SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

"It is a blatant conflict of interest and an attempt by President Trump to install a handpicked loyalist who he believes will put his interests over what may be best for the Postal Service and the American people."

President Donald Trump and the U.S. Postal Service's leadership have reportedly agreed to appoint a FedEx board member to succeed Louis DeJoy as postmaster general, heightening concerns that the administration is pushing the independent mail agency toward privatization.

The Washington Post reported late Tuesday that Trump and the USPS Board of Governors are expected to name former Waste Management CEO David Steiner to lead the Postal Service. Steiner is currently the lead independent director at FedEx, a Postal Service competitor.

Brian Renfroe, president of the National Association of Letter Carriers—a union representing nearly 300,000 active and retired letter carriers—called the decision to place Steiner at the head of the USPS "an aggressive step toward handing America's mail system over to corporate interests."

"Private shippers have been waiting to get USPS out of parcel delivery for years," said Renfroe. "Steiner's selection is an open invitation to do just that. This isn't just bad policy—it's a direct assault on the workers who keep the mail moving and the public connected. The damage will hit rural communities hardest, where the Postal Service isn't just a convenience—it's a lifeline. And make no mistake: If this appointment stands, it threatens 7.9 million jobs tied to the postal industry and service to over 300 million Americans."

"The board has the responsibility to do what is best for USPS," he added. "This decision is not only a failure in that responsibility but shows open contempt for the work of America's letter carriers and the public good."

"The Trump administration has been relentless in its attempts to privatize America's most trusted institution, both outwardly and behind the scenes."

The USPS Board of Governors—which is currently comprised of two Democrats, two Republicans, and an independent—is ultimately responsible for appointing the head of the mail service, who cannot be directly fired by the president.

The Post reported Tuesday that postal governors, who are appointed by the president and confirmed by the Senate, submitted three postmaster general finalists to the White House in recent days, including Steiner.

"Trump has the power to immediately reshape the [postal board] with five appointments: The board has four vacancies, plus a seat that is occupied temporarily," the Post noted. "Trump announced plans to nominate Anthony Lomangino, a GOP financier, to one of those roles."

Earlier this year, Trump considered but soon dropped a plan to fire every member of the postal board and bring the USPS under the direct control of his administration. The president has also spoken openly about privatizing the mail service, saying in the wake of his 2024 election win that "it's an idea that a lot of people have liked for a long time."

Rep. Gerry Connolly (D-Va.), the top Democrat on the House Oversight Committee, said in a statement Tuesday that "the Trump administration has been relentless in its attempts to privatize America's most trusted institution, both outwardly and behind the scenes."

"If these reports are true, it is a blatant conflict of interest and an attempt by President Trump to install a handpicked loyalist who he believes will put his interests over what may be best for the Postal Service and the American people," Connolly said of Steiner's selection. "The American people deserve a postmaster general who will stand up for an independent, fair, and accessible Postal Service and who will work with Congress to ensure Americans in all communities nationwide can continue to rely on this public service to deliver mail, medications, ballots, and more without prejudice."

Extending the CHIPS program conditions on stock buybacks to all firms receiving federal contracts, subsidies, and grants should be a no-brainer.

The Biden administration is giving companies a leg up in the competition for new subsidies for U.S. semiconductor manufacturing if they agree to forgo all stock buybacks for five years.

The reasoning? These CHIPS program subsidies, explained Commerce Secretary Gina Raimondo, “should be used to expand in America, to out-innovate the rest of the world. Invest in R&D and your workforce, not in buybacks.”

Wielding the power of the public purse against buybacks makes total sense.

Using public funds as a lever for discouraging this practice is good policy. But why just go after semiconductor companies?

Taxpayers want every dollar of their public investments to produce maximum benefits. But every dollar spent on stock buybacks is a dollar not spent on worker wages, R&D, and other productive investments to stimulate long-term growth and make U.S. companies more competitive. Analysts have documented how buybacks are associated with reduced capital investment and innovation and wage stagnation.

