SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

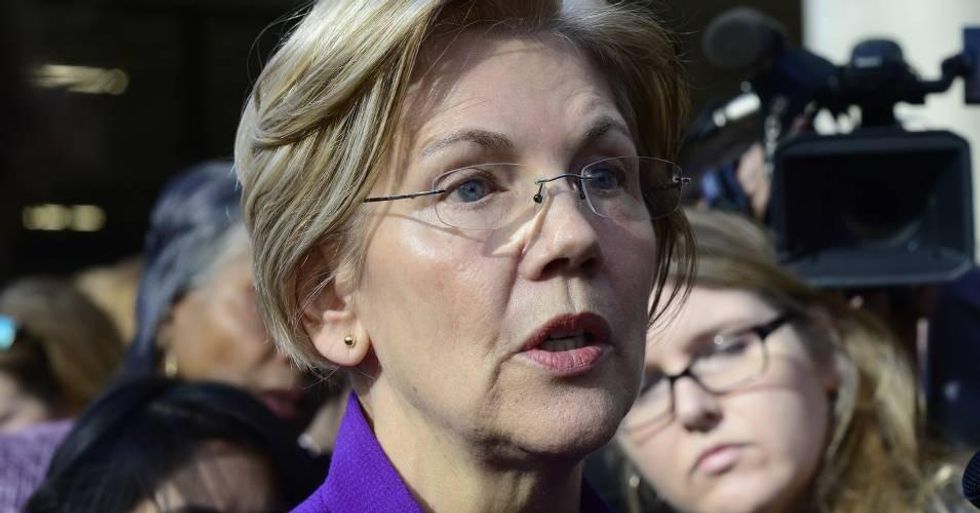

With the Senate voting on a Wall Street deregulation bill as early as Wednesday evening, U.S. Senator Elizabeth Warren (D-Mass.) marked today's 10-year anniversary of the financial crisis by unveiling new legislation that--in contrast to the "Bank Lobbyist Act"--aims to curb the fraud and greed of large financial institutions.

"The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients." --Sen. Elizabeth Warren"When Wall Street CEOs break the law, they should go to jail like anyone else. The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients," Warren declared in a statement.

Entitled "The Ending Too Big to Jail Act," the legislation (pdf) calls for three major changes to address the problem of financial executives not being held criminally responsible for the 2008 crisis. A fact-sheet laying out the proposals explains how they would:

Instead of passing the Bank Lobbyist Act, formally known as S. 2155, Warren said that "Congress should be marking the tenth anniversary of the financial crisis by strengthening rules on banks and bankers so Wall Street can never again get away with cheating Americans and crashing the economy."

Warren has been a vocal opponent of the deregulation bill--which the Congressional Budget Office (CBO) found would be a massive gift to some of the same Wall Street banks that led to the 2008 crash--and has also spoken out against her Democratic colleagues that are backing it.

Speaking on the Senate floor on Wednesday, Warren said that S. 2155 not only increases the chance for another financial meltdown, it has "landmines for American families." If it passes, she argued, the bill "guts protections for families that buy traditional and mobile homes and undermines our ability to enforce civil rights laws. And for what? So that banks that are already making record profits can tack on a little more to their bottom line?"

"If the Senate is going to spend two weeks dealing with the big banks, we should be making the rules tougher, not weaker. Today, I introduced the Ending Too Big to Jail Act, which would help make sure big bank executives are hauled out of their corner offices in handcuffs the next time they break the law," she continued. "That would do more for America's working families than anything in this bill--and I'm going to fight to make it the law."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

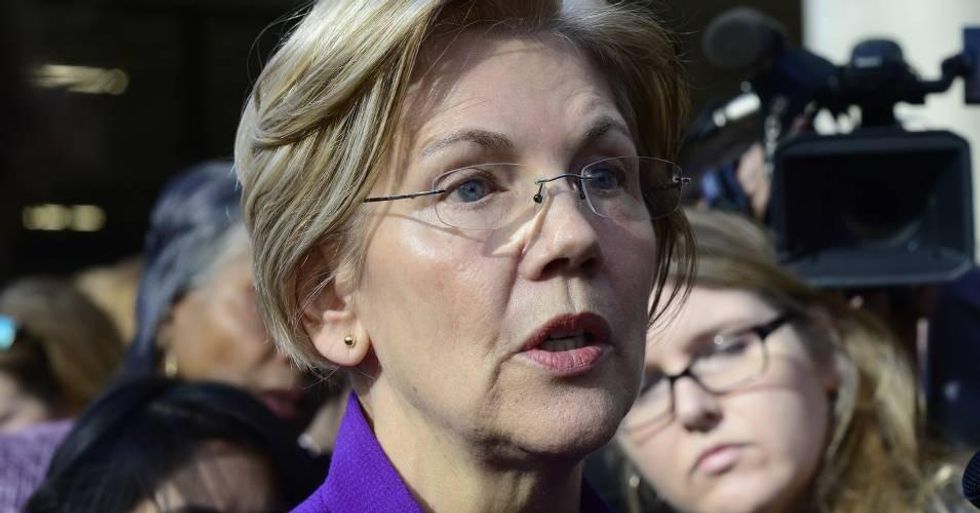

With the Senate voting on a Wall Street deregulation bill as early as Wednesday evening, U.S. Senator Elizabeth Warren (D-Mass.) marked today's 10-year anniversary of the financial crisis by unveiling new legislation that--in contrast to the "Bank Lobbyist Act"--aims to curb the fraud and greed of large financial institutions.

