SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

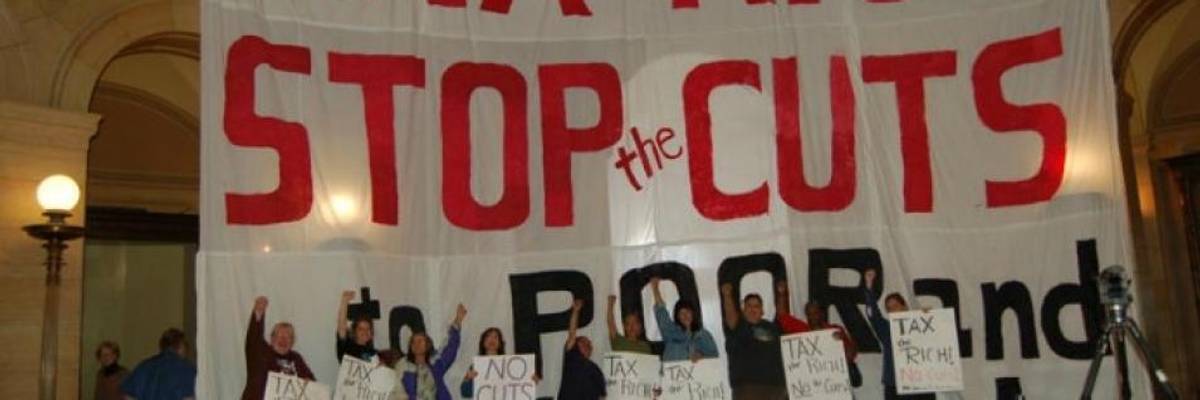

"Three decades of data prove that tax cuts for the wealthy do not 'trickle down' to working people or grow the overall economy," writes billionaire environmentalist Tom Steyer. (Photo: Fight Back! News/Kim DeFranco)

As President Donald Trump and the Republican Party move ahead with their attempt to deliver massive tax cuts to the wealthiest Americans, an analysis by the International Monetary Fund published Wednesday finds that the U.S. economy would be much better off if they did precisely the opposite.

"Three decades of data prove that tax cuts for the wealthy do not 'trickle down' to working people or grow the overall economy."

-- Tom Steyer, NextGen AmericaContrary to GOP talking points, the new report notes that "empirical evidence does not support" the argument that higher taxes for those in a nation's top income brackets would hinder economic growth.

The IMF's analysis comes as a growing number of wealthy Americans are joining the opposition to Trump's regressive tax plan--which would slash the top individual tax rate from 39.6 percent to 35 percent--and calling for higher taxes on those at the very top.

In a recent op-ed for the Los Angeles Times, environmentalist and billionaire president of NextGen America Tom Steyer declared that he is "strongly opposed to even one more penny in cuts for rich people and corporations" because such cuts "defund the critical public programs on which American families depend."

"Three decades of data prove that tax cuts for the wealthy do not 'trickle down' to working people or grow the overall economy," Steyer concluded. "Let's raise taxes on the rich and use the money to invest directly in the American people--by improving infrastructure, promoting clean energy, strengthening public education, and expanding healthcare. Let's boost wages to stimulate economic growth and job creation. It's the only way we will create broad prosperity, rebuild the middle class, and give working families a fair shake."

Billionaire venture capitalist Nick Hanauer joined the list of wealthy opponents of the Trump-GOP tax proposals on Wednesday, writing for Politico that the president's tax plan is "a massive and destructive financial giveaway masquerading as pro-growth tax reform."

"The American tax code is already rigged in favor of the rich and powerful, and the Trump/Ryan tax plan would make it only worse," Hanauer concludes. "If we truly want an economy that works better for all Americans, we need to move in the other direction."

"The American tax code is already rigged in favor of the rich and powerful, and the Trump/Ryan tax plan would make it only worse."

--Nick Hanauer

The new IMF analysis finds that such a move would contribute substantially to reducing income and wealth inequality, which--as previous IMF research has shown--does have a severely detrimental effect on economic growth.

But the report goes on to note that advanced nations have been moving in the wrong direction over the last several decades by steadily lowering tax rates for top earners.

"Personal income tax progressivity has declined steeply in the 1980s and 1990s, and has remained broadly stable since then," note IMF economists Vitor Gaspar and Mercedes Garcia-Escribano. "The average top income tax rate for OECD member countries fell from 62 percent in 1981 to 35 percent in 2015. In addition, tax systems are less progressive than indicated by the statutory rates, because wealthy individuals have more access to tax relief."

This decades-long decline in progressivity, the IMF's report notes, "cannot be fully explained" by claims that lower tax rates are "optimal" for sustainable economic growth.

The analysis concludes by arguing that there are plenty of good reasons for wealthy nations to increase the progressivity of their tax codes by raising rates for the rich, but that this "this could be difficult to implement politically, because better off individuals tend to have more political influence."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As President Donald Trump and the Republican Party move ahead with their attempt to deliver massive tax cuts to the wealthiest Americans, an analysis by the International Monetary Fund published Wednesday finds that the U.S. economy would be much better off if they did precisely the opposite.

"Three decades of data prove that tax cuts for the wealthy do not 'trickle down' to working people or grow the overall economy."

-- Tom Steyer, NextGen AmericaContrary to GOP talking points, the new report notes that "empirical evidence does not support" the argument that higher taxes for those in a nation's top income brackets would hinder economic growth.

