SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Here are just a few startling facts that tell you nearly all you need to know about who the American economy has worked for--and against--over the past several decades:

Published by the Institute for Policy Studies (IPS) on Tuesday in a new report--titled "Billionaire Bonanza 2018: The Role of Dynastic Wealth" (pdf)--these numbers paint a striking portrait of an economy designed to enrich a handful of individuals and family dynasties while leaving the rest of the American population with stagnant or falling wages, meager or even negative wealth, and soaring economic insecurity.

"Today's extreme wealth inequality is perhaps greater than any time in American history," Josh Hoxie, a co-author of the report, said in a statement. "This is largely the result of rapidly growing wealth dynasties and a rigged economy that enables the ultra-wealthy to grow their wealth to never-before-seen highs."

"These families have used their wealth and power to lobby and rig the rules to expand their wealth and power."

--Chuck Collins, Institute for Policy StudiesCiting economist Thomas Piketty's warning that the United States is operating under a system of "patrimonial capitalism" that allows the wealthy few to hoard their riches and pass them on to their heirs--fueling the rapid explosion of inequality since the 1970s--IPS found that "seven of the 20 wealthiest members of the Forbes 400 inherited their wealth from previous generations, often through companies founded by their ancestors."

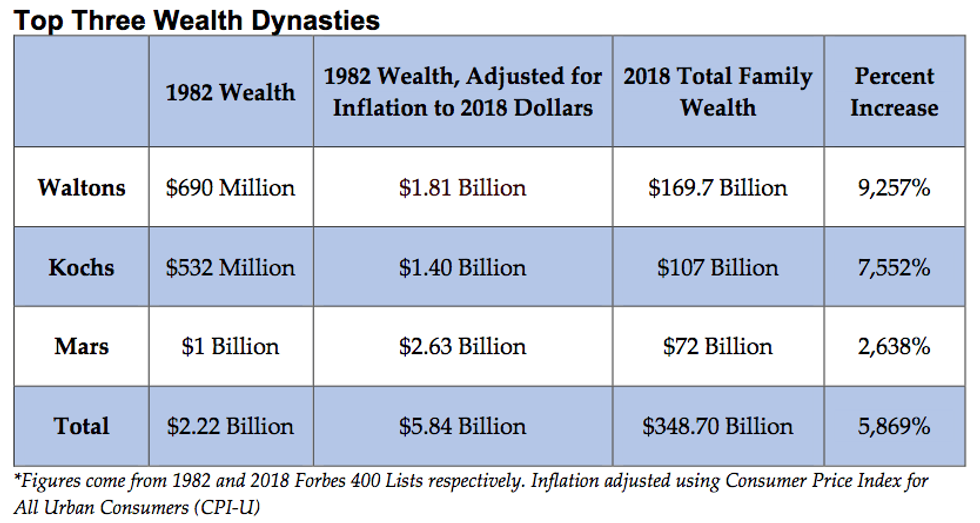

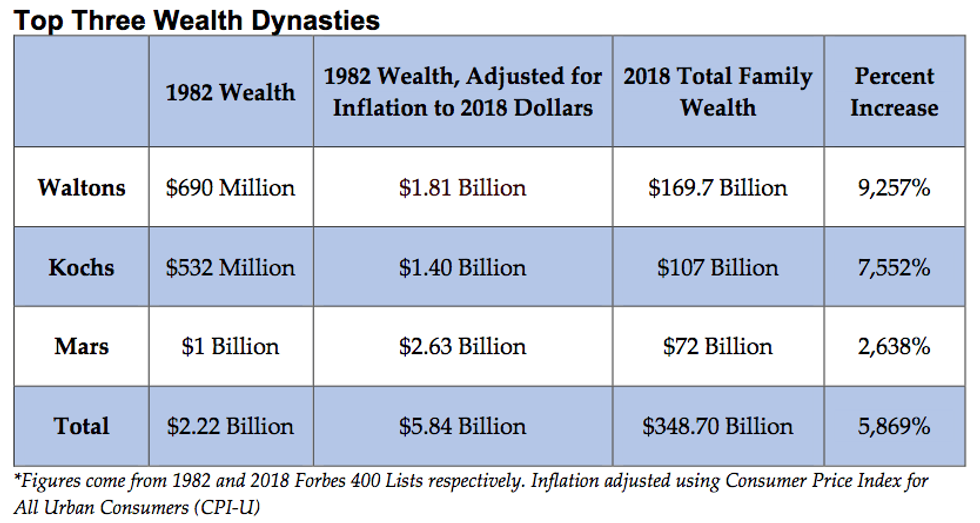

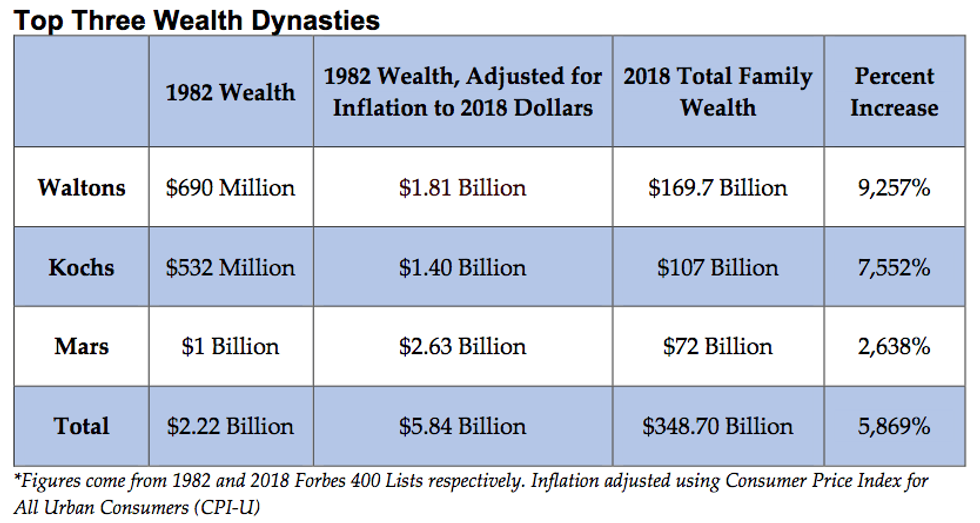

These members, the report notes, include "Charles and David Koch of Koch Industries as well as Jim, Alice, and S. Robson Walton of Walmart and Jacqueline and John Mars of the Mars candy empire."

According to IPS, these three "wealth dynasties" own a combined $348.7 billion--over four million times the median wealth of American families.

When IPS looked at the 15 wealthiest American families with multiple members on the vaunted Forbes 400 list, it found that the wealth of each of these families "comes from companies started by an earlier generation, either a parent or more distant ancestor. Each of them also represents a wealth dynasty passing generation to generation free from interruption."

Combined, these families are worth $618 billion.

In total, IPS found, "136 out of the 400 members of the Forbes 400 derive their wealth from companies started by an earlier generation. That's 34 percent, or about a third, of the entire list."

