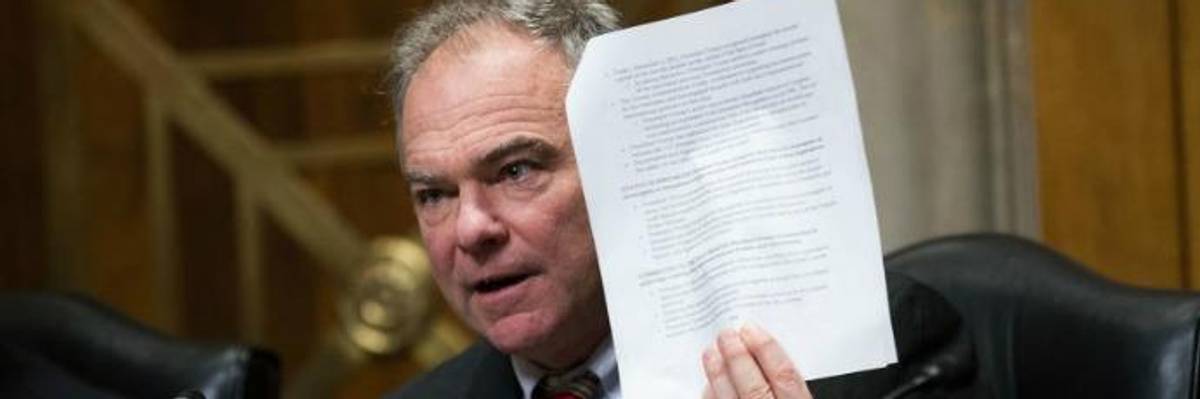

"Montanans and North Dakotans aren't itching to let bankers sell toxic mortgages again. In fact, if anything binds most Americans together, it's their mutual hatred of the banks," observed The Week's Jeff Spross. (Photo: Drew Angerer/Getty Images)

Democrats 'Fooling Themselves' to Think Wall Street Giveaway Will Bolster 2018 Chances, Progressives Warn

"The Democratic senators preparing to vote for this thing are either Wall Street toadies or complete political naifs."

Do Democrats actually believe that rewarding Wall Street will help them win re-election?

"There's no way that any vote in a red state or a blue state that supports Wall Street like this is a benefit at the polls."

--Charles Chamberlain, Democracy for America

That key question has been asked with growing frequency in recent days as a relatively large faction of centrist Democrats--led by Sens. Tim Kaine (D-Va.) and Heidi Heitkamp (N.D.)--has partnered with Republicans in the Senate to advance a deregulatory bill denounced by progressive lawmakers and independent commentators as a giveaway to massive banks and a possible catalyst for the next financial meltdown.

Robert Borasage, co-founder of Campaign for America's Future (CAF), argued in an interview with The Hill Tuesday that the final vote this week on the bank measure (S.2155) will be a "very significant thing, both symbolically and in substance."

As the GOP-crafted bill has sailed through the Senate, much of the media coverage has framed Democratic support for the legislation as pragmatism on the part of red-state senators facing tough re-election bids in 2018.

But progressives argue that any vote to relieve Wall Street will harm, not help, Democrats' chances--and new polling data (pdf) bolsters this view.

"There's no way that any vote in a red state or a blue state that supports Wall Street like this is a benefit at the polls," Charles Chamberlain, executive director of Democracy for America, told The Hill. "When you have a [Democratic Sen.] Jon Tester in Montana that votes in the wrong way on an issue like this, he's hurting his chances for reelection, he's not helping."

On Monday, 16 Democrats and Sen. Angus King (I-Maine) voted with the GOP to end debate on the deregulatory measure--labeled the "Bank Lobbyist Act" by Warren and other progressive opponents--effectively ensuring its passage later this week.

"The Democratic senators preparing to vote for this thing are either Wall Street toadies or complete political naifs."

--Jeff Spross, The Week

As CAF's Richard Eskow observed in an article on Tuesday, "These 16 Democrats have collectively received $24,488,961 in campaign contributions from savings and investment firms and commercial banks."

While Kaine and other corporate Democrats have attempted to insulate themselves from criticism by introducing amendments ostensibly aimed at improving the bill's enforcement provisions, The Intercept's Dave Dayen argues that these proposed changes are "pretend" fixes, given that Kaine openly admitted he will not fight for the changes.

"I don't need my amendment to pass," Kaine told a reporter on Monday. "I think the bill is solid as it is."

According to a survey (pdf) published last month by Public Policy Polling, most Americans are likely to disagree with Kaine's assessment. Most voters, including most Republicans, are far less likely to vote for a candidate who supports deregulating big banks, the poll found.

"Montanans and North Dakotans aren't itching to let bankers sell toxic mortgages again. In fact, if anything binds most Americans together, it's their mutual hatred of the banks," observed The Week's Jeff Spross on Tuesday. "The Democratic senators preparing to vote for this thing are either Wall Street toadies or complete political naifs. I leave it to readers to decide which is more likely. And which is worse."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Do Democrats actually believe that rewarding Wall Street will help them win re-election?

"There's no way that any vote in a red state or a blue state that supports Wall Street like this is a benefit at the polls."

--Charles Chamberlain, Democracy for America

That key question has been asked with growing frequency in recent days as a relatively large faction of centrist Democrats--led by Sens. Tim Kaine (D-Va.) and Heidi Heitkamp (N.D.)--has partnered with Republicans in the Senate to advance a deregulatory bill denounced by progressive lawmakers and independent commentators as a giveaway to massive banks and a possible catalyst for the next financial meltdown.

