SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

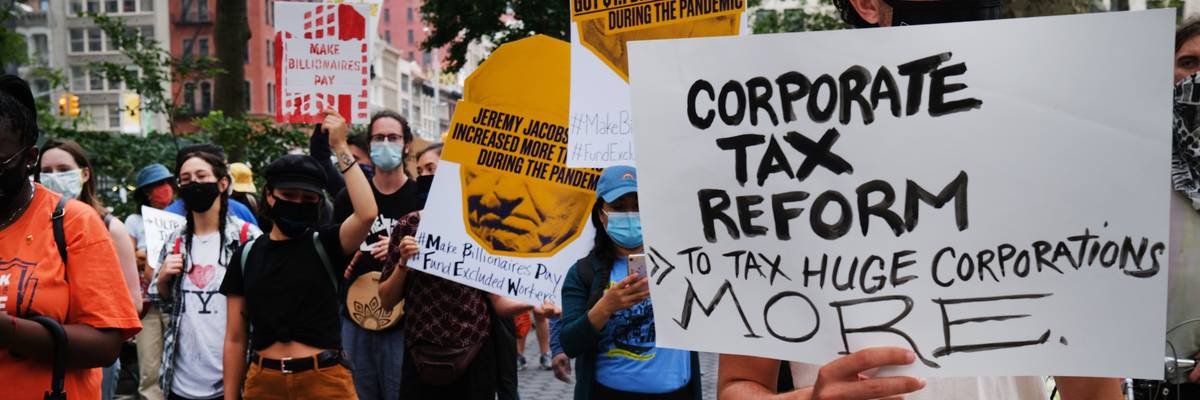

People participate in a "March on Billionaires" event on July 17, 2020 in New York City.

"We can raise the corporate tax rate and disincentivize this corporate profiteering that's costing Americans so much," said Groundwork Collaborative executive director Lindsay Owens.

The U.S. Congress should hike taxes on corporations that have been jacking up prices across the American economy to pad their bottom lines, one expert said Monday in a video message marking national Tax Day.

"These days most Americans are thinking a lot more about high prices than they are about taxes. But the two things are actually connected," said Groundwork Collaborative executive director Lindsay Owens, pointing to a 2017 law that delivered massive tax breaks to corporations and the rich.

Portions of that measure, which former President Donald Trump signed into law, are set to expire at the end of next year, prompting fresh calls for reforms aimed at reversing its damaging impacts. Billionaires have collectively gotten more than $2 trillion richer since the law's enactment, and corporate tax dodging has become even more prevalent.

Owens noted that in addition to rewarding themselves and their shareholders, corporations that benefited from the 2017 Tax Cuts and Jobs Act (TCJA) "also raised your prices."

"Why? Because they got to keep more of the winnings," Owens explained. "It was a lot more fun to overcharge you when they didn't have to send as much of it back to the Treasury Department."

When lawmakers revisit the TCJA, Owens said, they should "tackle this corporate greed at the source." A recent Groundwork analysis found that corporate profits drove 53% of inflation in the U.S. between April and September of last year.

"We can raise the corporate tax rate and disincentivize this corporate profiteering that's costing Americans so much," she added.

What do high prices and tax policy have in common? More than you may think.

On Tax Day, our Executive Director @owenslindsay1 explains — WATCH: pic.twitter.com/lYvJtZZG6j

— Groundwork Collaborative (@Groundwork) April 15, 2024

Owens' remarks came days after Republicans on the House Ways and Means Committee made clear they intend to pursue more tax cuts for big businesses and the wealthy if they take full control of Congress and the White House next year.

During a recent fundraiser at the home of a billionaire investor, Trump—the GOP's presumptive 2024 presidential nominee—said he would work to extend the expiring TCJA provisions if reelected. Making the law's tax cuts for individuals permanent, as Trump and Republican lawmakers have proposed, would overwhelmingly benefit the rich.

"If Democrats take over both houses of Congress in 2024, and [President Joe] Biden gets a second term, they must reverse the regressive tilt of the Trump tax law—raising more revenue while advancing the interests of low- and moderate-income families across the country rather than those of the wealthy," former U.S. Labor Secretary Robert Reich wrote in a blog post on Monday.

"Tax cuts for people making over $400,000 should end on schedule in 2025," Reich added. "The Trump tax law's provisions primarily benefiting high-income households are costly and do not trickle down."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The U.S. Congress should hike taxes on corporations that have been jacking up prices across the American economy to pad their bottom lines, one expert said Monday in a video message marking national Tax Day.

"These days most Americans are thinking a lot more about high prices than they are about taxes. But the two things are actually connected," said Groundwork Collaborative executive director Lindsay Owens, pointing to a 2017 law that delivered massive tax breaks to corporations and the rich.

