Americans Deserve Better Than What This Horrific GOP Budget Will Impose on the Sick, Hungry, and Poor

It's been clear for some time that House Republicans were headed down this harmful path, but to see the contours of this bill emerge is somehow still shocking: that they would hurt so many people who struggle to afford basic needs and whom they have promised to help.

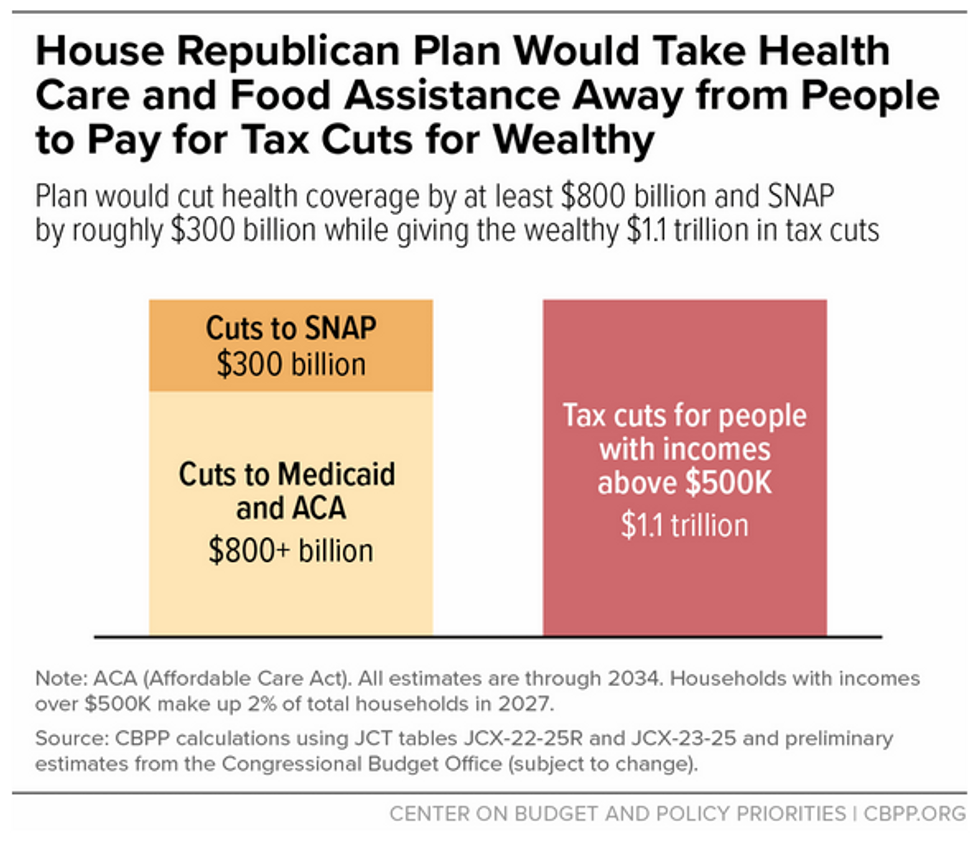

As House Republican leaders work to advance a reconciliation bill to the floor, their agenda couldn’t be clearer: stripping health care and food assistance away from millions of people and raising families’ costs, breaking their promises to help people on the margins of the economy — while showering ever larger tax breaks on the wealthiest households.

House Republicans’ extreme SNAP cuts would take some or all food assistance away from millions of low-income people and families who struggle to afford groceries. This will drive up hunger, deepen poverty, and leave more people unable to afford basic needs.

House Republicans are trying to hide much of the impact of the SNAP cuts by slashing federal funding and then passing the buck to states. When a state can’t come up with the money to backfill for the large federal cuts totaling billions nationally, it will have to choose how to cut the number of people getting help or whether to opt out of having a SNAP program entirely. With this scheme, the plan walks away from the 50-year, bipartisan commitment to ensure that poor children get the help they need, whether they live in Alabama, Missouri, or California.

Proponents want to shift blame for the cuts to states, but the blame game won’t matter to children, families, seniors, people with disabilities, veterans, small business owners, and others when they are hungry and can’t afford food. (Republican portrayals of who gets helped by SNAP and Medicaid are selective at best — about 1 in 4 veterans and 1 in 4 small business owners live in a household getting help from SNAP, Medicaid, or CHIP at some point in the year, Census data show.)

This plan is replete with proposals that will add red tape, making things more cumbersome, more bureaucratic, and less user-friendly — and ultimately designed to fail families in ways that will leave people sicker, poorer, and hungrier.

