SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

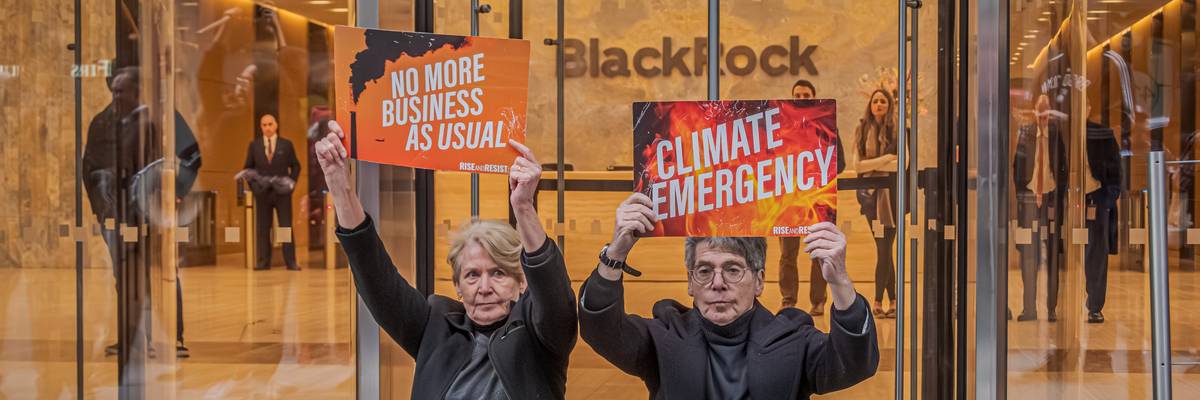

Participants are seen holding signs at a climate protest outside BlackRock headquarters.

Only by making investments in climate resilience and clean energy can asset managers like BlackRock truly protect the retirement savings of everyday Americans.

Every spring, Larry Fink, CEO of the world's largest asset manager BlackRock, publishes his annual letter to investors, often heralded as an indicator of where the financial industry is headed. This year, Fink focused on the need to "democratize" investing by giving regular people more access to invest in private markets, meaning businesses outside of stock exchanges.

Fink argued this move would not only help more people save more money for retirement, but that these investments are necessary to help meet the growing need for financing for the infrastructure and energy needs of the future. Unfortunately, his take on the energy needs of the future is concerning, emphasizing fossil fuel pipelines and infrastructure and AI data centers, while casting doubt on renewables.

Democratizing investing is a noble goal, but Fink's annual letter misses a key point: A secure retirement isn't just about the money you save, it's about retiring into a world you want to live in, with healthy communities and a livable climate. By failing to encourage investments that help facilitate the transition to a clean energy economy and create green jobs, BlackRock's efforts will undermine the long-term success of our financial markets and threaten the ability of everyday Americans to retire with dignity. If asset managers like BlackRock truly want to help people retire, they must uplift investments that increase returns for individuals AND help build a future where everyone thrives.

In pushing forward BlackRock's agenda on private markets, Fink's annual letter conveniently ignores two critical realities.

The first is the growing problem of economic inequality in the United States. The difficulty so many Americans face in reaching their saving and investing goals has less to do with limited access to private markets, and more to do with our egregious income divide. Right now, the top 1% holds nearly as much wealth as the bottom 90%. Helping more people be financially secure in retirement begins with investing in our communities and climate solutions to help create green jobs so that more people have the resources they need to save.

The second is the growing need for financing for, and opportunities to invest in, climate resilience and the clean energy transition. This includes everything from renewable energy infrastructure to disaster-proof buildings and climate-resilient farming.

True retirement security comes not only from individual savings, but from living in a world where our investments foster a safe and thriving future for all.

Estimates show global investments in clean energy must reach $4 trillion annually by 2030 to hit global climate goals. Although this goal may seem huge, reaching it is necessary to prevent much larger losses to our economy. By 2050, without further action, climate damages could permanently shrink economic output by 20%, cost $38 trillion annually, and slash global stocks by 50%. This translates to trillions of dollars lost annually due to extreme weather, damaged infrastructure, and lower productivity. Alongside these widespread economic losses, retirement savings would take a major hit. In other words, failing to invest in the transition to a clean energy economy will make our communities—and our savings—much worse off.

