Conservative legal activist Leonard Leo has gotten a lot of attention for his work to reshape the U.S. judicial system.

Ever since the summer, when he landed the biggest political advocacy donation in U.S. history (see ProPublica’s “How a Secretive Billionaire Handed His Fortune to the Architect of the Right-Wing Takeover of the Courts”), Leo has featured in story after story on the ways in which secretive funding from ultra-wealthy donors has shaped the courts and public policy.

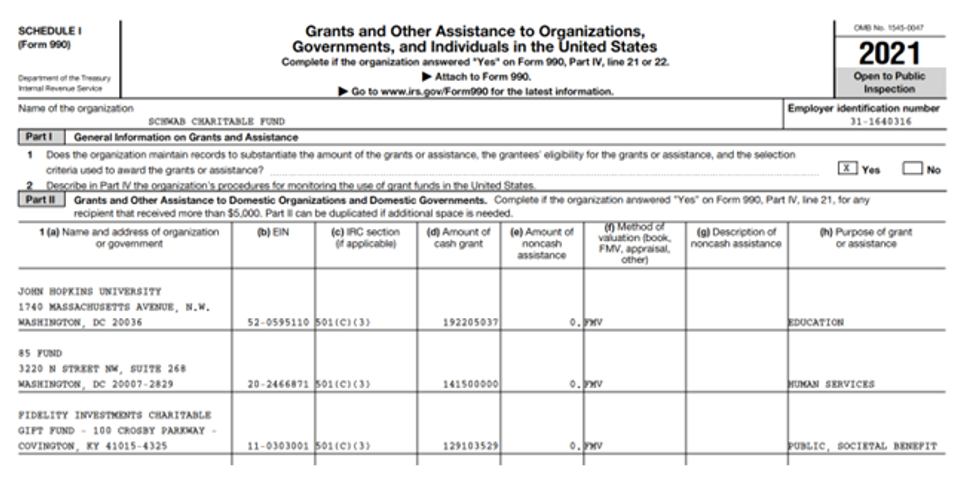

With newly released tax filings from Schwab Charitable — one of the nation’s largest sponsors of what are called donor-advised funds — we have another major piece of information on how this “dark money” moves.

During its most recently reported fiscal year (July 2021 to June 2022), Schwab made an enormous grant of $141.5 million to the 85 Fund, a key part of Leo’s burgeoning empire, formerly known as the Judicial Education Project. The 85 Fund is a 501(c)(3) public charity.

Unlike private foundations, donor-advised funds (DAFs) are not independent organizations that need to report their activities to the IRS and make those reports available to the public.

Instead, they’re accounts set up under a “sponsor” — in this case Schwab Charitable — a public charity that can house hundreds or even thousands of funds.

And while those sponsors need to file annual reports with the IRS, they do not have to report which of those DAFs make which grants.

That makes them ideal vehicles to conceal who the actual donors are behind sources of funding: if a private foundation made a similar grant it would show up on that foundation’s IRS filings attributed to the foundation, whose directors, officers, and finances are far more transparent.

Get the facts

Our Charity Reform Initiative

In addition to helping secretive donors avoid disclosure, DAF funding like this can also help organizations circumvent rules that prevent privately governed and funded organizations from masquerading as public charities. This is called the “public support test.”

Simply put, if a nonprofit received the bulk of its funding from a single source, its status as a public charity would be in jeopardy, and it would lose the many benefits deriving from that status.

But under current regulations, grants from DAFs are treated as grants from the sponsor, which is a public charity, and so would not tip the nonprofit out of its public charity status.

In its most recently reported filing (year ending December 31, 2021), 85 Fund’s total public support was $117 million. We don’t know how much it’s grown since, but that single grant from Schwab was more than 85 Fund’s entire revenue for that year.

It’s entirely likely that, if that grant had come from a private individual or a private foundation, 85 Fund would have lost its public charity status — the gift could not have been included in the calculation of its public support.

This merits much deeper investigation. It’s also a perfect example of one of the many ways that the regulations around donor-advised funds need fixing.

And this particular fix — attributing grants like this to the donor behind the DAF rather than the sponsor — had been stalled under consideration by the IRS for nearly 6 years.