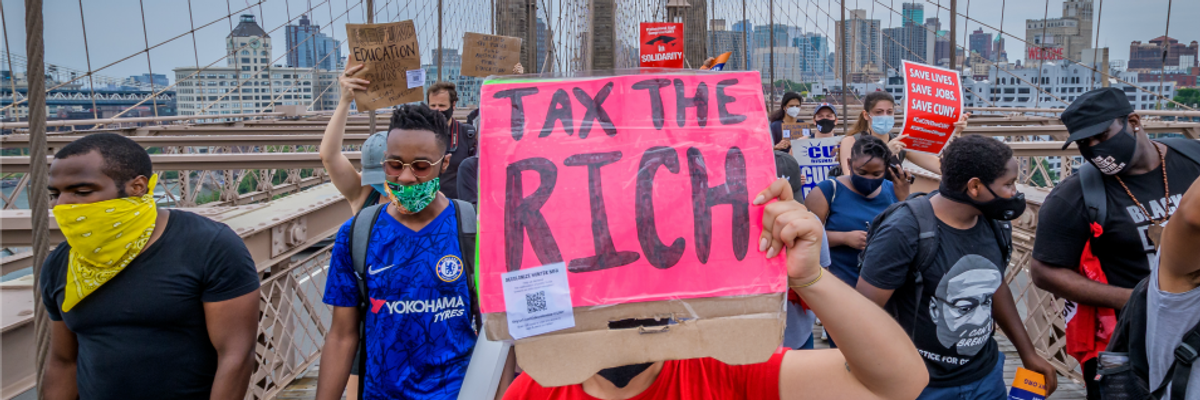

A demonstrator holds a "Tax the Rich" sign during a protest in New York on June 27, 2020. (Photo: Erik McGregor/LightRocket via Getty Images)

'An Absolute Outrage': Sanders Rips 'Wealthy Tax Cheats' as CBO Estimates $381 Billion in Annual Unpaid Taxes

"The richest 1% is responsible for 70% of all unpaid taxes... Congress is leaving hundreds of billions of dollars in taxes uncollected from the wealthy."

A Congressional Budget Office report commissioned by Sen. Bernie Sanders and published Wednesday found the amount of unpaid taxes from 2011 to 2013 averaged around $381 billion per year, a revenue shortfall the Vermont senator called an "absolute outrage" that is largely the result of big corporations and "wealthy tax cheats" dodging their obligations.

"The richest 1% is responsible for 70% of all unpaid taxes," Sanders said in a statement late Wednesday, pointing to a separate study of the so-called "tax gap" published last November.

"We could fund tuition-free college for all, eliminate child hunger, ensure clean drinking water for every American household, build half a million affordable housing units, provide masks to all."

--Sen. Bernie Sanders

The CBO analysis (pdf) out Wednesday found that massive Internal Revenue Service budget cuts and staff reductions over the past decade have resulted in a sharp decline in examination and enforcement of tax underpayment and avoidance.

"Enforcement activity for many high-income nonfilers has been reduced to a series of notices," the report says. The CBO's findings bolster reporting by ProPublica last year that found the IRS "now audits poor Americans at about the same rate as the top 1%" due in part to the high costs of examining the tax returns of the rich.

"The IRS examination rate for the largest corporations, those with $20 billion or more in assets, dropped by about half from 2010 to 2018," Sanders' office noted. "The wealthiest taxpayers, with more than $1 million in income, saw their audit rate cut by 63% during the same time period."

If the federal government collected the hundreds of billions in unpaid taxes owed mostly by the richest Americans, Sanders pointed out, "we could fund tuition-free college for all, eliminate child hunger, ensure clean drinking water for every American household, build half a million affordable housing units, provide masks to all, produce the protective gear and medical supplies our health workers need to combat this pandemic, and fully fund the U.S. Postal Service."

"That is an absolute outrage, and this report should make us take a long, hard look at what our national priorities are all about," said Sanders. "Congress is leaving hundreds of billions of dollars in taxes uncollected from the wealthy."

The CBO found that boosting the IRS budget for audits and collections by $20 billion over the next decade would increase federal tax revenue by $61 billion--and, as a result, reduce the federal budget deficit by $40 billion.

"For every dollar we invest in getting the IRS the staffing and resources it needs, we get three dollars back in unpaid taxes. Make no mistake: the primary beneficiaries of IRS funding cuts are wealthy tax cheats and large corporations," said Sanders. "Do not think for one second that the wealthiest country on Earth is unable to make critical investments to meet people's basic needs in terms of healthcare, food security, education, and unemployment."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A Congressional Budget Office report commissioned by Sen. Bernie Sanders and published Wednesday found the amount of unpaid taxes from 2011 to 2013 averaged around $381 billion per year, a revenue shortfall the Vermont senator called an "absolute outrage" that is largely the result of big corporations and "wealthy tax cheats" dodging their obligations.

