SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

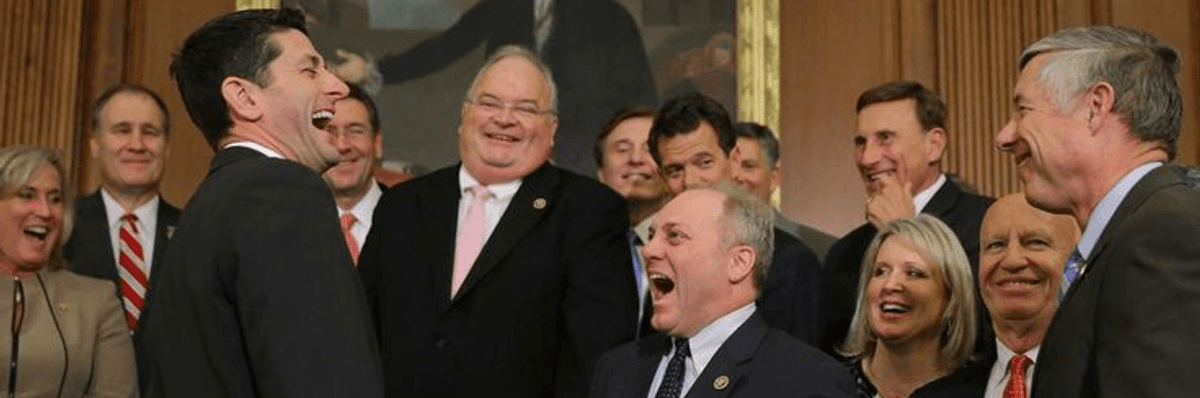

Speaker of the House Paul Ryan shares a laugh with Republican members of Congress after signing legislation to repeal the Affordable Care Act, also known as Obamacare, and to cut off federal funding of Planned Parenthood during an enrollment ceremony in the Rayburn Room at the U.S. Capitol January 7, 2016. (Photo: Chip Somodevilla/Getty Images)

Only liars and idiots believe Republican claims that their proposed tax cut is about helping the middle class. Everyone else understands it for what it is: a payoff by the Republicans to their wealthy masters.

Did the massive tax cuts and their concomitant debts produce the robust growth Republicans promised, and still claim? They did not. Here's the data.

"Did the massive tax cuts and their concomitant debts produce the robust growth Republicans promised, and still claim? They did not."

Over the twelve years of Reagan/Bush, GDP grew at an average of 2.8% per year. Bill Clinton raised taxes on the wealthy. The result? The economy grew at an average of 3.5% per year over his eight-year tenure, 25% faster per year than under Reagan/Bush.

But if you are interested in facts, the facts are undeniable. Massive tax cuts for the wealthy produce middling growth and massive debt. They are a prescription for economic disaster.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Robert Freeman is the Founder and Executive Director of The Global Uplift Project, a leading provider of educational infrastructure for the developing world. He is the author of The Best One Hour History series whose titles include World War I, The Cold War, The Vietnam War, and many others.

Only liars and idiots believe Republican claims that their proposed tax cut is about helping the middle class. Everyone else understands it for what it is: a payoff by the Republicans to their wealthy masters.

Did the massive tax cuts and their concomitant debts produce the robust growth Republicans promised, and still claim? They did not. Here's the data.

"Did the massive tax cuts and their concomitant debts produce the robust growth Republicans promised, and still claim? They did not."

Over the twelve years of Reagan/Bush, GDP grew at an average of 2.8% per year. Bill Clinton raised taxes on the wealthy. The result? The economy grew at an average of 3.5% per year over his eight-year tenure, 25% faster per year than under Reagan/Bush.

But if you are interested in facts, the facts are undeniable. Massive tax cuts for the wealthy produce middling growth and massive debt. They are a prescription for economic disaster.

Robert Freeman is the Founder and Executive Director of The Global Uplift Project, a leading provider of educational infrastructure for the developing world. He is the author of The Best One Hour History series whose titles include World War I, The Cold War, The Vietnam War, and many others.

Only liars and idiots believe Republican claims that their proposed tax cut is about helping the middle class. Everyone else understands it for what it is: a payoff by the Republicans to their wealthy masters.

Did the massive tax cuts and their concomitant debts produce the robust growth Republicans promised, and still claim? They did not. Here's the data.

"Did the massive tax cuts and their concomitant debts produce the robust growth Republicans promised, and still claim? They did not."

Over the twelve years of Reagan/Bush, GDP grew at an average of 2.8% per year. Bill Clinton raised taxes on the wealthy. The result? The economy grew at an average of 3.5% per year over his eight-year tenure, 25% faster per year than under Reagan/Bush.

But if you are interested in facts, the facts are undeniable. Massive tax cuts for the wealthy produce middling growth and massive debt. They are a prescription for economic disaster.