SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

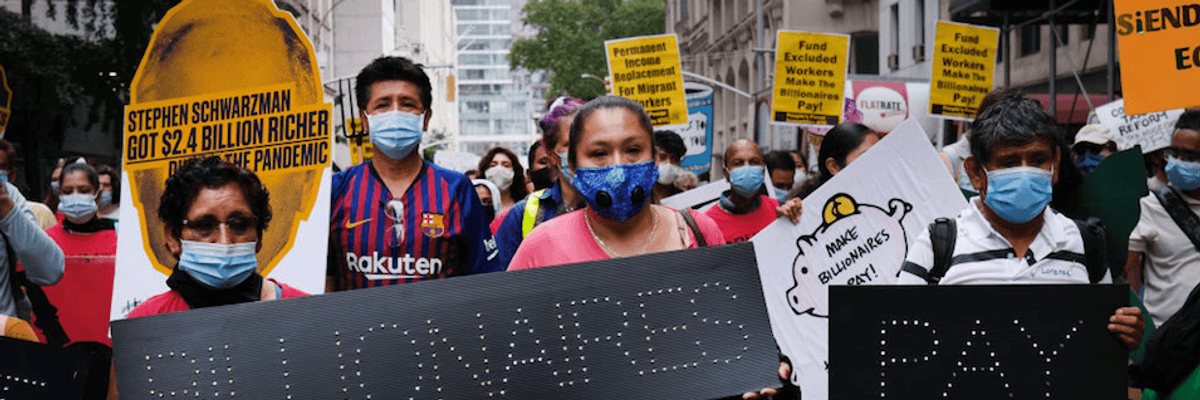

People participate in a "March on Billionaires" event on July 17, 2020 in New York City. (Photo: Spencer Platt/Getty Images)

Following grassroots pressure, New Jersey Gov. Phil Murphy on Tuesday signed a $32.7 billion, nine-month budget that fulfills the Democrat's promise to raise taxes on the state's wealthiest households and businesses--legislation that drew praise from economic justice advocates.

NJ.com reports the budget included an increase in the so-called milionaire's tax, which will rise from 8.97% to 10.75% for people earning between $1 million and $5 million. People earning over $5 million already pay the higher marginal rate.

Businesses making more than $1 million annually will also see a tax increase from 10.5% to 11.5%, although the higher tax rate is set to expire in 2022.

Murphy's administration estimates the millionaires tax hike will generate $390 million in revenue, plus another $210 million from raising the business tax.

The budget--which goes into effect on Thursday and will fund the state government through the end of next June--also authorizes some $4.5 billion in new debt, which Murphy says is necessary for the state to remain solvent. It will send billions of dollars to school districts and the public pension fund, and millions more to transit, while setting aside $2 billion for the state's rainy day fund. It also provides $500 tax rebates for around 800,000 of the state's 8.9 million residents.

Overall, spending will increase by 4% in 2021 over this year, an increase the governor insists is needed as New Jersey's most vulnerable residents struggle during the coronavirus pandemic, which has hit the state particularly hard.

"As we continue to fight this pandemic, this budget will provide the resources we need to build a stronger, fairer, more resilient future," Murphy-- a former Goldman Sachs executive--said Tuesday during a signing ceremony at Trenton's War Memorial Theater.

"This budget lives up to the ideal of shared sacrifice in trying times by including meaningful tax fairness," Murphy added. "This isn't just achieved by reinstating the millionaires tax, but also providing direct tax relief to hundreds of thousands of middle class and working families with children."

While Republicans slammed Murphy's budget as an election-year ploy bloated with unnecessary debt, a broad coalition of progressive advocates joined Democratic state lawmakers in applauding the increase in the millionaires tax.

"Today is a historic moment for New Jersey, as the state tax code is getting a lot fairer--and for good reason," said Sheila Reynertson, senior policy analyst at New Jersey Policy Perspective (NJPP). "Income inequality is at an all-time high, and for far too long, lawmakers failed to address this in a meaningful way. Today, that changes."

"The millionaires tax will help New Jersey maintain investments in crucial assets like education while responding to the Covid-19 health crisis without further worsening economic and racial inequality," Reynertson added. "We truly are setting an example for the nation on how to build an economy that works for all of us, not just a chosen few."

Renee Koubiadis, executive director of the Anti-Poverty Network of New Jersey, said her organization "is pleased to see the inclusion of a true millionaires tax and the continuation of a fair corporate business tax in the state budget."

"These steps move New Jersey towards real tax fairness with crucial new revenues, rather than putting an unfair burden on middle and low-income residents for our state's recovery," she added.

However, some progressive advocates said the budget does not do enough to help advance racial equity or help immigrant workers and undocumented immigrants.

"Today's budget signing is a historic but incomplete victory for tax fairness and equity," said Sara Cullinane, director of Make the Road New Jersey. "A half-million undocumented immigrants and potentially 225,000 U.S. citizens will see nothing in Covid aid. Many of these families have survived more than six months without income or a penny in government relief."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Following grassroots pressure, New Jersey Gov. Phil Murphy on Tuesday signed a $32.7 billion, nine-month budget that fulfills the Democrat's promise to raise taxes on the state's wealthiest households and businesses--legislation that drew praise from economic justice advocates.

NJ.com reports the budget included an increase in the so-called milionaire's tax, which will rise from 8.97% to 10.75% for people earning between $1 million and $5 million. People earning over $5 million already pay the higher marginal rate.

Businesses making more than $1 million annually will also see a tax increase from 10.5% to 11.5%, although the higher tax rate is set to expire in 2022.

Murphy's administration estimates the millionaires tax hike will generate $390 million in revenue, plus another $210 million from raising the business tax.