And yet in the past two years, S&P 500 corporations spent record annual sums repurchasing their own stock—$922.7 billion in 2022 and $881.7 billion in 2021. In the first half of 2023, share repurchases were down a bit but still an eye-popping $390.5 billion.

What’s the goal of all these buybacks? This financial maneuver artificially inflates the value of a company’s share price by reducing the supply on the open market. That keeps shareholders happy. It also creates huge windfalls for CEOs, since most of their compensation is in some form of stock-based pay, and their bonuses are often tied to financial targets that can be influenced by stock buybacks.

Using public funds as a lever for discouraging this practice is good policy. But why just go after semiconductor companies? Why not all corporations receiving federal funds of any sort?

Chip makers are notorious for their profligate buyback spending. But so are many other companies that are feeding at the federal trough—or stand to do so through new legislation.

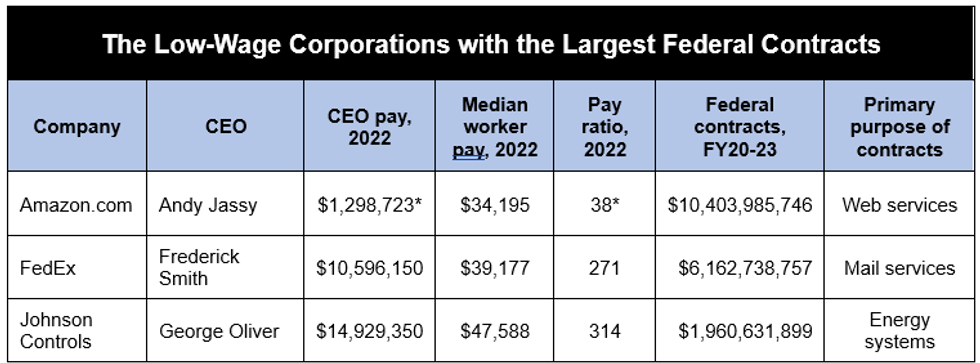

Source: Institute for Policy Studies, Executive Excess 2023. *Jassy accepted modest pay in 2022 after receiving a 2021 stock grant valued at $212 million.

A recent Institute for Policy Studies report takes a deep dive into the 100 S&P 500 corporations with the lowest median worker wages, a group we’ve dubbed the “Low-Wage 100.” We found that 51 of these firms are federal contractors, with a combined $24.1 billion in deals during fiscal years 2020-2023. Meanwhile, these 51 low-wage contractors spent nearly $160 billion on stock buybacks.

The largest? Amazon, with at least $10.4 billion in contracts for web services. Since January 2020, the e-commerce goliath has spent $6 billion on buybacks while paying their median worker just $34,195. These share repurchases have helped pump up Amazon CEO Andy Jassy’s personal holdings of Amazon stock to $265 million. These millions do not include the bulk of his 2021 mega-grant, a reward that will vest over 10 years.

FedEx, the second-largest contractor in the Low-Wage 100, pocketed $6.2 billion from Uncle Sam in fiscal years 2020-2023. FedEx spent $3.6 billion on buybacks during this period, a maneuver that helped prop up the value of CEO Fred Smith’s more than $5 billion in personal stock holdings, the largest stash held by any CEO in the Low-Wage 100.

We should view these public funds as a source of power to create an economy that works for everyone.

In 2022, his last year before transitioning to the FedEx executive chair slot, Smith made $10.6 million, 271 times FedEx median worker pay. Unlike competitor UPS, where more than 70% of employees are unionized, FedEx is notoriously anti-union.

Number three on our low-wage contractor list is Johnson Controls. Originally based in Milwaukee, the company moved its headquarters to Ireland in 2016 to lower its U.S. tax bill. But the company continues to receive major taxpayer-funded federal contracts, a haul worth nearly $2 billion in FY2020-2023, primarily for upgrading federal buildings to a more energy-efficient status.