"The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients." --Sen. Elizabeth Warren"When Wall Street CEOs break the law, they should go to jail like anyone else. The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients," Warren declared in a statement.

Entitled "The Ending Too Big to Jail Act," the legislation (pdf) calls for three major changes to address the problem of financial executives not being held criminally responsible for the 2008 crisis. A fact-sheet laying out the proposals explains how they would:

Instead of passing the Bank Lobbyist Act, formally known as S. 2155, Warren said that "Congress should be marking the tenth anniversary of the financial crisis by strengthening rules on banks and bankers so Wall Street can never again get away with cheating Americans and crashing the economy."

Warren has been a vocal opponent of the deregulation bill--which the Congressional Budget Office (CBO) found would be a massive gift to some of the same Wall Street banks that led to the 2008 crash--and has also spoken out against her Democratic colleagues that are backing it.

Speaking on the Senate floor on Wednesday, Warren said that S. 2155 not only increases the chance for another financial meltdown, it has "landmines for American families." If it passes, she argued, the bill "guts protections for families that buy traditional and mobile homes and undermines our ability to enforce civil rights laws. And for what? So that banks that are already making record profits can tack on a little more to their bottom line?"

"If the Senate is going to spend two weeks dealing with the big banks, we should be making the rules tougher, not weaker. Today, I introduced the Ending Too Big to Jail Act, which would help make sure big bank executives are hauled out of their corner offices in handcuffs the next time they break the law," she continued. "That would do more for America's working families than anything in this bill--and I'm going to fight to make it the law."

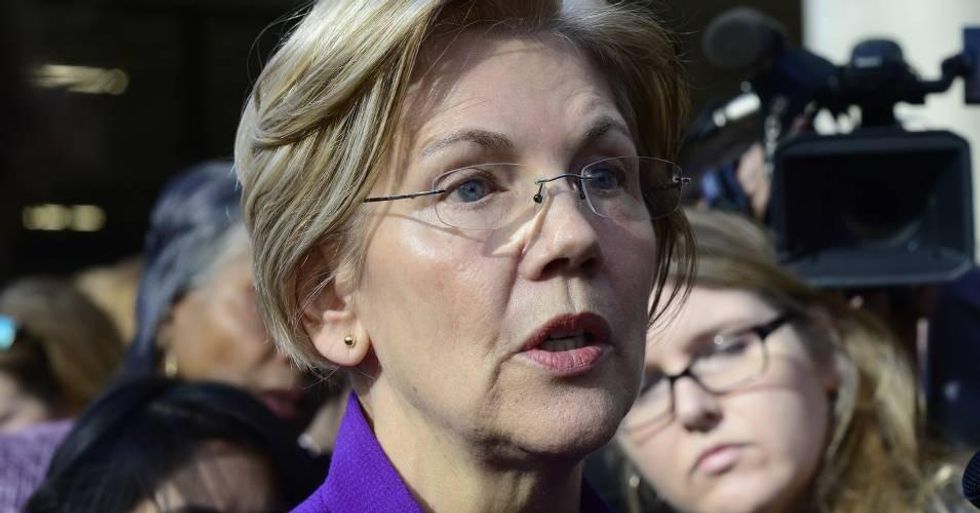

With the Senate voting on a Wall Street deregulation bill as early as Wednesday evening, U.S. Senator Elizabeth Warren (D-Mass.) marked today's 10-year anniversary of the financial crisis by unveiling new legislation that--in contrast to the "Bank Lobbyist Act"--aims to curb the fraud and greed of large financial institutions.

"The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients." --Sen. Elizabeth Warren"When Wall Street CEOs break the law, they should go to jail like anyone else. The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients," Warren declared in a statement.

Entitled "The Ending Too Big to Jail Act," the legislation (pdf) calls for three major changes to address the problem of financial executives not being held criminally responsible for the 2008 crisis. A fact-sheet laying out the proposals explains how they would:

Instead of passing the Bank Lobbyist Act, formally known as S. 2155, Warren said that "Congress should be marking the tenth anniversary of the financial crisis by strengthening rules on banks and bankers so Wall Street can never again get away with cheating Americans and crashing the economy."

Warren has been a vocal opponent of the deregulation bill--which the Congressional Budget Office (CBO) found would be a massive gift to some of the same Wall Street banks that led to the 2008 crash--and has also spoken out against her Democratic colleagues that are backing it.

Speaking on the Senate floor on Wednesday, Warren said that S. 2155 not only increases the chance for another financial meltdown, it has "landmines for American families." If it passes, she argued, the bill "guts protections for families that buy traditional and mobile homes and undermines our ability to enforce civil rights laws. And for what? So that banks that are already making record profits can tack on a little more to their bottom line?"

"If the Senate is going to spend two weeks dealing with the big banks, we should be making the rules tougher, not weaker. Today, I introduced the Ending Too Big to Jail Act, which would help make sure big bank executives are hauled out of their corner offices in handcuffs the next time they break the law," she continued. "That would do more for America's working families than anything in this bill--and I'm going to fight to make it the law."