At the same time, at least 13.7 million people would lose health coverage and become uninsured under the House Republicans’ Medicaid and Affordable Care Act marketplace agenda that deeply cuts Medicaid, erects new barriers to coverage, and allows the enhanced premium tax credits (PTCs) that help low- and middle-income families and small business owners afford health coverage to expire, the Congressional Budget Office (CBO) estimates. Some Republicans argue they shouldn’t be blamed for the 4 million people projected to lose coverage due to the PTCs’ expiration. That’s frankly absurd: they wrote a bill that extends all of the expiring 2017 tax cuts — and even expands provisions that benefit the wealthiest people in the country — yet chose not to extend the enhanced PTCs for people who need help affording coverage. That’s their agenda and they need to own it.

Like their approach to SNAP, House Republicans seek to obscure the impact of their health care cuts through complicated proposals, like limiting the ways states can fund Medicaid and adding lots of red tape and paperwork that makes it harder for people to get and keep health coverage. But here, too, there’s no hiding the outcome: millions of people, including children, will lose coverage and access to care for life-threatening and chronic illnesses as well as preventive care.

The House Republican plan targets some of its harshest attacks on people who are immigrants and their families. It would take away Medicare and marketplace coverage from certain immigrants, including people granted refugee and asylee status after proving they face persecution in their home countries, victims of trafficking and domestic violence, and people with Temporary Protected Status. The plan also takes away the Child Tax Credit from U.S. citizen children if both parents don’t have a Social Security number (even if one parent is a citizen), and strips access to SNAP benefits from people granted asylum and refugee status and other vulnerable groups who are living and working lawfully in the U.S.

Proponents of these cuts often falsely claim that they are restricting access for people who lack documentation, when the reality is that people without a documented immigration status already do not qualify for these benefits, and the cuts will largely impact lawfully present immigrants and U.S. citizen children in immigrant families.

Despite House Republicans’ rhetoric about supporting the “working class,” the plan targets working people and their families, making it much harder for them to get help weathering life’s ups and downs.Despite House Republicans’ rhetoric about supporting the “working class,” the plan targets working people and their families, making it much harder for them to get help weathering life’s ups and downs. Workers may need help because their employer lays them off or cuts their hours, or because they get sick or have to miss work to care for a sick loved one, and the House Republican plan takes help away from people in exactly these situations.

And for all of the rhetoric coming out of DOGE about making government work more efficiently, that commitment doesn’t seem to apply to working families who need help. This plan is replete with proposals that will add red tape, making things more cumbersome, more bureaucratic, and less user-friendly — and ultimately designed to fail families in ways that will leave people sicker, poorer, and hungrier.

Moreover, the House Republican plan would deny as many as 20 million children in working families from receiving the full $2,500 Child Tax Credit because their parents — who work important but low-paid jobs — don’t earn enough. The 17 million children who currently don’t get the full $2,000 Child Tax Credit would get nothing from the credit’s $500-per-child increase, even as families earning up to $400,000 would get the full increase. Last year 169 House Republicans voted to help most of the families they are now leaving out.

In contrast to its disdain for people whose budgets are stretched thin every month, the plan showers more tax cuts on the wealthy, extending the highly skewed provisions of the 2017 law and adding permanent expansions for wealthy households. In 2027 it gives households earning more than $1 million a year an annual tax cut of roughly $90,000, while low-income households receive an average of just $90 from the tax cuts — the same households who will then bear the brunt of cuts to Medicaid and SNAP.

This agenda won’t create a future of shared prosperity and economic opportunity, which is what’s required to build a country that’s truly great.

The plan’s tax cuts would cost nearly $4 trillion through 2034 — and over $5 trillion if one sees through its timing gimmicks like turning off tax cuts for middle-class families after four years while making some of its most top-tilted tax cuts — like the cut in the estate tax and the deduction for pass-through income — permanent. Moreover, the House Republicans cut more than $500 billion in clean energy tax credits — which would worsen health outcomes for communities facing high rates of pollution, and the plan’s health cuts would make it harder for them to access health care.

It’s been clear for some time that House Republicans were headed down this harmful path, but to see the contours of this bill emerge is somehow still shocking: that they would hurt so many people who struggle to afford basic needs and whom they have promised to help. And they continue to pursue this agenda at a time when the President’s tariffs, chaotically crafted and applied, have caused increased uncertainty and raised the risk of a recession, higher unemployment, and surging prices.

Whatever Republican policymakers may think, these policies aren’t popular with the public because they aren’t consistent with core American values, which include helping people when they fall on tough times and expecting wealthy people to pay their fair share.

This agenda won’t create a future of shared prosperity and economic opportunity, which is what’s required to build a country that’s truly great. There’s a better path forward, but it requires tearing up this legislation and replacing it with a plan that lowers costs and invests in people and families, while raising the revenues from the wealthy to make those investments and reduce economic risks associated with high debt.