"The richest 1% is responsible for 70% of all unpaid taxes," Sanders said in a statement late Wednesday, pointing to a separate study of the so-called "tax gap" published last November.

"We could fund tuition-free college for all, eliminate child hunger, ensure clean drinking water for every American household, build half a million affordable housing units, provide masks to all."

--Sen. Bernie Sanders

The CBO analysis (pdf) out Wednesday found that massive Internal Revenue Service budget cuts and staff reductions over the past decade have resulted in a sharp decline in examination and enforcement of tax underpayment and avoidance.

"Enforcement activity for many high-income nonfilers has been reduced to a series of notices," the report says. The CBO's findings bolster reporting by ProPublica last year that found the IRS "now audits poor Americans at about the same rate as the top 1%" due in part to the high costs of examining the tax returns of the rich.

"The IRS examination rate for the largest corporations, those with $20 billion or more in assets, dropped by about half from 2010 to 2018," Sanders' office noted. "The wealthiest taxpayers, with more than $1 million in income, saw their audit rate cut by 63% during the same time period."

If the federal government collected the hundreds of billions in unpaid taxes owed mostly by the richest Americans, Sanders pointed out, "we could fund tuition-free college for all, eliminate child hunger, ensure clean drinking water for every American household, build half a million affordable housing units, provide masks to all, produce the protective gear and medical supplies our health workers need to combat this pandemic, and fully fund the U.S. Postal Service."

"That is an absolute outrage, and this report should make us take a long, hard look at what our national priorities are all about," said Sanders. "Congress is leaving hundreds of billions of dollars in taxes uncollected from the wealthy."

The CBO found that boosting the IRS budget for audits and collections by $20 billion over the next decade would increase federal tax revenue by $61 billion--and, as a result, reduce the federal budget deficit by $40 billion.

"For every dollar we invest in getting the IRS the staffing and resources it needs, we get three dollars back in unpaid taxes. Make no mistake: the primary beneficiaries of IRS funding cuts are wealthy tax cheats and large corporations," said Sanders. "Do not think for one second that the wealthiest country on Earth is unable to make critical investments to meet people's basic needs in terms of healthcare, food security, education, and unemployment."

A Congressional Budget Office report commissioned by Sen. Bernie Sanders and published Wednesday found the amount of unpaid taxes from 2011 to 2013 averaged around $381 billion per year, a revenue shortfall the Vermont senator called an "absolute outrage" that is largely the result of big corporations and "wealthy tax cheats" dodging their obligations.

"The richest 1% is responsible for 70% of all unpaid taxes," Sanders said in a statement late Wednesday, pointing to a separate study of the so-called "tax gap" published last November.

"We could fund tuition-free college for all, eliminate child hunger, ensure clean drinking water for every American household, build half a million affordable housing units, provide masks to all."

--Sen. Bernie Sanders

The CBO analysis (pdf) out Wednesday found that massive Internal Revenue Service budget cuts and staff reductions over the past decade have resulted in a sharp decline in examination and enforcement of tax underpayment and avoidance.

"Enforcement activity for many high-income nonfilers has been reduced to a series of notices," the report says. The CBO's findings bolster reporting by ProPublica last year that found the IRS "now audits poor Americans at about the same rate as the top 1%" due in part to the high costs of examining the tax returns of the rich.

"The IRS examination rate for the largest corporations, those with $20 billion or more in assets, dropped by about half from 2010 to 2018," Sanders' office noted. "The wealthiest taxpayers, with more than $1 million in income, saw their audit rate cut by 63% during the same time period."

If the federal government collected the hundreds of billions in unpaid taxes owed mostly by the richest Americans, Sanders pointed out, "we could fund tuition-free college for all, eliminate child hunger, ensure clean drinking water for every American household, build half a million affordable housing units, provide masks to all, produce the protective gear and medical supplies our health workers need to combat this pandemic, and fully fund the U.S. Postal Service."

"That is an absolute outrage, and this report should make us take a long, hard look at what our national priorities are all about," said Sanders. "Congress is leaving hundreds of billions of dollars in taxes uncollected from the wealthy."

The CBO found that boosting the IRS budget for audits and collections by $20 billion over the next decade would increase federal tax revenue by $61 billion--and, as a result, reduce the federal budget deficit by $40 billion.

"For every dollar we invest in getting the IRS the staffing and resources it needs, we get three dollars back in unpaid taxes. Make no mistake: the primary beneficiaries of IRS funding cuts are wealthy tax cheats and large corporations," said Sanders. "Do not think for one second that the wealthiest country on Earth is unable to make critical investments to meet people's basic needs in terms of healthcare, food security, education, and unemployment."