House Ways and Means Committee Chairman Rep. Jason Smith (R-Mo.) speaks at a press conference on May 22, 2025.

Nonpartisan Analysis Confirms: GOP Tax Cuts Would Come Nowhere Close to Paying for Themselves

"Republicans are out here pretending their tax bill will be the single greatest boost to the economy ever, and JCT says they only get a minuscule boost."

An analysis released Thursday by the nonpartisan Joint Committee on Taxation found that the tax cuts at the center of Republicans' massive reconciliation package would do little to boost economic growth—and would not come anywhere close to paying for themselves.

The JCT report, published hours after Republicans pushed the bill through the House, estimates that the tax cuts would boost the nation's average annual economic growth by 0.03 percentage points over the next decade—hardly the explosion of growth that GOP lawmakers and President Donald Trump have promised.

Economic activity spurred by the tax breaks—which are largely an extension of soon-to-expire provisions of the 2017 Trump-GOP tax cuts—would increase federal revenues by roughly $103 billion between 2025 and 2034, according to JCT.

That would barely put a dent in the overall projected cost of the tax cuts, bringing it down to $3.7 trillion from $3.8 trillion.

"I'm sorry, it is so funny that JCT says the GOP tax provisions pay for only 2.7% of themselves," Bobby Kogan, senior director of federal budget policy at the Center for American Progress, wrote in response to the analysis. "Republicans are out here pretending their tax bill will be the single greatest boost to the economy ever, and JCT says they only get a minuscule boost."

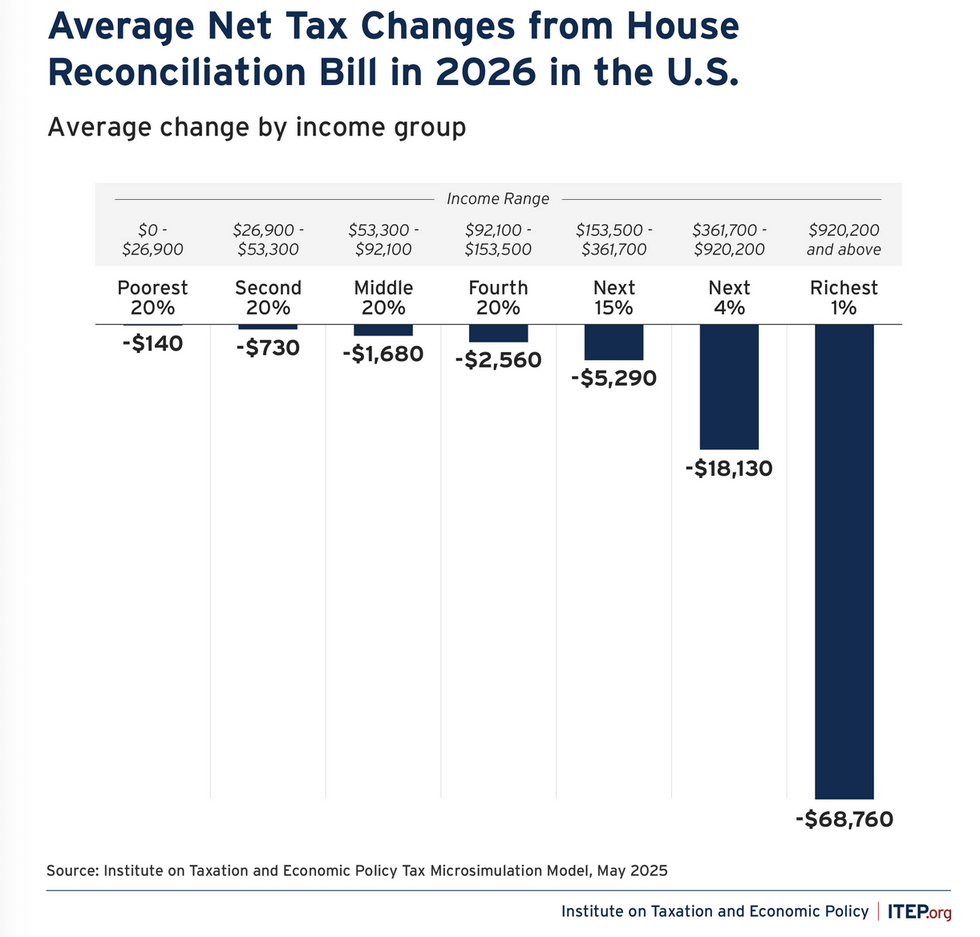

A separate analysis published Thursday by the Institute on Taxation and Economic Policy (ITEP) shows that the benefits of the Republican bill's tax provisions would flow disproportionately to the wealthiest Americans.

"The $121 billion in net tax cuts going to the richest 1% next year would exceed the amount going to the entire bottom 60% of taxpayers (about $90 billion)," said ITEP, whose analysis did not factor in the impact of the legislation's unparalleled cuts to Medicaid and federal nutrition assistance, which would deliver a major blow to the household resources of lower-income Americans.