Instead of focusing his annual letter on private markets, Fink should have focused on the investments necessary to support the long-term financial security and peace of mind for the millions of people he claims he wants to help save for retirement. Only by making investments in climate resilience and clean energy can asset managers like BlackRock truly protect the retirement savings of everyday Americans.

Retiring with dignity is not merely about having the financial security to live comfortably. It's also about the broader environment in which people live and age, which is something Fink apparently forgets. It's not only about having investment portfolios that can weather climate-related risks, but about having thriving communities and flourishing economies to retire in: cities with liveable temperatures, modern buildings, and plentiful clean energy, and people with access to good jobs, quality education, and affordable housing.

Financial security isn't just about having a diversified portfolio and a comfortable nest egg—it's intricately linked to the health of the environment. Ignoring climate risks jeopardizes the well-being of future retirees and the communities they call home. True retirement security comes not only from individual savings, but from living in a world where our investments foster a safe and thriving future for all.

To truly democratize investing, asset managers like BlackRock must direct their investment strategies to support climate resilience and the clean energy transition and provide prosperity for all Americans, within individual portfolios and beyond.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Every spring, Larry Fink, CEO of the world's largest asset manager BlackRock, publishes his annual letter to investors, often heralded as an indicator of where the financial industry is headed. This year, Fink focused on the need to "democratize" investing by giving regular people more access to invest in private markets, meaning businesses outside of stock exchanges.

Fink argued this move would not only help more people save more money for retirement, but that these investments are necessary to help meet the growing need for financing for the infrastructure and energy needs of the future. Unfortunately, his take on the energy needs of the future is concerning, emphasizing fossil fuel pipelines and infrastructure and AI data centers, while casting doubt on renewables.

Democratizing investing is a noble goal, but Fink's annual letter misses a key point: A secure retirement isn't just about the money you save, it's about retiring into a world you want to live in, with healthy communities and a livable climate. By failing to encourage investments that help facilitate the transition to a clean energy economy and create green jobs, BlackRock's efforts will undermine the long-term success of our financial markets and threaten the ability of everyday Americans to retire with dignity. If asset managers like BlackRock truly want to help people retire, they must uplift investments that increase returns for individuals AND help build a future where everyone thrives.

In pushing forward BlackRock's agenda on private markets, Fink's annual letter conveniently ignores two critical realities.

The first is the growing problem of economic inequality in the United States. The difficulty so many Americans face in reaching their saving and investing goals has less to do with limited access to private markets, and more to do with our egregious income divide. Right now, the top 1% holds nearly as much wealth as the bottom 90%. Helping more people be financially secure in retirement begins with investing in our communities and climate solutions to help create green jobs so that more people have the resources they need to save.

The second is the growing need for financing for, and opportunities to invest in, climate resilience and the clean energy transition. This includes everything from renewable energy infrastructure to disaster-proof buildings and climate-resilient farming.

True retirement security comes not only from individual savings, but from living in a world where our investments foster a safe and thriving future for all.

Estimates show global investments in clean energy must reach $4 trillion annually by 2030 to hit global climate goals. Although this goal may seem huge, reaching it is necessary to prevent much larger losses to our economy. By 2050, without further action, climate damages could permanently shrink economic output by 20%, cost $38 trillion annually, and slash global stocks by 50%. This translates to trillions of dollars lost annually due to extreme weather, damaged infrastructure, and lower productivity. Alongside these widespread economic losses, retirement savings would take a major hit. In other words, failing to invest in the transition to a clean energy economy will make our communities—and our savings—much worse off.

Instead of focusing his annual letter on private markets, Fink should have focused on the investments necessary to support the long-term financial security and peace of mind for the millions of people he claims he wants to help save for retirement. Only by making investments in climate resilience and clean energy can asset managers like BlackRock truly protect the retirement savings of everyday Americans.

Retiring with dignity is not merely about having the financial security to live comfortably. It's also about the broader environment in which people live and age, which is something Fink apparently forgets. It's not only about having investment portfolios that can weather climate-related risks, but about having thriving communities and flourishing economies to retire in: cities with liveable temperatures, modern buildings, and plentiful clean energy, and people with access to good jobs, quality education, and affordable housing.

