SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

The federal government is garnishing Social Security checks to recoup unpaid student debt, leaving thousands of retired or disabled Americans below the poverty line and setting the stage for an even bigger problem, according to a new report.

The data from the Government Accountability Office (GAO), compiled at the behest of Sens. Claire McCaskill (D-Mo.) and Elizabeth Warren (D-Mass.), showed that people over the age of 50 are the fastest-growing group with student debt, outpacing younger generations--and compared to younger borrowers, older Americans have "considerably higher rates of default on federal student loans." This leaves them open to having up to 15 percent of their benefit payment withheld, in what's called an "offset."

In 2015, the GAO reported (pdf), the Department of Education collected about $171 million in defaulted student loan debt through Social Security offsets from 114,000 people, the majority of that from borrowers aged 50 or older and receiving disability benefits. About 38,000 were above age 64, and more than three-quarters of older borrowers took out the loans to cover their own education, rather than to pay for their children's schooling. The typical monthly offset was slightly more than $140. And more than 70 percent of the money collected through offsets went toward interest and fees, as opposed to the loan balance.

"This report demonstrates just how draconian these Social Security offsets are and how there seems to be a failure at all sorts of levels of this policy," Persis Yu, the director of the Student Loan Borrower Assistance Project at the Boston-based National Consumer Law Center, told MarketWatch.

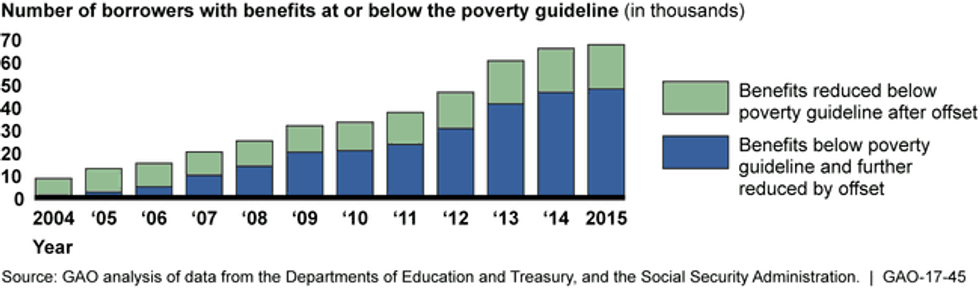

Meanwhile, the report states: "Older borrowers who remain in offset may increasingly experience financial hardship. Such is the case for a growing number of older borrowers whose Social Security benefits have fallen below the poverty guideline because the offset threshold is not adjusted for increases in costs of living."

Indeed, the program--which itself may be under threat from a Trump administration--already hands out insufficient benefits, with the GAO noting that "a growing number of these older borrowers already received Social Security benefits below the poverty guideline before offsets further reduced their income."

As shown in the chart below, this impacts tens of thousands of borrowers:

In its report on the "disturbing" trend, the Washington Post noted:

Some people have been granted financial hardship exemptions, while others have successfully applied for permanent disability discharge of their loans through the Education Department. But researchers at the GAO are critical of the agency's byzantine application process that puts borrowers at risk of falling back into garnishment. If people do not submit annual documentation to verify their income, their loans can be reinstated and the cuts can resume.

In turn, Warren decried the tactics described in the report as "predatory and counterproductive."

"The hard-earned Social Security checks that are the sole source of income for millions of seniors should not be siphoned off to pay interest and fees on student loan debt," she said in a statement. "It's no wonder many Americans don't think Washington works for them: our government is shoving tens of thousands of seniors and people with disabilities into poverty through garnishment every year--and charging them $15 every month for the privilege--just so that the Department of Education can collect a little bit more interest and keep boosting the government's student loan profits."

What's more, with Americans 65 and older seeing their total student loan debt grow by 385 percent since 2005, McCaskill warned that these numbers are merely "the tip of the iceberg of what may be to come."

"We could have hundreds of thousands of American seniors living in poverty due to garnished Social Security benefits if this trend continues," she said, "and we shouldn't allow that to happen."

Social Security Works and Student Debt Crisis, two non-profits working on different aspects of the burgeoning crisis laid out in the GAO's report, last year pledged to "always fight in solidarity with each other."

On Wednesday, Student Debt Crisis tweeted:

\u201cAlarming @USGAO report: Disabled/elderly student loan borrowers having social security garnished. We join @SSWorks to demand this stops!\u201d— Student Debt Crisis Center (SDCC) (@Student Debt Crisis Center (SDCC)) 1482264326

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The federal government is garnishing Social Security checks to recoup unpaid student debt, leaving thousands of retired or disabled Americans below the poverty line and setting the stage for an even bigger problem, according to a new report.