The budget--which goes into effect on Thursday and will fund the state government through the end of next June--also authorizes some $4.5 billion in new debt, which Murphy says is necessary for the state to remain solvent. It will send billions of dollars to school districts and the public pension fund, and millions more to transit, while setting aside $2 billion for the state's rainy day fund. It also provides $500 tax rebates for around 800,000 of the state's 8.9 million residents.

Overall, spending will increase by 4% in 2021 over this year, an increase the governor insists is needed as New Jersey's most vulnerable residents struggle during the coronavirus pandemic, which has hit the state particularly hard.

"As we continue to fight this pandemic, this budget will provide the resources we need to build a stronger, fairer, more resilient future," Murphy-- a former Goldman Sachs executive--said Tuesday during a signing ceremony at Trenton's War Memorial Theater.

"This budget lives up to the ideal of shared sacrifice in trying times by including meaningful tax fairness," Murphy added. "This isn't just achieved by reinstating the millionaires tax, but also providing direct tax relief to hundreds of thousands of middle class and working families with children."

While Republicans slammed Murphy's budget as an election-year ploy bloated with unnecessary debt, a broad coalition of progressive advocates joined Democratic state lawmakers in applauding the increase in the millionaires tax.

"Today is a historic moment for New Jersey, as the state tax code is getting a lot fairer--and for good reason," said Sheila Reynertson, senior policy analyst at New Jersey Policy Perspective (NJPP). "Income inequality is at an all-time high, and for far too long, lawmakers failed to address this in a meaningful way. Today, that changes."

"The millionaires tax will help New Jersey maintain investments in crucial assets like education while responding to the Covid-19 health crisis without further worsening economic and racial inequality," Reynertson added. "We truly are setting an example for the nation on how to build an economy that works for all of us, not just a chosen few."

Renee Koubiadis, executive director of the Anti-Poverty Network of New Jersey, said her organization "is pleased to see the inclusion of a true millionaires tax and the continuation of a fair corporate business tax in the state budget."

"These steps move New Jersey towards real tax fairness with crucial new revenues, rather than putting an unfair burden on middle and low-income residents for our state's recovery," she added.

However, some progressive advocates said the budget does not do enough to help advance racial equity or help immigrant workers and undocumented immigrants.

"Today's budget signing is a historic but incomplete victory for tax fairness and equity," said Sara Cullinane, director of Make the Road New Jersey. "A half-million undocumented immigrants and potentially 225,000 U.S. citizens will see nothing in Covid aid. Many of these families have survived more than six months without income or a penny in government relief."

Following grassroots pressure, New Jersey Gov. Phil Murphy on Tuesday signed a $32.7 billion, nine-month budget that fulfills the Democrat's promise to raise taxes on the state's wealthiest households and businesses--legislation that drew praise from economic justice advocates.

NJ.com reports the budget included an increase in the so-called milionaire's tax, which will rise from 8.97% to 10.75% for people earning between $1 million and $5 million. People earning over $5 million already pay the higher marginal rate.

Businesses making more than $1 million annually will also see a tax increase from 10.5% to 11.5%, although the higher tax rate is set to expire in 2022.

Murphy's administration estimates the millionaires tax hike will generate $390 million in revenue, plus another $210 million from raising the business tax.

The budget--which goes into effect on Thursday and will fund the state government through the end of next June--also authorizes some $4.5 billion in new debt, which Murphy says is necessary for the state to remain solvent. It will send billions of dollars to school districts and the public pension fund, and millions more to transit, while setting aside $2 billion for the state's rainy day fund. It also provides $500 tax rebates for around 800,000 of the state's 8.9 million residents.

Overall, spending will increase by 4% in 2021 over this year, an increase the governor insists is needed as New Jersey's most vulnerable residents struggle during the coronavirus pandemic, which has hit the state particularly hard.

"As we continue to fight this pandemic, this budget will provide the resources we need to build a stronger, fairer, more resilient future," Murphy-- a former Goldman Sachs executive--said Tuesday during a signing ceremony at Trenton's War Memorial Theater.

"This budget lives up to the ideal of shared sacrifice in trying times by including meaningful tax fairness," Murphy added. "This isn't just achieved by reinstating the millionaires tax, but also providing direct tax relief to hundreds of thousands of middle class and working families with children."

While Republicans slammed Murphy's budget as an election-year ploy bloated with unnecessary debt, a broad coalition of progressive advocates joined Democratic state lawmakers in applauding the increase in the millionaires tax.

"Today is a historic moment for New Jersey, as the state tax code is getting a lot fairer--and for good reason," said Sheila Reynertson, senior policy analyst at New Jersey Policy Perspective (NJPP). "Income inequality is at an all-time high, and for far too long, lawmakers failed to address this in a meaningful way. Today, that changes."

"The millionaires tax will help New Jersey maintain investments in crucial assets like education while responding to the Covid-19 health crisis without further worsening economic and racial inequality," Reynertson added. "We truly are setting an example for the nation on how to build an economy that works for all of us, not just a chosen few."

Renee Koubiadis, executive director of the Anti-Poverty Network of New Jersey, said her organization "is pleased to see the inclusion of a true millionaires tax and the continuation of a fair corporate business tax in the state budget."

"These steps move New Jersey towards real tax fairness with crucial new revenues, rather than putting an unfair burden on middle and low-income residents for our state's recovery," she added.

However, some progressive advocates said the budget does not do enough to help advance racial equity or help immigrant workers and undocumented immigrants.

"Today's budget signing is a historic but incomplete victory for tax fairness and equity," said Sara Cullinane, director of Make the Road New Jersey. "A half-million undocumented immigrants and potentially 225,000 U.S. citizens will see nothing in Covid aid. Many of these families have survived more than six months without income or a penny in government relief."