The IMF's analysis comes as a growing number of wealthy Americans are joining the opposition to Trump's regressive tax plan--which would slash the top individual tax rate from 39.6 percent to 35 percent--and calling for higher taxes on those at the very top.

In a recent op-ed for the Los Angeles Times, environmentalist and billionaire president of NextGen America Tom Steyer declared that he is "strongly opposed to even one more penny in cuts for rich people and corporations" because such cuts "defund the critical public programs on which American families depend."

"Three decades of data prove that tax cuts for the wealthy do not 'trickle down' to working people or grow the overall economy," Steyer concluded. "Let's raise taxes on the rich and use the money to invest directly in the American people--by improving infrastructure, promoting clean energy, strengthening public education, and expanding healthcare. Let's boost wages to stimulate economic growth and job creation. It's the only way we will create broad prosperity, rebuild the middle class, and give working families a fair shake."

Billionaire venture capitalist Nick Hanauer joined the list of wealthy opponents of the Trump-GOP tax proposals on Wednesday, writing for Politico that the president's tax plan is "a massive and destructive financial giveaway masquerading as pro-growth tax reform."

"The American tax code is already rigged in favor of the rich and powerful, and the Trump/Ryan tax plan would make it only worse," Hanauer concludes. "If we truly want an economy that works better for all Americans, we need to move in the other direction."

"The American tax code is already rigged in favor of the rich and powerful, and the Trump/Ryan tax plan would make it only worse."

--Nick Hanauer

The new IMF analysis finds that such a move would contribute substantially to reducing income and wealth inequality, which--as previous IMF research has shown--does have a severely detrimental effect on economic growth.

But the report goes on to note that advanced nations have been moving in the wrong direction over the last several decades by steadily lowering tax rates for top earners.

"Personal income tax progressivity has declined steeply in the 1980s and 1990s, and has remained broadly stable since then," note IMF economists Vitor Gaspar and Mercedes Garcia-Escribano. "The average top income tax rate for OECD member countries fell from 62 percent in 1981 to 35 percent in 2015. In addition, tax systems are less progressive than indicated by the statutory rates, because wealthy individuals have more access to tax relief."

This decades-long decline in progressivity, the IMF's report notes, "cannot be fully explained" by claims that lower tax rates are "optimal" for sustainable economic growth.

The analysis concludes by arguing that there are plenty of good reasons for wealthy nations to increase the progressivity of their tax codes by raising rates for the rich, but that this "this could be difficult to implement politically, because better off individuals tend to have more political influence."

As President Donald Trump and the Republican Party move ahead with their attempt to deliver massive tax cuts to the wealthiest Americans, an analysis by the International Monetary Fund published Wednesday finds that the U.S. economy would be much better off if they did precisely the opposite.

"Three decades of data prove that tax cuts for the wealthy do not 'trickle down' to working people or grow the overall economy."

-- Tom Steyer, NextGen AmericaContrary to GOP talking points, the new report notes that "empirical evidence does not support" the argument that higher taxes for those in a nation's top income brackets would hinder economic growth.

The IMF's analysis comes as a growing number of wealthy Americans are joining the opposition to Trump's regressive tax plan--which would slash the top individual tax rate from 39.6 percent to 35 percent--and calling for higher taxes on those at the very top.

In a recent op-ed for the Los Angeles Times, environmentalist and billionaire president of NextGen America Tom Steyer declared that he is "strongly opposed to even one more penny in cuts for rich people and corporations" because such cuts "defund the critical public programs on which American families depend."

"Three decades of data prove that tax cuts for the wealthy do not 'trickle down' to working people or grow the overall economy," Steyer concluded. "Let's raise taxes on the rich and use the money to invest directly in the American people--by improving infrastructure, promoting clean energy, strengthening public education, and expanding healthcare. Let's boost wages to stimulate economic growth and job creation. It's the only way we will create broad prosperity, rebuild the middle class, and give working families a fair shake."

Billionaire venture capitalist Nick Hanauer joined the list of wealthy opponents of the Trump-GOP tax proposals on Wednesday, writing for Politico that the president's tax plan is "a massive and destructive financial giveaway masquerading as pro-growth tax reform."

"The American tax code is already rigged in favor of the rich and powerful, and the Trump/Ryan tax plan would make it only worse," Hanauer concludes. "If we truly want an economy that works better for all Americans, we need to move in the other direction."

"The American tax code is already rigged in favor of the rich and powerful, and the Trump/Ryan tax plan would make it only worse."

--Nick Hanauer

The new IMF analysis finds that such a move would contribute substantially to reducing income and wealth inequality, which--as previous IMF research has shown--does have a severely detrimental effect on economic growth.

But the report goes on to note that advanced nations have been moving in the wrong direction over the last several decades by steadily lowering tax rates for top earners.

"Personal income tax progressivity has declined steeply in the 1980s and 1990s, and has remained broadly stable since then," note IMF economists Vitor Gaspar and Mercedes Garcia-Escribano. "The average top income tax rate for OECD member countries fell from 62 percent in 1981 to 35 percent in 2015. In addition, tax systems are less progressive than indicated by the statutory rates, because wealthy individuals have more access to tax relief."

This decades-long decline in progressivity, the IMF's report notes, "cannot be fully explained" by claims that lower tax rates are "optimal" for sustainable economic growth.

The analysis concludes by arguing that there are plenty of good reasons for wealthy nations to increase the progressivity of their tax codes by raising rates for the rich, but that this "this could be difficult to implement politically, because better off individuals tend to have more political influence."