June, 24 2021, 12:19pm EDT

Record Breaking Year for Environmental, Social, and Sustainable Governance (ESG) Shareholder Resolutions

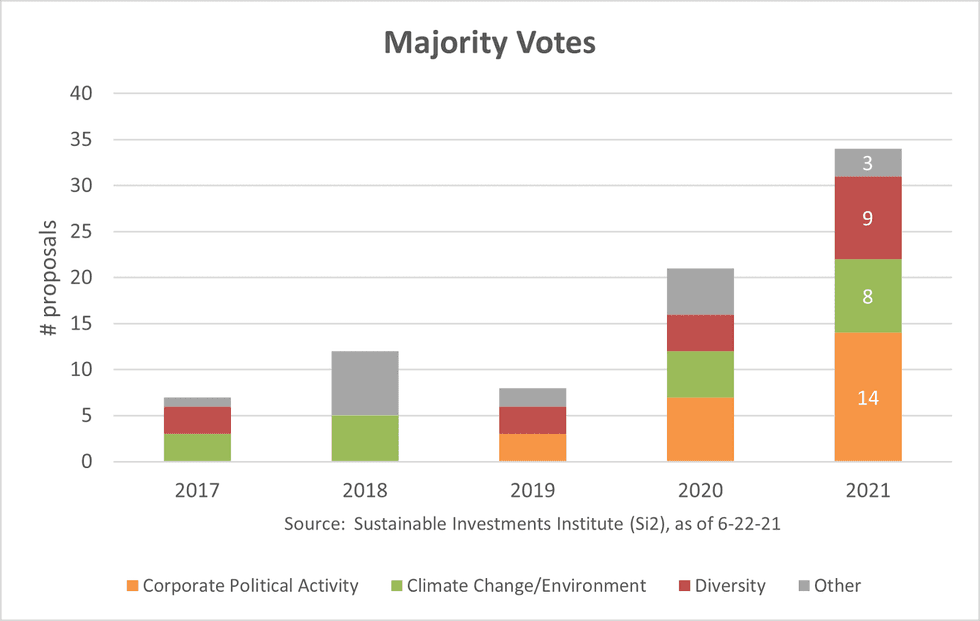

Nearly three dozen majority votes highlight historic increase in shareholder support.

WASHINGTON

The Proxy Preview team today released highlights of the unprecedented 2021 proxy season, which saw nearly three dozen majority votes for disclosure and action on environmental, social, and sustainable governance (ESG) shareholder resolutions.

To date, there have been 34 majority votes for ESG proposals, shattering last year's record of 21. More are likely by year's end. Last year, only two votes broke 70%, while this year 17 did. Eight were in the 80s and six saw more than 90% support. Four of the six that received more than 90% were supported by management -- a first for U.S. environmental and social resolutions. More importantly, other high-scoring proposals were opposed by management but still earned huge support.

"This has been an extraordinary year with record high votes for climate change, diversity, and political spending issues," said Michael Passoff, CEO of Proxy Impact and co-author of Proxy Preview. "Shareholder proposals about the COVID-19 pandemic and sexual harassment also received majority votes, while new proposals on racial justice gained unusually high support."

"The slew of majority votes suggests investors at large see ESG as material," said Heidi Welsh, Executive Director of the Sustainable Investments Institute (Si2) and co-author of Proxy Preview. "Evidence from the financial markets seems to contradict the intent of new SEC rules that will make it harder to file and resubmit shareholder proposals in 2022," Welsh added, noting that the SEC's own analysis showed most individuals will not be able to sponsor proposals at all.

"Looking ahead, the question now is how companies will implement changes to their policies and practices in response to these high votes, and how investors respond if they don't," said Andrew Behar, CEO of As You Sow and report publisher. "This year we saw three out of four dissident directors elected at ExxonMobil after shareholders lost patience with its inaction on climate change. All boards have been put on notice this could happen to them."

Top votes include:

Political Spending: Proposals about the ways in which companies influence the political system accounted for the largest group of majority votes -- 14. The top votes were for more election spending oversight and disclosure with 80.6% at Netflix and 80.1% at Chemed. A resolution asking for a report about climate change lobbying and advocacy, both directly and indirectly through trade and other associations, won 76.4% at Norfolk Southern, while the top vote for more generalized disclosure on lobbying was 66.3% at GEO Group.

Climate and environment: Eight climate change proposals earned more than 50% and resulted in the two highest votes of the year. Investors gave 98.8% support for reporting on supply chain deforestation impacts at Bunge and 98% for reporting on net-zero GHG goals at General Electric -- though management supported both. Yet votes were extraordinary even with management opposition, hitting 81.2% in favor for more disclosure on plastics pollution at DuPont de Nemours, 80.3% for adopting greenhouse gas (GHG) emission goals at Phillips 66, 76.2% for reporting on deforestation in the supply chain of Bloomin Brands, and 60.7% for cutting GHG emissions from oil and gas products sold by Chevron.

