SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Recent nonpartisan analyses have consistently found that the Republican tax plan, expected to hit the Senate floor for a vote as early as Thursday, would deliver even more wealth to the richest Americans. (Photo: vishpool/Flickr/cc)

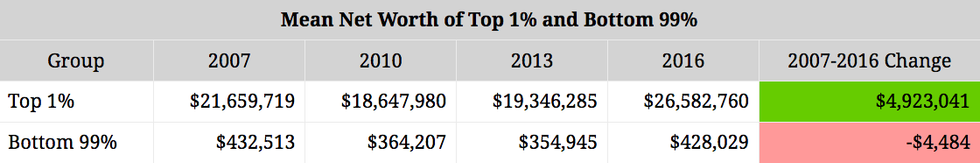

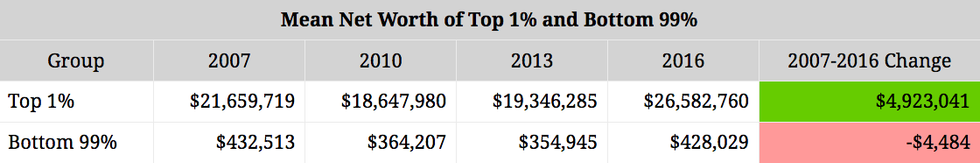

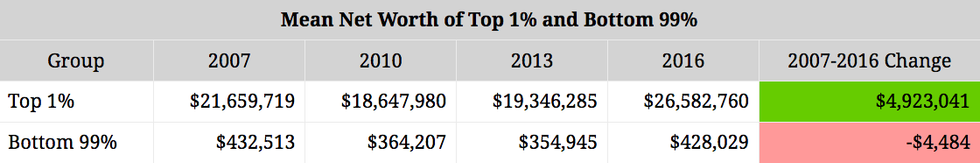

If any more evidence were needed to show that the wealthiest Americans really don't need a tax cut, here it is: Between 2007 and 2016, the average wealth of those in the top one percent grew by a whopping $4.9 million.

What about everyone else? In that same period, the average wealth of the bottom 99 percent declined by $4,500.

This is according to an analysis put out Wednesday by Matt Bruenig of the People's Policy Project, based on data from the Federal Reserve's Survey of Consumer Finances

Recent nonpartisan analyses have consistently found that the Republican tax plan, expected to hit the Senate floor for a vote as early as Thursday, would deliver even more wealth to the richest Americans. And contrary to GOP rhetoric, the plan would also hike taxes on millions of low-income and middle class families.

As tax analyst Hunter Blair of the Economic Policy Institute noted on Wednesday, the top one percent of households would on average see a $32,500 tax cut per year under the GOP plan. The bottom 20 percent of earners, by contrast, would pay $10 more annually.

Further undermining Republicans' "trickle down" selling points, numerous business leaders have already conceded that they are not planning to invest any of the extra cash they are set to receive into raising wages for workers, but will instead shower the windfall to their investors and stockholders.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

If any more evidence were needed to show that the wealthiest Americans really don't need a tax cut, here it is: Between 2007 and 2016, the average wealth of those in the top one percent grew by a whopping $4.9 million.

What about everyone else? In that same period, the average wealth of the bottom 99 percent declined by $4,500.

This is according to an analysis put out Wednesday by Matt Bruenig of the People's Policy Project, based on data from the Federal Reserve's Survey of Consumer Finances

Recent nonpartisan analyses have consistently found that the Republican tax plan, expected to hit the Senate floor for a vote as early as Thursday, would deliver even more wealth to the richest Americans. And contrary to GOP rhetoric, the plan would also hike taxes on millions of low-income and middle class families.

As tax analyst Hunter Blair of the Economic Policy Institute noted on Wednesday, the top one percent of households would on average see a $32,500 tax cut per year under the GOP plan. The bottom 20 percent of earners, by contrast, would pay $10 more annually.

Further undermining Republicans' "trickle down" selling points, numerous business leaders have already conceded that they are not planning to invest any of the extra cash they are set to receive into raising wages for workers, but will instead shower the windfall to their investors and stockholders.

If any more evidence were needed to show that the wealthiest Americans really don't need a tax cut, here it is: Between 2007 and 2016, the average wealth of those in the top one percent grew by a whopping $4.9 million.

What about everyone else? In that same period, the average wealth of the bottom 99 percent declined by $4,500.

This is according to an analysis put out Wednesday by Matt Bruenig of the People's Policy Project, based on data from the Federal Reserve's Survey of Consumer Finances

Recent nonpartisan analyses have consistently found that the Republican tax plan, expected to hit the Senate floor for a vote as early as Thursday, would deliver even more wealth to the richest Americans. And contrary to GOP rhetoric, the plan would also hike taxes on millions of low-income and middle class families.

As tax analyst Hunter Blair of the Economic Policy Institute noted on Wednesday, the top one percent of households would on average see a $32,500 tax cut per year under the GOP plan. The bottom 20 percent of earners, by contrast, would pay $10 more annually.

Further undermining Republicans' "trickle down" selling points, numerous business leaders have already conceded that they are not planning to invest any of the extra cash they are set to receive into raising wages for workers, but will instead shower the windfall to their investors and stockholders.