SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"It is absolutely outrageous that Donald Trump and Paul Ryan would seek to increase taxes on middle class families while lowering them for millionaires and billionaires," Frank Clemente, executive director of Americans for Tax Fairness, concluded in a statement on Friday. (Photo: Gage Skidmore/Flickr/cc)

The Trump administration has tried everything--including outright lies and suppression of contradictory evidence--to avoid admitting that its tax plan will primarily benefit the wealthiest Americans, but a new analysis released Friday by the non-partisan Tax Policy Center (TPC) makes that fact inescapable.

"By 2027, the top one percent would get 80 percent of the plan's tax cuts."

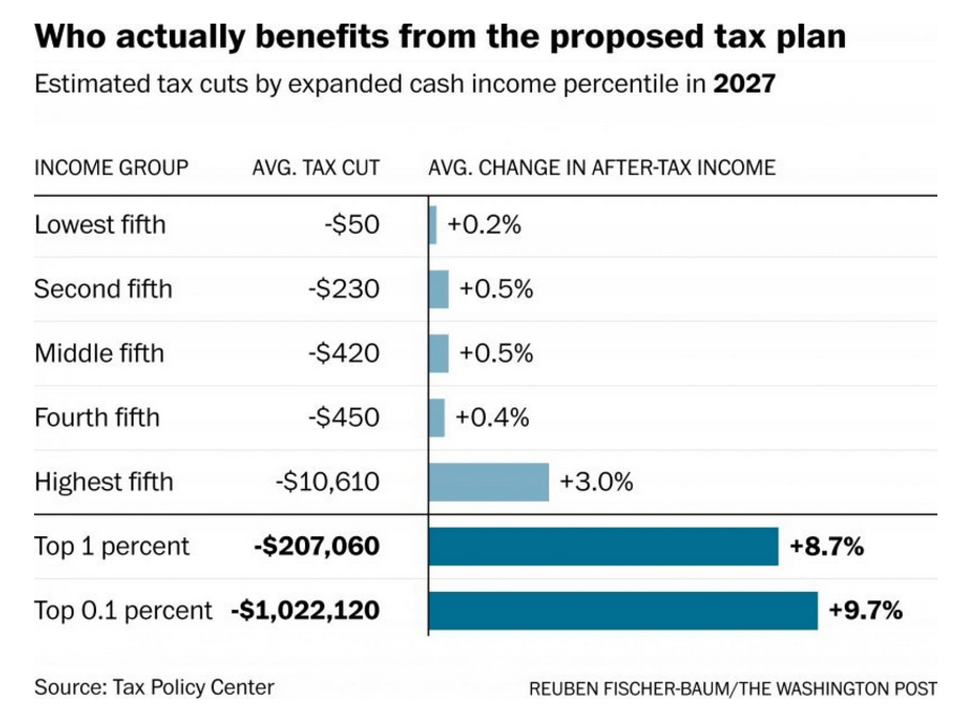

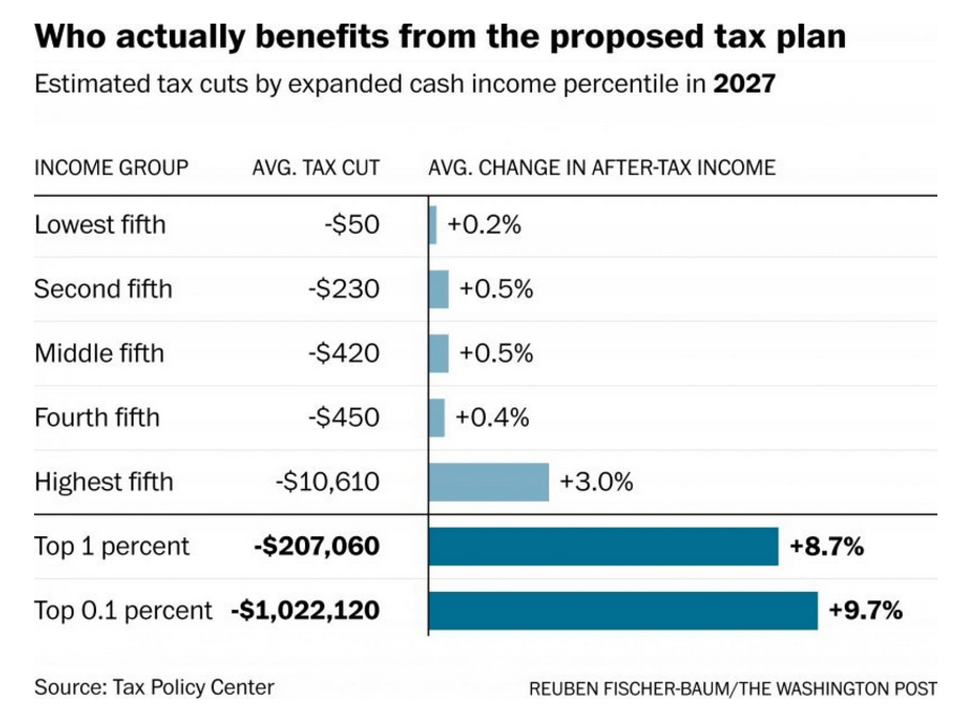

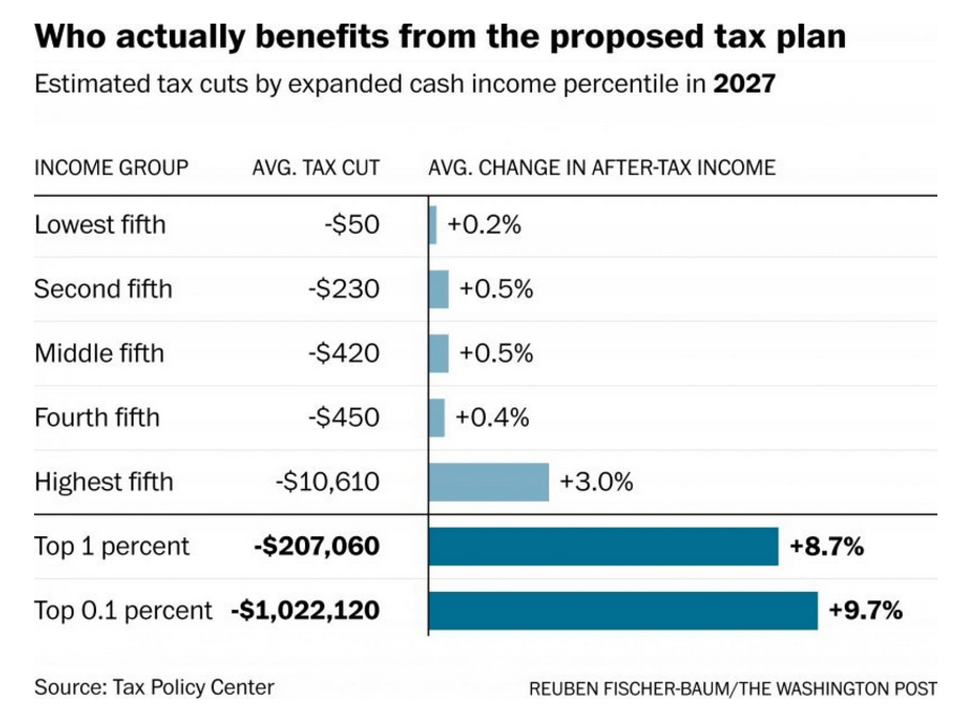

--Howard Gleckman, Tax Policy Center"Those with the very highest incomes would receive the biggest tax cuts," TPC's report, the first in-depth analysis of Trump's proposals, notes. "Taxpayers in the top one percent (incomes above $730,000), would receive about 50 percent of the total tax benefit [in 2018]; their after-tax income would increase an average of 8.5 percent."

By comparison, the after-tax income of those in the bottom 95 percent of the income distribution would only rise by somewhere between 0.5 and 1.2 percent--hardly the "miracle" President Donald Trump has promised, and made worse by his administration's proposed cuts to crucial safety net programs.