Portions of that measure, which former President Donald Trump signed into law, are set to expire at the end of next year, prompting fresh calls for reforms aimed at reversing its damaging impacts. Billionaires have collectively gotten more than $2 trillion richer since the law's enactment, and corporate tax dodging has become even more prevalent.

Owens noted that in addition to rewarding themselves and their shareholders, corporations that benefited from the 2017 Tax Cuts and Jobs Act (TCJA) "also raised your prices."

"Why? Because they got to keep more of the winnings," Owens explained. "It was a lot more fun to overcharge you when they didn't have to send as much of it back to the Treasury Department."

When lawmakers revisit the TCJA, Owens said, they should "tackle this corporate greed at the source." A recent Groundwork analysis found that corporate profits drove 53% of inflation in the U.S. between April and September of last year.

"We can raise the corporate tax rate and disincentivize this corporate profiteering that's costing Americans so much," she added.

What do high prices and tax policy have in common? More than you may think.

On Tax Day, our Executive Director @owenslindsay1 explains — WATCH: pic.twitter.com/lYvJtZZG6j

— Groundwork Collaborative (@Groundwork) April 15, 2024

Owens' remarks came days after Republicans on the House Ways and Means Committee made clear they intend to pursue more tax cuts for big businesses and the wealthy if they take full control of Congress and the White House next year.

During a recent fundraiser at the home of a billionaire investor, Trump—the GOP's presumptive 2024 presidential nominee—said he would work to extend the expiring TCJA provisions if reelected. Making the law's tax cuts for individuals permanent, as Trump and Republican lawmakers have proposed, would overwhelmingly benefit the rich.

"If Democrats take over both houses of Congress in 2024, and [President Joe] Biden gets a second term, they must reverse the regressive tilt of the Trump tax law—raising more revenue while advancing the interests of low- and moderate-income families across the country rather than those of the wealthy," former U.S. Labor Secretary Robert Reich wrote in a blog post on Monday.

"Tax cuts for people making over $400,000 should end on schedule in 2025," Reich added. "The Trump tax law's provisions primarily benefiting high-income households are costly and do not trickle down."

The U.S. Congress should hike taxes on corporations that have been jacking up prices across the American economy to pad their bottom lines, one expert said Monday in a video message marking national Tax Day.

"These days most Americans are thinking a lot more about high prices than they are about taxes. But the two things are actually connected," said Groundwork Collaborative executive director Lindsay Owens, pointing to a 2017 law that delivered massive tax breaks to corporations and the rich.

Portions of that measure, which former President Donald Trump signed into law, are set to expire at the end of next year, prompting fresh calls for reforms aimed at reversing its damaging impacts. Billionaires have collectively gotten more than $2 trillion richer since the law's enactment, and corporate tax dodging has become even more prevalent.

Owens noted that in addition to rewarding themselves and their shareholders, corporations that benefited from the 2017 Tax Cuts and Jobs Act (TCJA) "also raised your prices."

"Why? Because they got to keep more of the winnings," Owens explained. "It was a lot more fun to overcharge you when they didn't have to send as much of it back to the Treasury Department."

When lawmakers revisit the TCJA, Owens said, they should "tackle this corporate greed at the source." A recent Groundwork analysis found that corporate profits drove 53% of inflation in the U.S. between April and September of last year.

"We can raise the corporate tax rate and disincentivize this corporate profiteering that's costing Americans so much," she added.

What do high prices and tax policy have in common? More than you may think.

On Tax Day, our Executive Director @owenslindsay1 explains — WATCH: pic.twitter.com/lYvJtZZG6j

— Groundwork Collaborative (@Groundwork) April 15, 2024

Owens' remarks came days after Republicans on the House Ways and Means Committee made clear they intend to pursue more tax cuts for big businesses and the wealthy if they take full control of Congress and the White House next year.

During a recent fundraiser at the home of a billionaire investor, Trump—the GOP's presumptive 2024 presidential nominee—said he would work to extend the expiring TCJA provisions if reelected. Making the law's tax cuts for individuals permanent, as Trump and Republican lawmakers have proposed, would overwhelmingly benefit the rich.

"If Democrats take over both houses of Congress in 2024, and [President Joe] Biden gets a second term, they must reverse the regressive tilt of the Trump tax law—raising more revenue while advancing the interests of low- and moderate-income families across the country rather than those of the wealthy," former U.S. Labor Secretary Robert Reich wrote in a blog post on Monday.

"Tax cuts for people making over $400,000 should end on schedule in 2025," Reich added. "The Trump tax law's provisions primarily benefiting high-income households are costly and do not trickle down."