Imagine a vast field on which a terrible battle has recently been fought, the bare ground cratered by fusillade after fusillade of heavy artillery, trees reduced to blackened stumps, wisps of toxic gas hanging in the gray, and corpses everywhere.

A terrible scene, made worse by the sound of distant laughter, because somehow, on the heights commanding the dead zone, the officers' club has made it through intact. From its balconies flutter bunting, and across the blasted landscape there comes a chorus of hearty male voices in counterpoint to the wheedling of cadres of wheel-greasers, the click of betting chips, the orotund declamations of a visiting congressional delegation: in sum, the celebratory hullabaloo of a class of people that has sent entire nations off to perish but whose only concern right now is whether the '11 is ready to drink and who'll see to tipping the servants. The notion that there might be someone or some force out there getting ready to slouch toward the buttonwood tree to exact retribution scarcely ruffles the celebrants' joy.

Ah, Wall Street. As it was in the beginning, is now, and hopes to God it ever will be, world without end. Amen.

Or so it seems to me. It was in May 1961 that a series of circumstances took me from the hushed precincts of the Metropolitan Museum of Art, where I was working as a curatorial assistant in the European Paintings Department, to Lehman Brothers, to begin what for the next 30 years would be an involvement--I hesitate to call it "a career"--in investment banking. I would promote and execute deals, sit on boards, kiss ass, and lie through my teeth: the whole megillah. In consequence of which, I would wear Savile Row and carry a Hermes briefcase. I had Mme. Claude's home number in Paris and I frequented the best clubs in a half-dozen cities. But I had a problem: I was unable to develop the anticommunitarian moral opacity that is the key to real success on Wall Street.

I had my doubts from the beginning. A few months after I started to work downtown, I ran into an old friend from college and before, a man later to become one of New York's most esteemed writers and editors.

"So," he asked, "how do you like what you're doing now?"

"I like it quite a lot," I said. And this was true: these were new frontiers for me, the pace was lively, the money was good enough ($6,500 a year), and there was so much to learn. But there was one aspect of Wall Street that I found morally confusing if not distasteful: "There's one thing that bothers me, though. It's this: on the one hand the New York Stock Exchange has sent its president, the estimable G. Keith Funston, out into the countryside, supported by an expensive, extensive advertising campaign, to exhort the proletariat to Own your share of America! As if buying 50 shares of IBM or GM in 1961 is as much of a civic duty as buying a $100 war bond in 1943."

I then added, "But here's the thing. At the same time as Funston's out there doing his thing, if you ask any veteran Wall Street pro how the Street works, the first thing he'll tell you is: The public is always wrong. Always." I paused to let that sink in, then confessed, "I have to tell you, I have trouble squaring that circle."

And that was back when Wall Street was basically honest, brought into line thanks in part to Ferdinand Pecora's 1933 humiliation of the great bankers of the Jazz Age and even more so because of the communitarian exigencies forced on the nation by war. From Pearl Harbor to V-J Day, greed was definitely not good, and that proscriptive spirit lingered on right up to 1970, when everything started to change, and the traders began their long march through our great houses of finance, with the inevitable consequence that the Street's moral bookkeeping grew more and more contorted, its corruptions more elaborate, its self-interest less and less governable. What someone has called the "Greed Wars" began.

But now, I think, the game is at long last over.

As 2011 slithers to its end, none of the major problems that led to the crisis point three years ago have really been solved. Bank balance sheets still reek. Europe day by day becomes a financial black hole, with matter from the periphery being sucked toward the center until the vortex itself collapses. The Street and its ministries of propaganda have fallen back on a Big Lie as old as capitalism itself: that all that has gone wrong has been government's fault. This time, however, I don't think the argument that "Washington ate my homework" is going to work. This time, a firestorm is going to explode about the Street's head--and about time, too.

It's funny; the Big Lie has a long pedigree. A year or so ago, I was leafing through Ron Chernow's indispensable history of the Morgan financial interests, and found this interesting exchange between FDR and Russell Leffingwell, a Morgan partner and Washington fixer, a sort of Robert Strauss of his day. It dates from the summer of 1932, with FDR not yet in office:

"You and I know," wrote Leffingwell, "that we cannot cure the present deflation and depression by punishing the villains, real or imaginary, of the first post war decade, and that when it comes down to the day of reckoning nobody gets very far with all this prohibition and regulation stuff." To which FDR replied: "I wish we could get from the bankers themselves an admission that in the 1927 to 1929 period there were grave abuses and that the bankers themselves now support wholeheartedly methods to prevent recurrence thereof. Can't bankers see their own advantage in such a course?" And then Leffingwell again: "The bankers were not in fact responsible for 1927-29 and the politicians were. Why then should the bankers make a false confession?"

