September, 07 2012, 10:51am EDT

For Immediate Release

Contact:

Michelle Bazie,202-408-1080,bazie@cbpp.org

Statement by Chad Stone, Chief Economist, on the August Employment Report

Today's disappointing jobs report shows that despite 30 straight months of private-sector job creation -- including 103,000 new private-sector jobs in August -- unemployment will likely remain high for the foreseeable future, suggesting policymakers should extend federal unemployment insurance (UI) benefits beyond the end of the year. The unemployment rate's dip to 8.1 percent reflects a drop in labor force participation, not a strong labor market.

WASHINGTON

Today's disappointing jobs report shows that despite 30 straight months of private-sector job creation -- including 103,000 new private-sector jobs in August -- unemployment will likely remain high for the foreseeable future, suggesting policymakers should extend federal unemployment insurance (UI) benefits beyond the end of the year. The unemployment rate's dip to 8.1 percent reflects a drop in labor force participation, not a strong labor market.

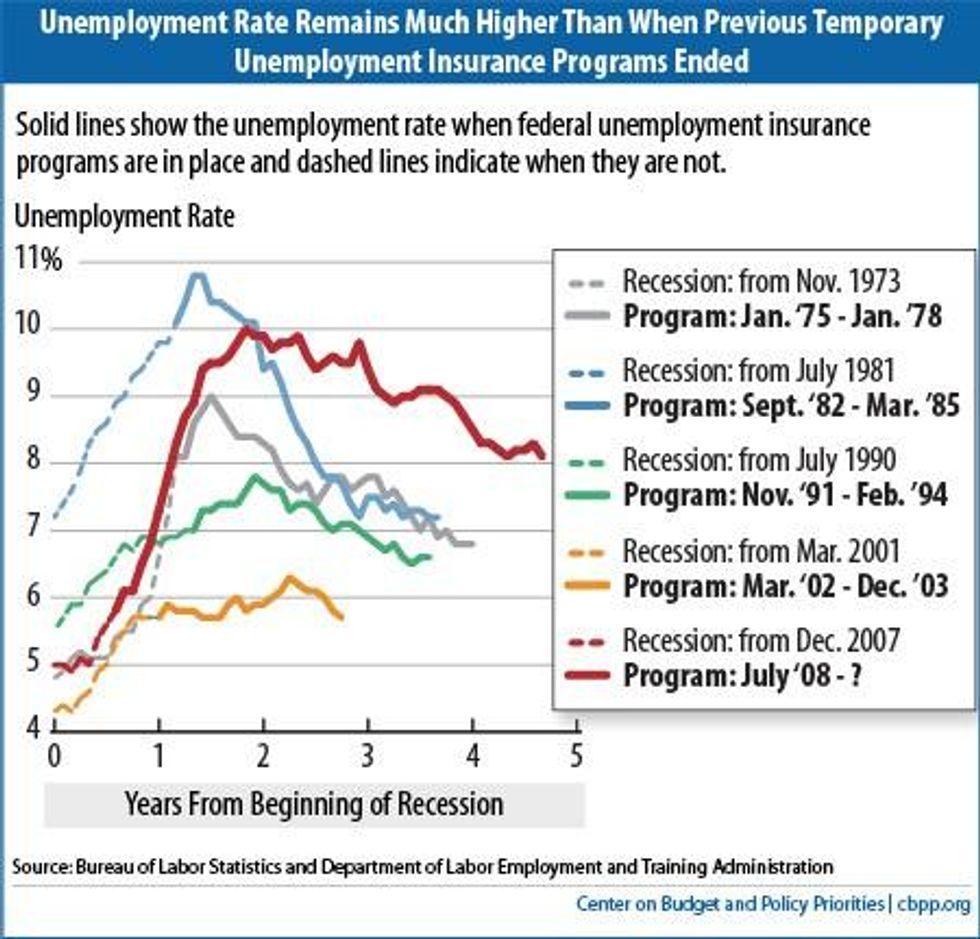

Policymakers have enacted emergency federal UI in every major recession since 1958, and they have never allowed any of these previous programs to expire before unemployment fell to 7.2 percent or lower (see chart for the most recent five programs). As Federal Reserve Chairman Bernanke said on August 31 at Jackson Hole, WY, "Unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum employment for some time."

The economy would benefit from more monetary stimulus from the Fed or fiscal stimulus from Congress to boost economic growth, but whether the Fed will act in response to today's jobs report remains uncertain and Congress shows no inclination to enact further fiscal stimulus this year.

