Sen. Bob Corker (R-Tenn.) speaks while flanked by Senate Majority Leader Mitch McConnell (R-Ky.), Sen. John Cornyn (R-Texas), and Sen. Roy Blunt (R-Mo.) during a news conference after the Republican policy luncheon on Capitol Hill September 16, 2015 in Washington, D.C. (Photo: Mark Wilson/Getty Images)

It's Not Just Corker: 14 GOP Senators Stand to Reap Millions From #CorkerKickback

Trump, who made much of his fortune in real estate, would also stand to profit from the provision

The GOP tax bill expected to hit the floor of Congress for a vote Tuesday afternoon has been characterized as legislation "written for Republicans' wealthy campaign contributors," but a report published Monday made clear that Republicans are not just attempting to fatten the already-overflowing pockets of their donors--they're also doing all they can to "feather their own nests."

According to an analysis of federal records by the International Business Times (IBT), a "special provision" buried in the 500-page Republican tax bill--which has come to be known as the #CorkerKickback--could amount to a combined $14 million annual income boost for "more than a quarter of all GOP senators."

As IBT reports:

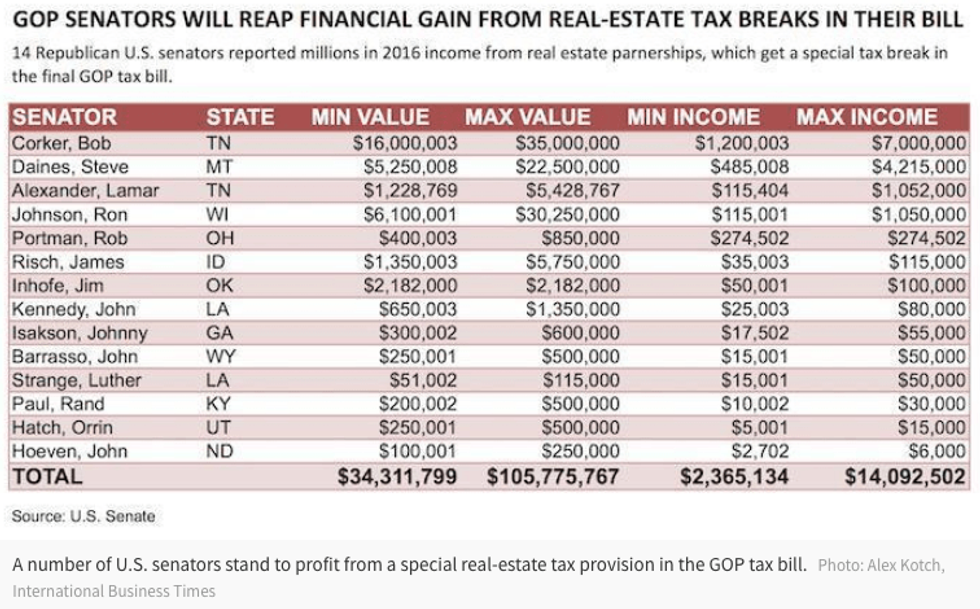

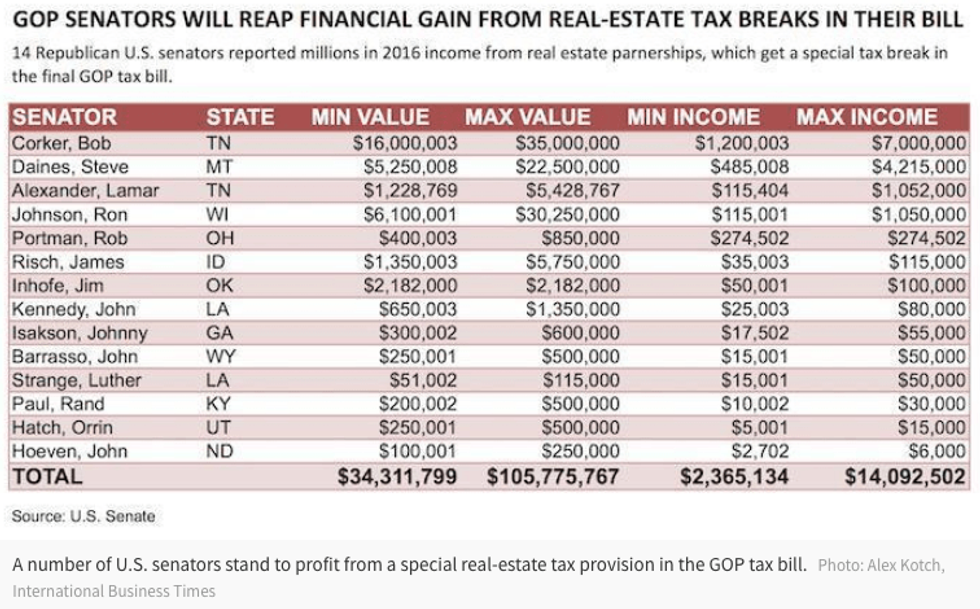

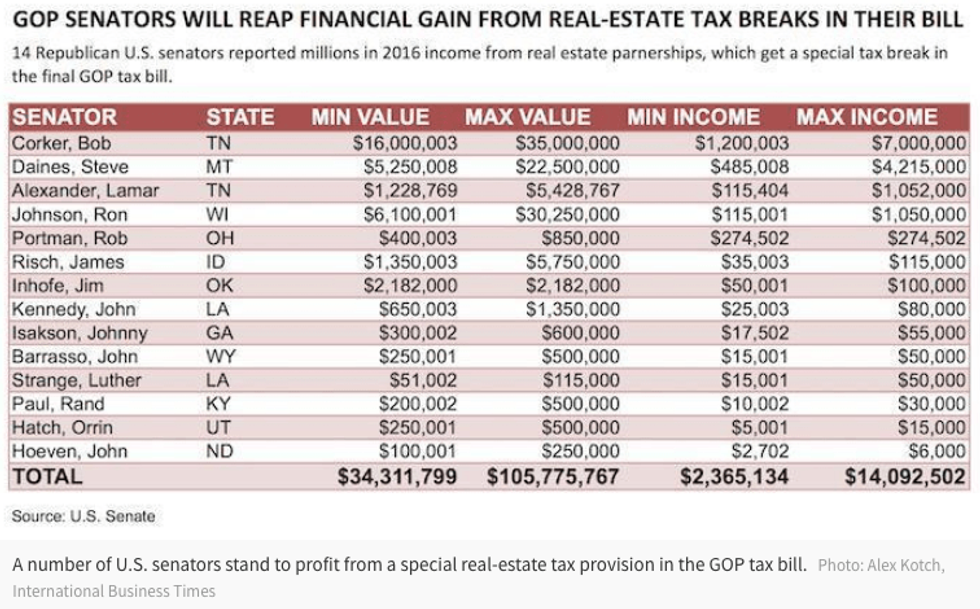

In all, 14 Republican senators (see list below) hold financial interests in 26 income-generating real-estate partnerships--worth as much as $105 million in total. Those holdings together produced between $2.4 million and $14.1 million in rent and interest income in 2016, according to federal records.

IBT first reported on the tax carve-out, which allows investors in "pass-through" entities, including real-estate partnerships such as LLCs and LPs, with few employees to deduct part of their income that passes through those partnerships.

Along with Sen. Bob Corker (R-Tenn.), one of the wealthiest members of Congress, the other senators who stand to benefit include Orrin Hatch (R-Utah)--who admitted on Monday that he authored the provision--and Ron Johnson, who has an estimated net worth of $36 million. Some of the senators on the list also happen to be recipients of large sums of campaign cash from the real estate industry, IBT adds.