Financial security isn't just about having a diversified portfolio and a comfortable nest egg—it's intricately linked to the health of the environment. Ignoring climate risks jeopardizes the well-being of future retirees and the communities they call home. True retirement security comes not only from individual savings, but from living in a world where our investments foster a safe and thriving future for all.

To truly democratize investing, asset managers like BlackRock must direct their investment strategies to support climate resilience and the clean energy transition and provide prosperity for all Americans, within individual portfolios and beyond.

Every spring, Larry Fink, CEO of the world's largest asset manager BlackRock, publishes his annual letter to investors, often heralded as an indicator of where the financial industry is headed. This year, Fink focused on the need to "democratize" investing by giving regular people more access to invest in private markets, meaning businesses outside of stock exchanges.

Fink argued this move would not only help more people save more money for retirement, but that these investments are necessary to help meet the growing need for financing for the infrastructure and energy needs of the future. Unfortunately, his take on the energy needs of the future is concerning, emphasizing fossil fuel pipelines and infrastructure and AI data centers, while casting doubt on renewables.

Democratizing investing is a noble goal, but Fink's annual letter misses a key point: A secure retirement isn't just about the money you save, it's about retiring into a world you want to live in, with healthy communities and a livable climate. By failing to encourage investments that help facilitate the transition to a clean energy economy and create green jobs, BlackRock's efforts will undermine the long-term success of our financial markets and threaten the ability of everyday Americans to retire with dignity. If asset managers like BlackRock truly want to help people retire, they must uplift investments that increase returns for individuals AND help build a future where everyone thrives.

In pushing forward BlackRock's agenda on private markets, Fink's annual letter conveniently ignores two critical realities.

The first is the growing problem of economic inequality in the United States. The difficulty so many Americans face in reaching their saving and investing goals has less to do with limited access to private markets, and more to do with our egregious income divide. Right now, the top 1% holds nearly as much wealth as the bottom 90%. Helping more people be financially secure in retirement begins with investing in our communities and climate solutions to help create green jobs so that more people have the resources they need to save.

The second is the growing need for financing for, and opportunities to invest in, climate resilience and the clean energy transition. This includes everything from renewable energy infrastructure to disaster-proof buildings and climate-resilient farming.

True retirement security comes not only from individual savings, but from living in a world where our investments foster a safe and thriving future for all.

Estimates show global investments in clean energy must reach $4 trillion annually by 2030 to hit global climate goals. Although this goal may seem huge, reaching it is necessary to prevent much larger losses to our economy. By 2050, without further action, climate damages could permanently shrink economic output by 20%, cost $38 trillion annually, and slash global stocks by 50%. This translates to trillions of dollars lost annually due to extreme weather, damaged infrastructure, and lower productivity. Alongside these widespread economic losses, retirement savings would take a major hit. In other words, failing to invest in the transition to a clean energy economy will make our communities—and our savings—much worse off.

Instead of focusing his annual letter on private markets, Fink should have focused on the investments necessary to support the long-term financial security and peace of mind for the millions of people he claims he wants to help save for retirement. Only by making investments in climate resilience and clean energy can asset managers like BlackRock truly protect the retirement savings of everyday Americans.

Retiring with dignity is not merely about having the financial security to live comfortably. It's also about the broader environment in which people live and age, which is something Fink apparently forgets. It's not only about having investment portfolios that can weather climate-related risks, but about having thriving communities and flourishing economies to retire in: cities with liveable temperatures, modern buildings, and plentiful clean energy, and people with access to good jobs, quality education, and affordable housing.

Financial security isn't just about having a diversified portfolio and a comfortable nest egg—it's intricately linked to the health of the environment. Ignoring climate risks jeopardizes the well-being of future retirees and the communities they call home. True retirement security comes not only from individual savings, but from living in a world where our investments foster a safe and thriving future for all.

To truly democratize investing, asset managers like BlackRock must direct their investment strategies to support climate resilience and the clean energy transition and provide prosperity for all Americans, within individual portfolios and beyond.