press call Tuesday that the group conducted a survey earlier this year on tax reform and investments in childcare, paid family medical leave, and aging and disability care.

"What we found is that there is extremely strong public support, across demographics, among caregivers, across political affiliations... for making the tax system fairer and using the revenues that are raised to invest in care," said Matsui. "And more specifically we found that over two-thirds of respondents supported allowing the 2017 tax cuts for the wealthiest to expire. So we think that this demonstrates that people understand very clearly that the way our tax system is structured directly affects the investments that we can make as a nation that are central to families' lives."

Highlighting the massive investments the federal government could make if legislators pass bold new tax reforms following next year's expiration of the Trump-era tax cuts, more than 100 public interest groups on Tuesday wrote to congressional leaders and urged them to correct the "large and costly mistake" that Republicans pushed through in 2017 over the objections of the public.

Nearly seven years after the passage of the Tax Cuts and Jobs Act (TCJA), said the coalition led by Groundwork Collaborative, the law has been proven to be "a failure on its own terms," with the average worker seeing none of the financial benefits promised by Republican Party and former President Donald Trump, who is running for the White House again.

"The Trump administration claimed that the TCJA's corporate tax cuts would lead to significantly higher wages for typical workers, but in reality, workers who earned less than $114,000—the overwhelming majority of Americans—did not experience any increase in earnings from the TCJA while the compensation of top corporate executives skyrocketed," wrote the groups, including Americans for Tax Fairness, Children's Defense Fund, and the National Domestic Workers Alliance.

The groups outlined three concrete goals that must be included in any tax reform considered by Congress in 2025:

Before the passage of the TCJA, the letter reads, the tax code "did not generate enough revenue to support pro-growth investments and fiscal responsibility; it reinforced economic, gender, and racial disparities; and it asked too little of the very wealthy and large corporations."

The TCJA "made those problems worse," the letter continues, with "massive and permanent cuts to corporate taxes and temporary cuts to individual and estate taxes that have largely benefited the wealthy and eroded tax revenues even further."

The letter was sent two weeks after the Congressional Budget Office released an analysis showing that extending the individual and real estate tax cuts in the TCJA past their 2025 expiration date would add $4.6 trillion to the national deficit.

The cost of "true pro-growth tax reform that supports public investments," said former National Economic Council deputy director Bharat Ramamurti on a press call about the letter, pales in comparison to the price of continuing the Trump tax cuts.

"You look at some of the things that historically Congress has been considering—when it comes to housing affordability, that's a few hundred billion dollars. Childcare affordability, a few hundred billion dollars," said Ramamurti, who helped coordinate the letter. "It's a fraction of the cost... It just reinforces the enormous scale of these tax benefits that have gone primarily to very wealthy individuals and to corporations."

Citing an economic analysis by the Center for American Progress, the letter notes that without the tax cuts enacted by Trump and former President George W. Bush, "the national debt, as a percent of GDP [gross domestic product], would be on a permanent downward trajectory today."

"The pre-TCJA tax code was expected to generate roughly 18% of GDP, but even that level is ultimately below what is needed to ensure adequate investments in our children, reduce poverty, address racial and gender disparities, fulfill our commitments to America's seniors, veterans, and people with disabilities—and support our continued growth and prosperity as a country," wrote the groups. "That is why the 2025 tax reform must generate substantially more revenue than simply letting all of the temporary provisions in the TCJA expire."

Under the Biden administration, they noted, economic policies that civil society groups have strongly pushed for have demonstrated how "investments in everyday people are the real key to economic growth." The groups pointed to the child tax credit, which slashed childhood poverty nearly in half when it was in place in 2021, and to climate investments in the Inflation Reduction Act, which cut energy costs for families and strengthened supply chains.

"This broad coalition is making clear that Congress cannot simply tinker around the edges of our tax code in 2025—it must reject the failed approach of the Bush and Trump tax cuts and use this opportunity to produce a fairer tax code that supports necessary investments and fuels faster and more inclusive growth," said Ramamurti in a statement. "The Trump tax bill was a bad law and 2025 is Congress' chance to replace it with something a lot better."

The coalition said Congress should view the expiration of the 2017 tax cuts as an opportunity "to address long-standing problems with our tax code" and to answer the call of a majority of Americans who believe the wealthiest households and corporations should pay more in taxes to contribute to investments in sectors of the economy such as caregiving.

Amy Matsui, director of income security and senior counsel at the National Women's Law Center, said on the press call Tuesday that the group conducted a survey earlier this year on tax reform and investments in childcare, paid family medical leave, and aging and disability care.

"What we found is that there is extremely strong public support, across demographics, among caregivers, across political affiliations... for making the tax system fairer and using the revenues that are raised to invest in care," said Matsui. "And more specifically we found that over two-thirds of respondents supported allowing the 2017 tax cuts for the wealthiest to expire. So we think that this demonstrates that people understand very clearly that the way our tax system is structured directly affects the investments that we can make as a nation that are central to families' lives."