The data from the Government Accountability Office (GAO), compiled at the behest of Sens. Claire McCaskill (D-Mo.) and Elizabeth Warren (D-Mass.), showed that people over the age of 50 are the fastest-growing group with student debt, outpacing younger generations--and compared to younger borrowers, older Americans have "considerably higher rates of default on federal student loans." This leaves them open to having up to 15 percent of their benefit payment withheld, in what's called an "offset."

In 2015, the GAO reported (pdf), the Department of Education collected about $171 million in defaulted student loan debt through Social Security offsets from 114,000 people, the majority of that from borrowers aged 50 or older and receiving disability benefits. About 38,000 were above age 64, and more than three-quarters of older borrowers took out the loans to cover their own education, rather than to pay for their children's schooling. The typical monthly offset was slightly more than $140. And more than 70 percent of the money collected through offsets went toward interest and fees, as opposed to the loan balance.

"This report demonstrates just how draconian these Social Security offsets are and how there seems to be a failure at all sorts of levels of this policy," Persis Yu, the director of the Student Loan Borrower Assistance Project at the Boston-based National Consumer Law Center, told MarketWatch.

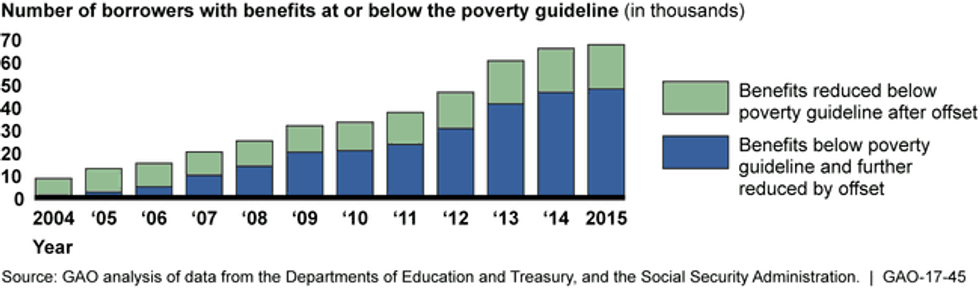

Meanwhile, the report states: "Older borrowers who remain in offset may increasingly experience financial hardship. Such is the case for a growing number of older borrowers whose Social Security benefits have fallen below the poverty guideline because the offset threshold is not adjusted for increases in costs of living."

Indeed, the program--which itself may be under threat from a Trump administration--already hands out insufficient benefits, with the GAO noting that "a growing number of these older borrowers already received Social Security benefits below the poverty guideline before offsets further reduced their income."

As shown in the chart below, this impacts tens of thousands of borrowers:

In its report on the "disturbing" trend, the Washington Post noted:

Some people have been granted financial hardship exemptions, while others have successfully applied for permanent disability discharge of their loans through the Education Department. But researchers at the GAO are critical of the agency's byzantine application process that puts borrowers at risk of falling back into garnishment. If people do not submit annual documentation to verify their income, their loans can be reinstated and the cuts can resume.

In turn, Warren decried the tactics described in the report as "predatory and counterproductive."

"The hard-earned Social Security checks that are the sole source of income for millions of seniors should not be siphoned off to pay interest and fees on student loan debt," she said in a statement. "It's no wonder many Americans don't think Washington works for them: our government is shoving tens of thousands of seniors and people with disabilities into poverty through garnishment every year--and charging them $15 every month for the privilege--just so that the Department of Education can collect a little bit more interest and keep boosting the government's student loan profits."

What's more, with Americans 65 and older seeing their total student loan debt grow by 385 percent since 2005, McCaskill warned that these numbers are merely "the tip of the iceberg of what may be to come."

"We could have hundreds of thousands of American seniors living in poverty due to garnished Social Security benefits if this trend continues," she said, "and we shouldn't allow that to happen."

Social Security Works and Student Debt Crisis, two non-profits working on different aspects of the burgeoning crisis laid out in the GAO's report, last year pledged to "always fight in solidarity with each other."

On Wednesday, Student Debt Crisis tweeted:

\u201cAlarming @USGAO report: Disabled/elderly student loan borrowers having social security garnished. We join @SSWorks to demand this stops!\u201d— Student Debt Crisis Center (SDCC) (@Student Debt Crisis Center (SDCC)) 1482264326

The federal government is garnishing Social Security checks to recoup unpaid student debt, leaving thousands of retired or disabled Americans below the poverty line and setting the stage for an even bigger problem, according to a new report.