As millions of American workers and households find themselves in an increasingly precarious economic position--unable, for instance, to afford a $400 emergency payment--these dynastic families have seen their already staggering wealth grow thousands of percentage points over the past three decades, contributing to the growing gulf between the ultra-rich and everyone else and giving a few billionaires disproportionate power to shape public policy.

"These families have used their wealth and power to lobby and rig the rules to expand their wealth and power," explained Chuck Collins, IPS senior scholar and co-author of the new report.

Contrary to the right-wing view that the vastly unequal wealth distribution in American society is the unavoidable result of "market forces" and ever-advancing technology, IPS argues that there is "nothing inevitable about dynastic wealth" and that such inequality is perpetuated by the wealthy themselves, who use a variety of "dynasty protection techniques" to undercut redistributive policies and escape taxes.

"There is now ample evidence that some billionaire families are engaged in aggressive practices to preserve dynastic wealth."

--Billionaire Bonanza 2018"There is now ample evidence that some billionaire families are engaged in aggressive practices to preserve dynastic wealth. These include using their wealth to lobby for tax cuts and public policies that will further enrich their enterprises," the report notes. "They hire armies of tax accountants, wealth managers, and trust lawyers to create trusts, shell corporations, and offshore accounts to move money around and dodge taxation and accountability."

Curtailing the meteoric rise of dynastic wealth and bringing inequality under control will require bold policy interventions that are sure to face resistance from the billionaires used to getting their way in the political sphere.

In its new report, IPS outlines two possible solutions: a wealth tax and an inheritance tax.

"A direct tax on wealth paid by the wealthiest one tenth of one percent could generate significant revenue to be reinvested in creating and restoring opportunities for low wealth households to prosper," the report notes.

Pointing out that the federal estate tax has been "significantly weakened"--most recently by President Donald Trump and the GOP's $1.5 trillion tax bill--IPS argues that "[t]axing inherited wealth as income would help break up current and future wealth dynasties."

