September, 01 2016, 12:00pm EDT

Report: Taxpayers Have Subsidized $2 Billion in Wall Street Executive Bonuses Since 2012

The Wall Street CEO Bonus Loophole

WASHINGTON

A new Institute for Policy Studies report is the first to calculate how much taxpayers have been subsidizing executive bonuses at the nation's largest banks.

The study focuses on a 1993 President Bill Clinton reform that was intended to rein in runaway CEO pay by capping the tax deductibility of compensation at $1 million. Instead, the new rule fueled the explosion of CEO pay by including a huge loophole for stock options and other "performance" pay. Hillary Clinton has said she wants to "reform" this loophole, but hasn't explicitly called for closing it.

The financial bailout closed this loophole for recipients, but only until they repaid their public funds. While homeowners and shareholders were still suffering from the crisis, banks began doling out massive stock-based awards that quickly ballooned in value, giving the banks huge tax write-offs and leaving ordinary taxpayers to make up the difference.

KEY FINDINGS:

- The top 20 U.S. banks paid out more than $2 billion in fully deductible performance bonuses to their top five executives over the past four years. At a 35 percent corporate tax rate, this translates into a taxpayer subsidy worth more than $725 million, or $1.7 million per executive per year.

- Wells Fargo CEO John Stumpf received the largest amount of such bonuses. Between 2012 and 2015, years in which his bank faced $10.4 billion in misconduct penalties, Stumpf pocketed more than $155 million in fully deductible performance pay. This works out to $54 million in tax subsidies for Wells Fargo -- just for one man's bonuses.

- Between 2010 and 2015, the top executives at the 20 largest banks pocketed nearly $800 million in stock-based "performance" pay-- before their firm's stock had returned to pre-crisis levels. With shareholders who had held on to their stock still in the red, executives were reaping massive bonuses that their banks could then deduct off their taxes.

EXAMPLES:

- JPMorgan Chase CEO Jamie Dimon cashed in $23 million in stock at the peak of the foreclosure crisis in 2010, when the firm's stock was trading around 15 percent lower than at the beginning of the market slide. Since then, the bank has racked up more than $28 billion in mortgage and other financial misconduct settlement fees.

- Wells Fargo CEO John Stumpf received a huge performance-based stock award in 2009 that ballooned in value to $21 million by the time it vested in 2013. At that time, Wells Fargo stock was below pre-crisis levels and the bank was holding nearly 85,000 mortgage loans in foreclosure.

- PNC Financial CEO James Rohr got more than 290,000 stock options in early 2009, when the bank's shares were trading at less than half pre-crisis values. Thanks to a bailout-fueled recovery, Rohr's options spiked in value to more than $22 million by the time he cashed out 2013.

"Taxpayers should not have to subsidize excessive CEO bonuses at any corporation," notes report author Sarah Anderson. "But such subsidies are particularly troubling when they prop up a pay system that encourages the reckless behavior which caused one devastating national crisis -- and could cause more in the future."

This 23rd edition of the annual IPS Executive Excess series includes the most comprehensive available catalog of CEO pay reforms, including legislation to eliminate the CEO bonus loophole that would generate an estimated $5 billion per year in additional revenue.

"The Wall Street CEO Bonus Loophole" report and related graphics are available at: www.ips-dc.org/executive-excess-2016-the-wall-street-ceo-bonus-loophole

Institute for Policy Studies turns Ideas into Action for Peace, Justice and the Environment. We strengthen social movements with independent research, visionary thinking, and links to the grassroots, scholars and elected officials. I.F. Stone once called IPS "the think tank for the rest of us." Since 1963, we have empowered people to build healthy and democratic societies in communities, the US, and the world. Click here to learn more, or read the latest below.

