SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Activists rally against President Donald Trump's reported plans to loosen Wall Street Regulations and repeal the Dodd-Frank Act outside of Goldman Sachs headquarters in Lower Manhattan, February 7, 2017 in New York City. (Photo: Drew Angerer/Getty Images)

In a warning sign that another devastating economic crash could be just around the corner, Public Citizen found in a report published Monday that penalties against some of the same Wall Street giants that sparked the 2008 financial crisis have plummeted under President Donald Trump.

"Instead of holding the industry that ransacked our economy accountable, our system of justice is being further rigged in its favor."

--Public Citizen

"How can Trump call himself 'tough on crime' while he lets the industry that crashed our economy 10 years ago get away with slap-on-the-wrist penalties?" Rick Claypool, a Public Citizen research director and author of the new report, said in a statement. "Weak enforcement gives Wall Street wrongdoers a green light to ramp up risk and recklessness. We know how that ended last time."

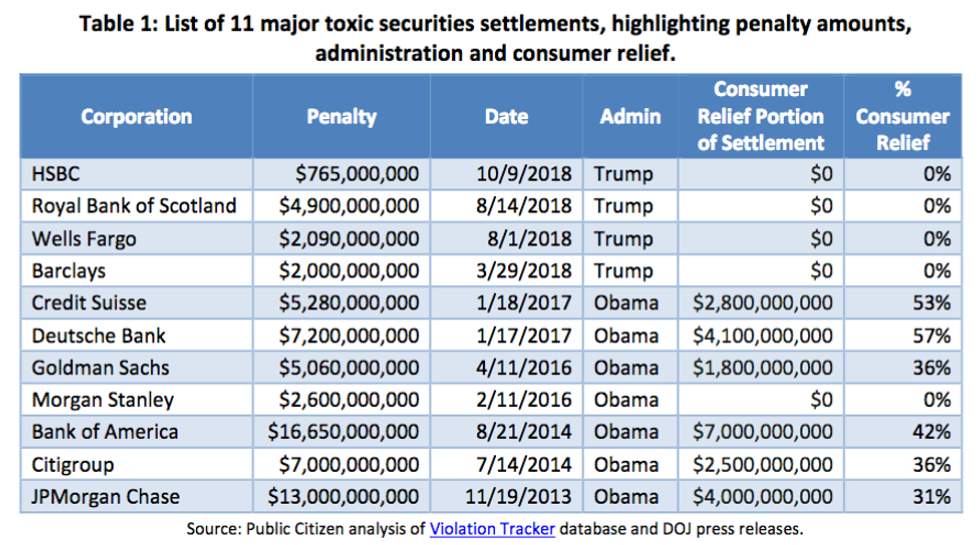

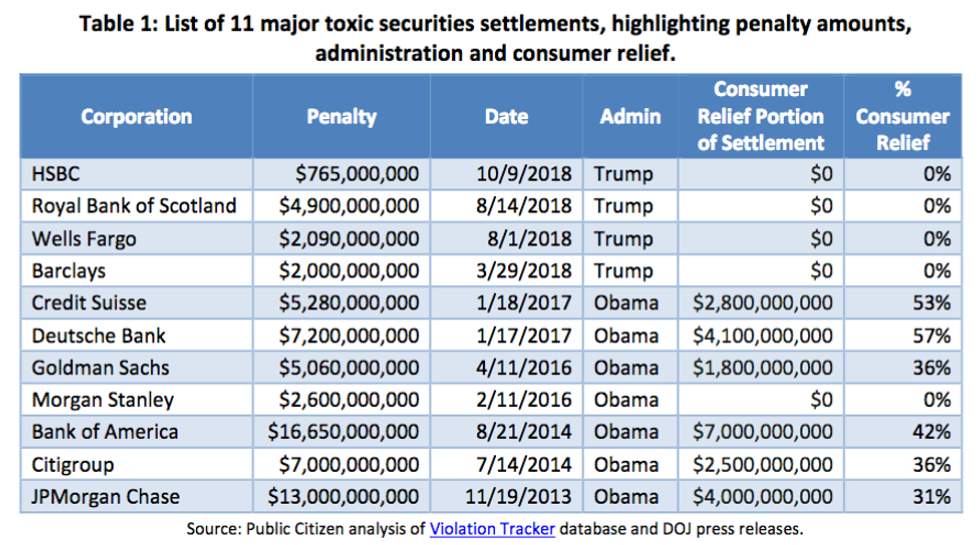

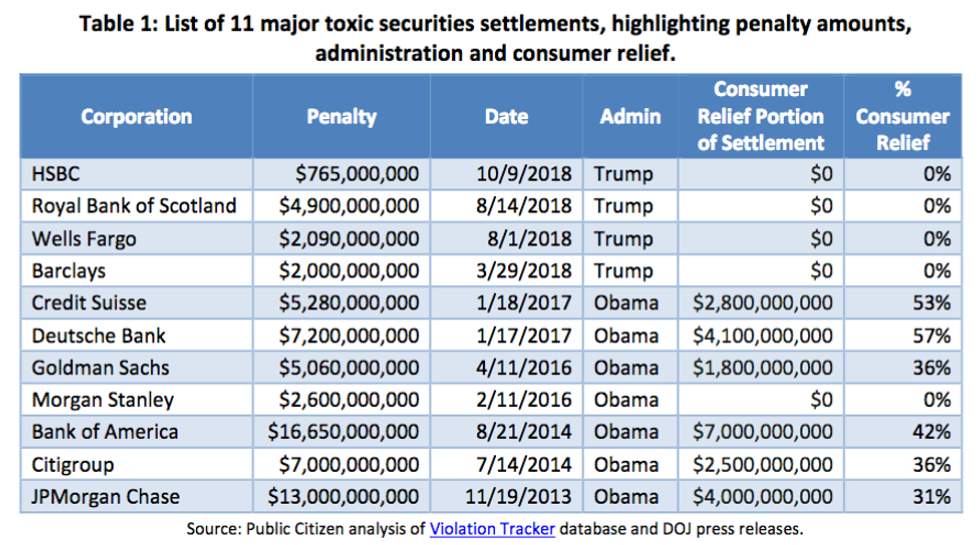

According to Public Citizen's analysis (pdf), in the four cases Trump's Department of Justice (DOJ) settled last year against major banks for "financial crisis-era allegations of toxic securities abuses," the penalties were 70 percent lower on average than those imposed by the Obama administration--which was widely criticized by progressives for letting Wall Street banks and executives off the hook for their role in the 2008 crash.

"These four 2018 settlements, which the [Trump] DOJ entered into with Royal Bank of Scotland, Wells Fargo, Barclays Capital, and HSBC, reveal the reduced enforcement that big banks that triggered the Great Recession now face," Public Citizen notes.

The group goes on to point out that, "unlike the Obama-era cases, the banks were allowed to settle while disputing the DOJ's allegations, and none of the settlements provided consumer relief. Taken together, Obama's penalties average out to $8.1 billion per case while Trump's penalties average $2.4 billion."