UI is one of the most cost-effective policies available for boosting economic growth and employment in a weak economy, and emergency federal UI has been an important source of support since mid-2008 for both unemployed workers and their families and the economy. Phased-in cuts this year in the maximum number of weeks of benefits, which policymakers enacted in February, have already weakened that support, and it will end altogether if policymakers allow the program to expire at the end of this year.

If the nation were recovering from a normal recession in which unemployment peaked around 8 percent, 30 straight months of private-sector job growth and a roughly two percentage point drop in unemployment would represent a solid improvement that justified ending federal UI. The Great Recession, however, produced such a large jobs deficit and high unemployment that the labor market is still in far from good health, and emergency federal UI still has an important role to play in supporting unemployed workers and their families and the economy beyond the end of this year.

About the August Jobs Report

Job growth slowed in August and a strong labor market recovery remains elusive.

- Private and government payrolls combined rose by 96,000 jobs in August. Private employers added 103,000 jobs, while government employment fell by 7,000. Federal employment rose by 3,000 jobs, but state government employment fell by 6,000, and local government employment fell by 4,000.

- This is the 30th straight month of private-sector job creation, with payrolls growing by 4.6 million jobs (a pace of 154,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 4.1 million jobs over the same period, or 135,000 a month. Total government jobs fell by 571,000 over this period, dominated by a loss of 398,000 local government jobs.

- Despite the 30 months of private-sector job growth, there were still 4.7 million fewer jobs on nonfarm payrolls in August than when the recession began in December 2007 and 4.2 million fewer jobs on private payrolls. After three months of strong job growth in the winter, payroll job growth has averaged just 97,000 jobs a month over the past six months.

- The unemployment rate edged down from 8.3 to 8.1 percent in August, and the number of unemployed Americans edged down to 12.5 million. The unemployment rate was 7.2 percent for whites (2.8 percentage points higher than at the start of the recession), 14.1 percent for African Americans (5.1 percentage points higher than at the start of the recession), and 10.2 percent for Hispanics or Latinos (3.9 percentage points higher than at the start of the recession).

- The recession and lack of job opportunities drove many people out of the labor force, and we have yet to see a sustained return to labor force participation (people aged 16 and over working or actively looking for work) that would mark a strong jobs recovery. In fact, the labor force shrank by 368,000 in August after falling by 150,000 in July as the number of people with a job fell by 119,000 and the number of unemployed workers fell by 250,000. (These numbers come from a different survey, which shows more month-to-month volatility than the payroll job growth numbers.)

- The labor force participation rate (the percentage of people aged 16 and over working or looking for work) fell to 63.5 percent in August, a level last seen in 1981.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has remained below 60 percent since early 2009, edged down to 58.3 percent in August.

- The Labor Department's most comprehensive alternative unemployment rate measure -- which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can't find full-time jobs -- was 14.7 percent in August. That's down from its all-time high of 17.2 percent in October 2009 in data that go back to 1994, but still 5.9 percentage points higher than at the start of the recession. By that measure, roughly 23 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. Two-fifths (40.0 percent) of the 12.5 million people who are unemployed -- 5.0 million people -- have been looking for work for 27 weeks or longer. These long-term unemployed represent 3.3 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is one of the nation's premier policy organizations working at the federal and state levels on fiscal policy and public programs that affect low- and moderate-income families and individuals.

LATEST NEWS

‘Don't Give the Pentagon $1 Trillion,’ Critics Say as House Passes Record US Military Spending Bill

"From ending the nursing shortage to insuring uninsured children, preventing evictions, and replacing lead pipes, every dollar the Pentagon wastes is a dollar that isn't helping Americans get by," said one group.

Dec 10, 2025

US House lawmakers on Wednesday approved a $900.6 billion military spending bill, prompting critics to highlight ways in which taxpayer funds could be better spent on programs of social uplift instead of perpetual wars.

The lower chamber voted 312-112 in favor of the National Defense Authorization Act (NDAA) for fiscal year 2026, which will fund what President Donald Trump and congressional Republicans call a "peace through strength" national security policy. The proposal now heads for a vote in the Senate, where it is also expected to pass.

Combined with $156 billion in supplemental funding included in the One Big Beautiful Bill signed in July by Trump, the NDAA would push military spending this fiscal year to over $1 trillion—a new record in absolute terms and a relative level unseen since World War II.

The House is about to vote on authorizing $901 billion in military spending, on top of the $156 billion included in the Big Beautiful Bill.70% of global military spending already comes from the US and its major allies.www.stephensemler.com/p/congress-s...