Diversity: The national debate over racial justice made itself known in proxy season by many more proposals about diversity in the workplace and executive suite, and on boards, with nine majorities. At the top were a resolution asking IBM for details on the effectiveness of diversity, equity, and inclusion programs (94.3% with management support), one asking Paycom Software about executive diversity (93.7% after management did not take a position), and 91.2% for more board diversity at First Solar despite a recommendation against it by the board. Board diversity also received 85.3% at Badger Meter, while a call for EEO-1 data disclosure earned 86.5% at Union Pacific, where a request for diversity program data also received 81.4%.

COVID-19: Concerns about the pandemic were at the heart of the third highest vote this year. Although Wendy's tried to keep a proposal about reporting on pandemic worker safety off the proxy ballot with an SEC challenge, it failed and in the end the company supported the proposal--prompting a 95.2% vote.

Sexual Harassment: A resolution on mandatory arbitration-which can hide sexual harassment problems-received 53.2% at Goldman Sachs and even more (59.4%) at solar panel maker Sunrun.

Racial Justice: Although they did not receive majority support, two new proposals about conducting racial justice audits received unusually high support for first-year resolutions, with 44.2% at Amazon.com and 40.5% at JPMorgan Chase.

As You Sow is the nation's non-profit leader in shareholder advocacy. Founded in 1992, we harness shareholder power to create lasting change that benefits people, planet, and profit. Our mission is to promote environmental and social corporate responsibility through shareholder advocacy, coalition building, and innovative legal strategies.

LATEST NEWS

Demanding Action From Congress, Khanna Says 'The American People Are Tired of Regime Change Wars'

"We don't want to be at war with a country of 90 million people in the Middle East," said Democratic US Rep. Ro Khanna.

Feb 28, 2026

US Rep. Ro Khanna on Saturday demanded swift action from Congress to stop the Trump administration's unauthorized military assault on Iran, saying in a video posted to social media that "the American people are tired of regime change wars that cost us billions of dollars and risk our lives."

"We don't want to be at war with a country of 90 million people in the Middle East," said Khanna (D-Calif.), calling on Congress to reconvene for a vote on Monday.

"Every member of Congress should go on record today on how they will vote on Thomas Massie and my War Powers resolution," Khanna added, referring to the Kentucky Republican who is co-leading the measure.

If passed, the resolution would require the president "to terminate the use of United States Armed Forces from hostilities against the Islamic Republic of Iran or any part of its government or military, unless explicitly authorized by a declaration of war or specific authorization for use of military force against Iran."

Watch Khanna's remarks:

Trump has launched an illegal regime change war in Iran with American lives at risk. Congress must convene on Monday to vote on @RepThomasMassie & my WPR to stop this. Every member of Congress should go on record this weekend on how they will vote. pic.twitter.com/tlRi3Vz849

— Ro Khanna (@RoKhanna) February 28, 2026

Days prior to the US-Israeli attack on Iran, the House Democratic leadership announced it would force a vote next week on the Khanna-Massie War Powers resolution following reports that top Democrats were slowwalking the measure behind closed doors.

Senate Democrats also said they planned to vote next week on a War Powers resolution led by Sens. Tim Kaine of Virginia.

In a statement on Saturday, Kaine called the US attacks on Iran "illegal" and said that "every single senator needs to go on the record about this dangerous, unnecessary, and idiotic action."

“Has President Trump learned nothing from decades of US meddling in Iran and forever wars in the Middle East? Is he too mentally incapacitated to realize that we had a diplomatic agreement with Iran that was keeping its nuclear program in check, until he ripped it up during his first term?" Kaine asked. "These strikes are a colossal mistake, and I pray they do not cost our sons and daughters in uniform and at embassies throughout the region their lives. The Senate should immediately return to session and vote on my War Powers resolution."

The chances of a War Powers resolution getting through the Republican-controlled Congress are virtually nonexistent, even though the American public overwhelmingly opposes US military action against Iran. Senate Majority Leader John Thune (R-SD) and House Speaker Mike Johnson (R-La.) both issued statements applauding Trump for the unauthorized Saturday attacks.

Cavan Kharrazian, senior policy adviser to the advocacy group Demand Progress, said that "Trump has no authority to launch another war on his own."

"The Constitution is clear. The need for a War Powers resolution is clear. Congress decides when this country goes to war, not the president," said Kharrazian. "Next week, every member of Congress will have to choose. Side with illegal, endless war, or side with the American people and reject yet another regime change war in the Middle East. Like with Iraq, the choice they make will echo loudly for years to come.”

Keep ReadingShow Less

'The Behavior of Rogue States': Global Revulsion as US and Israel Launch War on Iran

"The attacks on Iran by Israel and the United States are illegal, unprovoked, and unjustifiable," said Jeremy Corbyn, an independent member of the UK Parliament.

Feb 28, 2026

Elected officials, activists, and experts around the world voiced horror and outrage Saturday as US President Donald Trump and Israeli Prime Minister Benjamin Netanyahu jointly launched an illegal war on Iran with the explicit goal of toppling the nation's government, sparking chaos throughout the Middle East.

The wave of bombings, expected to mark the beginning of a wider assault, spurred airspace closures and flight cancellations across the region as countries braced for the fallout. While European leaders offered milquetoast responses to the unlawful military attack and Canadian and Australian officials openly endorsed it, leftist politicians and others unequivocally condemned the US and Israel as the aggressors.

