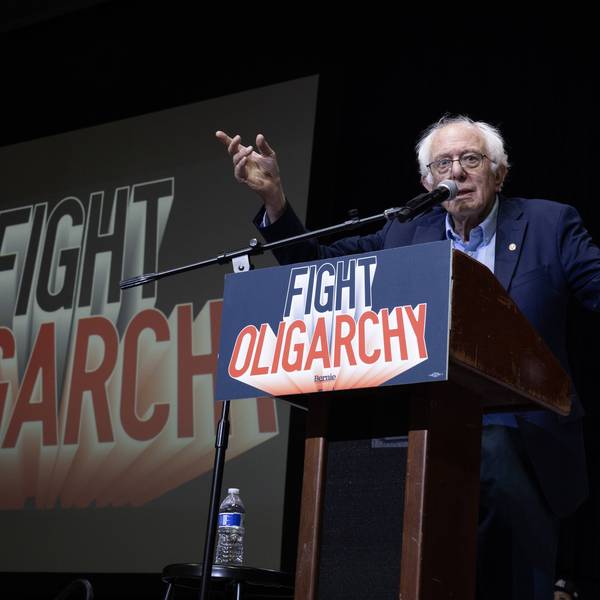

The United States does have a huge domestic market, so it can see shutdowns in certain segments and still likely get by without severe shortages, but smaller countries absolutely need diverse sources. (Photo: Johannes Eisle/AFP/Getty Images)

It's the End of the World Economy as We Know It, Just Like the Great Recession

The issue here is not the importance of the dollar, but rather the reluctance of other major economic powers to directly challenge U.S. policy.

Neil Irwin tells us there will be fundamental changes in the world economy as a result of the pandemic. While he repeats many things that are conventional wisdom, as is often the case, the conventional wisdom is not very wise.

First, the pandemic is supposed to teach us the dangers of having foreign sources of supply, as parts of our supply chain from China shut down when it was hard hit by the virus in December and January. While this is supposed to be a key takeaway from the pandemic, it makes little sense.

We have seen major factories shut down in the United States as a result of the pandemic, most recently a South Dakota processing plant that produces five percent of the nation's retail pork. The United States does have a huge domestic market, so it can see shutdowns in certain segments and still likely get by without severe shortages, but smaller countries absolutely need diverse sources. And, even in the case of the United States, it is helpful to have access to producers worldwide rather than being forced to just rely on domestic sources, especially since the timing and severity of the pandemic have varied greatly across countries.

The real lesson from this episode is the importance of having large stockpiles of key medical gear. The U.S. did not have adequate stockpiles because of the negligence of its government, but this issue is independent of where the items are produced.

The piece also raises the issue of U.S. companies being reluctant to invest in China because of concerns over intellectual property theft. While this is an often-stated concern, most items, like prescription drugs, can be reverse engineered without great difficulty. The U.S. will be better able to limit China's appropriation of items to which U.S. corporations have patent monopolies or related claims if it has agreements with China requiring it to respect these rules.

In the absence of such agreements, there is no reason that China should not make copies of items like prescription drugs, medical equipment, fertilizers, pesticides, computers, and software, to which U.S. companies have intellectual property claims, and sell them freely both on their domestic market and internationally. If the U.S. wants to protect the intellectual property claims of its corporations it will need more engagement with China, not less.

Finally, the piece does raise the importance of the dollar as the world's major reserve currency. This is and has been a growing problem for the world economy, since it makes much of the world subject to the whims of the Federal Reserve Board and the U.S. administration. In the last crisis, dollar swap lines were extended to certain countries, and not others, for clearly political purposes. This is likely happening again today.

However, the issue here is not the importance of the dollar, but rather the reluctance of other major economic powers (e.g. the EU, Japan, and even China) to directly challenge U.S. policy. Given the erratic and arbitrary actions of the Trump administration, hopefully, they will get over this reluctance, but to date this has not been the case.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Neil Irwin tells us there will be fundamental changes in the world economy as a result of the pandemic. While he repeats many things that are conventional wisdom, as is often the case, the conventional wisdom is not very wise.

First, the pandemic is supposed to teach us the dangers of having foreign sources of supply, as parts of our supply chain from China shut down when it was hard hit by the virus in December and January. While this is supposed to be a key takeaway from the pandemic, it makes little sense.

