SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

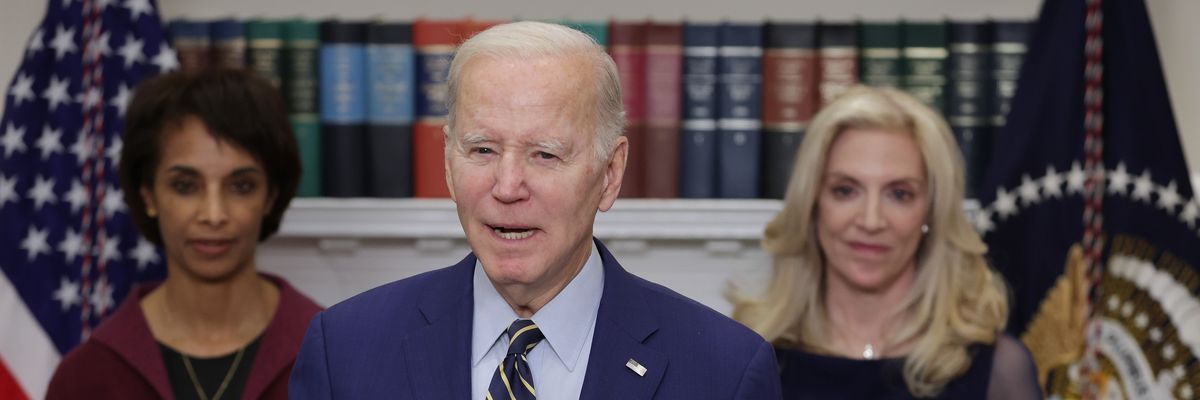

U.S. President Joe Biden delivers remarks on the February jobs report flanked by Council of Economic Advisers Chair Cecilia Rouse and National Economic Council Director Lael Brainard in the Roosevelt Room at the White House in Washington, D.C. on March 10, 2023.

"Republicans have already made clear they're on the side of the 1 Percenters and big corporations by trying to shield rich tax cheats and endangering Social Security and Medicare with deficit-busting tax cuts for the wealthy and corporations," said one expert. "The contrast couldn't be sharper."

While far-right Republicans continue threatening to blow up the global economy unless Congress makes cuts to popular social programs, progressive taxation experts are celebrating U.S. President Joe Biden's latest push to invest in "widespread prosperity" by raising taxes on wealthy individuals and corporations.

As part of his fiscal year 2024 budget blueprint unveiled Thursday, Biden calls for a 25% minimum tax on the wealthiest 0.01%; reforms to ensure high-income individuals pay their fair share into the Medicare Hospital Insurance trust fund; and repealing 2017 tax cuts and restoring the top tax rate of 39.6% for people making over $400,000 a year.

Along with pushing for raising the corporate tax rate from 21% to 28%—which is still far below the 35% rate that was in place prior to Republicans' 2017 tax overhaul—the president advocates expanding the child tax credit while eliminating tax subsidies for cryptocurrency transactions, fossil fuel companies, and real estate.

Biden also "proposes to reform the international tax system to reduce the incentives to book profits in low-tax jurisdictions, stop corporate inversions to tax havens, and raise the tax rate on U.S. multinationals' foreign earnings from 10.5% to 21%," according to a White House fact sheet.

Although many of these proposals are unlikely to go anywhere due to the GOP-controlled U.S. House and divided Senate, Groundwork Collaborative executive director Lindsay Owens said Friday that "it's great to see President Biden leading the charge to increase taxes on billionaires, crack down on stock buybacks by massive corporations, and prevent the wealthiest Americans from cheating on their taxes and avoiding paying what they owe."

"The tax policies laid out in this budget are fair, popular, and long overdue," she declared. "The next time someone claims that we can't afford to protect Social Security and Medicare for future generations—or that we need to cut popular investments in education, healthcare, housing, or clean energy—show them President Bident's latest budget proposal and ask them why they care so much about protecting the ultrawealthy from paying their fair share."

According to Institute on Taxation and Economic Policy executive director Amy Hanauer, "President Biden's budget proposal presents a bold vision for what tax justice should look like in America."

"The provisions would raise substantial revenue, fund important priorities, and increase tax fairness," she stressed. "The revenue raisers are laser-focused on taxing very wealthy individuals and corporations, and the budget would reduce the deficit while easing costs for American families, particularly for middle and low-income parents."

Americans for Tax Fairness executive director Frank Clemente asserted Thursday that "President Biden's budget plainly shows whose side he's on: working families struggling with the high cost of healthcare, childcare, housing and more—not the wealthy elite and their big corporations rolling in dough and dodging their fair share of taxes."

"Republicans have already made clear they're on the side of the 1 Percenters and big corporations by trying to shield rich tax cheats and endangering Social Security and Medicare with deficit-busting tax cuts for the wealthy and corporations," Clemente added. "The contrast couldn't be sharper."

As Common Dreams reported earlier Friday, the House Freedom Caucus said its 45 members would "consider voting" to raise the U.S. debt limit if their colleagues in Congress abandon some of Biden's key economic priorities, slash hundreds of billions of dollars in social spending, and restrict federal agencies' future budgets.

Responding on Twitter, Biden said that "extreme MAGA House Republicans are showing us what they value: tax breaks for the rich."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

While far-right Republicans continue threatening to blow up the global economy unless Congress makes cuts to popular social programs, progressive taxation experts are celebrating U.S. President Joe Biden's latest push to invest in "widespread prosperity" by raising taxes on wealthy individuals and corporations.

As part of his fiscal year 2024 budget blueprint unveiled Thursday, Biden calls for a 25% minimum tax on the wealthiest 0.01%; reforms to ensure high-income individuals pay their fair share into the Medicare Hospital Insurance trust fund; and repealing 2017 tax cuts and restoring the top tax rate of 39.6% for people making over $400,000 a year.

