Recalling last year's conference in the United Arab Emirates, Oil Change International global policy senior strategist Shady Khalil highlighted that "the world made a deal at COP28 to end the fossil fuel era. Now, at COP29, countries seem to have been struck with collective amnesia."

"With each new iteration of the texts, oil and gas producers managed to dilute the urgent commitment to phase out fossil fuels," Khalil said. "But let's be clear: Rich countries' failure to lead on fossil fuel phaseout and to put the trillions they have hoarded on the table has done more to imperil the energy transition than any obstructionist tactics from oil and gas producers."

This year's conference began November 11 and was

due to conclude on Friday, but parties to the Paris agreement were still negotiating the carbon market rules, which were finalized late Saturday, and the new collective quantified goal (NCQG) on climate finance.

"The carbon markets in Article 6 of the Paris agreement were pushed through COP29 in a take-it-or leave-it outcome,"

said Tamra Gilbertson of Indigenous Environmental Network, decrying "a new dangerous era in climate change negotiations."

As

Climate Home News reported, they establish two types of markets: "The first—known as Article 6.2—regulates bilateral carbon trading between countries, while Article 6.4 creates a global crediting mechanism for countries to sell emissions reductions."

The outlet pointed to expert warnings that "the rules for bilateral trades under 6.2 could open the door for the sale of junk carbon credits—one of the weaknesses of the previous crediting mechanism set up by the U.N. known as the Clean Development Mechanism (CDM)."

Jonathan Crook of Carbon Market Watch

said in a statement that "the package does not shine enough light on an already opaque system where countries won't be required to provide information about their deals well ahead of actual trades."

"Even worse, the last opportunity to strengthen the critically weak review process was largely missed," he continued. "Countries remain free to trade carbon credits that are of low quality, or even fail to comply with Article 6.2 rules, without any real oversight."

As for Article 6.4, “much lies in the hands of the supervisory body" that's set to resume work in early 2025, said Crook's colleague, Federica Dossi. "To show that it is ready to learn from past mistakes, it will have to take tough decisions next year and ensure that Article 6.4 credits will be markedly better than the units that old CDM projects will generate."

"If they are not, they will have to compete in a low-trust, low-integrity market where prices are likely to be at rock bottom and interest will be low," Dossi added. "Such a system would be a distraction, and a waste of 10 years worth of carbon market negotiations."

Some campaigners suggested that no matter what lies ahead, the embrace of carbon markets represents a failure. Kirtana Chandrasekaran at Friends of the Earth International

said that "the supposed 'COP of climate finance' has turned into the 'COP of false solutions.' The U.N. has given its stamp of approval to fraudulent and failed carbon markets."

"We have seen the impacts of these schemes: land grabs, Indigenous peoples' and human rights violations," Chandrasekaran noted. "The now-operationalized U.N. global carbon market may well be worse than existing voluntary ones and will continue to provide a get out of jail free card to Big Polluters whilst devastating communities and ecosystems."

Chandrasekaran's colleague Seán McLoughlin at Friends of the Earth Ireland was similarly critical of the conference's finance deal,

asserting that "Baku is a big F U to climate justice, to the poorest communities who are on the frontlines of climate breakdown."

"COP29 has failed those who have done least to cause climate change and who are most vulnerable to climate breakdown because the process is still in thrall to fossil fuel bullies and rich countries more committed to shirking their historical responsibility than safeguarding our common future," he said. "Now it's back to citizens to demand our governments do the right thing. We must keep demanding the trillions, not billions owed in climate debt and a comprehensive, swift, and equitable fossil fuel phaseout. The struggle for climate justice is not over."

Campaigners and developing nations

fought for $1.3 trillion in annual climate finance from those most responsible for the planetary crisis. Instead, the NCQG document only directs developed countries to provide the Global South with $300 billion per year by 2035, with a goal of reaching the higher figure by also seeking funds from private sources.

The deal almost didn't happen at all. As

The Guardian detailed Saturday: "Developed countries including the U.K., the U.S., and E.U. members were pushed into raising their offer from an original $250 billion a year tabled on Friday, to $300 billion. Poor countries argued for more, and in the early evening two groups representing some of the world's poorest countries walked out of one key meeting, threatening to collapse the negotiations."

While Simon Stiell, executive secretary of U.N. Climate Change,

celebrated the NCQG as "an insurance policy for humanity, amid worsening climate impacts hitting every country," Chiara Martinelli, director at Climate Action Network Europe, put it in the context of the $100 billion target set in 2009, which wealthy governments didn't meet.

"Rich countries own the responsibility for the failed outcome at COP29," Martinelli

said. "The talk of tripling from the $100 billion goal might sound impressive, but in reality, it falls far short, barely increasing from the previous commitment when adjusted for inflation and considering the bulk of this money will come in the form of unsustainable loans. This is not solidarity. It's smoke and mirrors that betray the needs of those on the frontlines of the climate crisis."