[image or embed]

— Stephen Semler (@stephensemler.bsky.social) December 10, 2025 at 1:16 PM

The Congressional Progressive Caucus (CPC) led opposition to the bill on Capitol Hill, focusing on what lawmakers called misplaced national priorities, as well as Trump's abuse of emergency powers to deploy National Guard troops in Democratic-controlled cities under pretext of fighting crime and unauthorized immigration.

Others sounded the alarm over the Trump administration's apparent march toward a war on Venezuela—which has never attacked the US or any other country in its nearly 200-year history but is rich in oil and is ruled by socialists offering an alternative to American-style capitalism.

"I will always support giving service members what they need to stay safe but that does not mean rubber-stamping bloated budgets or enabling unchecked executive war powers," CPC Deputy Chair Ilhan Omar (D-Minn.) said on social media, explaining her vote against legislation that "pours billions into weapons systems the Pentagon itself has said it does not need."

"It increases funding for defense contractors who profit from global instability and it advances a vision of national security rooted in militarization instead of diplomacy, human rights, or community well-being," Omar continued.

"At a time when families in Minnesota’s 5th District are struggling with rising costs, when our schools and social services remain underfunded, and when the Pentagon continues to evade a clean audit year after year, Congress should be investing in people," she added.

The Congressional Equality Caucus decried the NDAA's inclusion of a provision banning transgender women from full participation in sports programs at US military academies:

The NDAA should invest in our military, not target minority communities for exclusion.While we're grateful that most anti-LGBTQI+ provisions were removed, the GOP kept one anti-trans provision in the final bill—and that's one too many.We're committed to repealing it.

[image or embed]

— Congressional Equality Caucus (@equality.house.gov) December 10, 2025 at 3:03 PM

Advocacy groups also denounced the legislation, with the Institute for Policy Studies' National Priorities Project (NPP) noting that "from ending the nursing shortage to insuring uninsured children, preventing evictions, and replacing lead pipes, every dollar the Pentagon wastes is a dollar that isn't helping Americans get by."

"The last thing Congress should do is deliver $1 trillion into the hands of [Defense] Secretary Pete Hegseth," NPP program director Lindsay Koshgarian said in a statement Wednesday. "Under Secretary Hegseth's leadership, the Pentagon has killed unidentified boaters in the Caribbean, sent the National Guard to occupy peaceful US cities, and driven a destructive and divisive anti-diversity agenda in the military."

Keep ReadingShow Less

Fed Cut Interest Rates But Can't Undo 'Damage Created by Trump's Chaos Economy,' Expert Says

"Working families are heading into the holidays feeling stretched, stressed, and far from jolly."

Dec 10, 2025

A leading economist and key congressional Democrat on Wednesday pointed to the Federal Reserve's benchmark interest rate cut as just the latest evidence of the havoc that President Donald Trump is wreaking on the economy.

The US central bank has a dual mandate to promote price stability and maximum employment. The Federal Open Market Committee may raise the benchmark rate to reduce inflation, or cut it to spur economic growth, including hiring. However, the FOMC is currently contending with a cooling job market and soaring costs.

After the FOMC's two-day monthly meeting, the divided committee announced a quarter-point reduction to 3.5-3.75%. It's the third time the panel has cut the federal funds rate in recent months after a pause during the early part of Trump's second term.

"Today's decision shows that the Trump economy is in a sorry state and that the Federal Reserve is concerned about a weakening job market," House Budget Committee Ranking Member Brendan Boyle (D-Pa.) said in a statement. "On top of a flailing job market, the president's tariffs—his national sales tax—continue to fuel inflation."

"To make matters worse, extreme Republican policies, including Trump's Big Ugly Law, are driving healthcare costs sharply higher," he continued, pointing to the budget package that the president signed in July. "I will keep fighting to lower costs and for an economy that works for every American."

Alex Jacquez, a former Obama administration official who is now chief of policy and advocacy at the Groundwork Collaborative, similarly said that "Trump's reckless handling of the economy has backed the Fed into a corner—stuck between rising costs and a weakening job market, it has no choice but to try and offer what little relief they can to consumers via rate cuts."

"But the Fed cannot undo the damage created by Trump's chaos economy," Jacquez added, "and working families are heading into the holidays feeling stretched, stressed, and far from jolly."

Thanks to the historically long federal government shutdown, the FOMC didn't have typical data—the consumer price index or jobs report—to inform Wednesday's decision. Instead, its new statement and projections "relied on 'available indicators,' which Fed officials have said include their own internal surveys, community contacts, and private data," Reuters reported.

"The most recent official data on unemployment and inflation is for September, and showed the unemployment rate rising to 4.4% from 4.3%, while the Fed's preferred measure of inflation also increased slightly to 2.8% from 2.7%," the news agency noted. "The Fed has a 2% inflation target, but the pace of price increases has risen steadily from 2.3% in April, a fact at least partly attributable to the pass-through of rising import taxes to consumers and a driving force behind the central bank's policy divide."