"Because of changes in tax law and aggressive use of trusts and tax dodges, we are now witnessing a resurgence of dynastic inherited wealth," Collins of IPS observed in an op-ed for Common Dreams on Tuesday. "To protect our democracy, we need to strengthen and expand taxes that reduce this concentration of wealth and power."

Common Dreams is powered by optimists who believe in the power of informed and engaged citizens to ignite and enact change to make the world a better place. We're hundreds of thousands strong, but every single supporter makes the difference. Your contribution supports this bold media model—free, independent, and dedicated to reporting the facts every day. Stand with us in the fight for economic equality, social justice, human rights, and a more sustainable future. As a people-powered nonprofit news outlet, we cover the issues the corporate media never will. |

Here are just a few startling facts that tell you nearly all you need to know about who the American economy has worked for--and against--over the past several decades:

Published by the Institute for Policy Studies (IPS) on Tuesday in a new report--titled "Billionaire Bonanza 2018: The Role of Dynastic Wealth" (pdf)--these numbers paint a striking portrait of an economy designed to enrich a handful of individuals and family dynasties while leaving the rest of the American population with stagnant or falling wages, meager or even negative wealth, and soaring economic insecurity.

"Today's extreme wealth inequality is perhaps greater than any time in American history," Josh Hoxie, a co-author of the report, said in a statement. "This is largely the result of rapidly growing wealth dynasties and a rigged economy that enables the ultra-wealthy to grow their wealth to never-before-seen highs."

"These families have used their wealth and power to lobby and rig the rules to expand their wealth and power."

--Chuck Collins, Institute for Policy StudiesCiting economist Thomas Piketty's warning that the United States is operating under a system of "patrimonial capitalism" that allows the wealthy few to hoard their riches and pass them on to their heirs--fueling the rapid explosion of inequality since the 1970s--IPS found that "seven of the 20 wealthiest members of the Forbes 400 inherited their wealth from previous generations, often through companies founded by their ancestors."

These members, the report notes, include "Charles and David Koch of Koch Industries as well as Jim, Alice, and S. Robson Walton of Walmart and Jacqueline and John Mars of the Mars candy empire."

According to IPS, these three "wealth dynasties" own a combined $348.7 billion--over four million times the median wealth of American families.

When IPS looked at the 15 wealthiest American families with multiple members on the vaunted Forbes 400 list, it found that the wealth of each of these families "comes from companies started by an earlier generation, either a parent or more distant ancestor. Each of them also represents a wealth dynasty passing generation to generation free from interruption."

Combined, these families are worth $618 billion.

In total, IPS found, "136 out of the 400 members of the Forbes 400 derive their wealth from companies started by an earlier generation. That's 34 percent, or about a third, of the entire list."

As millions of American workers and households find themselves in an increasingly precarious economic position--unable, for instance, to afford a $400 emergency payment--these dynastic families have seen their already staggering wealth grow thousands of percentage points over the past three decades, contributing to the growing gulf between the ultra-rich and everyone else and giving a few billionaires disproportionate power to shape public policy.

"These families have used their wealth and power to lobby and rig the rules to expand their wealth and power," explained Chuck Collins, IPS senior scholar and co-author of the new report.

Contrary to the right-wing view that the vastly unequal wealth distribution in American society is the unavoidable result of "market forces" and ever-advancing technology, IPS argues that there is "nothing inevitable about dynastic wealth" and that such inequality is perpetuated by the wealthy themselves, who use a variety of "dynasty protection techniques" to undercut redistributive policies and escape taxes.

"There is now ample evidence that some billionaire families are engaged in aggressive practices to preserve dynastic wealth."

--Billionaire Bonanza 2018"There is now ample evidence that some billionaire families are engaged in aggressive practices to preserve dynastic wealth. These include using their wealth to lobby for tax cuts and public policies that will further enrich their enterprises," the report notes. "They hire armies of tax accountants, wealth managers, and trust lawyers to create trusts, shell corporations, and offshore accounts to move money around and dodge taxation and accountability."

Curtailing the meteoric rise of dynastic wealth and bringing inequality under control will require bold policy interventions that are sure to face resistance from the billionaires used to getting their way in the political sphere.

In its new report, IPS outlines two possible solutions: a wealth tax and an inheritance tax.

"A direct tax on wealth paid by the wealthiest one tenth of one percent could generate significant revenue to be reinvested in creating and restoring opportunities for low wealth households to prosper," the report notes.

Pointing out that the federal estate tax has been "significantly weakened"--most recently by President Donald Trump and the GOP's $1.5 trillion tax bill--IPS argues that "[t]axing inherited wealth as income would help break up current and future wealth dynasties."

