Exposed: How Walmart Spun an 'Extensive and Secretive Web' of Overseas Tax Havens

Report is first-ever comprehensive documentation of the company's tax avoidance schemes

Walmart has built a vast, undisclosed network of overseas tax havens--accounting for more than $76 billion of assets--that allows the multinational corporation to shirk public disclosure laws as well as its fair share of both foreign and U.S. taxes, according to a groundbreaking report published Wednesday by Americans for Tax Fairness.

All told, the retail behemoth has established at least 78 subsidiaries in 15 offshore tax havens, none of them publicly reported before. The stunning revelations are based on research conducted by the United Food & Commercial Workers International Union, using publicly available documents filed in various countries by Walmart and its subsidiaries.

"Most people know that Walmart is the world's largest corporation," the report begins. "Virtually no one knows that Walmart has an extensive and secretive web of subsidiaries located in countries widely known as tax havens.

The analysis, titled The Walmart Web: How the World's Biggest Corporation Uses Tax Havens to Dodge Taxes (pdf), shows that Walmart has no fewer than 22 shell companies in Luxembourg--20 established since 2009 and five in 2015 alone. According to the study, Walmart has transferred ownership of more than $45 billion in assets to those subsidiaries since 2011, but reported paying less than 1 percent in tax to Luxembourg on $1.3 billion in profits from 2010 through 2013.

Luxembourg, the report authors are quick to note, has been referred to as a "magical fairyland" of tax avoidance.

Bloomberg explains:

Wal-Mart employs a popular legal strategy in that country called a hybrid loan. It permits companies' offshore units to take tax deductions for interest paid--typically on paper only--to their parents in the U.S. The parent, however, doesn't include that interest as taxable income in the U.S.

The [Organization for Economic Cooperation and Development] has called for an end to the tax benefits of such loans. Luxembourg generated headlines last year after the International Consortium of Investigative Journalists revealed its role in cutting the tax bills of hundreds of multinationals.

"Companies use tax havens to dodge taxes," stated Frank Clemente, executive director of Americans for Tax Fairness. "It appears that's the secret game Walmart is playing."

He continued: "We are calling on Congress, federal agencies and international organizations to determine if Walmart is skirting the law when it comes to reporting its use of tax havens, using various schemes to dodge taxes, and getting a sweetheart deal from Luxembourg that is the equivalent of illegal state aid. Average Americans and small businesses have to make up the difference when Walmart doesn't pay its fair share of taxes."

Indeed, a 2014 Americans for Tax Fairness study showed that public nutrition, health care, and housing assistance provided to Walmart workers cost U.S. taxpayers at least $6.2 billion a year.

The report authors admit that "it is impossible to determine from publicly available financial statements the extent to which this tax-haven expansion has already affected the company's bottom line--and reduced the tax revenues of governments around the world."

And so it will continue to be, Americans for Tax Fairness declares: "In the absence of reforms to the international tax system, including the stricter disclosure requirements proposed in this report, the scope and scale of Walmart's tax avoidance will continue to evade precise calculation."

Furthermore, the findings have implications beyond just one greedy corporation. In addition to casting light on Walmart's secretive tax avoidance schemes, "the discovery that Walmart has built an extensive web of tax-haven subsidiaries suggests that a range of exotic international tax avoidance strategies are being adapted in new sectors of the economy," the report warns, given that big corporate players in the tax-haven game have historically been high-tech firms, pharmaceutical companies and Wall Street banks.

The revelations come as U.S. lawmakers consider ways to ensure corporations pay their fair share.

As the report states: "It is our hope that this case study about Walmart's secretive and extensive use of tax havens causes members of Congress to rethink their approach on how to tax these offshore profits and international tax issues in general."