Amy Hanauer, ITEP's executive director, said Thursday that "it's not surprising that this bill was written behind closed doors and rushed through in the night before Americans had a chance to see what it contains."

"This bill extends enormous tax cuts to those who have the most," said Hanauer. "It will increase inequality, reduce health coverage, and take food from people's tables, all to shower the wealthiest people in this country and foreign investors with tax breaks. In the end, this reconciliation bill redistributes resources up the income scale, widening the already-huge chasm between the rich and the rest of us."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

An analysis released Thursday by the nonpartisan Joint Committee on Taxation found that the tax cuts at the center of Republicans' massive reconciliation package would do little to boost economic growth—and would not come anywhere close to paying for themselves.

The JCT report, published hours after Republicans pushed the bill through the House, estimates that the tax cuts would boost the nation's average annual economic growth by 0.03 percentage points over the next decade—hardly the explosion of growth that GOP lawmakers and President Donald Trump have promised.

Economic activity spurred by the tax breaks—which are largely an extension of soon-to-expire provisions of the 2017 Trump-GOP tax cuts—would increase federal revenues by roughly $103 billion between 2025 and 2034, according to JCT.

That would barely put a dent in the overall projected cost of the tax cuts, bringing it down to $3.7 trillion from $3.8 trillion.

"I'm sorry, it is so funny that JCT says the GOP tax provisions pay for only 2.7% of themselves," Bobby Kogan, senior director of federal budget policy at the Center for American Progress, wrote in response to the analysis. "Republicans are out here pretending their tax bill will be the single greatest boost to the economy ever, and JCT says they only get a minuscule boost."

A separate analysis published Thursday by the Institute on Taxation and Economic Policy (ITEP) shows that the benefits of the Republican bill's tax provisions would flow disproportionately to the wealthiest Americans.

"The $121 billion in net tax cuts going to the richest 1% next year would exceed the amount going to the entire bottom 60% of taxpayers (about $90 billion)," said ITEP, whose analysis did not factor in the impact of the legislation's unparalleled cuts to Medicaid and federal nutrition assistance, which would deliver a major blow to the household resources of lower-income Americans.

Amy Hanauer, ITEP's executive director, said Thursday that "it's not surprising that this bill was written behind closed doors and rushed through in the night before Americans had a chance to see what it contains."

"This bill extends enormous tax cuts to those who have the most," said Hanauer. "It will increase inequality, reduce health coverage, and take food from people's tables, all to shower the wealthiest people in this country and foreign investors with tax breaks. In the end, this reconciliation bill redistributes resources up the income scale, widening the already-huge chasm between the rich and the rest of us."

An analysis released Thursday by the nonpartisan Joint Committee on Taxation found that the tax cuts at the center of Republicans' massive reconciliation package would do little to boost economic growth—and would not come anywhere close to paying for themselves.

The JCT report, published hours after Republicans pushed the bill through the House, estimates that the tax cuts would boost the nation's average annual economic growth by 0.03 percentage points over the next decade—hardly the explosion of growth that GOP lawmakers and President Donald Trump have promised.

Economic activity spurred by the tax breaks—which are largely an extension of soon-to-expire provisions of the 2017 Trump-GOP tax cuts—would increase federal revenues by roughly $103 billion between 2025 and 2034, according to JCT.

That would barely put a dent in the overall projected cost of the tax cuts, bringing it down to $3.7 trillion from $3.8 trillion.

"I'm sorry, it is so funny that JCT says the GOP tax provisions pay for only 2.7% of themselves," Bobby Kogan, senior director of federal budget policy at the Center for American Progress, wrote in response to the analysis. "Republicans are out here pretending their tax bill will be the single greatest boost to the economy ever, and JCT says they only get a minuscule boost."

A separate analysis published Thursday by the Institute on Taxation and Economic Policy (ITEP) shows that the benefits of the Republican bill's tax provisions would flow disproportionately to the wealthiest Americans.

"The $121 billion in net tax cuts going to the richest 1% next year would exceed the amount going to the entire bottom 60% of taxpayers (about $90 billion)," said ITEP, whose analysis did not factor in the impact of the legislation's unparalleled cuts to Medicaid and federal nutrition assistance, which would deliver a major blow to the household resources of lower-income Americans.

Amy Hanauer, ITEP's executive director, said Thursday that "it's not surprising that this bill was written behind closed doors and rushed through in the night before Americans had a chance to see what it contains."

"This bill extends enormous tax cuts to those who have the most," said Hanauer. "It will increase inequality, reduce health coverage, and take food from people's tables, all to shower the wealthiest people in this country and foreign investors with tax breaks. In the end, this reconciliation bill redistributes resources up the income scale, widening the already-huge chasm between the rich and the rest of us."