"Because of changes in tax law and aggressive use of trusts and tax dodges, we are now witnessing a resurgence of dynastic inherited wealth," Collins of IPS observed in an op-ed for Common Dreams on Tuesday. "To protect our democracy, we need to strengthen and expand taxes that reduce this concentration of wealth and power."

Here are just a few startling facts that tell you nearly all you need to know about who the American economy has worked for--and against--over the past several decades:

Published by the Institute for Policy Studies (IPS) on Tuesday in a new report--titled "Billionaire Bonanza 2018: The Role of Dynastic Wealth" (pdf)--these numbers paint a striking portrait of an economy designed to enrich a handful of individuals and family dynasties while leaving the rest of the American population with stagnant or falling wages, meager or even negative wealth, and soaring economic insecurity.

"Today's extreme wealth inequality is perhaps greater than any time in American history," Josh Hoxie, a co-author of the report, said in a statement. "This is largely the result of rapidly growing wealth dynasties and a rigged economy that enables the ultra-wealthy to grow their wealth to never-before-seen highs."

"These families have used their wealth and power to lobby and rig the rules to expand their wealth and power."

--Chuck Collins, Institute for Policy StudiesCiting economist Thomas Piketty's warning that the United States is operating under a system of "patrimonial capitalism" that allows the wealthy few to hoard their riches and pass them on to their heirs--fueling the rapid explosion of inequality since the 1970s--IPS found that "seven of the 20 wealthiest members of the Forbes 400 inherited their wealth from previous generations, often through companies founded by their ancestors."

These members, the report notes, include "Charles and David Koch of Koch Industries as well as Jim, Alice, and S. Robson Walton of Walmart and Jacqueline and John Mars of the Mars candy empire."

According to IPS, these three "wealth dynasties" own a combined $348.7 billion--over four million times the median wealth of American families.

When IPS looked at the 15 wealthiest American families with multiple members on the vaunted Forbes 400 list, it found that the wealth of each of these families "comes from companies started by an earlier generation, either a parent or more distant ancestor. Each of them also represents a wealth dynasty passing generation to generation free from interruption."

Combined, these families are worth $618 billion.

In total, IPS found, "136 out of the 400 members of the Forbes 400 derive their wealth from companies started by an earlier generation. That's 34 percent, or about a third, of the entire list."

As millions of American workers and households find themselves in an increasingly precarious economic position--unable, for instance, to afford a $400 emergency payment--these dynastic families have seen their already staggering wealth grow thousands of percentage points over the past three decades, contributing to the growing gulf between the ultra-rich and everyone else and giving a few billionaires disproportionate power to shape public policy.

"These families have used their wealth and power to lobby and rig the rules to expand their wealth and power," explained Chuck Collins, IPS senior scholar and co-author of the new report.

Contrary to the right-wing view that the vastly unequal wealth distribution in American society is the unavoidable result of "market forces" and ever-advancing technology, IPS argues that there is "nothing inevitable about dynastic wealth" and that such inequality is perpetuated by the wealthy themselves, who use a variety of "dynasty protection techniques" to undercut redistributive policies and escape taxes.

"There is now ample evidence that some billionaire families are engaged in aggressive practices to preserve dynastic wealth."

--Billionaire Bonanza 2018"There is now ample evidence that some billionaire families are engaged in aggressive practices to preserve dynastic wealth. These include using their wealth to lobby for tax cuts and public policies that will further enrich their enterprises," the report notes. "They hire armies of tax accountants, wealth managers, and trust lawyers to create trusts, shell corporations, and offshore accounts to move money around and dodge taxation and accountability."

Curtailing the meteoric rise of dynastic wealth and bringing inequality under control will require bold policy interventions that are sure to face resistance from the billionaires used to getting their way in the political sphere.

In its new report, IPS outlines two possible solutions: a wealth tax and an inheritance tax.

"A direct tax on wealth paid by the wealthiest one tenth of one percent could generate significant revenue to be reinvested in creating and restoring opportunities for low wealth households to prosper," the report notes.

Pointing out that the federal estate tax has been "significantly weakened"--most recently by President Donald Trump and the GOP's $1.5 trillion tax bill--IPS argues that "[t]axing inherited wealth as income would help break up current and future wealth dynasties."

"Because of changes in tax law and aggressive use of trusts and tax dodges, we are now witnessing a resurgence of dynastic inherited wealth," Collins of IPS observed in an op-ed for Common Dreams on Tuesday. "To protect our democracy, we need to strengthen and expand taxes that reduce this concentration of wealth and power."