The government agency tasked with shielding Americans from unfair practices by banks, creditors, and corporations announced Tuesday that it was taking steps to revise regulations for payday lenders--regarded by consumer protection advocates as predatory corporations that take advantage of people in dire financial straits.

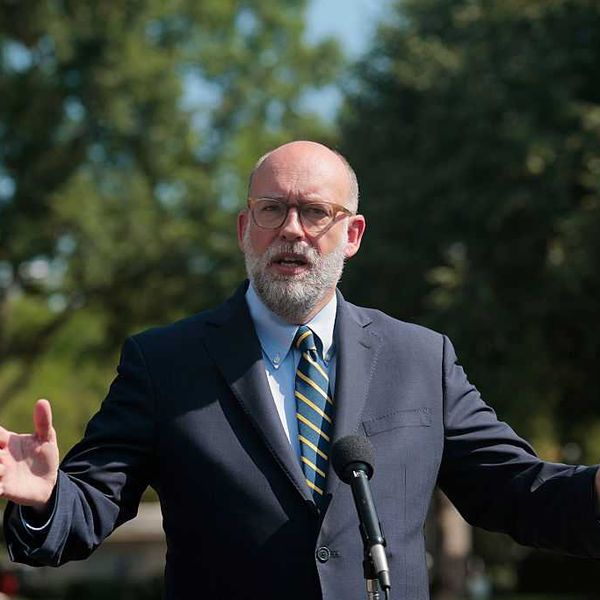

Weeks after being installed as the new director of the Consumer Financial Protection Bureau (CFPB), Mick Mulvaney issued a statement saying the agency would reconsider its Payday Rule, finalized only in October.

"By scrapping this rule, Mulvaney will allow his campaign donors to continue to generate massive fees peddling some of the most abusive financial products in existence."--Sen. Elizabeth Warren (D-Mass.)

The rule requires payday loan companies to vet borrowers to make sure they'll be able to pay back their small cash loans. Payday loans are required to be paid back on the borrower's next payday, some with interest rates exceeding 300 percent.

"The CFPB thoroughly and thoughtfully considered every aspect of this issue over the course of several years," Karl Frisch, executive director of the progressive group Allied Progress, said in a statement. "There is no reason to delay implementation of this rule--unless you are more concerned with the needs of payday lenders than you are with the interests of the consumers these financial bottom-feeders prey upon."

The CFPB's move signals a clear shift away from the stated mission of the watchdog agency--which was formed at the urging of Sen. Elizabeth Warren (D-Mass.) following the 2008 financial meltdown--and toward the agenda of Mulvaney, who has called the bureau "extraordinarily frightening" and "a sick, sad" joke in the past and said in a 2014 interview, "some of us would like to get rid of it."

Warren noted in a statement that payday lenders donated to Mulvaney's congressional campaigns when he represented South Carolina in the House, presenting a serious conflict of interest in Mulvaney's new role.

"Payday lenders spent $63,000 helping Mick Mulvaney get elected to Congress and now their investment is paying off many times over," Warren said. "By scrapping this rule, Mulvaney will allow his campaign donors to continue to generate massive fees peddling some of the most abusive financial products in existence."