Under federal law, tipped workers are allowed to be paid a much lower minimum wage—just $2.13 per hour compared with $7.25 for nontipped workers. Tipped workers are, consequentially, more likely to live in poverty.

This is the case in Washington, D.C., where, according to data from the Bureau of Labor Statistics analyzed by the Economic Policy Institute, 7.7% of tipped workers live in poverty compared to 2.6% of nontipped workers.

In 2022, D.C. voters overwhelmingly voted to address this problem, supporting Initiative 82, which would have gradually raised the minimum wage for tipped workers—just over $5.35 an hour at the time—to match what other workers receive by 2027.

In 2022, D.C.'s standard minimum wage—which increases each year pegged to inflation—was $16.10. As of 2025, it has increased to $17.95.

As the initiative to raise the tipped minimum wage began, restaurant industry lobbying groups like the Restaurant Association of Metropolitan Washington (RAMW) fought tooth-and-nail to roll it back.

In Jacobin, Raeghn Draper wrote that this group, and others like it around the country, "claim to speak on behalf of restaurant workers, but they are not worker organizations."

Instead, Draper wrote, "They are extensions of the National Restaurant Association (NRA), an industry group historically aligned with large corporate chains like McDonald's, Taco Bell, and Olive Garden—none exactly known for their commitment to workers' rights or well-being."

These groups waged an aggressive disinformation campaign, claiming that by phasing out the subminimum wage, restaurants, crushed by their increasing operating costs, would be forced to close en masse.

The RAMW even touted a survey of its own member restaurants purporting to show that 44% of full-service casual restaurants would have no choice but to close their doors by the end of 2025 due to the policy.

As Draper points out, citing data from an independent investigation by D.C.'s Office of the Budget Director, "the number of D.C. restaurant closures in 2024 did rise slightly compared to the previous year, but restaurant openings also increased, outpacing closures by a margin of two to one."

A study by the EPI likewise found that—despite industry claims that the higher wage requirements were forcing restaurants to lay off their employees—D.C. was seeing more employment growth than other towns in the region without requirements to raise wages.

But media outlets uncritically reported the restaurant industry's narrative about mass closures, and their attempts to "manufacture a crisis," as Draper says, paid off.

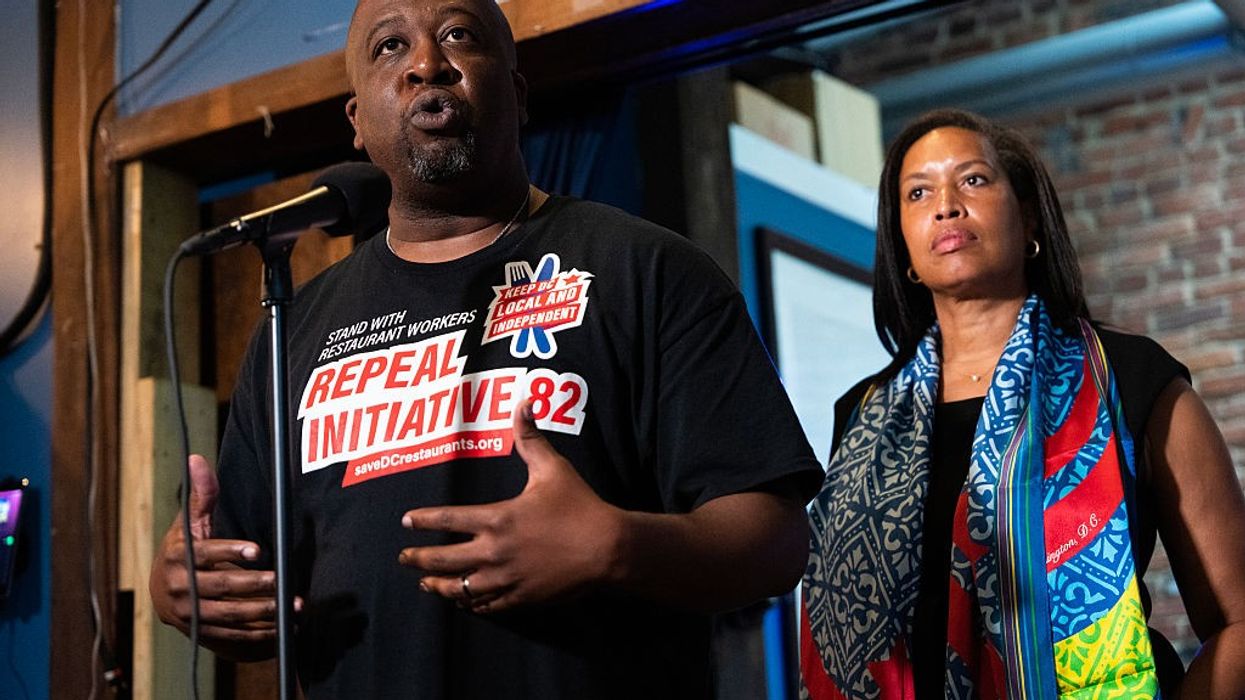

While making public appearances with restaurant industry lobbyists, Democratic Mayor Muriel Bowser signed legislation halting the wage increases in June—freezing the tipped minimum wage at $10 an hour. She pushed for a full repeal, which would have knocked the tipped wage back down to $8 an hour. But the city council voted it down.

On Monday, despite fierce protests from workers and unions, the city council voted 7-5 to freeze the tipped wage at $10 until July 2026, when it will increase by a measly five cents. They also voted to dramatically slow the tipped wage increases to just 5% each year until 2034, when it will be capped at 75% of the standard minimum wage.

Members of the council, as well as many media outlets, including Axios and The Washington Post, described the decision as a "compromise" between employers and workers. RAMW, which lamented that it was "not a full repeal," has portrayed it that way, though it nevertheless described it as a "win for the industry."

Fair wage activists, however, described it not as a compromise, but an assault on a hard-won democratic victory.

"In what world is this a compromise?" asked One Fair Wage, one of the groups that campaigned for the initiative. "Call it what it is: a pay cut and a betrayal of the working people."

"D.C. Council just voted to overturn the will of the people and freeze wages for tipped workers," said the Fair Budget Coalition in a post on X following the vote. "As rents and other costs rise, it is a CHOICE to maintain a subminimum wage for struggling D.C. residents."

According to EPI, a person living in Washington, D.C. needs to earn just under $31 an hour to afford the cost of living. The average wage paid to tipped workers like bartenders, waiters, and waitresses falls several dollars short of this.

"The voters told us what they wanted when they voted overwhelmingly for I-82—twice—and this is not it," said Brianne Nadeau, one of the council members who voted against reversing the wage hikes. "Restaurant workers and the organizations that represent them have been fighting this battle for wage protections for years, and they shouldn't have to keep fighting it. And this council should not keep on telling the voters they don't know what's best for themselves."

"The council chose corporate lobbyists over tipped workers," said One Fair Wage. To the council members who voted for it, they said: "We see you. We won't forget."