SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"His campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for."

Amid calls for ousting Democratic congressional leadership because the party caved in the government shutdown fight over healthcare, a YouGov poll released Monday shows the nationwide popularity of New York City Mayor-elect Zohran Mamdani's economic agenda.

Mamdani beat former New York Gov. Andrew Cuomo in both the June Democratic primary and last week's general election by campaigning unapologetically as a democratic socialist dedicated to making the nation's largest city more affordable for working people.

Multiple polls have suggested that Mamdani's progressive platform offers Democrats across the United States a roadmap for candidates in next year's midterms and beyond. As NYC's next mayor began assembling his team and the movement that worked to elect him created a group to keep fighting for his ambitious agenda, YouGov surveyed 1,133 US adults after his victory.

While just 31% of those surveyed said they would have voted for Mamdani—more than any other candidate—and the same share said they would vote for a candidate who identified as a "democratic socialist," the policies he ran on garnered far more support.

YouGov found:

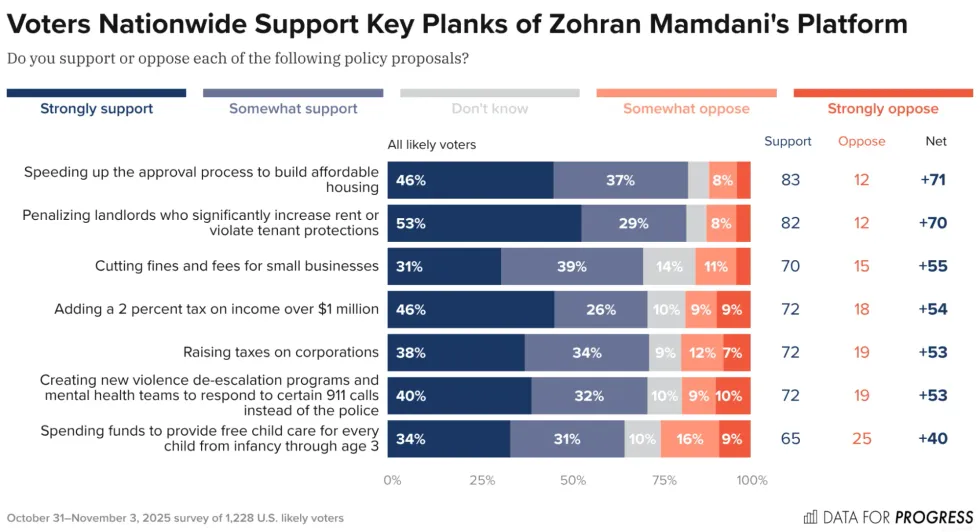

Data for Progress similarly surveyed 1,228 likely voters from across the United States about key pieces of Mamdani's platform before his win. The think tank found that large majorities of Americans support efforts to build more affordable housing, higher taxes for corporations as well as millionaires and billionaires, and free childcare, among other policies.

"There's a common refrain from some pundits to dismiss Mamdani's victory as a quirk of New York City politics rather than a sign of something bigger," Data for Progress executive director Ryan O'Donnell wrote last week. "But his campaign paired moral conviction with concrete plans to lower costs and expand access to services, making it unmistakable what he stood for and whom he was fighting for. The lesson isn't that every candidate should mimic his style—you can't fake authenticity—but that voters everywhere respond when a candidate connects economic populism to clear, actionable goals."

"Candidates closer to the center are running on an affordability message as well," he noted, pointing to Democrat Mikie Sherrill's gubernatorial victory in New Jersey. "When a center-left figure like Sherill is running on taking on corporate power, it underscores how central economic populism has become across the political spectrum. Her message may have been less fiery than Mamdani's, but she drew from a similar well of voter frustration over rising costs and corporate influence. In doing so, Sherrill demonstrated to voters that her administration would play an active role in lowering costs—something that voters nationwide overwhelmingly believe the government should be doing."

"Why would corporations spend millions on Trump's ballroom or Bitcoin? Because they're getting billions in unlegislated tax breaks," said one Democratic lawmaker.

The Trump administration is quietly waging an all-out regulatory war on a Biden-era corporate tax that aimed to prevent large companies from dodging their tax liabilities while reporting huge profits.

The corporate alternative minimum tax (CAMT) was enacted as part of the Inflation Reduction Act, Democratic legislation that former President Joe Biden signed into law in 2022. The CAMT requires highly profitable US corporations to pay a tax of at least 15% on their so-called book profits, the figures reported to shareholders.