LATEST NEWS

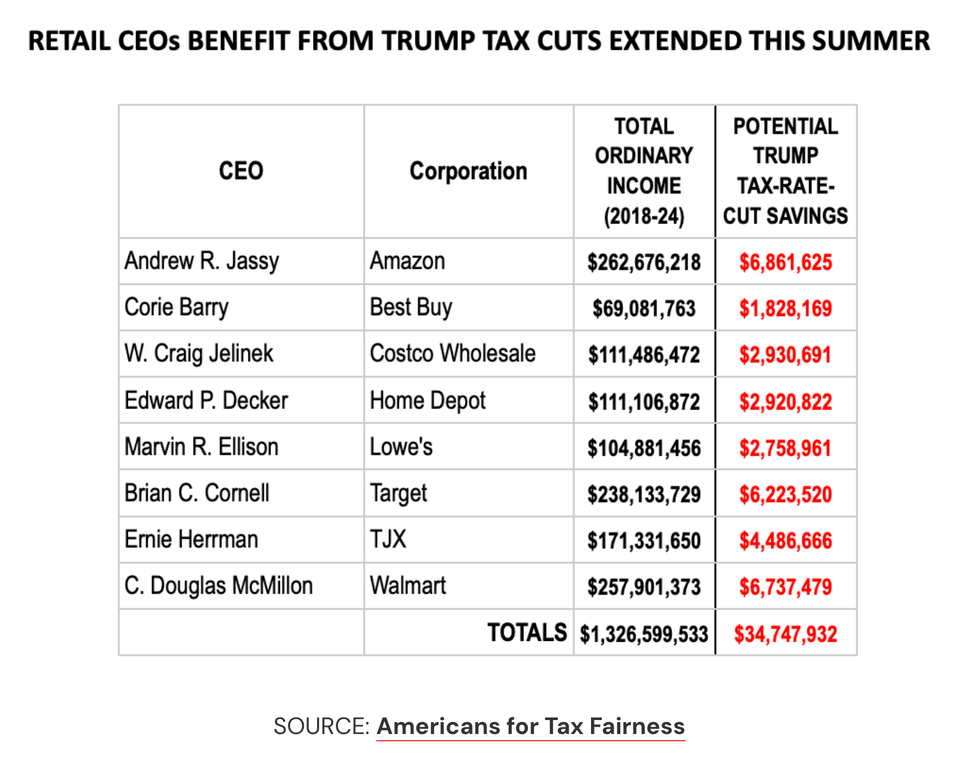

As Wage Growth Slows and Unemployment Rises, Trump Tax Cuts Deliver Big for Mega-Rich Retail CEOs

"At the same time prices have soared for consumers and retail workers remain stuck in low-wage jobs, big-store CEOs and shareholders have reaped higher profits and lower taxes."

Dec 19, 2025

As workers face slowing wage growth, a worsening cost-of-living crisis, and rising unemployment, the chief executives of top corporate retailers in the United States are reaping huge gains from the tax cuts that US President Donald Trump and congressional Republicans extended over the summer.

An analysis released Friday by the progressive advocacy group Americans for Tax Fairness (ATF) estimates that the CEOs of Amazon, Best Buy, Costco, Home Depot, Lowe's, Target, TJX, and Walmart have collectively saved close to $35 million on their individual tax returns in the seven years the Trump tax cuts have been in effect.

Thanks to the Trump-GOP tax law, which took effect in 2018, the companies examined in the analysis paid a tax rate of just 17.5% between 2018 and 2024—roughly half what they paid prior to the law's enactment.

"While at the same time prices have soared for consumers and retail workers remain stuck in low-wage jobs, big-store CEOs and shareholders have reaped higher profits and lower taxes," David Kass, ATF’s executive director, said in a statement. "If we want a system that alleviates economic stress on average Americans instead of exacerbating it during the holiday season, we need to raise taxes on corporations and the rich, invest in workers and families with expanded public services."

Workers at the major retailers haven't fared nearly as well. ATF noted that "the average worker at the eight stores was paid less than $32,000 in 2024."

"Amazon—the world’s largest retailer—refuses to even sit down with its employees who have formed a labor union for better pay, benefits, and working conditions," the group observed. "If Lowe’s had used the nearly $50 billion it spent on stock buybacks over the seven-year period to instead raise employee wages, its workers would have each been paid almost $200,000 more."

Across the US economy, workers are seeing wage growth stagnate amid elevated and still-rising prices, which are forcing many to skip meals and ration their medications to make ends meet.

The Labor Department said earlier this week that wage growth decelerated to 3.5% year over year—the slowest pace since before the Covid-19 pandemic. Unemployment, meanwhile, rose in November to the highest level in four years.

The ATF analysis came days after Trump delivered a lie-filled primetime speech defending his handling of the US economy as his approval ratings tanked, with American voters across party lines increasingly furious over the high costs of housing, groceries, healthcare, and other necessities.

During the speech, Trump vowed that Americans would soon "see the results of the largest tax cuts in American history."

But the richest people in the country are set to reap disproportionate benefits from the tax cuts. As Bloomberg reported earlier this week, "Many filers—particularly those who could most use the financial boost—may soon be disappointed."

"Wealthy taxpayers in high-tax states like California, New York, and New Jersey are the biggest winners," the outlet noted.

Keep ReadingShow Less

Dems Call to Investigate Commerce Secretary Boosting AI Data Centers That 'Enrich His Entire Family'

"Never in modern US history has the office intersected so broadly and deeply with the financial interests of the commerce secretary’s own family," according to the New York Times.

Dec 19, 2025

A group of Democratic lawmakers has called for the Commerce Department to investigate whether its billionaire secretary, Howard Lutnick, is improperly boosting artificial intelligence data centers that "stand to enrich his entire family."

The group of 25 House and Senate Democrats, led by Sen. Elizabeth Warren (D-Mass.) and Rep. Madeleine Dean (D-Pa.), sent a letter on Thursday urging the department's acting inspector general, Duane Townsend, to review whether Lutnick violated any part of the ethics agreement he signed following his nomination.

That agreement required him to divest his stake in the financial services firm Cantor Fitzgerald, which he had owned and led for decades. Cantor owns the Newmark Group, a real estate broker that facilitates leases for AI data centers.

Lutnick stepped down from his position as CEO in February, handing his financial stake in the company to his adult sons, Brandon and Kyle.