The lack of government data has also shifted journalists' attention to other sources, including the revelation from global payroll processing firm ADP that the US lost 32,000 jobs in November, as well as Gallup's finding last week that Americans' confidence in the economy has fallen by seven points over the past month and is now at its lowest level in over a year.

The Associated Press highlighted that the rate cut is "good news" for US job-seekers:

"Overall, we've seen a slowing demand for workers with employers not hiring the way they did a couple of years ago," said Cory Stahle, senior economist at the Indeed Hiring Lab. "By lowering the interest rate, you make it a little more financially reasonable for employers to hire additional people. Especially in some areas—like startups, where companies lean pretty heavily on borrowed money—that's the hope here."

Stahle acknowledged that it could take time for the rate cuts to filter down to employers and then to workers, but he said the signal of the reduction is also important.

"Beyond the size of the cut, it tells employers and job-seekers something about the Federal Reserve's priorities and focus. That they're concerned about the labor market and willing to step in and support the labor market. It's an assurance of the reserve's priorities."

The Federal Reserve is now projecting only one rate cut next year. During a Wednesday press conference, Fed Chair Jerome Powell pointed to the three cuts since September and said that "we are well positioned to wait to see how the economy evolves."

However, Powell is on his way out, with his term ending in May, and Trump signaled in a Tuesday interview with Politico that agreeing with immediate interest rate cuts is a litmus test for his next nominee to fill the role.

Trump—who embarked on a nationwide "affordability tour" this week after claiming last week that "the word 'affordability' is a Democrat scam"—also graded the US economy on his watch, giving it an A+++++.

US Sen. Bernie Sanders (I-Vt.) responded: "Really? 60% of Americans live paycheck to paycheck. 800,000 are homeless. Food prices are at record highs. Wages lag behind inflation. God help us when we have a B+++++ economy."

Keep ReadingShow Less

Sanders Champions Those Fighting Back Against Water-Sucking, Energy-Draining, Cost-Boosting Data Centers

Dec 10, 2025

Americans who are resisting the expansion of artificial intelligence data centers in their communities are up against local law enforcement and the Trump administration, which is seeking to compel cities and towns to host the massive facilities without residents' input.

On Wednesday, US Sen. Bernie Sanders (I-Vt.) urged AI data center opponents to keep up the pressure on local, state, and federal leaders, warning that the rapid expansion of the multi-billion-dollar behemoths in places like northern Virginia, Wisconsin, and Michigan is set to benefit "oligarchs," while working people pay "with higher water and electric bills."

"Americans must fight back against billionaires who put profits over people," said the senator.

In a video posted on the social media platform X, Sanders pointed to two major AI projects—a $165 billion data center being built in Abilene, Texas by OpenAI and Oracle and one being constructed in Louisiana by Meta.

The centers are projected to use as much electricity as 750,000 homes and 1.2 million homes, respectively, and Meta's project will be "the size of Manhattan."

Hundreds gathered in Abilene in October for a "No Kings" protest where one local Democratic political candidate spoke out against "billion-dollar corporations like Oracle" and others "moving into our rural communities."

"They’re exploiting them for all of their resources, and they are creating a surveillance state,” said Riley Rodriguez, a candidate for Texas state Senate District 28.

In Holly Ridge, Lousiana, the construction of the world's largest data center has brought thousands of dump trucks and 18-wheelers driving through town on a daily basis, causing crashes to rise 600% and forcing a local school to shut down its playground due to safety concerns.

And people in communities across the US know the construction of massive data centers are only the beginning of their troubles, as electricity bills have surged this year in areas like northern Virginia, Illinois, and Ohio, which have a high concentration of the facilities.

The centers are also projected to use the same amount of water as 18.5 million homes normally, according to a letter signed by more than 200 environmental justice groups this week.

And in a survey of Pennsylvanians last week, Emerson College found 55% of respondents believed the expansion of AI will decrease the number of jobs available in their current industry. Sanders released an analysis in October showing that corporations including Amazon, Walmart, and UnitedHealth Group are already openly planning to slash jobs by shifting operations to AI.

In his video on Wednesday, Sanders applauded residents who have spoken out against the encroachment of Big Tech firms in their towns and cities.

"In community after community, Americans are fighting back against the data centers being built by some of the largest and most powerful corporations in the world," said Sanders. "They are opposing the destruction of their local environment, soaring electric bills, and the diversion of scarce water supplies."

Keep ReadingShow Less

Most Popular