SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

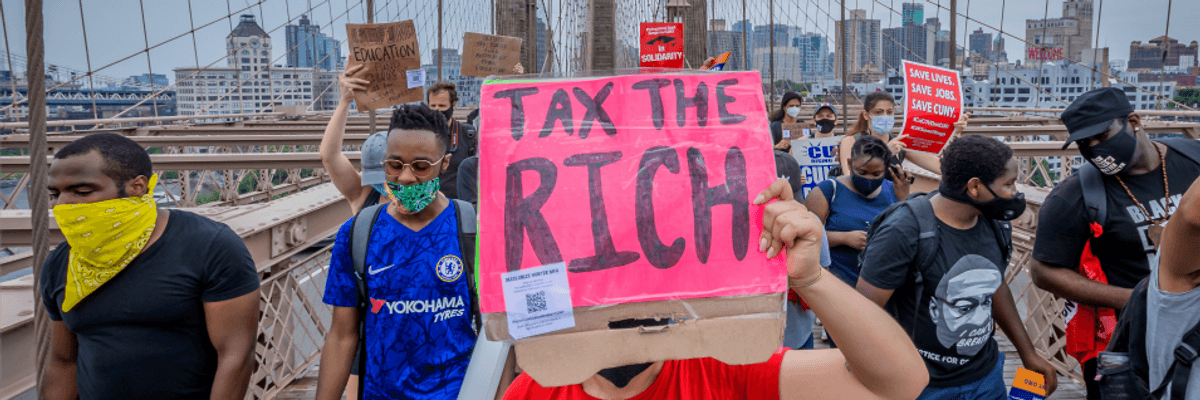

Special treatment for the rich is enshrined into the most fundamental building blocks of the tax code. (Photo: Erik McGregor/LightRocket via Getty Images)

The New York Times detailed years of aggressive tax evasion by President Donald Trump in its bombshell report. It seems obvious based on the numbers, including the fact that he paid no federal income taxes whatsoever in 10 of the last 15 years and that he paid just $750 a year in both 2016 and 2017, that Trump might have crossed a legal line. But that is missing the point.

The real scandal isn't whether Trump cheated his way out of paying millions of dollars in taxes -- it's that our tax system is designed to let rich people like him avoid paying taxes without breaking a single law. Trump may have taken tax avoidance to an extreme, but these schemes are far from unique among the ranks of the ultra-rich. To them and the politicians they donate to, this kind of tax avoidance is a feature, not a bug, of our tax code.

Most Americans understand on some level that our government and our tax system are biased in favor of the rich and powerful, but few have any idea of just how skewed things really are. We have a tax code riddled with loopholes available only to e wealthy, all arrayed in a vast ecosystem of wealth protection that gives millionaires and billionaires endless options to shrink their tax bill below the level of what ordinary working Americans pay.

The game is rigged from start to finish. It doesn't even take abusing obscure loopholes for rich people to end up ahead. Special treatment for the rich is enshrined into the most fundamental building blocks of the tax code.

Most Americans have to work for a living and pay income taxes on what they earn. Rich people, on the other hand, largely live off of their investments, which are taxed at a significantly lower rate than standard income taxes. The top rate for long-term capital gains is just 20%, meaning a billionaire making millions of dollars a year from his investments will end up with a lower top tax rate than someone working for a salary of just $41,000.

I've seen this difference play out firsthand as I've retired from working on Wall Street to live off of my investments. I'm making just as much money as I used to, sometimes more, but now that I'm not working for it my tax bill has dropped substantially. Instead of paying a tax rate in the mid 30s, I pay a tax rate of somewhere in the high teens without using any of the loopholes shown in Trump's tax returns. Tax loopholes and a shrinking IRS.

None of this is accidental. A tax code doesn't just appear out of thin air. This was all deliberately written into the tax code by elected officials who now happen to include President Trump himself. Trump and congressional Republicans completely rewrote the federal tax code with the 2017 Tax Cuts and Jobs Act. To no one's surprise, it includes many more opportunities for rich people to get out of paying their fair share, including a few provisions like a new deduction for pass-through businesses that seemed perfectly designed to help a certain real estate developer living in the White House.

It's also no surprise that when wealthy Americans like Trump step over the line from standard tax avoidance to outright law-breaking, they're likely to get away with it. From 2011 to 2019, the percentage of millionaires who were audited by the Internal Revenue Service dropped from 12% to just 3%. Why? Because the law enforcement of the IRS has been systematically defunded by conservatives for a decade. The agency lost 29% of its enforcement resources between 2010 and 2018, sapping it of the funding and personnel it needs to audit rich people with complicated finances.

This combination of inept enforcement and deliberately regressive policies work together to create a system that doesn't just permit the kind of behavior detailed in Trump's tax returns, but encourages it. So yes, the American people should be angry about Trump's tax bill, but they should be even more angry that this is what our system is designed to do. If they want real change, they need to focus their energy on holding all rich Americans accountable, not just Trump.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The New York Times detailed years of aggressive tax evasion by President Donald Trump in its bombshell report. It seems obvious based on the numbers, including the fact that he paid no federal income taxes whatsoever in 10 of the last 15 years and that he paid just $750 a year in both 2016 and 2017, that Trump might have crossed a legal line. But that is missing the point.

The real scandal isn't whether Trump cheated his way out of paying millions of dollars in taxes -- it's that our tax system is designed to let rich people like him avoid paying taxes without breaking a single law. Trump may have taken tax avoidance to an extreme, but these schemes are far from unique among the ranks of the ultra-rich. To them and the politicians they donate to, this kind of tax avoidance is a feature, not a bug, of our tax code.

