SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

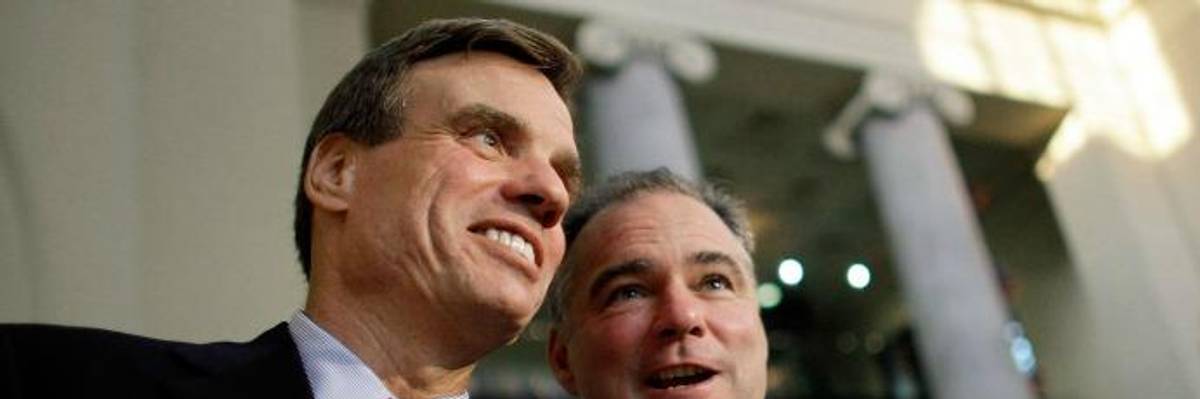

Virginia Sens. Mark Warner and Tim Kaine talk during a fundraising event at the Science Museum of Virginia August 14, 2008 in Richmond, Virginia. (Photo: Chip Somodevilla/Getty Images)

Democrats had the power to stop a massive big bank giveaway from passing the Senate Wednesday night, but instead they decided--with a "green light" from Senate Minority Leader Chuck Schumer (D-N.Y)--to hand the GOP more than enough votes to ram the deregulatory bill through instead, commemorating the tenth anniversary of the 2008 financial crisis by significantly increasing the risk of another one.

"The Senate Democrats who joined the GOP to deliver this bank giveaway were as politically short-sighted as they were reckless in putting our economy at risk."

--Kurt Walters, Rootstrikers

In addition to Sen. Angus King (I-Maine), 16 Democrats joined a unified Republican caucus in approving the so-called "Economic Growth, Regulatory Relief, and Consumer Protection Act."

Rootstrikers, an anti-corruption group that worked for weeks to mobilize against what progressive critics have termed the "Bank Lobbyist Act," called Wednesday's vote "a shameful moment for the Senate" and placed much of the blame on Schumer, who voted against the measure but refused to whip against it.

"The Senate Democrats who joined the GOP to deliver this bank giveaway were as politically short-sighted as they were reckless in putting our economy at risk," Rootstrikers campaign director Kurt Walters said in a statement following the measure's passage. "Can Schumer's Democrats claim to fight for the little guy after deregulating 25 of the country's 40 biggest banks--and making it more likely the little guy's money will be used to give them bailouts?"

While Democratic supporters of the bill continued insisting to the very end it is aimed at providing relief to over-burdened community banks, numerous independent analyses have shown that the legislation's most consequential provisions are aimed at relieving massive banks that received upwards of $40 billion in bailout money during the 2008 financial crisis.

Even Equifax--a large credit-reporting company that suffered an enormous data breach last year and waited six weeks to inform the public--will benefit greatly from the legislation if it is passed in its current form.

"In addition to setting the stage for another taxpayer-funded bailout, this bill reduces safeguards against discriminatory, predatory lending for some of the most vulnerable consumers," Lisa Gilbert, vice president of legislative affairs at Public Citizen, said in a statement.

As consumer groups, former regulators, civil rights organizations, and labor unions denounced the bill's passage on Wednesday, the measure's success did find one welcome audience: the Trump White House.

Having successfully made its way through the Senate after weeks of debate, the largest deregulatory measure since the financial crisis is now headed to the House, where it could be altered--but probably not in favor of consumers, as the House deregulation push has been even more extreme than the Senate's.

In a tweet following Wednesday's vote, Rep. Keith Ellison (D-Minn.) vowed to pick up where his progressive colleagues in the Senate left off by doing everything he can to make sure the bill fails.

"Some of my colleagues may have forgotten about how bad the financial crash was, but I haven't," Ellison wrote. "Analysis by the nonpartisan CBO found this bill increases the likelihood of another taxpayer bailout. I will do everything in my power to fight it in the House."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Democrats had the power to stop a massive big bank giveaway from passing the Senate Wednesday night, but instead they decided--with a "green light" from Senate Minority Leader Chuck Schumer (D-N.Y)--to hand the GOP more than enough votes to ram the deregulatory bill through instead, commemorating the tenth anniversary of the 2008 financial crisis by significantly increasing the risk of another one.

"The Senate Democrats who joined the GOP to deliver this bank giveaway were as politically short-sighted as they were reckless in putting our economy at risk."

