Even as the Senate-passed coronavirus relief bill moves toward likely passage by the Democratic-controlled U.S. House of Representatives as early as Friday, progressives Thursday continued to raise their voices against--and urged lawmakers to stop--what they say is a massive corporate giveaway contained in the legislative package.

"Though Senate Democrats have said that they successfully negotiated adequate oversight for this money, I have a different definition of adequate," said Morris Pearl, chair of the Patriotic Millionaires and a former managing director at BlackRock, one the world's largest investment and money management firms.

"Under the bill as it stands," warned Pearl, "Secretary Steven Mnuchin would have nearly free rein to use that $500 billion to bail out any corporation he pleases, with almost no conditions, and would merely have to 'make himself available' to testify before Congress on those decisions after the fact."

While other progressive tax policy groups like Americans for Tax Fairness (ATF) acknowledged that "Democrat-led changes made it far more family and worker-focused," the overall balance of the Senate package "still favors corporate and business interests."

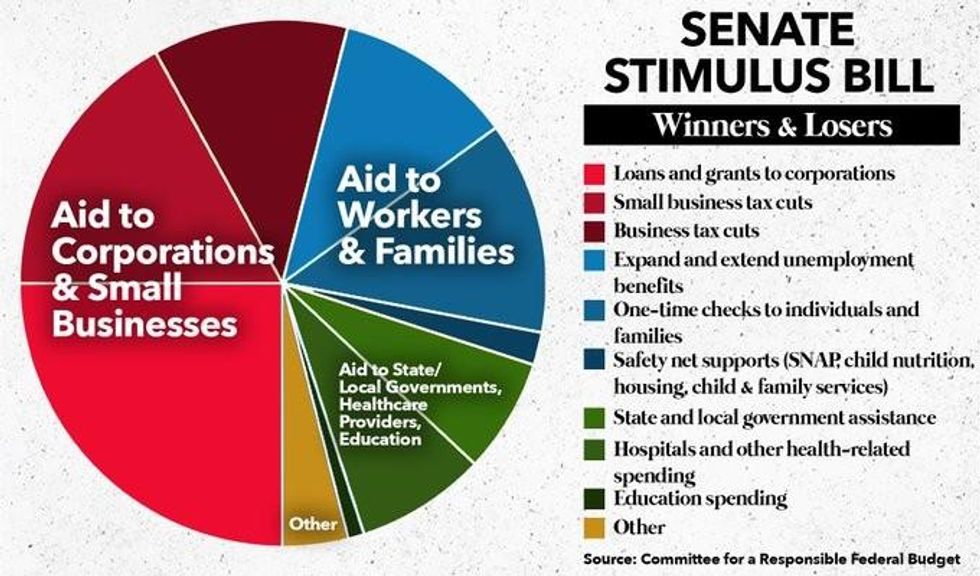

On Thursday, ATF put out a detailed breakdown of just how skewed to the corporate side the deal was:

As the above graphic shows, the $2.3 trillion in total funding was allotted as follows:

- 54% to corporations and small businesses through loans, grants and tax cuts

- 26% to workers and families, including 2% to safety net services

- 8% to hospitals and other health-related spending

- 7% to state and local governments

- 1% to education services

- 4% to other services

With Mnuchin--who developed a notorious reputation as the "Foreclosure King" following the 2008 financial crisis--largely in charge of the fund, critics warn that the so-called "oversight provision, including an inspector general and congressional panel, would amount to little more than limited and after-the-fact accountability.

"Instead of forcing American taxpayers to spend $500 billion subsidizing a fund for Secretary Mnuchin," said Pearl, "that money would be far better spent going directly back to the people, by ensuring financial security for poor and middle-class Americans in the months it will take to be rid of this disease."

Pointing out Mnuchin's role in pushing through the GOP's massive tax giveaway to corporate America and the very rich in 2017, Pearl added, "In what world does it seem like good economic practice to hand half a trillion dollars in taxpayer money to Secretary Mnuchin, a man whose only previous political achievement was helping pass a nearly $2 trillion tax cut for millionaires, billionaires, and corporations?"

Joining in opposition to the existence of the $500 billion corporate bailout mechanism, the progressive advocacy group Tax March called such a scenario "absolutely unacceptable" and launched a petition Thursday calling on the public to urge members of Congress to "remove the Mnuchin corporate slush fund and put the American people first."

"This crisis has reminded the nation that working people are the backbone of our economy," the petition reads. "The era of blank checks for corporations needs to end."

Maura Quint, the group's executive director, said in a statement ahead of the Senate vote Wednesday that Republicans were "using a global health crisis as a way to grab money for their rich friends and donors."

"Corporations already got a no-strings-attached bailout in the form of massive tax breaks through the Trump Tax Scam and then their CEOs used that money to gold-plate the bathrooms on their third yacht," Quint said. "Handing Mnuchin a huge slush fund to dole out at whim to his greedy friends is a non-starter and its inclusion in this bill is, to put it mildly, complete bullshit."

Morris agreed.

"Our economy can survive without a few more corporate bailouts at the whims of the Trump administration," he said, "but it cannot survive millions of people who need to work for a living becoming destitute. We need to do more for working people right now, not waste time and taxpayer money on a slush fund for rich business owners."