World's Financial Elite Get Lofty on 'Inequality,' But Critics Unimpressed

'We need much bigger changes ... not just speaking out against inequality and not just speaking out against contradictory policies, but actually making those policy changes'

In reference to last week's "Spring Meetings" between the World Bank and the International Monetary Fund, critics are calling on the two financial giants to put their money where their mouths are and initiate policies that fight growing global inequality, rather than create it.

In the build-up to the annual meetings between finance ministers, central bankers and other top officials, three reports were published by the IMF and World Bank that warn about the growing gap between the global rich and poor. These reports call for a change in IMF and World Bank lending and advisory policies including the implentation of measures that would eradicate global tax evasion and create tax code reform that benefits the poor over the rich.

However, according to executive director of Oxfam America Ray Offenheiser, even though World Bank President Jim Yong Kim and IMF managing director Christine Lagarde "have been outspoken about the dangers of skyrocketing inequality," the world has yet to see "real initiatives to back up their rhetoric."

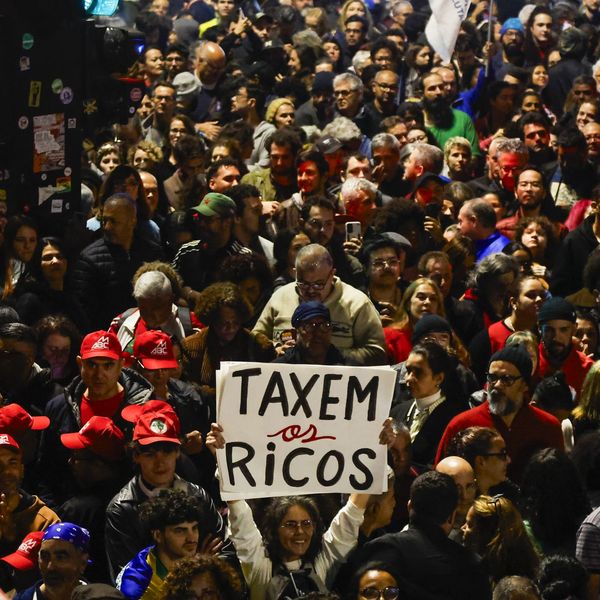

The lofty talk coming from IMF and World Bank officials has left some observers scratching their heads. As institutions well known for pushing fiscal policies that have enriched the world's wealthiest while pushing punishing austerity on struggling nations, some quipped that the recent talk has them sounding like they just returned from an Occupy Wall Street rally.

"From the Occupy movement, to the corridors of power: the rallying cry against inequality could be heard the last few days in a setting far removed from the street demonstrations that sprouted in 2011," wrote Alexander Panetta, reporting for the Canadian Press. "The past week's global financial meetings heard repeated warnings about inequality and its deleterious effect on economic growth."

Head of the IMF Christine Lagarde, went so far as to say that the organization is already incorporating these ideas into the policy advice it offers member-states, Panetta reports.

"The fund is always changing, evolving in the past 70 years," Min Zhu, deputy managing director of the IMF, told a panel discussion on Thursday. "After the [2008 financial ] crisis, particularly, income inequality became an issue."

However, as rights group Oxfam pointed out last week, despite this shift in language, those organizations are yet to actively shift policies away from their austerity-driven past.

"International financial institutions should change the policy advice they [give] countries and shift the balance towards investment in health, education and progressive fiscal policies," said Oxfam's Offenheiser. "Austerity worsens inequality, as the IMF and World Bank know well. They advised aggressive cuts to health and education in developing countries in the 1980s and 90s, and some of these countries took two decades to climb back to square one. Gaps between rich and poor widened, economies were shattered, and the poor continued to get poorer even when growth improved."

According to a recent report by the the European Network on Debt and Development (Eurodad), these harsh austerity measures imposed by the International Monetary Fund have actually risen sharply over the last few years, causing hardship for poor countries. According to the group, this increase in IMF driven austerity is placing a heavy debt burden on poor countries with little to no payback, despite promises by the financial behemoth to change.

"What we found was truly shocking," wrote Jesse Griffiths, co-author of the report and director of Eurodad. "The IMF is going backwards - increasing the number of policy conditions per loan, and remaining heavily engaged in highly sensitive and political policy areas."

Crisis-ridden Ukraine was the latest to accept austerity measures in exchange for up to $27 billion dollars in loans, including massive cuts in pensions and a 40 percent increase in the consumer prices for gas to heat their homes.

"And the unfortunate thing is that even though Lagarde and the IMF may be bringing up this issue," said Deborah James Director of International Programs at the Center for Economic and Policy Research on the Real News Network ahead of the meetings, "the policies that they are still imposing to this day on countries around the world that have to accept loans from the IMF, as well as the policy advice that they give to countries that are not under IMF loan conditionalities, are still actually exacerbating inequality to an amazing degree."