Robert Borasage, co-founder of Campaign for America's Future (CAF), argued in an interview with The Hill Tuesday that the final vote this week on the bank measure (S.2155) will be a "very significant thing, both symbolically and in substance."

As the GOP-crafted bill has sailed through the Senate, much of the media coverage has framed Democratic support for the legislation as pragmatism on the part of red-state senators facing tough re-election bids in 2018.

But progressives argue that any vote to relieve Wall Street will harm, not help, Democrats' chances--and new polling data (pdf) bolsters this view.

"There's no way that any vote in a red state or a blue state that supports Wall Street like this is a benefit at the polls," Charles Chamberlain, executive director of Democracy for America, told The Hill. "When you have a [Democratic Sen.] Jon Tester in Montana that votes in the wrong way on an issue like this, he's hurting his chances for reelection, he's not helping."

On Monday, 16 Democrats and Sen. Angus King (I-Maine) voted with the GOP to end debate on the deregulatory measure--labeled the "Bank Lobbyist Act" by Warren and other progressive opponents--effectively ensuring its passage later this week.

"The Democratic senators preparing to vote for this thing are either Wall Street toadies or complete political naifs."

--Jeff Spross, The Week

As CAF's Richard Eskow observed in an article on Tuesday, "These 16 Democrats have collectively received $24,488,961 in campaign contributions from savings and investment firms and commercial banks."

While Kaine and other corporate Democrats have attempted to insulate themselves from criticism by introducing amendments ostensibly aimed at improving the bill's enforcement provisions, The Intercept's Dave Dayen argues that these proposed changes are "pretend" fixes, given that Kaine openly admitted he will not fight for the changes.

"I don't need my amendment to pass," Kaine told a reporter on Monday. "I think the bill is solid as it is."

According to a survey (pdf) published last month by Public Policy Polling, most Americans are likely to disagree with Kaine's assessment. Most voters, including most Republicans, are far less likely to vote for a candidate who supports deregulating big banks, the poll found.

"Montanans and North Dakotans aren't itching to let bankers sell toxic mortgages again. In fact, if anything binds most Americans together, it's their mutual hatred of the banks," observed The Week's Jeff Spross on Tuesday. "The Democratic senators preparing to vote for this thing are either Wall Street toadies or complete political naifs. I leave it to readers to decide which is more likely. And which is worse."

Do Democrats actually believe that rewarding Wall Street will help them win re-election?

"There's no way that any vote in a red state or a blue state that supports Wall Street like this is a benefit at the polls."

--Charles Chamberlain, Democracy for America

That key question has been asked with growing frequency in recent days as a relatively large faction of centrist Democrats--led by Sens. Tim Kaine (D-Va.) and Heidi Heitkamp (N.D.)--has partnered with Republicans in the Senate to advance a deregulatory bill denounced by progressive lawmakers and independent commentators as a giveaway to massive banks and a possible catalyst for the next financial meltdown.

Robert Borasage, co-founder of Campaign for America's Future (CAF), argued in an interview with The Hill Tuesday that the final vote this week on the bank measure (S.2155) will be a "very significant thing, both symbolically and in substance."

As the GOP-crafted bill has sailed through the Senate, much of the media coverage has framed Democratic support for the legislation as pragmatism on the part of red-state senators facing tough re-election bids in 2018.

But progressives argue that any vote to relieve Wall Street will harm, not help, Democrats' chances--and new polling data (pdf) bolsters this view.

"There's no way that any vote in a red state or a blue state that supports Wall Street like this is a benefit at the polls," Charles Chamberlain, executive director of Democracy for America, told The Hill. "When you have a [Democratic Sen.] Jon Tester in Montana that votes in the wrong way on an issue like this, he's hurting his chances for reelection, he's not helping."

On Monday, 16 Democrats and Sen. Angus King (I-Maine) voted with the GOP to end debate on the deregulatory measure--labeled the "Bank Lobbyist Act" by Warren and other progressive opponents--effectively ensuring its passage later this week.

"The Democratic senators preparing to vote for this thing are either Wall Street toadies or complete political naifs."

--Jeff Spross, The Week

As CAF's Richard Eskow observed in an article on Tuesday, "These 16 Democrats have collectively received $24,488,961 in campaign contributions from savings and investment firms and commercial banks."

While Kaine and other corporate Democrats have attempted to insulate themselves from criticism by introducing amendments ostensibly aimed at improving the bill's enforcement provisions, The Intercept's Dave Dayen argues that these proposed changes are "pretend" fixes, given that Kaine openly admitted he will not fight for the changes.

"I don't need my amendment to pass," Kaine told a reporter on Monday. "I think the bill is solid as it is."

According to a survey (pdf) published last month by Public Policy Polling, most Americans are likely to disagree with Kaine's assessment. Most voters, including most Republicans, are far less likely to vote for a candidate who supports deregulating big banks, the poll found.

"Montanans and North Dakotans aren't itching to let bankers sell toxic mortgages again. In fact, if anything binds most Americans together, it's their mutual hatred of the banks," observed The Week's Jeff Spross on Tuesday. "The Democratic senators preparing to vote for this thing are either Wall Street toadies or complete political naifs. I leave it to readers to decide which is more likely. And which is worse."