Along with pushing for raising the corporate tax rate from 21% to 28%—which is still far below the 35% rate that was in place prior to Republicans' 2017 tax overhaul—the president advocates expanding the child tax credit while eliminating tax subsidies for cryptocurrency transactions, fossil fuel companies, and real estate.

Biden also "proposes to reform the international tax system to reduce the incentives to book profits in low-tax jurisdictions, stop corporate inversions to tax havens, and raise the tax rate on U.S. multinationals' foreign earnings from 10.5% to 21%," according to a White House fact sheet.

Although many of these proposals are unlikely to go anywhere due to the GOP-controlled U.S. House and divided Senate, Groundwork Collaborative executive director Lindsay Owens said Friday that "it's great to see President Biden leading the charge to increase taxes on billionaires, crack down on stock buybacks by massive corporations, and prevent the wealthiest Americans from cheating on their taxes and avoiding paying what they owe."

"The tax policies laid out in this budget are fair, popular, and long overdue," she declared. "The next time someone claims that we can't afford to protect Social Security and Medicare for future generations—or that we need to cut popular investments in education, healthcare, housing, or clean energy—show them President Bident's latest budget proposal and ask them why they care so much about protecting the ultrawealthy from paying their fair share."

According to Institute on Taxation and Economic Policy executive director Amy Hanauer, "President Biden's budget proposal presents a bold vision for what tax justice should look like in America."

"The provisions would raise substantial revenue, fund important priorities, and increase tax fairness," she stressed. "The revenue raisers are laser-focused on taxing very wealthy individuals and corporations, and the budget would reduce the deficit while easing costs for American families, particularly for middle and low-income parents."

Americans for Tax Fairness executive director Frank Clemente asserted Thursday that "President Biden's budget plainly shows whose side he's on: working families struggling with the high cost of healthcare, childcare, housing and more—not the wealthy elite and their big corporations rolling in dough and dodging their fair share of taxes."

"Republicans have already made clear they're on the side of the 1 Percenters and big corporations by trying to shield rich tax cheats and endangering Social Security and Medicare with deficit-busting tax cuts for the wealthy and corporations," Clemente added. "The contrast couldn't be sharper."

As Common Dreams reported earlier Friday, the House Freedom Caucus said its 45 members would "consider voting" to raise the U.S. debt limit if their colleagues in Congress abandon some of Biden's key economic priorities, slash hundreds of billions of dollars in social spending, and restrict federal agencies' future budgets.

Responding on Twitter, Biden said that "extreme MAGA House Republicans are showing us what they value: tax breaks for the rich."

While far-right Republicans continue threatening to blow up the global economy unless Congress makes cuts to popular social programs, progressive taxation experts are celebrating U.S. President Joe Biden's latest push to invest in "widespread prosperity" by raising taxes on wealthy individuals and corporations.

As part of his fiscal year 2024 budget blueprint unveiled Thursday, Biden calls for a 25% minimum tax on the wealthiest 0.01%; reforms to ensure high-income individuals pay their fair share into the Medicare Hospital Insurance trust fund; and repealing 2017 tax cuts and restoring the top tax rate of 39.6% for people making over $400,000 a year.

Along with pushing for raising the corporate tax rate from 21% to 28%—which is still far below the 35% rate that was in place prior to Republicans' 2017 tax overhaul—the president advocates expanding the child tax credit while eliminating tax subsidies for cryptocurrency transactions, fossil fuel companies, and real estate.

Biden also "proposes to reform the international tax system to reduce the incentives to book profits in low-tax jurisdictions, stop corporate inversions to tax havens, and raise the tax rate on U.S. multinationals' foreign earnings from 10.5% to 21%," according to a White House fact sheet.

Although many of these proposals are unlikely to go anywhere due to the GOP-controlled U.S. House and divided Senate, Groundwork Collaborative executive director Lindsay Owens said Friday that "it's great to see President Biden leading the charge to increase taxes on billionaires, crack down on stock buybacks by massive corporations, and prevent the wealthiest Americans from cheating on their taxes and avoiding paying what they owe."

"The tax policies laid out in this budget are fair, popular, and long overdue," she declared. "The next time someone claims that we can't afford to protect Social Security and Medicare for future generations—or that we need to cut popular investments in education, healthcare, housing, or clean energy—show them President Bident's latest budget proposal and ask them why they care so much about protecting the ultrawealthy from paying their fair share."

According to Institute on Taxation and Economic Policy executive director Amy Hanauer, "President Biden's budget proposal presents a bold vision for what tax justice should look like in America."

"The provisions would raise substantial revenue, fund important priorities, and increase tax fairness," she stressed. "The revenue raisers are laser-focused on taxing very wealthy individuals and corporations, and the budget would reduce the deficit while easing costs for American families, particularly for middle and low-income parents."

Americans for Tax Fairness executive director Frank Clemente asserted Thursday that "President Biden's budget plainly shows whose side he's on: working families struggling with the high cost of healthcare, childcare, housing and more—not the wealthy elite and their big corporations rolling in dough and dodging their fair share of taxes."

"Republicans have already made clear they're on the side of the 1 Percenters and big corporations by trying to shield rich tax cheats and endangering Social Security and Medicare with deficit-busting tax cuts for the wealthy and corporations," Clemente added. "The contrast couldn't be sharper."

As Common Dreams reported earlier Friday, the House Freedom Caucus said its 45 members would "consider voting" to raise the U.S. debt limit if their colleagues in Congress abandon some of Biden's key economic priorities, slash hundreds of billions of dollars in social spending, and restrict federal agencies' future budgets.

Responding on Twitter, Biden said that "extreme MAGA House Republicans are showing us what they value: tax breaks for the rich."