SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Imagine sitting at the kitchen table, stressing out over your family's finances. Between the student loan debt, the credit card debt, the car loan, the mortgage, the phone bill, the groceries, electricity and the water, you only have so much in your bank account to cover a few of those things. To avoid defaulting on your debt or having your car repossessed, you'll either have to forgo electricity for your home, or you can simply collect the debt owed to you by your rich neighbors, all of which totals more than you would make in 10 years. Would you shut off your lights, or collect what you're owed and settle all of your debt?

Any politician who bemoans the national debt, whether they be American, Greek, Spanish or otherwise, is lying to you if they blame anyone but the richest 0.001% for the state's massive debt. Because the richest 0.001% have anywhere between $21 trillion and $32 trillion stashed in overseas bank accounts simply to avoid paying their fair share of taxes. It's a number that's simply beyond comprehension. Even if someone were to spend a million dollars a day since Jesus was born, they would have only spent $700 billion by today, just $0.7 trillion.

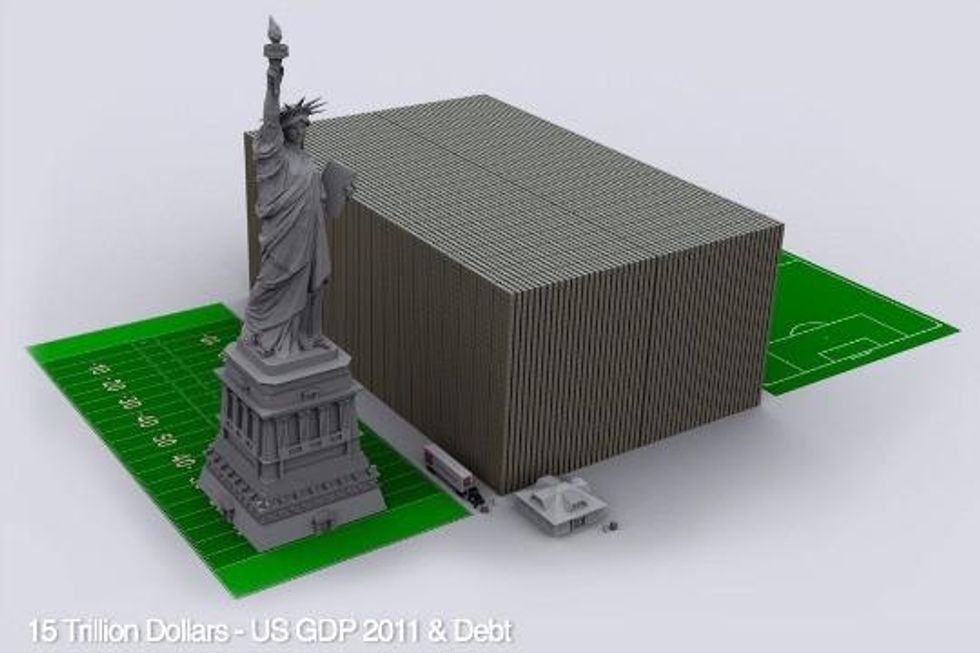

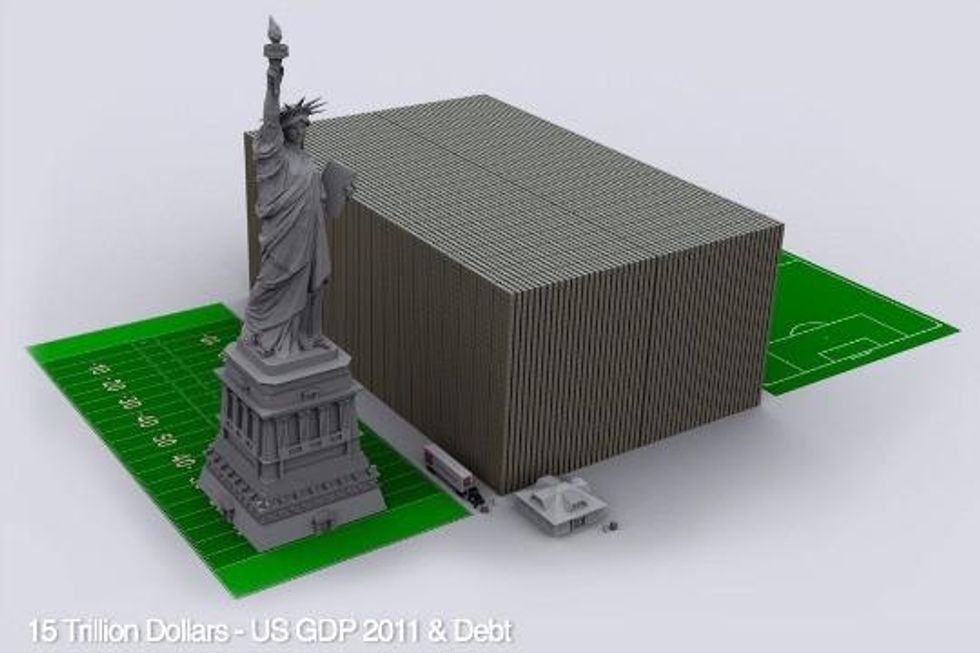

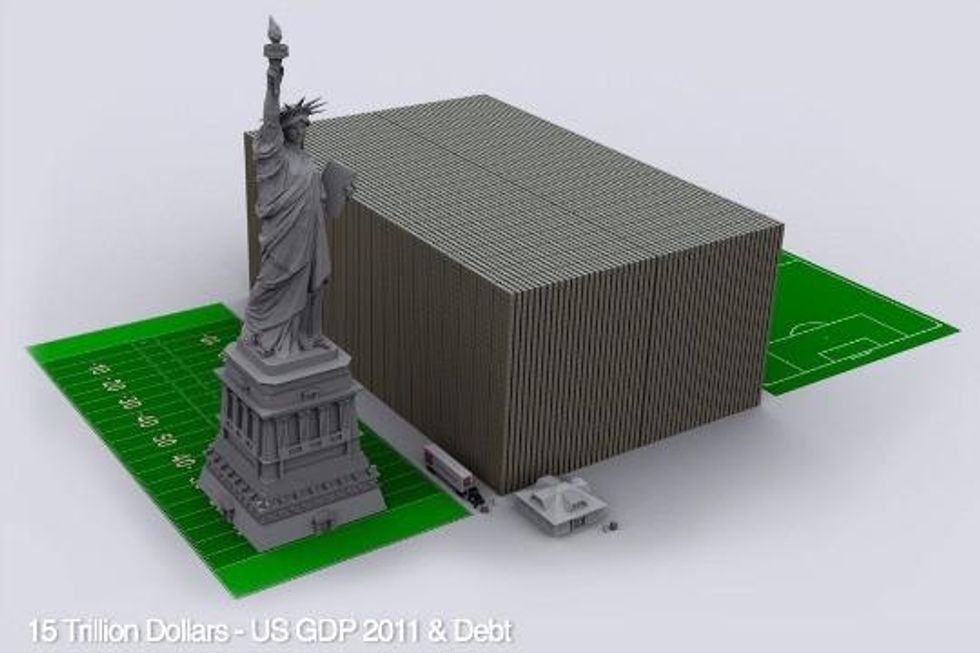

$32 trillion is a hell of a lot of money. In fact, it's more than double the United States' total accumulated debt. In fact, $32 trillion would be enough to settle both the debt of the United States and the European Union, combined. Visualized in cash, the amount of money stashed overseas by the 0.001% would be almost as high as the Statue of Liberty, and wider than two football fields. And thanks to the numerous loopholes, gimmicks and special deductions written into the tax code at the request of corporate lobbyists who have the ear of the chairmen of tax-writing committees worldwide, public debts and corporate profits are skyrocketing, while tax revenues and the standard of living for the other 99% of us is plummeting.