"The attacks on Iran by Israel and the United States are illegal, unprovoked, and unjustifiable," said Jeremy Corbyn, an independent member of the British Parliament and former leader of the UK Labour Party. "Peace and diplomacy was possible. Instead, Israel and the United States chose war."

"This is the behavior of rogue states—and they have jeopardized the safety of humankind around the world with this catastrophic act of aggression," Corbyn added. "Our government must condemn this flagrant breach of international law, and urgently pursue a foreign policy based on justice, sovereignty, and peace."

Progressive International co-founder Yanis Varoufakis, the former finance minister of Greece, echoed Corbyn's criticism of the US and Israel as "rogue states."

"Israel and the USA," he wrote on social media, "have started a war not against Iran but against the whole world. We stand with Iranians, with humanity, against the notion that Israel and the US can bomb anyone their fancy takes them to bomb."

Badr Albusaidi, the foreign minister of Oman and the mediator of recent US-Iran talks, said he was "dismayed" by news of the US-Israel attacks on Iran, which were quickly followed by reports of horrific atrocities. Albusaidi said hours before the bombs started falling on Iran that a diplomatic resolution was within reach.

"Active and serious negotiations have yet again been undermined," Albusaidi lamented on Saturday. "Neither the interests of the United States nor the cause of global peace are well served by this. And I pray for the innocents who will suffer. I urge the United States not to get sucked in further."

Leftist Colombian President Gustavo Petro said he believes "President Donald Trump has made a mistake today" and implored the "helpless United Nations" to "convene immediately" in response to the US-Israel attacks and retaliation by Iran and allied groups in the region.

Iran vowed a "crushing" response to the US-Israeli onslaught, firing drones and missiles at Israel and pledging to hit US military installations in the region.

Al Jazeera reported that "Iran has targeted United States assets across the Gulf Arab states in retaliation for a huge joint attack on Iran by the US and Israel, as the region’s worst fears of being ignited in the flames of a sustained war loom."

"The Iranian government on Saturday confirmed its attacks on several targets, according to the Fars news agency, including Bahrain, Kuwait, Qatar, and the United Arab Emirates, where US airbases are hosted," the outlet noted.

Keep ReadingShow Less

Oman's Foreign Minister Said US-Iran Deal Was 'Within Our Reach.' Then Trump Started Bombing

"The Omani FM decided to go public," suggested one observer, "so that the American people knew that peace was within reach when Trump instead opted for war."

Feb 28, 2026

Hours before President Donald Trump announced his decision to bomb Iran and pursue the overthrow of its government, the foreign minister of Oman appeared, in person, on one of the most prominent US television news programs to declare that a diplomatic breakthrough was possible.

"I can see that the peace deal is within our reach," Badr Albusaidi, the mediator of recent talks between the US and Iran, told "Face the Nation" host Margaret Brennan on Friday. "I'm asking to continue this process because we have already achieved quite a substantial progress in the direction of a deal. And the heart of this deal is very important, and I think we have captured that heart."

Pressed for specifics, Albusaidi said that Iran committed during the talks to renounce the possibility of amassing "nuclear material that will create a bomb"—a pledge that Trump claimed Iran refused to make as part of his justification for Saturday's strikes.

"This is something that is not in the old deal that was negotiated during President Obama's time," Albusaidi said, referring to the 2015 nuclear accord that Trump ditched during his first term in the White House. "This is something completely new. It really makes the enrichment argument less relevant, because now we are talking about zero stockpiling. And that is very, very important, because if you cannot stockpile material that is enriched, then there is no way you can actually create a bomb, whether you enrich or don't enrich. And I think this is really something that has been missed a lot by the media, and I want to clarify that from the standpoint of a mediator."

"There is no accumulation, so there would be zero accumulation, zero stockpiling, and full verification," the Omani foreign minister continued. "Full and comprehensive verification by the [International Atomic Energy Agency]."

In a social media post following the interview, Albusaidi reiterated that a deal "is now within reach" and implored all parties to "support the negotiators in closing the deal." Prior to Saturday's attacks, additional US-Iran talks were scheduled for next week.

Watch the full segment, which critics highlighted as evidence that the US-Israeli attacks on Saturday were aimed at forestalling a diplomatic resolution:

Trita Parsi, executive vice president of the US-based Quincy Institute for Responsible Statecraft, wrote in response to Albusaidi's remarks that "the Omanis are famously cautious."

"The Omani FM going on CBS to reveal what has actually been achieved in the negotiations is quite unprecedented. And what has been achieved is significant—Trump can indeed declare victory. Listen to this segment—it goes way beyond what Obama achieved," Parsi wrote. "But everything indicates that Trump won't take yes for an answer. That he will start a war of choice very soon."

"Which is probably why the Omani FM decided to go public," Parsi added. "So that the American people knew that peace was within reach when Trump instead opted for war."

According to one survey released earlier this month, just 21% of Americans support "the United States initiating an attack on Iran under the current circumstances."

Keep ReadingShow Less

Most Popular