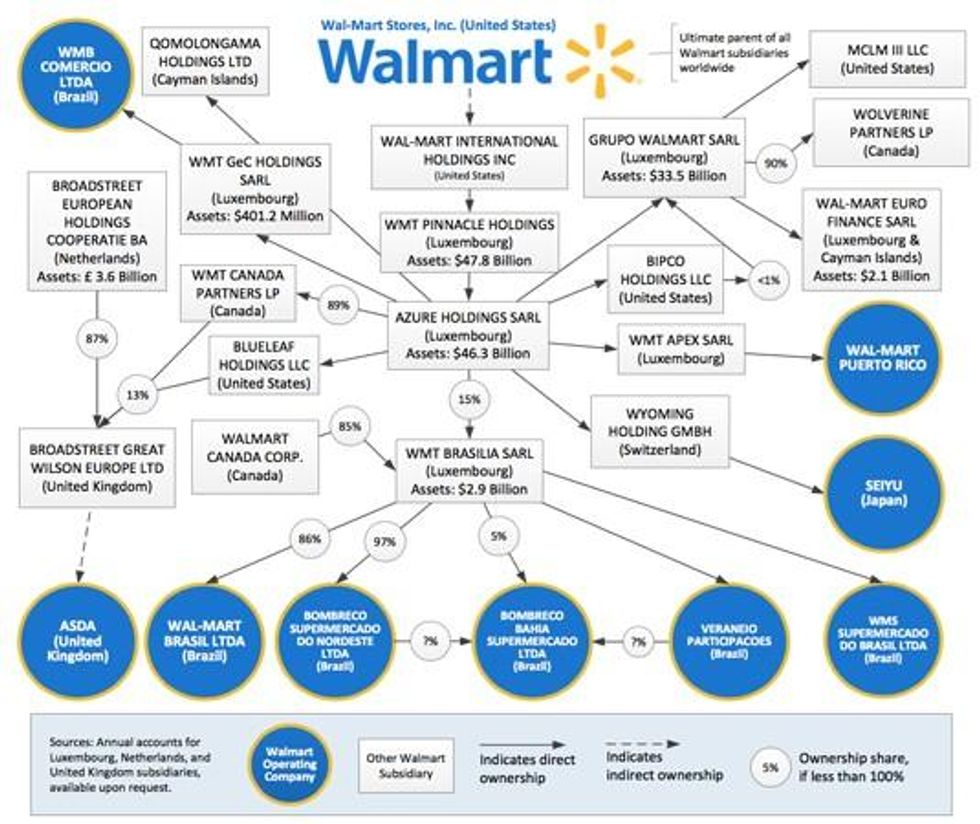

For a more detailed look at Walmart's overseas shell companies, see the diagram from Americans for Tax Fairness below:

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Walmart has built a vast, undisclosed network of overseas tax havens--accounting for more than $76 billion of assets--that allows the multinational corporation to shirk public disclosure laws as well as its fair share of both foreign and U.S. taxes, according to a groundbreaking report published Wednesday by Americans for Tax Fairness.

All told, the retail behemoth has established at least 78 subsidiaries in 15 offshore tax havens, none of them publicly reported before. The stunning revelations are based on research conducted by the United Food & Commercial Workers International Union, using publicly available documents filed in various countries by Walmart and its subsidiaries.

"Most people know that Walmart is the world's largest corporation," the report begins. "Virtually no one knows that Walmart has an extensive and secretive web of subsidiaries located in countries widely known as tax havens.

The analysis, titled The Walmart Web: How the World's Biggest Corporation Uses Tax Havens to Dodge Taxes (pdf), shows that Walmart has no fewer than 22 shell companies in Luxembourg--20 established since 2009 and five in 2015 alone. According to the study, Walmart has transferred ownership of more than $45 billion in assets to those subsidiaries since 2011, but reported paying less than 1 percent in tax to Luxembourg on $1.3 billion in profits from 2010 through 2013.

Luxembourg, the report authors are quick to note, has been referred to as a "magical fairyland" of tax avoidance.

Bloomberg explains:

Wal-Mart employs a popular legal strategy in that country called a hybrid loan. It permits companies' offshore units to take tax deductions for interest paid--typically on paper only--to their parents in the U.S. The parent, however, doesn't include that interest as taxable income in the U.S.

The [Organization for Economic Cooperation and Development] has called for an end to the tax benefits of such loans. Luxembourg generated headlines last year after the International Consortium of Investigative Journalists revealed its role in cutting the tax bills of hundreds of multinationals.

"Companies use tax havens to dodge taxes," stated Frank Clemente, executive director of Americans for Tax Fairness. "It appears that's the secret game Walmart is playing."

He continued: "We are calling on Congress, federal agencies and international organizations to determine if Walmart is skirting the law when it comes to reporting its use of tax havens, using various schemes to dodge taxes, and getting a sweetheart deal from Luxembourg that is the equivalent of illegal state aid. Average Americans and small businesses have to make up the difference when Walmart doesn't pay its fair share of taxes."

Indeed, a 2014 Americans for Tax Fairness study showed that public nutrition, health care, and housing assistance provided to Walmart workers cost U.S. taxpayers at least $6.2 billion a year.

The report authors admit that "it is impossible to determine from publicly available financial statements the extent to which this tax-haven expansion has already affected the company's bottom line--and reduced the tax revenues of governments around the world."

And so it will continue to be, Americans for Tax Fairness declares: "In the absence of reforms to the international tax system, including the stricter disclosure requirements proposed in this report, the scope and scale of Walmart's tax avoidance will continue to evade precise calculation."