Trump--who has claimed repeatedly and falsely that the tax bill will cost him and his rich friends "a fortune"--could also see a nice profit from the last-minute addition to a bill already stuffed with corporate giveaways. As IBT notes, Trump "owns or directs over 560 companies" that will get a tax cut thanks to the real estate pass-through provision.

The discovery of the #CorkerKickback quickly sparked fury on social media, which translated into intense pressure on Corker and other Republican senators to explain how a measure that would personally enrich them ended up in the final version of their deeply unpopular bill.

In a letter on Monday, Hatch expressed "disgust" at press reports suggesting that the provision may have been included for reasons of self-interest or in an effort to win Corker's vote. But, as IBT reports, Hatch didn't deny that he stands to benefit from the measure he is helping ram through Congress, nor did he "dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included" the "Corker Kickback."

As the lead editorial in Tuesday's New York Times notes, "The tax bill's generosity toward real estate titans stands in stark contrast to its stinginess toward the average wage earner as well as its very real damage to taxpayers in high-cost states."

"Whatever the Republicans' protestations," the Times concluded, "this malodorous loophole is further confirmation that congressional leaders are doing everything they can to maximize benefits for the wealthy at the expense of almost everybody else."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The GOP tax bill expected to hit the floor of Congress for a vote Tuesday afternoon has been characterized as legislation "written for Republicans' wealthy campaign contributors," but a report published Monday made clear that Republicans are not just attempting to fatten the already-overflowing pockets of their donors--they're also doing all they can to "feather their own nests."