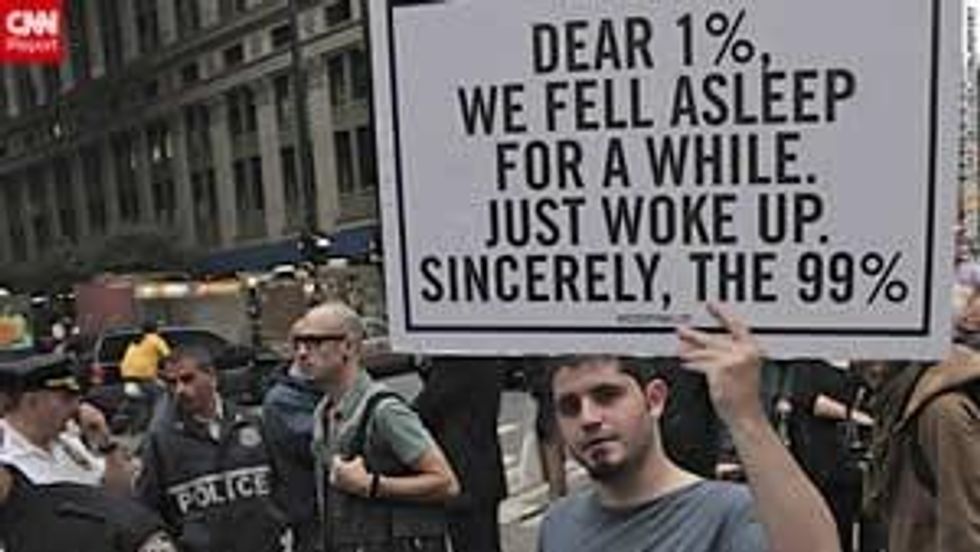

This time, I fear, the public anger will not be deflected. Confessions, not false, will be exacted. Occupy Wall Street has set the snowball rolling; you may not think much of OWS--I have my own reservations, although none are philosophical or moral--but it has made America aware of a sinister, usurious process by which wealth has systematically been funneled into fewer and fewer hands. A process in which Washington played a useful supporting role, but no more than that.

Over the next year, I expect the "what" will give way to the "how" in the broad electorate's comprehension of the financial situation. The 99 percent must learn to differentiate the bloodsuckers and rent-extractors from those in the 1 percent who make the world a better, more just place to live. Once people realize how Wall Street made its pile, understand how financiers get rich, what it is that they actually do, the time will become ripe for someone to gather the spreading ripples of anger and perplexity into a focused tsunami of retribution. To make the bastards pay, properly, for the grief and woe they have caused. Perhaps not to the extent proposed by H. L. Mencken, who wrote that when a bank fails, the first order of business should be to hang its board of directors, but in a manner in which the pain is proportionate to the collateral damage. Possibly an excess-profits tax retroactive to 2007, or some form of "Tobin tax" on transactions, or a wealth tax. The era of money for nothing will be over.

But it won't just end with taxes. When the great day comes, Wall Street will pray for another Pecora, because compared with the rough beast now beginning to strain at the leash, Pecora will look like Phil Gramm. Humiliation and ridicule, even financial penalties, will be the least of the Street's tribulations. There will be prosecutions and show trials. There will be violence, mark my words. Houses burnt, property defaced. I just hope that this time the mob targets the right people in Wall Street and in Washington. (How does a right-thinking Christian go about asking Santa for Mitch McConnell's head under the Christmas tree?) There will be kleptocrats who threaten to take themselves elsewhere if their demands on jurisdictions and tax breaks aren't met, and I say let 'em go!

At the end of the day, the convulsion to come won't really be about Wall Street's derivatives malefactions, or its subprime fun and games, or rogue trading, or the folly of banks. It will be about this society's final opportunity to rip away the paralyzing shackles of corruption or else dwell forever in a neofeudal social order. You might say that 1384 has replaced 1984 as our worst-case scenario. I have lived what now, at 75, is starting to feel like a long life. If anyone asks me what has been the great American story of my lifetime, I have a ready answer. It is the corruption, money-based, that has settled like some all-enveloping excremental mist on the landscape of our hopes, that has permeated every nook of any institution or being that has real influence on the way we live now. Sixty years ago, if you had asked me, on the basis of all that I had been taught, whether I thought this condition of general rot was possible in this country, I would have told you that you were nuts. And I would have been very wrong. What has happened in this country has made a lie of my boyhood.

There should be more to America, Gore Vidal has written, than who pays tax to whom. It has been in Wall Street's interest to shrivel our sensibilities as a nation, to shove aside the verities of which General MacArthur spoke at West Point--duty, honor, country--in favor of grubby schemes and scams and "carried interest" calculations. Time, I think, to take the country back.