SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

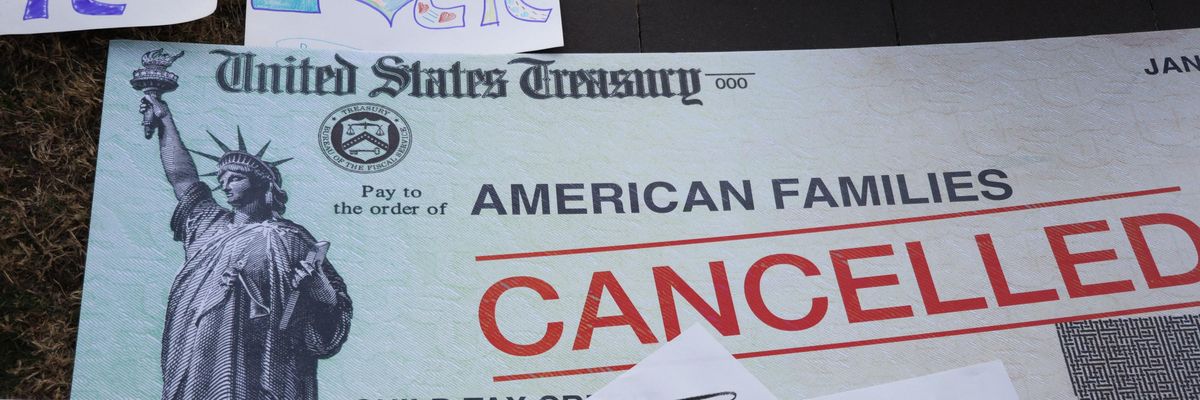

Children draw on top of a 'cancelled check' prop during a rally in front of the U.S. Capitol December 13, 2021 in Washington, D.C. (Photo: Alex Wong/Getty Images)

Date when the expanded child tax credit, which Congress approved last year as part of the American Rescue Plan pandemic stimulus, expired because the closely divided U.S. Senate failed to renew it as part of the Build Back Better Act: 12/31/2021

Because of the expanded child tax credit, amount in monthly payments per child that eligible families had been receiving since last July without having to take any action: $250 to $300

Number of families that received the payments: more than 36 million

This past December alone, number of children the expanded child tax credit lifted out of poverty: 3.7 million

Percent of those children who were white, Latino, and Black, respectively: 38, 38, 20

If the Senate had not allowed the expanded child tax credit to expire, percent by which the policy was projected to reduce child poverty in the U.S.: more than 40

With no expanded child tax credit payments made in January, percentage points by which the monthly child poverty rate is expected to increase nationwide: 5

Rank of the South among U.S. regions with the highest child poverty rates: 1

Date on which Axios reported that Sen. Michael Bennet, a Colorado Democrat involved in negotiations to revive the credit, was open to scaling back eligibility to win support from Sen. Joe Manchin of West Virginia, a millionaire corporate Democrat who joined Republicans to block the policy's extension: 2/1/2022

Previous income limit for the full expanded tax credit payment for couples and for single-parent families, respectively: $150,000 and $112,500

Income level that Manchin told West Virginia MetroNews he wants to prioritize while also imposing a work requirement for parents: $75,000 or less

Percent of West Virginia parents who oppose work requirements for the expanded credit, according to a poll conducted last year: 75

Number of times Manchin has demanded work requirements before approving tax cuts for the wealthy or called for means testing of defense contractors before approving military spending bills, as Shailly Barnes of the Poor People's Campaign noted at a Feb. 3 press conference in Charleston, West Virginia: 0

Rank of West Virginia among states with the highest percentage of children living in poverty as of 2019: 7

Number of West Virginia children living in poverty as of 2019: 69,975

Percent of West Virginia children who benefited from the expanded child tax credit: 93

Of those children, portion who had been unable to benefit from the credit under the pre-expansion rules because their parents were too poor to pay taxes: about 1/2

Date on which Poor People's Campaign leaders published an editorial in which they decried Manchin's position on the expanded child tax credit and said that, given his months of broken promises, they lack faith he'd support a bill even with the compromises he's demanding: 2/3/2022

Date on which the Poor People's Campaign is holding a Moral March on Washington to call on leaders to address poverty: 6/18/2022

(Click on figure to go to source.)

