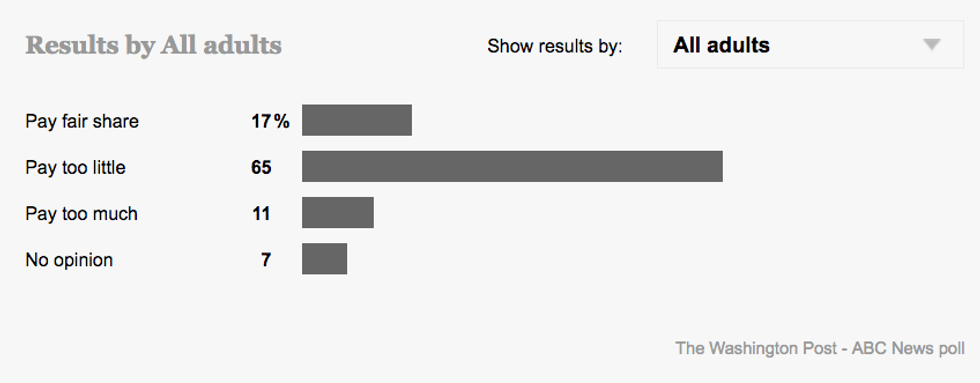

As President Donald Trump looks to pivot from his party's collapsing Obamacare repeal efforts to "tax reform" this week, an ABC News/Washington Post poll (pdf) released Tuesday found that most Americans strongly disapprove of the White House's desire to drastically slash the corporate tax rate: 65 percent of Americans believe that corporations pay too little in taxes, not too much, the survey found.

The poll also revealed what a majority of Americans think of Trump's broad outlines for tax reform so far: not much. Twenty-eight percent expressed support for the president's tax agenda, while 44 percent said they oppose it.

Furthermore, 73 percent of respondents said--consistent with previous surveys--that the U.S. economic system disproportionately favors the wealthy, and that Trump's tax plan will only worsen the gap between the richest and everyone else.

As Axios reported over the weekend, the so-called "Big Six"--a team of White House officials and Republican lawmakers--is set to unveil the "framework" of their plan on Wednesday as Trump delivers a tax-focused speech in Indiana.

Trump has in the past said he favors reducing the corporate tax rate from 35 percent to 15 percent, arguing that American businesses pay the "highest tax rates in the world." But a recent analysis by the Economic Policy Institute (EPI) found that by utilizing various loopholes and tax avoidance maneuvers, corporations manage to pay far less than the statutory rate of 35 percent.

Despite Trump's insistence that his tax agenda is not designed to benefit the rich, reports indicate that his administration wants to cut the top individual tax rate from 39.6 percent to 35 percent.