Public Citizen's report comes nearly a year after Republicans and Democrats in Congress teamed up to pass Trump-backed legislation that loosened regulations on some of the nation's largest financial institutions, a move that analysts warned significantly heightens the risk of another financial crisis.

According to Public Citizen, the Trump administration's willingness to let big banks off with little more than "slap-on-the-wrist penalties" for serious abuses consitutes yet another systemic risk to the American economy.

"Trump's lenience to Wall Street, which is clear to Wall Street analysts, becomes an invitation to misconduct," the group said. "The lower penalties, combined with the refusal to require penalized banks to accept the facts contained in the Justice Department's allegations against them and the elimination of consumer relief from these settlements mean the Trump administration is rewarding Wall Street wrongdoers for resisting settlements and stringing out negotiations."

"Instead of holding the industry that ransacked our economy accountable," Public Citizen concluded, "our system of justice is being further rigged in its favor."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

In a warning sign that another devastating economic crash could be just around the corner, Public Citizen found in a report published Monday that penalties against some of the same Wall Street giants that sparked the 2008 financial crisis have plummeted under President Donald Trump.

"Instead of holding the industry that ransacked our economy accountable, our system of justice is being further rigged in its favor."

--Public Citizen

"How can Trump call himself 'tough on crime' while he lets the industry that crashed our economy 10 years ago get away with slap-on-the-wrist penalties?" Rick Claypool, a Public Citizen research director and author of the new report, said in a statement. "Weak enforcement gives Wall Street wrongdoers a green light to ramp up risk and recklessness. We know how that ended last time."