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Date when the expanded child tax credit, which Congress approved last year as part of the American Rescue Plan pandemic stimulus, expired because the closely divided U.S. Senate failed to renew it as part of the Build Back Better Act: 12/31/2021

Because of the expanded child tax credit, amount in monthly payments per child that eligible families had been receiving since last July without having to take any action: $250 to $300

Number of families that received the payments: more than 36 million

This past December alone, number of children the expanded child tax credit lifted out of poverty: 3.7 million

Percent of those children who were white, Latino, and Black, respectively: 38, 38, 20

If the Senate had not allowed the expanded child tax credit to expire, percent by which the policy was projected to reduce child poverty in the U.S.: more than 40

With no expanded child tax credit payments made in January, percentage points by which the monthly child poverty rate is expected to increase nationwide: 5

Rank of the South among U.S. regions with the highest child poverty rates: 1

Date on which Axios reported that Sen. Michael Bennet, a Colorado Democrat involved in negotiations to revive the credit, was open to scaling back eligibility to win support from Sen. Joe Manchin of West Virginia, a millionaire corporate Democrat who joined Republicans to block the policy's extension: 2/1/2022

Previous income limit for the full expanded tax credit payment for couples and for single-parent families, respectively: $150,000 and $112,500

Income level that Manchin told West Virginia MetroNews he wants to prioritize while also imposing a work requirement for parents: $75,000 or less

Percent of West Virginia parents who oppose work requirements for the expanded credit, according to a poll conducted last year: 75

Number of times Manchin has demanded work requirements before approving tax cuts for the wealthy or called for means testing of defense contractors before approving military spending bills, as Shailly Barnes of the Poor People's Campaign noted at a Feb. 3 press conference in Charleston, West Virginia: 0

Rank of West Virginia among states with the highest percentage of children living in poverty as of 2019: 7

Number of West Virginia children living in poverty as of 2019: 69,975

Percent of West Virginia children who benefited from the expanded child tax credit: 93

Of those children, portion who had been unable to benefit from the credit under the pre-expansion rules because their parents were too poor to pay taxes: about 1/2

Date on which Poor People's Campaign leaders published an editorial in which they decried Manchin's position on the expanded child tax credit and said that, given his months of broken promises, they lack faith he'd support a bill even with the compromises he's demanding: 2/3/2022

Date on which the Poor People's Campaign is holding a Moral March on Washington to call on leaders to address poverty: 6/18/2022

(Click on figure to go to source.)

Date when the expanded child tax credit, which Congress approved last year as part of the American Rescue Plan pandemic stimulus, expired because the closely divided U.S. Senate failed to renew it as part of the Build Back Better Act: 12/31/2021

Because of the expanded child tax credit, amount in monthly payments per child that eligible families had been receiving since last July without having to take any action: $250 to $300

Number of families that received the payments: more than 36 million

This past December alone, number of children the expanded child tax credit lifted out of poverty: 3.7 million

Percent of those children who were white, Latino, and Black, respectively: 38, 38, 20

If the Senate had not allowed the expanded child tax credit to expire, percent by which the policy was projected to reduce child poverty in the U.S.: more than 40

With no expanded child tax credit payments made in January, percentage points by which the monthly child poverty rate is expected to increase nationwide: 5

Rank of the South among U.S. regions with the highest child poverty rates: 1

Date on which Axios reported that Sen. Michael Bennet, a Colorado Democrat involved in negotiations to revive the credit, was open to scaling back eligibility to win support from Sen. Joe Manchin of West Virginia, a millionaire corporate Democrat who joined Republicans to block the policy's extension: 2/1/2022

Previous income limit for the full expanded tax credit payment for couples and for single-parent families, respectively: $150,000 and $112,500

Income level that Manchin told West Virginia MetroNews he wants to prioritize while also imposing a work requirement for parents: $75,000 or less

Percent of West Virginia parents who oppose work requirements for the expanded credit, according to a poll conducted last year: 75

Number of times Manchin has demanded work requirements before approving tax cuts for the wealthy or called for means testing of defense contractors before approving military spending bills, as Shailly Barnes of the Poor People's Campaign noted at a Feb. 3 press conference in Charleston, West Virginia: 0

Rank of West Virginia among states with the highest percentage of children living in poverty as of 2019: 7

Number of West Virginia children living in poverty as of 2019: 69,975

Percent of West Virginia children who benefited from the expanded child tax credit: 93

Of those children, portion who had been unable to benefit from the credit under the pre-expansion rules because their parents were too poor to pay taxes: about 1/2

Date on which Poor People's Campaign leaders published an editorial in which they decried Manchin's position on the expanded child tax credit and said that, given his months of broken promises, they lack faith he'd support a bill even with the compromises he's demanding: 2/3/2022

Date on which the Poor People's Campaign is holding a Moral March on Washington to call on leaders to address poverty: 6/18/2022

(Click on figure to go to source.)