SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

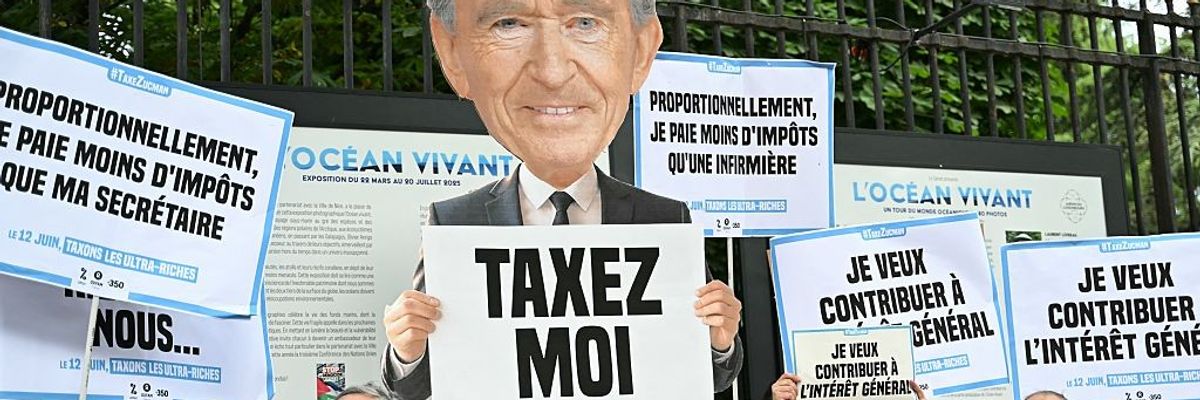

Protesters hold placards, including one featuring French businessman and CEO of LVMH Bernard Arnault (C), during a protest in front of the Senate in Paris on June 12, 2025.

"Not only is it necessary to impose a stronger burden of justice on billionaires, but more importantly, it is possible."

Seven Nobel laureates on Monday published an op-ed advocating for "a minimum tax for the ultrarich, expressed as a percentage of their wealth," in the French newspaper Le Monde.

"They have never been so wealthy and yet contribute very little to the public coffers: From Bernard Arnault to Elon Musk, billionaires have significantly lower tax rates than the average taxpayer," wrote Daron Acemoglu, George Akerlof, Abhijit Banerjee, Esther Duflo, Simon Johnson, Paul Krugman, and Joseph Stiglitz.

Citing pioneering research from the E.U. Tax Observatory, the renowned economists noted that "ultrawealthy individuals pay around 0% to 0.6% of their wealth in income tax. In a country like the United States, their effective tax rate is around 0.6%, while in a country like France, it is closer to 0.1%."

Although the "ultrawealthy can easily structure their wealth to avoid income tax, which is supposed to be the cornerstone of tax justice," the strategies for doing so differ by region, the experts detailed. Europeans often use family holding companies that are banned in the United States, "which explains why the wealthy are more heavily taxed there than in Europe—though some have still managed to find workarounds."

The good news is that "there is no inevitability here. Not only is it necessary to impose a stronger burden of justice on billionaires, but more importantly, it is possible," argued the economists, who say that taxing the overall wealth of the ultrarich, not just income, is the key.

The wealth tax approach, they wrote, "is effective because it targets all forms of tax optimization, whatever their nature. It is targeted, as it applies only to the wealthiest taxpayers, and only to those among them who engage in tax avoidance."

💡 "One of the most promising avenues is to introduce a minimum tax for the ultra-rich, expressed as a percentage of their wealth."Seven Nobel laureates in economics advocate for the Zucman tax in their latest op-ed.Read the full @lemonde.fr article 👇www.lemonde.fr/idees/articl...

[image or embed]

— EU Tax Observatory (@taxobservatory.bsky.social) July 7, 2025 at 8:05 AM

The anticipated impact would be significant. As the op-ed highlights: "Globally, a 2% minimum tax on billionaire wealth would generate about $250 billion in tax revenue—from just 3,000 individuals. In Europe, around $50 billion could be raised. And by extending this minimum rate to individuals with wealth over $100 million, these sums would increase significantly."