Furthermore, the findings have implications beyond just one greedy corporation. In addition to casting light on Walmart's secretive tax avoidance schemes, "the discovery that Walmart has built an extensive web of tax-haven subsidiaries suggests that a range of exotic international tax avoidance strategies are being adapted in new sectors of the economy," the report warns, given that big corporate players in the tax-haven game have historically been high-tech firms, pharmaceutical companies and Wall Street banks.

The revelations come as U.S. lawmakers consider ways to ensure corporations pay their fair share.

As the report states: "It is our hope that this case study about Walmart's secretive and extensive use of tax havens causes members of Congress to rethink their approach on how to tax these offshore profits and international tax issues in general."

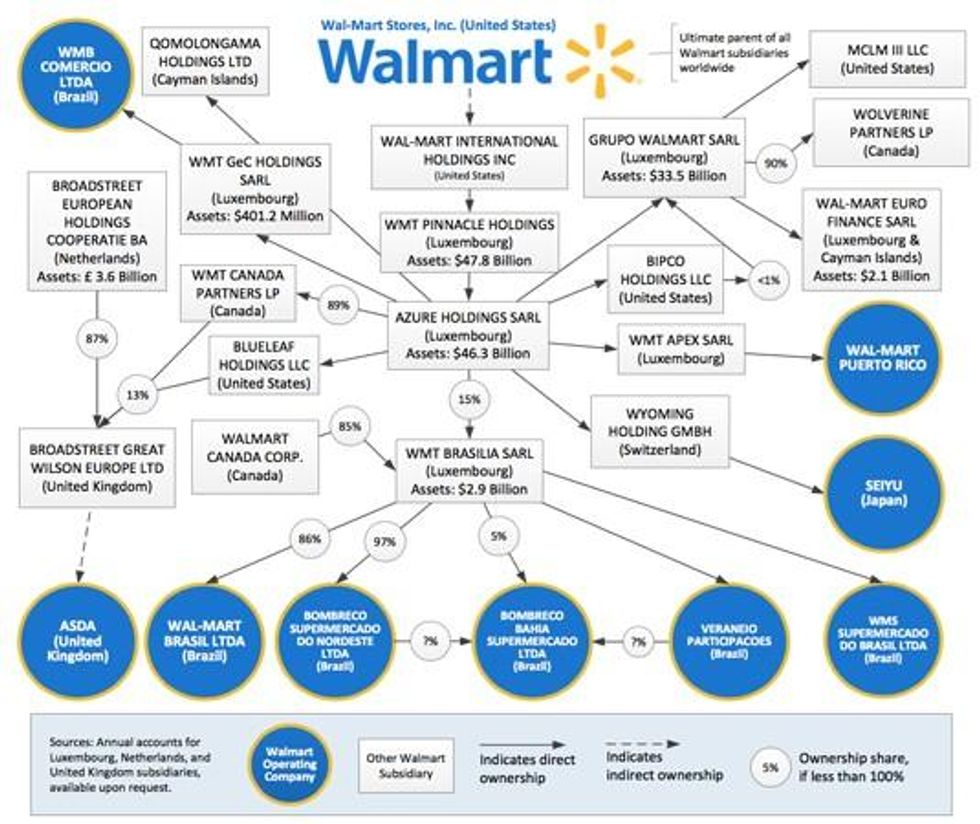

For a more detailed look at Walmart's overseas shell companies, see the diagram from Americans for Tax Fairness below:

Walmart has built a vast, undisclosed network of overseas tax havens--accounting for more than $76 billion of assets--that allows the multinational corporation to shirk public disclosure laws as well as its fair share of both foreign and U.S. taxes, according to a groundbreaking report published Wednesday by Americans for Tax Fairness.

All told, the retail behemoth has established at least 78 subsidiaries in 15 offshore tax havens, none of them publicly reported before. The stunning revelations are based on research conducted by the United Food & Commercial Workers International Union, using publicly available documents filed in various countries by Walmart and its subsidiaries.

"Most people know that Walmart is the world's largest corporation," the report begins. "Virtually no one knows that Walmart has an extensive and secretive web of subsidiaries located in countries widely known as tax havens.

The analysis, titled The Walmart Web: How the World's Biggest Corporation Uses Tax Havens to Dodge Taxes (pdf), shows that Walmart has no fewer than 22 shell companies in Luxembourg--20 established since 2009 and five in 2015 alone. According to the study, Walmart has transferred ownership of more than $45 billion in assets to those subsidiaries since 2011, but reported paying less than 1 percent in tax to Luxembourg on $1.3 billion in profits from 2010 through 2013.

Luxembourg, the report authors are quick to note, has been referred to as a "magical fairyland" of tax avoidance.

Bloomberg explains:

Wal-Mart employs a popular legal strategy in that country called a hybrid loan. It permits companies' offshore units to take tax deductions for interest paid--typically on paper only--to their parents in the U.S. The parent, however, doesn't include that interest as taxable income in the U.S.