The Sundance 2012 documentary "We're Not Broke" (full disclosure: I'm in it) explains the numerous dodges that multinational corporations use to avoid taxation, like transfer- pricing, and gimmicks they're still pushing for to avoid even more tax, like repatriation, and territorial tax systems. Nicholas Shaxson's book "Treasure Islands" explains the history of tax dodging, going all the way back to the Vestey family's intricate financial ploys, and delves into the shady business of blind trusts. Through these underhanded means, the secret offshore economy is actually greater than the combined GDP of both the United States and Japanese economies combined. To illustrate further, the money hidden offshore by a tiny fraction of the global elite is worth more than what over 200,000,000 employed Americans and Japanese add to their economies.

Nations from the USA to Greece to Spain to Ireland are all hemorrhaging tax dollars by the billions every year into these offshore accounts. The money padding the pockets of the immensely rich could instead be used to insure that workers have a pension when they retire, that police officers and firefighters in Scranton, PA could be paid more than minimum wage, that public school students could have books in the classroom. Instead, these powerful corporations spend millions lobbying Congress to cut their taxes even more, which causes Congress to force austerity on the rest of us, which means the 99% has to make do with even less while the richest 0.001% makes off like bandits.

The richest 0.001% would probably argue that none of the tactics they use to dodge taxes are technically illegal, which is true. But something being legal doesn't make it morally right. Child labor was legal until people demanded it be stopped. The same could be said for apartheid, segregation, and slavery. All of these things were seen as lawful until enough people called for change.

Enough is enough. Let's demand a stop to all austerity policies until our leaders promise to end offshore tax abuse. And if they won't, let's elect leaders this November who will.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Imagine sitting at the kitchen table, stressing out over your family's finances. Between the student loan debt, the credit card debt, the car loan, the mortgage, the phone bill, the groceries, electricity and the water, you only have so much in your bank account to cover a few of those things. To avoid defaulting on your debt or having your car repossessed, you'll either have to forgo electricity for your home, or you can simply collect the debt owed to you by your rich neighbors, all of which totals more than you would make in 10 years. Would you shut off your lights, or collect what you're owed and settle all of your debt?

Any politician who bemoans the national debt, whether they be American, Greek, Spanish or otherwise, is lying to you if they blame anyone but the richest 0.001% for the state's massive debt. Because the richest 0.001% have anywhere between $21 trillion and $32 trillion stashed in overseas bank accounts simply to avoid paying their fair share of taxes. It's a number that's simply beyond comprehension. Even if someone were to spend a million dollars a day since Jesus was born, they would have only spent $700 billion by today, just $0.7 trillion.

$32 trillion is a hell of a lot of money. In fact, it's more than double the United States' total accumulated debt. In fact, $32 trillion would be enough to settle both the debt of the United States and the European Union, combined. Visualized in cash, the amount of money stashed overseas by the 0.001% would be almost as high as the Statue of Liberty, and wider than two football fields. And thanks to the numerous loopholes, gimmicks and special deductions written into the tax code at the request of corporate lobbyists who have the ear of the chairmen of tax-writing committees worldwide, public debts and corporate profits are skyrocketing, while tax revenues and the standard of living for the other 99% of us is plummeting.

The Sundance 2012 documentary "We're Not Broke" (full disclosure: I'm in it) explains the numerous dodges that multinational corporations use to avoid taxation, like transfer- pricing, and gimmicks they're still pushing for to avoid even more tax, like repatriation, and territorial tax systems. Nicholas Shaxson's book "Treasure Islands" explains the history of tax dodging, going all the way back to the Vestey family's intricate financial ploys, and delves into the shady business of blind trusts. Through these underhanded means, the secret offshore economy is actually greater than the combined GDP of both the United States and Japanese economies combined. To illustrate further, the money hidden offshore by a tiny fraction of the global elite is worth more than what over 200,000,000 employed Americans and Japanese add to their economies.

Nations from the USA to Greece to Spain to Ireland are all hemorrhaging tax dollars by the billions every year into these offshore accounts. The money padding the pockets of the immensely rich could instead be used to insure that workers have a pension when they retire, that police officers and firefighters in Scranton, PA could be paid more than minimum wage, that public school students could have books in the classroom. Instead, these powerful corporations spend millions lobbying Congress to cut their taxes even more, which causes Congress to force austerity on the rest of us, which means the 99% has to make do with even less while the richest 0.001% makes off like bandits.

The richest 0.001% would probably argue that none of the tactics they use to dodge taxes are technically illegal, which is true. But something being legal doesn't make it morally right. Child labor was legal until people demanded it be stopped. The same could be said for apartheid, segregation, and slavery. All of these things were seen as lawful until enough people called for change.

Enough is enough. Let's demand a stop to all austerity policies until our leaders promise to end offshore tax abuse. And if they won't, let's elect leaders this November who will.

Imagine sitting at the kitchen table, stressing out over your family's finances. Between the student loan debt, the credit card debt, the car loan, the mortgage, the phone bill, the groceries, electricity and the water, you only have so much in your bank account to cover a few of those things. To avoid defaulting on your debt or having your car repossessed, you'll either have to forgo electricity for your home, or you can simply collect the debt owed to you by your rich neighbors, all of which totals more than you would make in 10 years. Would you shut off your lights, or collect what you're owed and settle all of your debt?

Any politician who bemoans the national debt, whether they be American, Greek, Spanish or otherwise, is lying to you if they blame anyone but the richest 0.001% for the state's massive debt. Because the richest 0.001% have anywhere between $21 trillion and $32 trillion stashed in overseas bank accounts simply to avoid paying their fair share of taxes. It's a number that's simply beyond comprehension. Even if someone were to spend a million dollars a day since Jesus was born, they would have only spent $700 billion by today, just $0.7 trillion.

$32 trillion is a hell of a lot of money. In fact, it's more than double the United States' total accumulated debt. In fact, $32 trillion would be enough to settle both the debt of the United States and the European Union, combined. Visualized in cash, the amount of money stashed overseas by the 0.001% would be almost as high as the Statue of Liberty, and wider than two football fields. And thanks to the numerous loopholes, gimmicks and special deductions written into the tax code at the request of corporate lobbyists who have the ear of the chairmen of tax-writing committees worldwide, public debts and corporate profits are skyrocketing, while tax revenues and the standard of living for the other 99% of us is plummeting.

The Sundance 2012 documentary "We're Not Broke" (full disclosure: I'm in it) explains the numerous dodges that multinational corporations use to avoid taxation, like transfer- pricing, and gimmicks they're still pushing for to avoid even more tax, like repatriation, and territorial tax systems. Nicholas Shaxson's book "Treasure Islands" explains the history of tax dodging, going all the way back to the Vestey family's intricate financial ploys, and delves into the shady business of blind trusts. Through these underhanded means, the secret offshore economy is actually greater than the combined GDP of both the United States and Japanese economies combined. To illustrate further, the money hidden offshore by a tiny fraction of the global elite is worth more than what over 200,000,000 employed Americans and Japanese add to their economies.

Nations from the USA to Greece to Spain to Ireland are all hemorrhaging tax dollars by the billions every year into these offshore accounts. The money padding the pockets of the immensely rich could instead be used to insure that workers have a pension when they retire, that police officers and firefighters in Scranton, PA could be paid more than minimum wage, that public school students could have books in the classroom. Instead, these powerful corporations spend millions lobbying Congress to cut their taxes even more, which causes Congress to force austerity on the rest of us, which means the 99% has to make do with even less while the richest 0.001% makes off like bandits.

The richest 0.001% would probably argue that none of the tactics they use to dodge taxes are technically illegal, which is true. But something being legal doesn't make it morally right. Child labor was legal until people demanded it be stopped. The same could be said for apartheid, segregation, and slavery. All of these things were seen as lawful until enough people called for change.

Enough is enough. Let's demand a stop to all austerity policies until our leaders promise to end offshore tax abuse. And if they won't, let's elect leaders this November who will.