That's according to a June 2024 report that French economist and E.U. Tax Observatory director Gabriel Zucman prepared for the Group of 20's Brazilian presidency—which was followed by G20 leaders' November commitment to taxing the rich and last month's related proposal from the governments of Brazil, South Africa, and Spain.

"The international movement is underway," the economists declared Monday, also pointing to recent developments on the "Zucman tax" in France. The French National Assembly voted in favor of a 2% minimum tax on wealth exceeding €100 million, or $117 million, in February—but the Senate rejected the measure last month.

The economists urged the European country to keep working at it, writing that "at a time of ballooning public deficits and exploding extreme wealth, the French government must seize the initiative approved by the National Assembly. There is no reason to wait for an international agreement to be finalized—on the contrary, France should lead by example, as it has done in the past," when it was the first country to introduce a value-added tax (VAT).

"As for the risk of tax exile, the bill passed by the National Assembly provides that taxpayers would remain subject to the minimum tax for five years after leaving the country," they wrote. "The government could go further and propose extending this period to 10 years, which would likely reduce the risk of expatriation even more."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Seven Nobel laureates on Monday published an op-ed advocating for "a minimum tax for the ultrarich, expressed as a percentage of their wealth," in the French newspaper Le Monde.

"They have never been so wealthy and yet contribute very little to the public coffers: From Bernard Arnault to Elon Musk, billionaires have significantly lower tax rates than the average taxpayer," wrote Daron Acemoglu, George Akerlof, Abhijit Banerjee, Esther Duflo, Simon Johnson, Paul Krugman, and Joseph Stiglitz.

Citing pioneering research from the E.U. Tax Observatory, the renowned economists noted that "ultrawealthy individuals pay around 0% to 0.6% of their wealth in income tax. In a country like the United States, their effective tax rate is around 0.6%, while in a country like France, it is closer to 0.1%."

Although the "ultrawealthy can easily structure their wealth to avoid income tax, which is supposed to be the cornerstone of tax justice," the strategies for doing so differ by region, the experts detailed. Europeans often use family holding companies that are banned in the United States, "which explains why the wealthy are more heavily taxed there than in Europe—though some have still managed to find workarounds."

The good news is that "there is no inevitability here. Not only is it necessary to impose a stronger burden of justice on billionaires, but more importantly, it is possible," argued the economists, who say that taxing the overall wealth of the ultrarich, not just income, is the key.

The wealth tax approach, they wrote, "is effective because it targets all forms of tax optimization, whatever their nature. It is targeted, as it applies only to the wealthiest taxpayers, and only to those among them who engage in tax avoidance."

💡 "One of the most promising avenues is to introduce a minimum tax for the ultra-rich, expressed as a percentage of their wealth."Seven Nobel laureates in economics advocate for the Zucman tax in their latest op-ed.Read the full @lemonde.fr article 👇www.lemonde.fr/idees/articl...

[image or embed]

— EU Tax Observatory (@taxobservatory.bsky.social) July 7, 2025 at 8:05 AM

The anticipated impact would be significant. As the op-ed highlights: "Globally, a 2% minimum tax on billionaire wealth would generate about $250 billion in tax revenue—from just 3,000 individuals. In Europe, around $50 billion could be raised. And by extending this minimum rate to individuals with wealth over $100 million, these sums would increase significantly."

That's according to a June 2024 report that French economist and E.U. Tax Observatory director Gabriel Zucman prepared for the Group of 20's Brazilian presidency—which was followed by G20 leaders' November commitment to taxing the rich and last month's related proposal from the governments of Brazil, South Africa, and Spain.

"The international movement is underway," the economists declared Monday, also pointing to recent developments on the "Zucman tax" in France. The French National Assembly voted in favor of a 2% minimum tax on wealth exceeding €100 million, or $117 million, in February—but the Senate rejected the measure last month.

