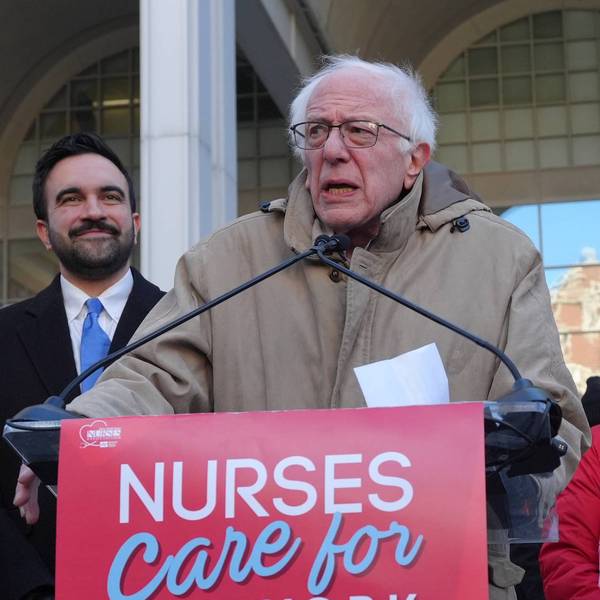

With student debt figures continuing to climb, U.S. Sen. Bernie Sanders (I-Vt.) plans to unveil legislation this week to provide tuition-free higher education for students at 4-year colleges and universities in the United States.

The proposal, which Sanders plans to introduce on Tuesday, would eliminate undergraduate tuition at public colleges and universities and expand work-study programs.

"Countries like Germany, Denmark, Sweden, and many more are providing free or inexpensive higher education for their young people," Sanders, who is running for president as a Democrat, said in a news release. "They understand how important it is to be investing in their youth. We should be doing the same."

Earlier this year, in a speech at Johnson State College in Vermont, Sanders called for a "revolution" in the way higher education is funded in the U.S.

"We must fundamentally restructure our student loan program," he said at the time, adding: "It makes no sense that students and their parents are forced to pay interest rates for higher education loans that are much higher than they pay for car loans or housing mortgages. We must also end the practice of the government making $127 billion over the next decade in profits from student loans."

The average class of 2015 borrower will graduate college with just over $35,000 in debt, according to an analysis by Edvisors, a publisher of free websites about planning and paying for college. What's more, a full 71 percent of this year's college graduates borrowed money to pay for their undergraduate education. As the Boston Globe put it, the class of 2015 is "the most indebted class in history, graduating with a whopping $56 billion in student loan debt."

Meanwhile, the Huffington Post reported that on Thursday, the Consumer Financial Protection Bureau "launched a broad review of the often murky business of student loan servicing, questioning whether the roughly 40 million Americans with student debt are being treated fairly under a patchwork of rules and market forces that could leave them vulnerable to abuse."

The review, wrote HuffPo financial and regulatory correspondent Shahien Nasiripour, "is the clearest sign that the federal consumer agency intends to establish stronger rules governing the roughly $1.2 trillion student debt market. Nearly 90 percent of student debt is overseen by the oft-criticized U.S. Department of Education, and borrowers say dodgy practices are common, bad information rampant, and basic necessities like full payment histories or accurate pay-off amounts often hard to obtain."