SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

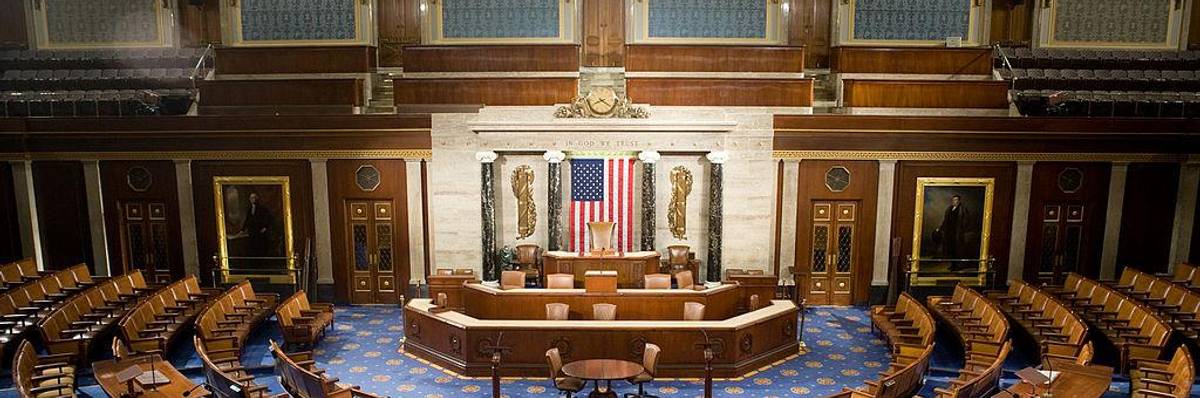

Politicians voiced their opinions, but they didn't listen to the public's opinions in any systematic manner. (Photo by Brendan Hoffman/Getty Images)

The new Covid-19 stimulus package will be a great relief for tens of millions of Americans, but the process of getting to it exposed the need to overhaul our broken budget politics. Both parties have been at fault in creating a process that is chaotic, undemocratic and ultimately reckless.

The late Illinois Sen. Everett Dirksen famously quipped, "A billion here, a billion there, and soon enough you're talking real money." Now, we toss around the trillions.

The new round of Covid-19 relief is estimated to cost around $900 billion. We don't really know the bottom line, as there has not yet been a budget "score" by the nonpartisan Congressional Budget Office. But we do know Congress is agreeing to spend a vast sum, in this case roughly 4.4% of GDP (or over a quarter of the federal tax revenues for the year), without waiting for a nonpartisan estimate of the likely costs.

Even more problematic? Congressional leaders have not sought or welcomed an open national deliberation about best uses of the stimulus funds.

There should have been an effort through online congressional hearings to gauge the public's priorities regarding different kinds of outlays: help for the hungry and unemployed, support for health workers, additional funding for testing and tracing systems, financial backstopping for small businesses, and assistance to state and local governments which need to pay to keep teachers, firemen and policemen on the front lines.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The new Covid-19 stimulus package will be a great relief for tens of millions of Americans, but the process of getting to it exposed the need to overhaul our broken budget politics. Both parties have been at fault in creating a process that is chaotic, undemocratic and ultimately reckless.

The late Illinois Sen. Everett Dirksen famously quipped, "A billion here, a billion there, and soon enough you're talking real money." Now, we toss around the trillions.

The new round of Covid-19 relief is estimated to cost around $900 billion. We don't really know the bottom line, as there has not yet been a budget "score" by the nonpartisan Congressional Budget Office. But we do know Congress is agreeing to spend a vast sum, in this case roughly 4.4% of GDP (or over a quarter of the federal tax revenues for the year), without waiting for a nonpartisan estimate of the likely costs.

Even more problematic? Congressional leaders have not sought or welcomed an open national deliberation about best uses of the stimulus funds.

There should have been an effort through online congressional hearings to gauge the public's priorities regarding different kinds of outlays: help for the hungry and unemployed, support for health workers, additional funding for testing and tracing systems, financial backstopping for small businesses, and assistance to state and local governments which need to pay to keep teachers, firemen and policemen on the front lines.

The new Covid-19 stimulus package will be a great relief for tens of millions of Americans, but the process of getting to it exposed the need to overhaul our broken budget politics. Both parties have been at fault in creating a process that is chaotic, undemocratic and ultimately reckless.

The late Illinois Sen. Everett Dirksen famously quipped, "A billion here, a billion there, and soon enough you're talking real money." Now, we toss around the trillions.

The new round of Covid-19 relief is estimated to cost around $900 billion. We don't really know the bottom line, as there has not yet been a budget "score" by the nonpartisan Congressional Budget Office. But we do know Congress is agreeing to spend a vast sum, in this case roughly 4.4% of GDP (or over a quarter of the federal tax revenues for the year), without waiting for a nonpartisan estimate of the likely costs.

Even more problematic? Congressional leaders have not sought or welcomed an open national deliberation about best uses of the stimulus funds.

There should have been an effort through online congressional hearings to gauge the public's priorities regarding different kinds of outlays: help for the hungry and unemployed, support for health workers, additional funding for testing and tracing systems, financial backstopping for small businesses, and assistance to state and local governments which need to pay to keep teachers, firemen and policemen on the front lines.