On Tuesday, a coalition of more than 20 progressive activist and labor groups is launching a new campaign to reform the financial industry.

The group, Take on Wall Street, aims to utilize public anger at the banking industry and the momentum of the Occupy Wall Street movement, as well as the efforts of groups like the AFL-CIO and Communications Workers of America (CWA), to introduce an agenda that would change the way the financial sector operates.

Take On Wall Street will formally announce its campaign launch at an event Tuesday night, which will feature a headlining speech by Sen. Elizabeth Warren (D-Mass.), an outspoken proponent of financial reform.

The campaign is calling on U.S. Congress to adopt pending legislation that would introduce five key changes:

- Close the carried interest loophole that lets billionaire Wall Street money managers pay lower tax rates than nurses or construction workers;

- Create a Wall Street speculation tax that would discourage short-term bets and generate billions in new revenue to make college affordable, invest in our infrastructure, and create jobs in our cities;

- End "Too Big to Fail" by breaking up the big banks--making them smaller, simpler, and safer;

- Stop subsidizing million dollar CEO bonuses by ending the CEO pay tax loophole; and

- End predatory lending and also expand access to fair consumer banking services through "a public option" like postal banking.

"The big banks are bigger than they were before the 2008 crisis, and CEOs and Wall Street money managers continue to benefit from obscene tax loopholes that cost us billions," a statement from the group reads.

Campaign for America's Future communications director Isaiah J. Poole explained in a post published Tuesday that the reforms are "the broadest effort yet to combine these proposals into a singular reform push."

"[B]road support for the Take On Wall Street agenda will limit [Hillary] Clinton's ability to pivot, especially if this agenda helps elect new Senate and House members committed to not allowing Wall Street to keep rigging the economy against the rest of us," Poole writes.

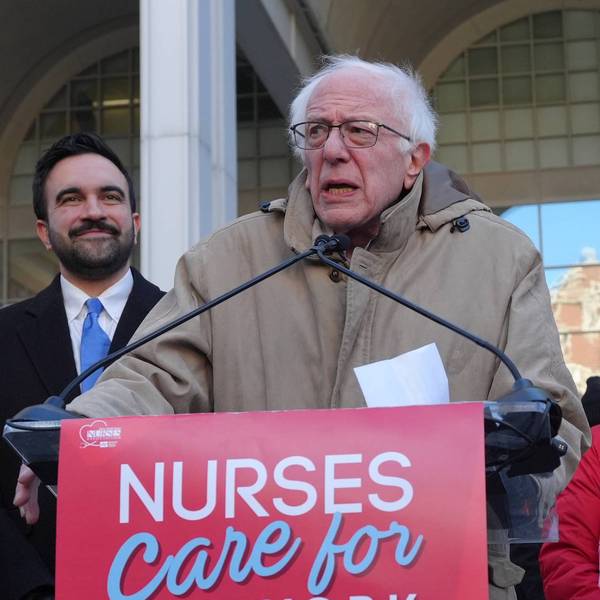

With Bernie Sanders making economic justice a central platform of his campaign, the 2016 election is the perfect time to capitalize on populist anger toward Wall Street, supporters say.

As Lisa Donner, executive director of the advocacy group Americans for Financial Reform, told the Washington Post on Tuesday, "I think the tone of the election has reminded many people just how deeply felt the frustration and anger is about the way that Wall Street has shaped the economy in its own interest."

AFL-CIO executive director Richard Trumka added, "We are going to make this an issue in congressional races. No one will be able to run from this."