The firm could receive considerably more federal support over coming years, thanks to new infrastructure and energy legislation. Under CEO George Oliver’s leadership, the firm has spent $4.5 billion on stock buybacks since 2020. That contributed to a 139% increase in his personal stockholdings, to $131.7 million. In 2022 Oliver made 314 times as much as his typical employee.

Extending the CHIPS program conditions on stock buybacks to all firms receiving federal contracts, subsidies, and grants should be a no-brainer. It would complement President Joe Biden’s support for other tools for reducing buybacks, including his proposal to quadruple a new 1% excise tax on share repurchases.

The administration could also do much more to leverage the power of the public purse against extreme pay disparities. The proposed Patriotic Corporations Act could serve as a model. This bill would grant preferential treatment in contracting to firms with CEO-worker pay ratios of 100 to 1 or less, among other benchmarks, including neutrality in union organizing. The Congressional Progressive Caucus has called on Biden to introduce such incentives.

By encouraging big companies to narrow their pay gaps, the administration would also help ensure that taxpayers get the biggest bang for the buck for federal contract dollars. Studies have shown that companies with narrow gaps tend to perform better because more equitable pay practices tend to bring out the best in all employees.

The administration should also build on Biden’s executive order requiring large construction firms involved in public infrastructure projects to negotiate collective agreements with their workers. Unions and other pro-worker advocacy groups have called on the president to expand that requirement to contractors that provide goods and other services.

In fiscal 2022, Uncle Sam awarded more than $705 billion in unclassified contracts (and an undisclosed amount of classified contracts). Billions more go out the door every year in the form of subsidies, grants, and tax credits.

We should view these public funds as a source of power to create an economy that works for everyone. Public money should support the public goodnot line the pockets of overpaid CEOs.

Washington Redskins owner Dan Snyder announced Friday that he would conduct a "thorough review" of his NFL team's racist name, which has been the target of protests for decades by Indigenous people and other critics who say the name amounts to a harmful slur.

Snyder's announcement comes after at least five decades of public actions by Indigenous tribes and civil rights organizations, but the catalyst for the review appeared to be demands made by the team's corporate partners.

FedEx, which sponsors the Redskins' home stadium and whose CEO is a partial owner of the team, released a statement Thursday saying, "We have communicated to the team in Washington our request that they change the team name."

Nike also removed Redskins merchandise from its online store on Thursday. The two companies, along with PepsiCo, last week received letters from 87 of their investors--worth a collective $620 billion--calling on them to end their business partnerships with the Redskins unless the team changed its name.

Snyder's signal that a potential name change could be forthcoming came after decades of outcry from Indigenous people, all of which he dismissed in 2013 by claiming he would "never change the name."

In 1968, the National Congress of American Indians launched its first campaign aimed at removing harmful stereotypes and images from U.S. media and popular culture. Four years later, 11 activists approached the team for the first time to request a name change, and in 1992, an estimated 3,000 people demonstrated at the Super Bowl to demand the change in the largest-ever protest over the issue.

"Money changes everything," the anti-bigotry campaign Sleeping Giants tweeted on Friday.

\u201cYesterday, investors and sponsors demanded that the Redskins change their name.\n\nMoney changes everything.\u201d— Sleeping Giants (@Sleeping Giants) 1593790690

Snyder's announcement came amid historic racial injustice protests across the U.S., sparked by the killings of George Floyd, Breonna Taylor, and Ahmaud Arbery.

Snyder has also faced recent pressure from elected officials to change the Redskins' name, as he aims to move the team from FedEx Field in Maryland to RFK Stadium in Washington, D.C., the city the team represents. The stadium sits on government-owned land and lawmakers including Del. Eleanor Holmes Norton (D-D.C.) have demanded the name change before Snyder purchases the stadium.

"He has got a problem he can't get around, and he particularly can't get around it today, after the George Floyd killing," said Norton.

Rep. Raul Grijalva (D-Ariz.) has also demanded the name be changed, saying it is up to Snyder to "step into this century."

"There is no way to justify" keeping the name, Grijalva said Thursday.