The data from the Government Accountability Office (GAO), compiled at the behest of Sens. Claire McCaskill (D-Mo.) and Elizabeth Warren (D-Mass.), showed that people over the age of 50 are the fastest-growing group with student debt, outpacing younger generations--and compared to younger borrowers, older Americans have "considerably higher rates of default on federal student loans." This leaves them open to having up to 15 percent of their benefit payment withheld, in what's called an "offset."

In 2015, the GAO reported (pdf), the Department of Education collected about $171 million in defaulted student loan debt through Social Security offsets from 114,000 people, the majority of that from borrowers aged 50 or older and receiving disability benefits. About 38,000 were above age 64, and more than three-quarters of older borrowers took out the loans to cover their own education, rather than to pay for their children's schooling. The typical monthly offset was slightly more than $140. And more than 70 percent of the money collected through offsets went toward interest and fees, as opposed to the loan balance.

"This report demonstrates just how draconian these Social Security offsets are and how there seems to be a failure at all sorts of levels of this policy," Persis Yu, the director of the Student Loan Borrower Assistance Project at the Boston-based National Consumer Law Center, told MarketWatch.

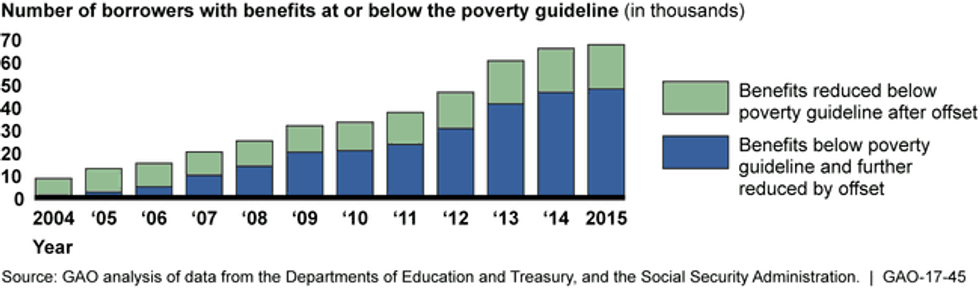

Meanwhile, the report states: "Older borrowers who remain in offset may increasingly experience financial hardship. Such is the case for a growing number of older borrowers whose Social Security benefits have fallen below the poverty guideline because the offset threshold is not adjusted for increases in costs of living."

Indeed, the program--which itself may be under threat from a Trump administration--already hands out insufficient benefits, with the GAO noting that "a growing number of these older borrowers already received Social Security benefits below the poverty guideline before offsets further reduced their income."

As shown in the chart below, this impacts tens of thousands of borrowers:

In its report on the "disturbing" trend, the Washington Post noted:

Some people have been granted financial hardship exemptions, while others have successfully applied for permanent disability discharge of their loans through the Education Department. But researchers at the GAO are critical of the agency's byzantine application process that puts borrowers at risk of falling back into garnishment. If people do not submit annual documentation to verify their income, their loans can be reinstated and the cuts can resume.

In turn, Warren decried the tactics described in the report as "predatory and counterproductive."

"The hard-earned Social Security checks that are the sole source of income for millions of seniors should not be siphoned off to pay interest and fees on student loan debt," she said in a statement. "It's no wonder many Americans don't think Washington works for them: our government is shoving tens of thousands of seniors and people with disabilities into poverty through garnishment every year--and charging them $15 every month for the privilege--just so that the Department of Education can collect a little bit more interest and keep boosting the government's student loan profits."

What's more, with Americans 65 and older seeing their total student loan debt grow by 385 percent since 2005, McCaskill warned that these numbers are merely "the tip of the iceberg of what may be to come."

"We could have hundreds of thousands of American seniors living in poverty due to garnished Social Security benefits if this trend continues," she said, "and we shouldn't allow that to happen."

Social Security Works and Student Debt Crisis, two non-profits working on different aspects of the burgeoning crisis laid out in the GAO's report, last year pledged to "always fight in solidarity with each other."

On Wednesday, Student Debt Crisis tweeted:

\u201cAlarming @USGAO report: Disabled/elderly student loan borrowers having social security garnished. We join @SSWorks to demand this stops!\u201d— Student Debt Crisis Center (SDCC) (@Student Debt Crisis Center (SDCC)) 1482264326