According to Public Citizen's analysis (pdf), in the four cases Trump's Department of Justice (DOJ) settled last year against major banks for "financial crisis-era allegations of toxic securities abuses," the penalties were 70 percent lower on average than those imposed by the Obama administration--which was widely criticized by progressives for letting Wall Street banks and executives off the hook for their role in the 2008 crash.

"These four 2018 settlements, which the [Trump] DOJ entered into with Royal Bank of Scotland, Wells Fargo, Barclays Capital, and HSBC, reveal the reduced enforcement that big banks that triggered the Great Recession now face," Public Citizen notes.

The group goes on to point out that, "unlike the Obama-era cases, the banks were allowed to settle while disputing the DOJ's allegations, and none of the settlements provided consumer relief. Taken together, Obama's penalties average out to $8.1 billion per case while Trump's penalties average $2.4 billion."

Public Citizen's report comes nearly a year after Republicans and Democrats in Congress teamed up to pass Trump-backed legislation that loosened regulations on some of the nation's largest financial institutions, a move that analysts warned significantly heightens the risk of another financial crisis.

According to Public Citizen, the Trump administration's willingness to let big banks off with little more than "slap-on-the-wrist penalties" for serious abuses consitutes yet another systemic risk to the American economy.

"Trump's lenience to Wall Street, which is clear to Wall Street analysts, becomes an invitation to misconduct," the group said. "The lower penalties, combined with the refusal to require penalized banks to accept the facts contained in the Justice Department's allegations against them and the elimination of consumer relief from these settlements mean the Trump administration is rewarding Wall Street wrongdoers for resisting settlements and stringing out negotiations."

"Instead of holding the industry that ransacked our economy accountable," Public Citizen concluded, "our system of justice is being further rigged in its favor."

In a warning sign that another devastating economic crash could be just around the corner, Public Citizen found in a report published Monday that penalties against some of the same Wall Street giants that sparked the 2008 financial crisis have plummeted under President Donald Trump.

"Instead of holding the industry that ransacked our economy accountable, our system of justice is being further rigged in its favor."

--Public Citizen

"How can Trump call himself 'tough on crime' while he lets the industry that crashed our economy 10 years ago get away with slap-on-the-wrist penalties?" Rick Claypool, a Public Citizen research director and author of the new report, said in a statement. "Weak enforcement gives Wall Street wrongdoers a green light to ramp up risk and recklessness. We know how that ended last time."

According to Public Citizen's analysis (pdf), in the four cases Trump's Department of Justice (DOJ) settled last year against major banks for "financial crisis-era allegations of toxic securities abuses," the penalties were 70 percent lower on average than those imposed by the Obama administration--which was widely criticized by progressives for letting Wall Street banks and executives off the hook for their role in the 2008 crash.

"These four 2018 settlements, which the [Trump] DOJ entered into with Royal Bank of Scotland, Wells Fargo, Barclays Capital, and HSBC, reveal the reduced enforcement that big banks that triggered the Great Recession now face," Public Citizen notes.

The group goes on to point out that, "unlike the Obama-era cases, the banks were allowed to settle while disputing the DOJ's allegations, and none of the settlements provided consumer relief. Taken together, Obama's penalties average out to $8.1 billion per case while Trump's penalties average $2.4 billion."

Public Citizen's report comes nearly a year after Republicans and Democrats in Congress teamed up to pass Trump-backed legislation that loosened regulations on some of the nation's largest financial institutions, a move that analysts warned significantly heightens the risk of another financial crisis.

According to Public Citizen, the Trump administration's willingness to let big banks off with little more than "slap-on-the-wrist penalties" for serious abuses consitutes yet another systemic risk to the American economy.

"Trump's lenience to Wall Street, which is clear to Wall Street analysts, becomes an invitation to misconduct," the group said. "The lower penalties, combined with the refusal to require penalized banks to accept the facts contained in the Justice Department's allegations against them and the elimination of consumer relief from these settlements mean the Trump administration is rewarding Wall Street wrongdoers for resisting settlements and stringing out negotiations."

"Instead of holding the industry that ransacked our economy accountable," Public Citizen concluded, "our system of justice is being further rigged in its favor."