As the Institute on Taxation and Economic Policy has explained: "Many of the special breaks that corporations use to avoid taxes work by allowing companies to report profits to the IRS that are much smaller than their book profits. Corporate leaders prefer to report low profits to the IRS (to reduce taxes) and high profits to the public (to attract investors)."

But since President Donald Trump took office in January, his administration has issued guidance and regulatory proposals designed to gut the CAMT. The effort is a boon to corporate giants and rich private equity investors at a time when the Trump administration is relentlessly attacking programs for low-income Americans, including Medicaid and nutrition assistance.

The New York Times reported Saturday that "with its various tax relief provisions, the administration is now effectively adding hundreds of billions of dollars in new breaks for big businesses and investors" on top of the trillions of dollars in tax cuts included in the Trump-GOP budget law enacted over the summer.

"The Treasury is empowered to write rules to help the IRS carry out tax laws passed by Congress," the newspaper added. "But the aggressive actions of the Trump administration raise questions about whether it is exceeding its legal authority."

Why would corporations spend millions on Trump's ballroom or bitcoin?

Because they're getting billions in unlegislated tax breaks.

We've gone from a system where the rich must pay taxes for public services, to one where they must pay the president for private favors.

— Tom Malinowski (@Malinowski) November 8, 2025

The administration's assault on the CAMT has drawn scrutiny from members of Congress.

In a September 8 letter to US Treasury Secretary Scott Bessent, a group of Democratic lawmakers and Sen. Angus King (I-Maine) warned that the administration's guidance notices "create new loopholes in the corporate alternative minimum tax for the largest and wealthiest corporations."

"Most troubling, Notice 2025-27, issued this June, allows companies to avoid CAMT if their income—under a simplified accounting method—is below $800 million," the lawmakers wrote. "The Biden administration previously set the safe harbor threshold precisely at $500 million in its proposed CAMT rule after calculating that a higher safe harbor threshold would risk exempting corporations that should be subject to CAMT under statute."

"Now, less than nine months later and with zero justification, this new guidance summarily asserts that an $800 million safe harbor will not run that risk," they continued. "We are seriously concerned that this cursory loosening of CAMT enforcement will simply allow more wealthy corporations to avoid paying their legally owed share."

"For too long, our tax systems have favored wealth over work," said the report's co-author. "State wealth proceeds taxes would take a major step toward correcting that imbalance.”

Taxing the passive proceeds of extreme wealth—including capital gains and stock dividends—is an easy way for states to generate billions of dollars in revenue, reduce inequality, and boost fairness in tax systems, according to a report published Thursday.

The Institute on Taxation and Economic Policy (ITEP) report shows how state-level wealth proceeds taxes of just 4% on profits generated by means including capital gains, dividends, and passive business income could raise more than $45 billion a year in revenue nationwide, while an enhanced version of such a levy would generate $57 billion annually.

According to the report, approximately three-quarters of such revenue would come from households with annual incomes exceeding $1 million—and only 4.4% of US taxpayers would owe anything at all.

Wealth inequality gets worse when working households pay more in taxes than wealthy owners.States have a simple way to address this problem and raise much-needed revenue.It's well past time for a Wealth Proceeds Tax.

[image or embed]

— ITEP (@itep.org) October 30, 2025 at 10:44 AM

Other key findings of the report include:

In 2023, Minnesota became the first state to enact a law piggybacking a wealth proceeds tax on the federal net investment income tax (NIIT), a levy on certain earnings from high-income individuals, estates, and trusts. Minnesota's 1% tax only applies to such wealth exceeding $1 million and is expected to raise more than $60 million in revenue in 2026.

Other states, while not having a wealth proceeds tax, apply higher levies on certain types of proceeds. Massachusetts, for example, imposes a short-term capital gains that is 3.5% higher than the ordinary state income tax rate, while Maryland enacted a 2% levy on short- and long-term capital gains for households earning more than $350,000 annually.

“States have an untapped opportunity to tax extremely wealthy families," ITEP senior analyst and report co-author Sarah Austin said in a statement. “The federal government already defines what counts as wealth-derived income, so states can easily adapt that framework to make their tax codes fairer and more robust.”

The report's other author, ITEP research director Carl Davis, said: "For too long, our tax systems have favored wealth over work. State wealth proceeds taxes would take a major step toward correcting that imbalance.”