Referencing Christine Lagarde's record as head of the IMF so far, James continued:

I would say that the policies have not shifted as much as they should have, given the situation that has happened ... IMF also needs to step up to the plate with issues like debt cancellation, when you have a country like Jamaica that has almost 150 percent debt-to-GDP ratio. They're continually being impoverished by their IMF agreement. So there needs to be debt cancellation. There needs to be globally a sovereign debt workout mechanism. It's extremely important. It's been demanded by civil society and governments that are, you know, having this terrible debt problem, the hangovers, for so long ... But we need to see much bigger changes happening with the policies and the IMF and Lagarde, not just speaking out against inequality and not just speaking out against contradictory policies, but actually making those policy changes within the IMF which we are still waiting to see.

______________________

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Jacob Chamberlain is a former staff writer for Common Dreams. He is the author of Migrant Justice in the Age of Removal. His website is www.jacobpchamberlain.com.

In reference to last week's "Spring Meetings" between the World Bank and the International Monetary Fund, critics are calling on the two financial giants to put their money where their mouths are and initiate policies that fight growing global inequality, rather than create it.

In the build-up to the annual meetings between finance ministers, central bankers and other top officials, three reports were published by the IMF and World Bank that warn about the growing gap between the global rich and poor. These reports call for a change in IMF and World Bank lending and advisory policies including the implentation of measures that would eradicate global tax evasion and create tax code reform that benefits the poor over the rich.

However, according to executive director of Oxfam America Ray Offenheiser, even though World Bank President Jim Yong Kim and IMF managing director Christine Lagarde "have been outspoken about the dangers of skyrocketing inequality," the world has yet to see "real initiatives to back up their rhetoric."

The lofty talk coming from IMF and World Bank officials has left some observers scratching their heads. As institutions well known for pushing fiscal policies that have enriched the world's wealthiest while pushing punishing austerity on struggling nations, some quipped that the recent talk has them sounding like they just returned from an Occupy Wall Street rally.

"From the Occupy movement, to the corridors of power: the rallying cry against inequality could be heard the last few days in a setting far removed from the street demonstrations that sprouted in 2011," wrote Alexander Panetta, reporting for the Canadian Press. "The past week's global financial meetings heard repeated warnings about inequality and its deleterious effect on economic growth."

Head of the IMF Christine Lagarde, went so far as to say that the organization is already incorporating these ideas into the policy advice it offers member-states, Panetta reports.

"The fund is always changing, evolving in the past 70 years," Min Zhu, deputy managing director of the IMF, told a panel discussion on Thursday. "After the [2008 financial ] crisis, particularly, income inequality became an issue."

However, as rights group Oxfam pointed out last week, despite this shift in language, those organizations are yet to actively shift policies away from their austerity-driven past.

"International financial institutions should change the policy advice they [give] countries and shift the balance towards investment in health, education and progressive fiscal policies," said Oxfam's Offenheiser. "Austerity worsens inequality, as the IMF and World Bank know well. They advised aggressive cuts to health and education in developing countries in the 1980s and 90s, and some of these countries took two decades to climb back to square one. Gaps between rich and poor widened, economies were shattered, and the poor continued to get poorer even when growth improved."

According to a recent report by the the European Network on Debt and Development (Eurodad), these harsh austerity measures imposed by the International Monetary Fund have actually risen sharply over the last few years, causing hardship for poor countries. According to the group, this increase in IMF driven austerity is placing a heavy debt burden on poor countries with little to no payback, despite promises by the financial behemoth to change.

"What we found was truly shocking," wrote Jesse Griffiths, co-author of the report and director of Eurodad. "The IMF is going backwards - increasing the number of policy conditions per loan, and remaining heavily engaged in highly sensitive and political policy areas."

Crisis-ridden Ukraine was the latest to accept austerity measures in exchange for up to $27 billion dollars in loans, including massive cuts in pensions and a 40 percent increase in the consumer prices for gas to heat their homes.

"And the unfortunate thing is that even though Lagarde and the IMF may be bringing up this issue," said Deborah James Director of International Programs at the Center for Economic and Policy Research on the Real News Network ahead of the meetings, "the policies that they are still imposing to this day on countries around the world that have to accept loans from the IMF, as well as the policy advice that they give to countries that are not under IMF loan conditionalities, are still actually exacerbating inequality to an amazing degree."