The [Organization for Economic Cooperation and Development] has called for an end to the tax benefits of such loans. Luxembourg generated headlines last year after the International Consortium of Investigative Journalists revealed its role in cutting the tax bills of hundreds of multinationals.

"Companies use tax havens to dodge taxes," stated Frank Clemente, executive director of Americans for Tax Fairness. "It appears that's the secret game Walmart is playing."

He continued: "We are calling on Congress, federal agencies and international organizations to determine if Walmart is skirting the law when it comes to reporting its use of tax havens, using various schemes to dodge taxes, and getting a sweetheart deal from Luxembourg that is the equivalent of illegal state aid. Average Americans and small businesses have to make up the difference when Walmart doesn't pay its fair share of taxes."

Indeed, a 2014 Americans for Tax Fairness study showed that public nutrition, health care, and housing assistance provided to Walmart workers cost U.S. taxpayers at least $6.2 billion a year.

The report authors admit that "it is impossible to determine from publicly available financial statements the extent to which this tax-haven expansion has already affected the company's bottom line--and reduced the tax revenues of governments around the world."

And so it will continue to be, Americans for Tax Fairness declares: "In the absence of reforms to the international tax system, including the stricter disclosure requirements proposed in this report, the scope and scale of Walmart's tax avoidance will continue to evade precise calculation."

Furthermore, the findings have implications beyond just one greedy corporation. In addition to casting light on Walmart's secretive tax avoidance schemes, "the discovery that Walmart has built an extensive web of tax-haven subsidiaries suggests that a range of exotic international tax avoidance strategies are being adapted in new sectors of the economy," the report warns, given that big corporate players in the tax-haven game have historically been high-tech firms, pharmaceutical companies and Wall Street banks.

The revelations come as U.S. lawmakers consider ways to ensure corporations pay their fair share.

As the report states: "It is our hope that this case study about Walmart's secretive and extensive use of tax havens causes members of Congress to rethink their approach on how to tax these offshore profits and international tax issues in general."

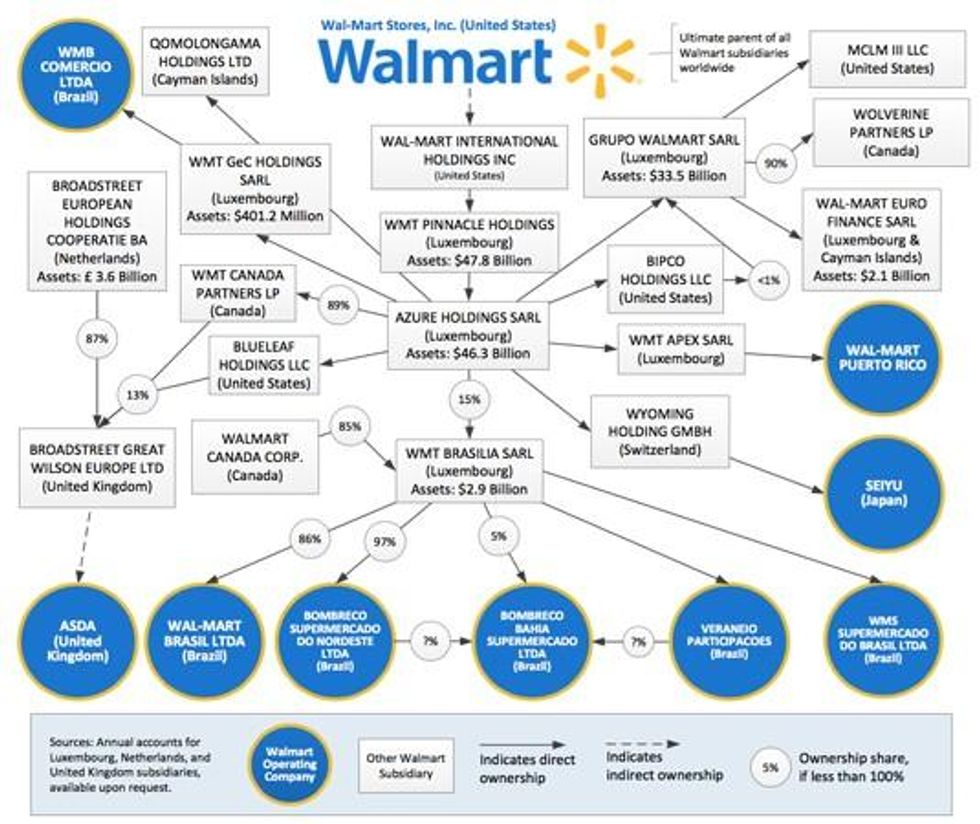

For a more detailed look at Walmart's overseas shell companies, see the diagram from Americans for Tax Fairness below: