SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

National news media often broadcast misinformation when discussing the debt of the United States government, erroneously targeting Social Security as the main culprit whether intentionally or from genuine ignorance.

The coverage of the federal debt by news media generally considered credible often mirrors, unfortunately, the falsehoods heard from Republican lawmakers in blaming Social Security as a major driver of the federal debt. Such misleading news coverage was embedded in a recent segment aired during the week of Thanksgiving on the PBS NewsHour, which is an hour I watch regularly to typically be informed by sound journalism. But in the segment at issue here, I witnessed misinformation broadcast to the public that could shape public opinion into thinking, quite erroneously, that Social Security needs gutting because it is the culprit increasing the federal debt. It isn’t.

This particular segment on the federal debt on PBS NewsHour was introduced on Tuesday November 21 by coanchor Amna Nawaz stating how the “U.S. government remains open this Thanksgiving week, thanks to a temporary funding deal Congress passed last week.” But when that temporary funding starts expiring in January, Nawaz added, “conservatives are signaling they won’t pass another funding deal without addressing a bigger issue, the swelling U.S. national debt.”

Then coanchor Geoff Bennett and correspondent Lisa Desjardins, standing before a screen with varying charts, discussed the growing interest paid on the federal debt. As Desjardins put it, “just the interest on our debt is so large [in the past year] that it is almost [the size of} the entire Department of Defense budget.” That statement may be true, but that was not the punchline of the segment.

Social Security hasn’t reduced available general revenue nor been the reason why politicians are not funding programs for younger constituencies.

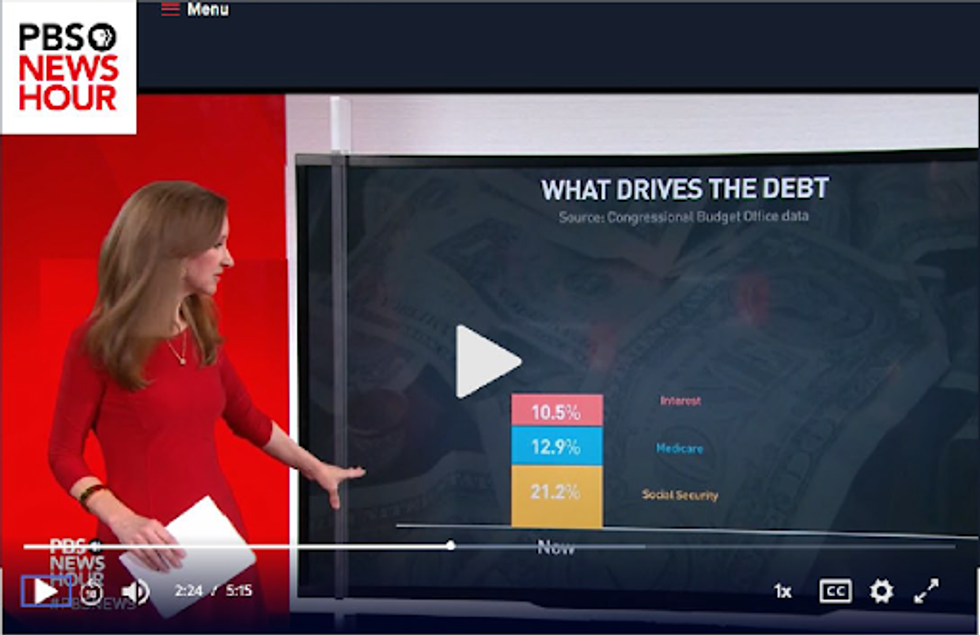

The NewsHour segment ended mirroring the Republican Party’s mantra that Social Security is the major driver of the federal debt. As Desjardins concluded “the three largest drivers of the debt are in reality” Social Security, Medicare, and interest on the debt, with each in the chart displayed indicated as accounting respectively for 21.2%, 12.9%, and 10.5% of total federal expenditures. Desjardins added, “Really what’s happening here is Congress is not addressing the big drivers of the debt at all.”

In a recent piece with misinformation embedded in its title alone, “Why We’re Borrowing to Fund the Elderly While Neglecting Everyone Else,” columnist Catherine Rampell also implied that borrowing to fund Social Security benefits will, as she wrote, “continue to crowd out future spending obligations in years ahead” on programs for the young like “pre-K, or child care, or paid parental leave, or a more generous child tax credit.”

One problem in such depictions exemplified by the NewsHour and in Rampell’s article is that Social Security, specifically, is funded almost exclusively by its own revenue source. Not by borrowing, as Ms. Rampell implies without providing supportive evidence for that contention (because there isn’t any). Nor funded by general revenue as likely many believe when seeing typical charts on federal spending (like that shown in the segment aired on PBS NewsHour) that include Social Security expenditures, which are not at all funded by general revenue but, rather, by its separate targeted payroll and income taxes.

Actually, as I have written about previously, Social Security is today the entity owning the most debt, $2.7 trillion in Treasury securities (Monthly Treasury Report, Table 6, Schedule D as of October 31, 2023). More than the two foreign governments owning the most U.S. debt, Japan today owning U.S. securities valuing $1.1 trillion and China with under $1 trillion.

Surpluses in Social Security revenue by law have to be invested in U.S. securities. And revenue surpluses have over the years been the norm in the program. Thus, Social Security for years, in essence, funded the debt with its surplus revenue, not caused it.

Social Security hasn’t reduced available general revenue nor been the reason why politicians are not funding programs for younger constituencies as Ms. Rampell alludes to in her piece. Tax cuts during the Trump and Bush administrations, however, did help do that. Growth in deficits and debt, as analysis by the Center for American Progress indicates, has largely been driven by those tax cuts. Tax cuts reducing general revenue applicable to programs like the earlier expanded child tax credit that, before expiring, lifted more children out of poverty.

The Social Security program has nevertheless, according to reports by the Board of Trustees overseeing the program, recently incurred shortfalls in its dedicated revenue stream. In 2022, a 4% shortfall noted in the trustees’ current report (Table II.B1, page 7). And those recent shortfalls have been met simply by just cashing in some U.S. securities the program acquired over the years with revenue surpluses.

But true enough, within current parameters of the program, the trustees predict the program’s reserves (i.e., securities) will be depleted by 2033. Then relying solely on Social Security’s separate tax revenue, it is predicted only 77% of benefits due will be payable. That’s not being totally broke, but it would have an adverse effect on the income many elderly depend upon.

Raising the Social Security retirement age to purportedly reduce costs also has adverse effects that, as I discussed earlier, the Congressional Research Service among others have outlined. For one, among those of lesser means who also on average have lower life expectancies, increasing the retirement age would reduce their lifetime Social Security benefits collected disproportionately relative to reductions among higher income earners with typically longer life expectancies. Increasing the retirement age would, furthermore, disproportionately harm those retiring early due to work-related health impairment suffered most prevalently in blue-collar occupations.

A different option some propose to increase revenue is eliminating the cap on the income subject to the Social Security payroll tax. In 2024 the limit on income taxed will be $168,600. Income above that limit would not currently be taxed.

However Social Security is made solvent for the future, one thing is quite clear. Social Security has not been the reason for incurred and increasing U.S. debt.

Simpson-Bowles Urge Action to Fix the DebtCo-founders of the Campaign to Fix the Debt Alan Simpson and Erskine Bowles give straight talk on the national debt. The gross ...

The Campaign to Fix the Debt, the $40 million dollar astroturf "supergroup" that CMD exposed on the cover of the Nation magazine, has shifted into high gear in an effort to leverage the debt ceiling crisis into cuts to Social Security and Medicare.

Today, the group launched a six figure TV ad buy that reaches new heights of hypocrisy -- and that is saying a lot.

Former U.S. Senator Alan Simpson and Morgan Stanley board member Erskine Bowles have long been spokespersons for Fix the Debt. The "folksy" Simpson: "For cryin' out loud, Erskine, who isn't fed up with what's goin' on in Washington?" The Bowles tsk tsk: "These politicians are playing games jerking our country around from crisis to crisis."

This is rich from a group that has been hyping a debt and deficit crisis since its launch in July 2012, even though the deficit has been cut in half in recent years. In January 2013 Fix the Debt steering committee member and former Tennessee Governor Phil Bredesen admitted that Fix the Debt's strategy was to create an "artificial crisis" to achieve a "grand bargain" on Medicare and Social Security.

Moreover, Fix the Debt was started with a $5 million donation from crisis king Pete Peterson. Peterson has been warning that our Social Security would create a "Pearl Harbor" type crisis for decades as my colleague Lisa Graves documented in her Nation piece "Peterson's Long History of Deficit Scaremongering."

Bowles and Simpson have long been Peterson retainers. Peterson launched a massive effort to prop up the Simpson-Bowles commission and its $4 trillion austerity package, he bankrolled "America Speaks" town hall meetings, launched a TV ad campaign and bankrolled bus tours to the heartland to gin up a faint patina of grassroots support for austerity.

For the Fix the Debt austerity hounds, cuts are the goal as their latest letter makes clear. Under their "chained CPI" proposal, over the next 25 years the average retired federal employee would lose $48,000; the average Social Security recipient would lose $23,000; and, the average military retiree would lose $42,000, says U.S. Senator Bernie Sanders.

Make no mistake a Simpson-Bowles type plan would be disastrous for our economy, costing some 4 million jobs for starters says the Economic Policy Institute.

Cartoonist Mark Fiore brilliantly skewers the phony Fix the Debt gang in his new video.

As the debt ceiling looms and the horse trading continues, you can follow the conversation on Twitter at #nocuts and learn more at PetersonPyramid.org.

Pete Peterson Exposed: The "Grand Bargain" HoaxThe "Grand Bargain" is a hoax. Find out more about who's behind the push for austerity in deficit hawk America. Learn more about ...