Though the transfer of his stake was supposed to happen in May, records show he did not do so until October, after receiving an ethics waiver from the Trump administration that allowed him to continue working on matters that could affect the company.

The lawmakers described some of these potential conflicts in the letter, many of which were revealed by a New York Times investigation last month:

Multiple press reports indicate that, in his capacity as head of the Commerce Department, Secretary Lutnick has helped boost AI data centers in ways that will likely enrich his own family. He has made public appearances promoting data center projects—including at least one that his family's company has worked on.

Furthermore, Secretary Lutnick has reportedly pressured foreign governments to invest in the US data center industry. For example, as part of a recent AI chips export deal with the United Arab Emirates (UAE), Secretary Lutnick reportedly pushed the UAE to "build data centers in America,” in exchange for the United States loosening export control restrictions on certain advanced chips. The Trump administration ultimately approved this deal, under which the Lutnick-backed Newmark Group is primed to profit from that Emirati investment.

Similarly, as part of another trade deal, Secretary Lutnick reportedly pushed South Korea to invest hundreds of billions of dollars in the United States. One startup vying for some of South Korea's investment has paid the Lutnick family's companies millions in fees to help it secure financing and land for its new data center.

Though businesspeople have often occupied the role of Commerce Secretary, the Times reported last month that "never in modern US history has the office intersected so broadly and deeply with the financial interests of the commerce secretary’s own family, according to interviews with ethics lawyers and historians."

According to the company's most recent quarterly earnings report, Newmark has completed more than $25 billion in data center deals over the past 12 months, resulting in its most lucrative year in the firm's history.

Citing evidence that the construction of AI data centers considerably spikes energy costs for consumers, the lawmakers said, "There is substantial public interest in ensuring that Secretary Lutnick is not violating federal ethics law to propel data centers that will be profitable for his family while making life more expensive for working Americans."

Keep ReadingShow Less

Tanking Economy and Higher Prices Put Trump on ‘Naughty List’ This Holiday Season, Group Says

"Families are heading into the holidays facing snowballing costs on everything from toys and groceries to health care and utilities, yet Trump continues to call affordability a hoax."

Dec 19, 2025

President Donald Trump delivered a speech on Wednesday in which he tried to convince US voters that the economy under his watch was the envy of the world.

However, newly released data shows that Americans are not buying it.

The latest data from the University of Michigan's Surveys of Consumers showed consumer sentiment of current economic conditions dropped yet again in December to a rating of 50.4, which represents a 33% drop from the 74.0 consumer sentiment rating one year ago.

The Groundwork Collaborative released a report on Friday that slammed the president's economic stewardship and said that "it is no surprise that a record number of Americans put Trump’s economic performance on the naughty list this holiday season."

The group then explained why Americans have good reason to be pessimistic.

One of the most glaring problems with Trump's economy at the moment, the group contended, is the labor market, which has reported net negative job growth over the last two months.

What's more, Groundwork Collaborative noted that "the number of people working part time for economic reasons rose to 5.5 million in November, an increase of about 909,000 since September, as Americans are unable to find full-time employment."

The group also hit Trump for his tariffs on imported goods, which have already cost the average American family an estimated $1,200 so far and are projected to cost them $2,100 next year, assuming the tariffs remain at their current levels.

Alex Jacquez, chief of policy and advocacy at Groundwork Collaborative, said that current economic conditions were the opposite of what Trump promised during the 2024 presidential campaign, when he vowed to lower prices starting on his first day in office.

"Families are heading into the holidays facing snowballing costs on everything from toys and groceries to health care and utilities, yet Trump continues to call affordability a hoax," said Jacquez. "As working families yearn for the ghost of economies past, let’s hope the Scrooge in the White House makes a resolution to stop gaslighting Americans and get serious about bringing costs down in the new year."

Groundwork Collaborative's analysis came one day after the Center on Budget and Policy Priorities (CBPP) released a report on Thursday that outlined how Trump and his Republican allies have worked to make life less affordable for US voters over the last year.

Beyond the aforementioned tariffs cited by Groundwork Collaborative, CBPP cited the major cuts that Trump and the GOP made to Medicaid and the Supplemental Nutritional Assistance Program (SNAP) in the One Big Beautiful Bill Act that they passed into law earlier this year.

CBPP also flagged Trump and the GOP's cuts to renewable energy projects that the group argued are raising the cost of electricity at a time when electric grids are coming under heavy strain from the energy demands of artificial intelligence data centers. Making this crisis potentially even worse, the think tank noted that Trump has proposed entirely eliminating the Low Income Home Energy Assistance Program (LIHEAP).

Taken together, CBPP suggested that GOP policies have been taking a hatchet to the budgets of US households in the bottom half of the income distribution scale.

"Households with incomes in the bottom half of the distribution... spend almost 90% of their incomes on basic items: utilities, groceries, health care, transportation, and shelter," wrote CBPP. "And to help afford those basics, many need assistance, such as Medicaid, SNAP, or LIHEAP, that the Administration has put on the chopping block."

Keep ReadingShow Less

Most Popular