We have seen major factories shut down in the United States as a result of the pandemic, most recently a South Dakota processing plant that produces five percent of the nation's retail pork. The United States does have a huge domestic market, so it can see shutdowns in certain segments and still likely get by without severe shortages, but smaller countries absolutely need diverse sources. And, even in the case of the United States, it is helpful to have access to producers worldwide rather than being forced to just rely on domestic sources, especially since the timing and severity of the pandemic have varied greatly across countries.

The real lesson from this episode is the importance of having large stockpiles of key medical gear. The U.S. did not have adequate stockpiles because of the negligence of its government, but this issue is independent of where the items are produced.

The piece also raises the issue of U.S. companies being reluctant to invest in China because of concerns over intellectual property theft. While this is an often-stated concern, most items, like prescription drugs, can be reverse engineered without great difficulty. The U.S. will be better able to limit China's appropriation of items to which U.S. corporations have patent monopolies or related claims if it has agreements with China requiring it to respect these rules.

In the absence of such agreements, there is no reason that China should not make copies of items like prescription drugs, medical equipment, fertilizers, pesticides, computers, and software, to which U.S. companies have intellectual property claims, and sell them freely both on their domestic market and internationally. If the U.S. wants to protect the intellectual property claims of its corporations it will need more engagement with China, not less.

Finally, the piece does raise the importance of the dollar as the world's major reserve currency. This is and has been a growing problem for the world economy, since it makes much of the world subject to the whims of the Federal Reserve Board and the U.S. administration. In the last crisis, dollar swap lines were extended to certain countries, and not others, for clearly political purposes. This is likely happening again today.

However, the issue here is not the importance of the dollar, but rather the reluctance of other major economic powers (e.g. the EU, Japan, and even China) to directly challenge U.S. policy. Given the erratic and arbitrary actions of the Trump administration, hopefully, they will get over this reluctance, but to date this has not been the case.

Neil Irwin tells us there will be fundamental changes in the world economy as a result of the pandemic. While he repeats many things that are conventional wisdom, as is often the case, the conventional wisdom is not very wise.

First, the pandemic is supposed to teach us the dangers of having foreign sources of supply, as parts of our supply chain from China shut down when it was hard hit by the virus in December and January. While this is supposed to be a key takeaway from the pandemic, it makes little sense.

We have seen major factories shut down in the United States as a result of the pandemic, most recently a South Dakota processing plant that produces five percent of the nation's retail pork. The United States does have a huge domestic market, so it can see shutdowns in certain segments and still likely get by without severe shortages, but smaller countries absolutely need diverse sources. And, even in the case of the United States, it is helpful to have access to producers worldwide rather than being forced to just rely on domestic sources, especially since the timing and severity of the pandemic have varied greatly across countries.

The real lesson from this episode is the importance of having large stockpiles of key medical gear. The U.S. did not have adequate stockpiles because of the negligence of its government, but this issue is independent of where the items are produced.

The piece also raises the issue of U.S. companies being reluctant to invest in China because of concerns over intellectual property theft. While this is an often-stated concern, most items, like prescription drugs, can be reverse engineered without great difficulty. The U.S. will be better able to limit China's appropriation of items to which U.S. corporations have patent monopolies or related claims if it has agreements with China requiring it to respect these rules.

In the absence of such agreements, there is no reason that China should not make copies of items like prescription drugs, medical equipment, fertilizers, pesticides, computers, and software, to which U.S. companies have intellectual property claims, and sell them freely both on their domestic market and internationally. If the U.S. wants to protect the intellectual property claims of its corporations it will need more engagement with China, not less.

Finally, the piece does raise the importance of the dollar as the world's major reserve currency. This is and has been a growing problem for the world economy, since it makes much of the world subject to the whims of the Federal Reserve Board and the U.S. administration. In the last crisis, dollar swap lines were extended to certain countries, and not others, for clearly political purposes. This is likely happening again today.

However, the issue here is not the importance of the dollar, but rather the reluctance of other major economic powers (e.g. the EU, Japan, and even China) to directly challenge U.S. policy. Given the erratic and arbitrary actions of the Trump administration, hopefully, they will get over this reluctance, but to date this has not been the case.