Most Americans understand on some level that our government and our tax system are biased in favor of the rich and powerful, but few have any idea of just how skewed things really are. We have a tax code riddled with loopholes available only to e wealthy, all arrayed in a vast ecosystem of wealth protection that gives millionaires and billionaires endless options to shrink their tax bill below the level of what ordinary working Americans pay.

The game is rigged from start to finish. It doesn't even take abusing obscure loopholes for rich people to end up ahead. Special treatment for the rich is enshrined into the most fundamental building blocks of the tax code.

Most Americans have to work for a living and pay income taxes on what they earn. Rich people, on the other hand, largely live off of their investments, which are taxed at a significantly lower rate than standard income taxes. The top rate for long-term capital gains is just 20%, meaning a billionaire making millions of dollars a year from his investments will end up with a lower top tax rate than someone working for a salary of just $41,000.

I've seen this difference play out firsthand as I've retired from working on Wall Street to live off of my investments. I'm making just as much money as I used to, sometimes more, but now that I'm not working for it my tax bill has dropped substantially. Instead of paying a tax rate in the mid 30s, I pay a tax rate of somewhere in the high teens without using any of the loopholes shown in Trump's tax returns. Tax loopholes and a shrinking IRS.

None of this is accidental. A tax code doesn't just appear out of thin air. This was all deliberately written into the tax code by elected officials who now happen to include President Trump himself. Trump and congressional Republicans completely rewrote the federal tax code with the 2017 Tax Cuts and Jobs Act. To no one's surprise, it includes many more opportunities for rich people to get out of paying their fair share, including a few provisions like a new deduction for pass-through businesses that seemed perfectly designed to help a certain real estate developer living in the White House.

It's also no surprise that when wealthy Americans like Trump step over the line from standard tax avoidance to outright law-breaking, they're likely to get away with it. From 2011 to 2019, the percentage of millionaires who were audited by the Internal Revenue Service dropped from 12% to just 3%. Why? Because the law enforcement of the IRS has been systematically defunded by conservatives for a decade. The agency lost 29% of its enforcement resources between 2010 and 2018, sapping it of the funding and personnel it needs to audit rich people with complicated finances.

This combination of inept enforcement and deliberately regressive policies work together to create a system that doesn't just permit the kind of behavior detailed in Trump's tax returns, but encourages it. So yes, the American people should be angry about Trump's tax bill, but they should be even more angry that this is what our system is designed to do. If they want real change, they need to focus their energy on holding all rich Americans accountable, not just Trump.

The New York Times detailed years of aggressive tax evasion by President Donald Trump in its bombshell report. It seems obvious based on the numbers, including the fact that he paid no federal income taxes whatsoever in 10 of the last 15 years and that he paid just $750 a year in both 2016 and 2017, that Trump might have crossed a legal line. But that is missing the point.

The real scandal isn't whether Trump cheated his way out of paying millions of dollars in taxes -- it's that our tax system is designed to let rich people like him avoid paying taxes without breaking a single law. Trump may have taken tax avoidance to an extreme, but these schemes are far from unique among the ranks of the ultra-rich. To them and the politicians they donate to, this kind of tax avoidance is a feature, not a bug, of our tax code.

Most Americans understand on some level that our government and our tax system are biased in favor of the rich and powerful, but few have any idea of just how skewed things really are. We have a tax code riddled with loopholes available only to e wealthy, all arrayed in a vast ecosystem of wealth protection that gives millionaires and billionaires endless options to shrink their tax bill below the level of what ordinary working Americans pay.

The game is rigged from start to finish. It doesn't even take abusing obscure loopholes for rich people to end up ahead. Special treatment for the rich is enshrined into the most fundamental building blocks of the tax code.

Most Americans have to work for a living and pay income taxes on what they earn. Rich people, on the other hand, largely live off of their investments, which are taxed at a significantly lower rate than standard income taxes. The top rate for long-term capital gains is just 20%, meaning a billionaire making millions of dollars a year from his investments will end up with a lower top tax rate than someone working for a salary of just $41,000.

I've seen this difference play out firsthand as I've retired from working on Wall Street to live off of my investments. I'm making just as much money as I used to, sometimes more, but now that I'm not working for it my tax bill has dropped substantially. Instead of paying a tax rate in the mid 30s, I pay a tax rate of somewhere in the high teens without using any of the loopholes shown in Trump's tax returns. Tax loopholes and a shrinking IRS.

None of this is accidental. A tax code doesn't just appear out of thin air. This was all deliberately written into the tax code by elected officials who now happen to include President Trump himself. Trump and congressional Republicans completely rewrote the federal tax code with the 2017 Tax Cuts and Jobs Act. To no one's surprise, it includes many more opportunities for rich people to get out of paying their fair share, including a few provisions like a new deduction for pass-through businesses that seemed perfectly designed to help a certain real estate developer living in the White House.

It's also no surprise that when wealthy Americans like Trump step over the line from standard tax avoidance to outright law-breaking, they're likely to get away with it. From 2011 to 2019, the percentage of millionaires who were audited by the Internal Revenue Service dropped from 12% to just 3%. Why? Because the law enforcement of the IRS has been systematically defunded by conservatives for a decade. The agency lost 29% of its enforcement resources between 2010 and 2018, sapping it of the funding and personnel it needs to audit rich people with complicated finances.

This combination of inept enforcement and deliberately regressive policies work together to create a system that doesn't just permit the kind of behavior detailed in Trump's tax returns, but encourages it. So yes, the American people should be angry about Trump's tax bill, but they should be even more angry that this is what our system is designed to do. If they want real change, they need to focus their energy on holding all rich Americans accountable, not just Trump.