--Kurt Walters, Rootstrikers

In addition to Sen. Angus King (I-Maine), 16 Democrats joined a unified Republican caucus in approving the so-called "Economic Growth, Regulatory Relief, and Consumer Protection Act."

Rootstrikers, an anti-corruption group that worked for weeks to mobilize against what progressive critics have termed the "Bank Lobbyist Act," called Wednesday's vote "a shameful moment for the Senate" and placed much of the blame on Schumer, who voted against the measure but refused to whip against it.

"The Senate Democrats who joined the GOP to deliver this bank giveaway were as politically short-sighted as they were reckless in putting our economy at risk," Rootstrikers campaign director Kurt Walters said in a statement following the measure's passage. "Can Schumer's Democrats claim to fight for the little guy after deregulating 25 of the country's 40 biggest banks--and making it more likely the little guy's money will be used to give them bailouts?"

While Democratic supporters of the bill continued insisting to the very end it is aimed at providing relief to over-burdened community banks, numerous independent analyses have shown that the legislation's most consequential provisions are aimed at relieving massive banks that received upwards of $40 billion in bailout money during the 2008 financial crisis.

Even Equifax--a large credit-reporting company that suffered an enormous data breach last year and waited six weeks to inform the public--will benefit greatly from the legislation if it is passed in its current form.

"In addition to setting the stage for another taxpayer-funded bailout, this bill reduces safeguards against discriminatory, predatory lending for some of the most vulnerable consumers," Lisa Gilbert, vice president of legislative affairs at Public Citizen, said in a statement.

As consumer groups, former regulators, civil rights organizations, and labor unions denounced the bill's passage on Wednesday, the measure's success did find one welcome audience: the Trump White House.

Having successfully made its way through the Senate after weeks of debate, the largest deregulatory measure since the financial crisis is now headed to the House, where it could be altered--but probably not in favor of consumers, as the House deregulation push has been even more extreme than the Senate's.

In a tweet following Wednesday's vote, Rep. Keith Ellison (D-Minn.) vowed to pick up where his progressive colleagues in the Senate left off by doing everything he can to make sure the bill fails.

"Some of my colleagues may have forgotten about how bad the financial crash was, but I haven't," Ellison wrote. "Analysis by the nonpartisan CBO found this bill increases the likelihood of another taxpayer bailout. I will do everything in my power to fight it in the House."

Democrats had the power to stop a massive big bank giveaway from passing the Senate Wednesday night, but instead they decided--with a "green light" from Senate Minority Leader Chuck Schumer (D-N.Y)--to hand the GOP more than enough votes to ram the deregulatory bill through instead, commemorating the tenth anniversary of the 2008 financial crisis by significantly increasing the risk of another one.

"The Senate Democrats who joined the GOP to deliver this bank giveaway were as politically short-sighted as they were reckless in putting our economy at risk."

--Kurt Walters, Rootstrikers

In addition to Sen. Angus King (I-Maine), 16 Democrats joined a unified Republican caucus in approving the so-called "Economic Growth, Regulatory Relief, and Consumer Protection Act."

Rootstrikers, an anti-corruption group that worked for weeks to mobilize against what progressive critics have termed the "Bank Lobbyist Act," called Wednesday's vote "a shameful moment for the Senate" and placed much of the blame on Schumer, who voted against the measure but refused to whip against it.

"The Senate Democrats who joined the GOP to deliver this bank giveaway were as politically short-sighted as they were reckless in putting our economy at risk," Rootstrikers campaign director Kurt Walters said in a statement following the measure's passage. "Can Schumer's Democrats claim to fight for the little guy after deregulating 25 of the country's 40 biggest banks--and making it more likely the little guy's money will be used to give them bailouts?"

While Democratic supporters of the bill continued insisting to the very end it is aimed at providing relief to over-burdened community banks, numerous independent analyses have shown that the legislation's most consequential provisions are aimed at relieving massive banks that received upwards of $40 billion in bailout money during the 2008 financial crisis.

Even Equifax--a large credit-reporting company that suffered an enormous data breach last year and waited six weeks to inform the public--will benefit greatly from the legislation if it is passed in its current form.

"In addition to setting the stage for another taxpayer-funded bailout, this bill reduces safeguards against discriminatory, predatory lending for some of the most vulnerable consumers," Lisa Gilbert, vice president of legislative affairs at Public Citizen, said in a statement.

As consumer groups, former regulators, civil rights organizations, and labor unions denounced the bill's passage on Wednesday, the measure's success did find one welcome audience: the Trump White House.

Having successfully made its way through the Senate after weeks of debate, the largest deregulatory measure since the financial crisis is now headed to the House, where it could be altered--but probably not in favor of consumers, as the House deregulation push has been even more extreme than the Senate's.

In a tweet following Wednesday's vote, Rep. Keith Ellison (D-Minn.) vowed to pick up where his progressive colleagues in the Senate left off by doing everything he can to make sure the bill fails.

"Some of my colleagues may have forgotten about how bad the financial crash was, but I haven't," Ellison wrote. "Analysis by the nonpartisan CBO found this bill increases the likelihood of another taxpayer bailout. I will do everything in my power to fight it in the House."