Referencing Christine Lagarde's record as head of the IMF so far, James continued:

I would say that the policies have not shifted as much as they should have, given the situation that has happened ... IMF also needs to step up to the plate with issues like debt cancellation, when you have a country like Jamaica that has almost 150 percent debt-to-GDP ratio. They're continually being impoverished by their IMF agreement. So there needs to be debt cancellation. There needs to be globally a sovereign debt workout mechanism. It's extremely important. It's been demanded by civil society and governments that are, you know, having this terrible debt problem, the hangovers, for so long ... But we need to see much bigger changes happening with the policies and the IMF and Lagarde, not just speaking out against inequality and not just speaking out against contradictory policies, but actually making those policy changes within the IMF which we are still waiting to see.

______________________

Jacob Chamberlain is a former staff writer for Common Dreams. He is the author of Migrant Justice in the Age of Removal. His website is www.jacobpchamberlain.com.

In reference to last week's "Spring Meetings" between the World Bank and the International Monetary Fund, critics are calling on the two financial giants to put their money where their mouths are and initiate policies that fight growing global inequality, rather than create it.

In the build-up to the annual meetings between finance ministers, central bankers and other top officials, three reports were published by the IMF and World Bank that warn about the growing gap between the global rich and poor. These reports call for a change in IMF and World Bank lending and advisory policies including the implentation of measures that would eradicate global tax evasion and create tax code reform that benefits the poor over the rich.

However, according to executive director of Oxfam America Ray Offenheiser, even though World Bank President Jim Yong Kim and IMF managing director Christine Lagarde "have been outspoken about the dangers of skyrocketing inequality," the world has yet to see "real initiatives to back up their rhetoric."

The lofty talk coming from IMF and World Bank officials has left some observers scratching their heads. As institutions well known for pushing fiscal policies that have enriched the world's wealthiest while pushing punishing austerity on struggling nations, some quipped that the recent talk has them sounding like they just returned from an Occupy Wall Street rally.

"From the Occupy movement, to the corridors of power: the rallying cry against inequality could be heard the last few days in a setting far removed from the street demonstrations that sprouted in 2011," wrote Alexander Panetta, reporting for the Canadian Press. "The past week's global financial meetings heard repeated warnings about inequality and its deleterious effect on economic growth."

Head of the IMF Christine Lagarde, went so far as to say that the organization is already incorporating these ideas into the policy advice it offers member-states, Panetta reports.

"The fund is always changing, evolving in the past 70 years," Min Zhu, deputy managing director of the IMF, told a panel discussion on Thursday. "After the [2008 financial ] crisis, particularly, income inequality became an issue."

However, as rights group Oxfam pointed out last week, despite this shift in language, those organizations are yet to actively shift policies away from their austerity-driven past.

"International financial institutions should change the policy advice they [give] countries and shift the balance towards investment in health, education and progressive fiscal policies," said Oxfam's Offenheiser. "Austerity worsens inequality, as the IMF and World Bank know well. They advised aggressive cuts to health and education in developing countries in the 1980s and 90s, and some of these countries took two decades to climb back to square one. Gaps between rich and poor widened, economies were shattered, and the poor continued to get poorer even when growth improved."

According to a recent report by the the European Network on Debt and Development (Eurodad), these harsh austerity measures imposed by the International Monetary Fund have actually risen sharply over the last few years, causing hardship for poor countries. According to the group, this increase in IMF driven austerity is placing a heavy debt burden on poor countries with little to no payback, despite promises by the financial behemoth to change.

"What we found was truly shocking," wrote Jesse Griffiths, co-author of the report and director of Eurodad. "The IMF is going backwards - increasing the number of policy conditions per loan, and remaining heavily engaged in highly sensitive and political policy areas."

Crisis-ridden Ukraine was the latest to accept austerity measures in exchange for up to $27 billion dollars in loans, including massive cuts in pensions and a 40 percent increase in the consumer prices for gas to heat their homes.

"And the unfortunate thing is that even though Lagarde and the IMF may be bringing up this issue," said Deborah James Director of International Programs at the Center for Economic and Policy Research on the Real News Network ahead of the meetings, "the policies that they are still imposing to this day on countries around the world that have to accept loans from the IMF, as well as the policy advice that they give to countries that are not under IMF loan conditionalities, are still actually exacerbating inequality to an amazing degree."

Referencing Christine Lagarde's record as head of the IMF so far, James continued:

I would say that the policies have not shifted as much as they should have, given the situation that has happened ... IMF also needs to step up to the plate with issues like debt cancellation, when you have a country like Jamaica that has almost 150 percent debt-to-GDP ratio. They're continually being impoverished by their IMF agreement. So there needs to be debt cancellation. There needs to be globally a sovereign debt workout mechanism. It's extremely important. It's been demanded by civil society and governments that are, you know, having this terrible debt problem, the hangovers, for so long ... But we need to see much bigger changes happening with the policies and the IMF and Lagarde, not just speaking out against inequality and not just speaking out against contradictory policies, but actually making those policy changes within the IMF which we are still waiting to see.

______________________