And as Howard Gleckman, senior fellow at TPC, notes, the disparity between benefits accrued by the rich and everyone else "would grow over time."

"By 2027, the top one percent would get 80 percent of the plan's tax cuts while the share for middle-income households would drop to about five percent," Gleckman observed. "On average, taxes for the top one percent would fall by more than $200,000 or 8.7 percent of their after-tax incomes."

Those in the top 0.1 percent would fare even better if Trump's plan--which TPC found would reduce federal revenue by $2.4 trillion over the next decade--becomes the law of the land.

On average, the wealthiest 0.1 percent would pocket an extra million bucks in after-tax income.

The analysis also found not only that the rich would massively benefit from Trump's proposals, but also that many middle class and low-income families would end up paying more in taxes.

By 2027, TPC's report notes, one in four middle class families would end up with higher taxes.

"It is absolutely outrageous that Donald Trump and Paul Ryan would seek to increase taxes on middle class families while lowering them for millionaires and billionaires," Frank Clemente, executive director of Americans for Tax Fairness, concluded in a statement on Friday. "It's doubly outrageous that while they're doling out extra yachts and private jets to the elite, their budgets make cuts to Medicaid, Medicare, Social Security, and public education, further lowering the standard of living for working families. That's no tax plan, that's a tax scam."

Overall, TPC's findings thoroughly undermine Trump's promise to "ensure that the benefits are focused on the middle class, the working men and women, not the highest-income earners," as many immediately observed on social media.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The Trump administration has tried everything--including outright lies and suppression of contradictory evidence--to avoid admitting that its tax plan will primarily benefit the wealthiest Americans, but a new analysis released Friday by the non-partisan Tax Policy Center (TPC) makes that fact inescapable.

"By 2027, the top one percent would get 80 percent of the plan's tax cuts."

--Howard Gleckman, Tax Policy Center"Those with the very highest incomes would receive the biggest tax cuts," TPC's report, the first in-depth analysis of Trump's proposals, notes. "Taxpayers in the top one percent (incomes above $730,000), would receive about 50 percent of the total tax benefit [in 2018]; their after-tax income would increase an average of 8.5 percent."

By comparison, the after-tax income of those in the bottom 95 percent of the income distribution would only rise by somewhere between 0.5 and 1.2 percent--hardly the "miracle" President Donald Trump has promised, and made worse by his administration's proposed cuts to crucial safety net programs.

And as Howard Gleckman, senior fellow at TPC, notes, the disparity between benefits accrued by the rich and everyone else "would grow over time."

"By 2027, the top one percent would get 80 percent of the plan's tax cuts while the share for middle-income households would drop to about five percent," Gleckman observed. "On average, taxes for the top one percent would fall by more than $200,000 or 8.7 percent of their after-tax incomes."

Those in the top 0.1 percent would fare even better if Trump's plan--which TPC found would reduce federal revenue by $2.4 trillion over the next decade--becomes the law of the land.

On average, the wealthiest 0.1 percent would pocket an extra million bucks in after-tax income.

The analysis also found not only that the rich would massively benefit from Trump's proposals, but also that many middle class and low-income families would end up paying more in taxes.

By 2027, TPC's report notes, one in four middle class families would end up with higher taxes.

"It is absolutely outrageous that Donald Trump and Paul Ryan would seek to increase taxes on middle class families while lowering them for millionaires and billionaires," Frank Clemente, executive director of Americans for Tax Fairness, concluded in a statement on Friday. "It's doubly outrageous that while they're doling out extra yachts and private jets to the elite, their budgets make cuts to Medicaid, Medicare, Social Security, and public education, further lowering the standard of living for working families. That's no tax plan, that's a tax scam."

Overall, TPC's findings thoroughly undermine Trump's promise to "ensure that the benefits are focused on the middle class, the working men and women, not the highest-income earners," as many immediately observed on social media.

The Trump administration has tried everything--including outright lies and suppression of contradictory evidence--to avoid admitting that its tax plan will primarily benefit the wealthiest Americans, but a new analysis released Friday by the non-partisan Tax Policy Center (TPC) makes that fact inescapable.

"By 2027, the top one percent would get 80 percent of the plan's tax cuts."

--Howard Gleckman, Tax Policy Center"Those with the very highest incomes would receive the biggest tax cuts," TPC's report, the first in-depth analysis of Trump's proposals, notes. "Taxpayers in the top one percent (incomes above $730,000), would receive about 50 percent of the total tax benefit [in 2018]; their after-tax income would increase an average of 8.5 percent."

By comparison, the after-tax income of those in the bottom 95 percent of the income distribution would only rise by somewhere between 0.5 and 1.2 percent--hardly the "miracle" President Donald Trump has promised, and made worse by his administration's proposed cuts to crucial safety net programs.

And as Howard Gleckman, senior fellow at TPC, notes, the disparity between benefits accrued by the rich and everyone else "would grow over time."

"By 2027, the top one percent would get 80 percent of the plan's tax cuts while the share for middle-income households would drop to about five percent," Gleckman observed. "On average, taxes for the top one percent would fall by more than $200,000 or 8.7 percent of their after-tax incomes."

Those in the top 0.1 percent would fare even better if Trump's plan--which TPC found would reduce federal revenue by $2.4 trillion over the next decade--becomes the law of the land.

On average, the wealthiest 0.1 percent would pocket an extra million bucks in after-tax income.

The analysis also found not only that the rich would massively benefit from Trump's proposals, but also that many middle class and low-income families would end up paying more in taxes.

By 2027, TPC's report notes, one in four middle class families would end up with higher taxes.

"It is absolutely outrageous that Donald Trump and Paul Ryan would seek to increase taxes on middle class families while lowering them for millionaires and billionaires," Frank Clemente, executive director of Americans for Tax Fairness, concluded in a statement on Friday. "It's doubly outrageous that while they're doling out extra yachts and private jets to the elite, their budgets make cuts to Medicaid, Medicare, Social Security, and public education, further lowering the standard of living for working families. That's no tax plan, that's a tax scam."

Overall, TPC's findings thoroughly undermine Trump's promise to "ensure that the benefits are focused on the middle class, the working men and women, not the highest-income earners," as many immediately observed on social media.