The economists urged the European country to keep working at it, writing that "at a time of ballooning public deficits and exploding extreme wealth, the French government must seize the initiative approved by the National Assembly. There is no reason to wait for an international agreement to be finalized—on the contrary, France should lead by example, as it has done in the past," when it was the first country to introduce a value-added tax (VAT).

"As for the risk of tax exile, the bill passed by the National Assembly provides that taxpayers would remain subject to the minimum tax for five years after leaving the country," they wrote. "The government could go further and propose extending this period to 10 years, which would likely reduce the risk of expatriation even more."

Seven Nobel laureates on Monday published an op-ed advocating for "a minimum tax for the ultrarich, expressed as a percentage of their wealth," in the French newspaper Le Monde.

"They have never been so wealthy and yet contribute very little to the public coffers: From Bernard Arnault to Elon Musk, billionaires have significantly lower tax rates than the average taxpayer," wrote Daron Acemoglu, George Akerlof, Abhijit Banerjee, Esther Duflo, Simon Johnson, Paul Krugman, and Joseph Stiglitz.

Citing pioneering research from the E.U. Tax Observatory, the renowned economists noted that "ultrawealthy individuals pay around 0% to 0.6% of their wealth in income tax. In a country like the United States, their effective tax rate is around 0.6%, while in a country like France, it is closer to 0.1%."

Although the "ultrawealthy can easily structure their wealth to avoid income tax, which is supposed to be the cornerstone of tax justice," the strategies for doing so differ by region, the experts detailed. Europeans often use family holding companies that are banned in the United States, "which explains why the wealthy are more heavily taxed there than in Europe—though some have still managed to find workarounds."

The good news is that "there is no inevitability here. Not only is it necessary to impose a stronger burden of justice on billionaires, but more importantly, it is possible," argued the economists, who say that taxing the overall wealth of the ultrarich, not just income, is the key.

The wealth tax approach, they wrote, "is effective because it targets all forms of tax optimization, whatever their nature. It is targeted, as it applies only to the wealthiest taxpayers, and only to those among them who engage in tax avoidance."

💡 "One of the most promising avenues is to introduce a minimum tax for the ultra-rich, expressed as a percentage of their wealth."Seven Nobel laureates in economics advocate for the Zucman tax in their latest op-ed.Read the full @lemonde.fr article 👇www.lemonde.fr/idees/articl...

[image or embed]

— EU Tax Observatory (@taxobservatory.bsky.social) July 7, 2025 at 8:05 AM

The anticipated impact would be significant. As the op-ed highlights: "Globally, a 2% minimum tax on billionaire wealth would generate about $250 billion in tax revenue—from just 3,000 individuals. In Europe, around $50 billion could be raised. And by extending this minimum rate to individuals with wealth over $100 million, these sums would increase significantly."

That's according to a June 2024 report that French economist and E.U. Tax Observatory director Gabriel Zucman prepared for the Group of 20's Brazilian presidency—which was followed by G20 leaders' November commitment to taxing the rich and last month's related proposal from the governments of Brazil, South Africa, and Spain.

"The international movement is underway," the economists declared Monday, also pointing to recent developments on the "Zucman tax" in France. The French National Assembly voted in favor of a 2% minimum tax on wealth exceeding €100 million, or $117 million, in February—but the Senate rejected the measure last month.

The economists urged the European country to keep working at it, writing that "at a time of ballooning public deficits and exploding extreme wealth, the French government must seize the initiative approved by the National Assembly. There is no reason to wait for an international agreement to be finalized—on the contrary, France should lead by example, as it has done in the past," when it was the first country to introduce a value-added tax (VAT).

"As for the risk of tax exile, the bill passed by the National Assembly provides that taxpayers would remain subject to the minimum tax for five years after leaving the country," they wrote. "The government could go further and propose extending this period to 10 years, which would likely reduce the risk of expatriation even more."