Also stressing that "it's not even real 'money,' by and large," but rather "a motley mix of loans and privatized investment," Oxfam International's climate change policy lead, Nafkote Dabi, called the agreement "a global Ponzi scheme that the private equity vultures and public relations people will now exploit."

"The terrible verdict from the Baku climate talks shows that rich countries view the Global South as ultimately expendable, like pawns on a chessboard," Dabi charged. "The $300 billion so-called 'deal' that poorer countries have been bullied into accepting is unserious and dangerous—a soulless triumph for the rich, but a genuine disaster for our planet and communities who are being flooded, starved, and displaced today by climate breakdown."

Rachel Cleetus from the Union of Concerned Scientists, who is in Baku, took aim at not only rich governments, but also the host, saying that "the Azerbaijani COP29 Presidency's ineptitude in brokering an agreement at this consequential climate finance COP will go down in ignominy."

Cleetus' group is based in the United States, which is preparing for a January transfer of power from Democratic President Joe Biden to Republican President-elect Donald Trump, who notably

ditched the Paris agreement during his first term.

"The United States—the world's largest historical contributor of heat-trapping emissions—is going to see a monumental shift in its global diplomacy posture as the incoming anti-science Trump administration will likely exit the Paris agreement and take a wrecking ball to domestic climate and clean energy policies," Cleetus warned. "While some politically and economically popular clean energy policies may prove durable and action from forward-looking states and businesses will be significant, there's no doubt that a lack of robust federal leadership will leave U.S. climate action hobbled for a time."

"Other nations—including E.U. countries and China—will need to do what they can to fill the void," she stressed. "Between now and COP30 in Brazil next year, nations have a lot of ground to make up to have any hope of limiting runaway climate change."

Ben Goloff of the U.S.-based Center for Biological Diversity called out the departing Biden administration, arguing that it "should be going out with at least a signal of its moral climate commitment, not copping out ahead of the Trump 2.0 disaster."

Signs call for for the Global North to "pay up" during a COP29 action in Baku, Azerbaijan. (Photo: Marie Jacquemin/Greenpeace)

Signs call for for the Global North to "pay up" during a COP29 action in Baku, Azerbaijan. (Photo: Marie Jacquemin/Greenpeace) A

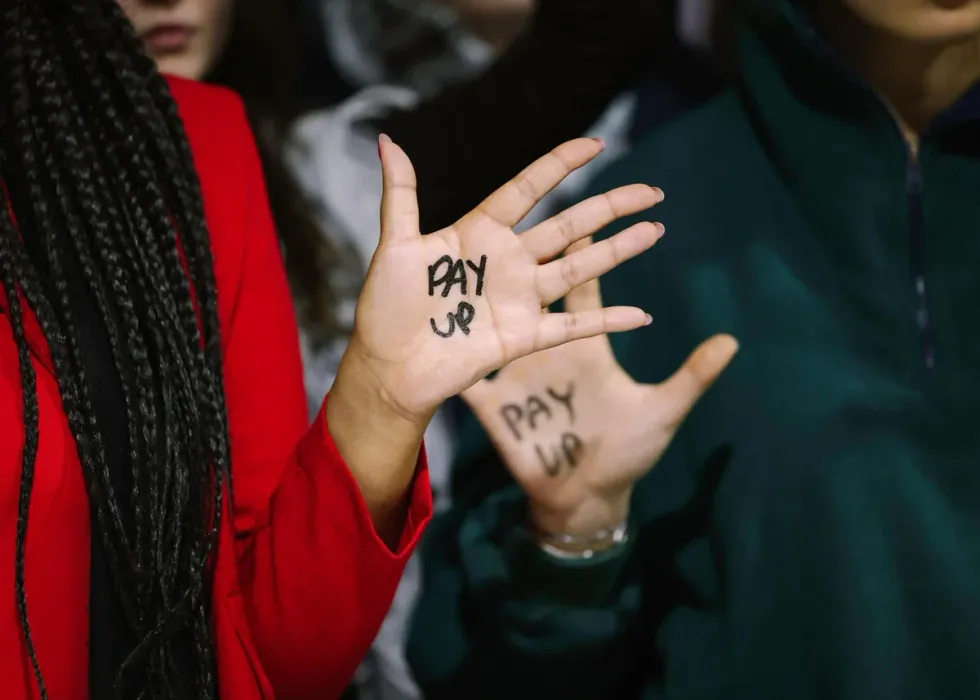

A  A close-up of hands with "pay up" written on them at COP29 in Baku, Azerbaijan. (Photo: Marie Jacquemin/Greenpeace)

A close-up of hands with "pay up" written on them at COP29 in Baku, Azerbaijan. (Photo: Marie Jacquemin/Greenpeace) A sign of "persistir," Portuguese for "to persist," sends a signal that the work must continue onto COP30 in Brazil. (Photo: Marie Jacquemin/Greenpeace)

A sign of "persistir," Portuguese for "to persist," sends a signal that the work must continue onto COP30 in Brazil. (Photo: Marie Jacquemin/Greenpeace)