According to an analysis of federal records by the International Business Times (IBT), a "special provision" buried in the 500-page Republican tax bill--which has come to be known as the #CorkerKickback--could amount to a combined $14 million annual income boost for "more than a quarter of all GOP senators."

As IBT reports:

In all, 14 Republican senators (see list below) hold financial interests in 26 income-generating real-estate partnerships--worth as much as $105 million in total. Those holdings together produced between $2.4 million and $14.1 million in rent and interest income in 2016, according to federal records.

IBT first reported on the tax carve-out, which allows investors in "pass-through" entities, including real-estate partnerships such as LLCs and LPs, with few employees to deduct part of their income that passes through those partnerships.

Along with Sen. Bob Corker (R-Tenn.), one of the wealthiest members of Congress, the other senators who stand to benefit include Orrin Hatch (R-Utah)--who admitted on Monday that he authored the provision--and Ron Johnson, who has an estimated net worth of $36 million. Some of the senators on the list also happen to be recipients of large sums of campaign cash from the real estate industry, IBT adds.

Trump--who has claimed repeatedly and falsely that the tax bill will cost him and his rich friends "a fortune"--could also see a nice profit from the last-minute addition to a bill already stuffed with corporate giveaways. As IBT notes, Trump "owns or directs over 560 companies" that will get a tax cut thanks to the real estate pass-through provision.

The discovery of the #CorkerKickback quickly sparked fury on social media, which translated into intense pressure on Corker and other Republican senators to explain how a measure that would personally enrich them ended up in the final version of their deeply unpopular bill.

In a letter on Monday, Hatch expressed "disgust" at press reports suggesting that the provision may have been included for reasons of self-interest or in an effort to win Corker's vote. But, as IBT reports, Hatch didn't deny that he stands to benefit from the measure he is helping ram through Congress, nor did he "dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included" the "Corker Kickback."

As the lead editorial in Tuesday's New York Times notes, "The tax bill's generosity toward real estate titans stands in stark contrast to its stinginess toward the average wage earner as well as its very real damage to taxpayers in high-cost states."

"Whatever the Republicans' protestations," the Times concluded, "this malodorous loophole is further confirmation that congressional leaders are doing everything they can to maximize benefits for the wealthy at the expense of almost everybody else."

The GOP tax bill expected to hit the floor of Congress for a vote Tuesday afternoon has been characterized as legislation "written for Republicans' wealthy campaign contributors," but a report published Monday made clear that Republicans are not just attempting to fatten the already-overflowing pockets of their donors--they're also doing all they can to "feather their own nests."

According to an analysis of federal records by the International Business Times (IBT), a "special provision" buried in the 500-page Republican tax bill--which has come to be known as the #CorkerKickback--could amount to a combined $14 million annual income boost for "more than a quarter of all GOP senators."

As IBT reports:

In all, 14 Republican senators (see list below) hold financial interests in 26 income-generating real-estate partnerships--worth as much as $105 million in total. Those holdings together produced between $2.4 million and $14.1 million in rent and interest income in 2016, according to federal records.

IBT first reported on the tax carve-out, which allows investors in "pass-through" entities, including real-estate partnerships such as LLCs and LPs, with few employees to deduct part of their income that passes through those partnerships.

Along with Sen. Bob Corker (R-Tenn.), one of the wealthiest members of Congress, the other senators who stand to benefit include Orrin Hatch (R-Utah)--who admitted on Monday that he authored the provision--and Ron Johnson, who has an estimated net worth of $36 million. Some of the senators on the list also happen to be recipients of large sums of campaign cash from the real estate industry, IBT adds.

Trump--who has claimed repeatedly and falsely that the tax bill will cost him and his rich friends "a fortune"--could also see a nice profit from the last-minute addition to a bill already stuffed with corporate giveaways. As IBT notes, Trump "owns or directs over 560 companies" that will get a tax cut thanks to the real estate pass-through provision.

The discovery of the #CorkerKickback quickly sparked fury on social media, which translated into intense pressure on Corker and other Republican senators to explain how a measure that would personally enrich them ended up in the final version of their deeply unpopular bill.

In a letter on Monday, Hatch expressed "disgust" at press reports suggesting that the provision may have been included for reasons of self-interest or in an effort to win Corker's vote. But, as IBT reports, Hatch didn't deny that he stands to benefit from the measure he is helping ram through Congress, nor did he "dispute that Corker voted against the Senate bill when it restricted him from getting a personal benefit, and then switched his position and announced his support for the final bill after it included" the "Corker Kickback."

As the lead editorial in Tuesday's New York Times notes, "The tax bill's generosity toward real estate titans stands in stark contrast to its stinginess toward the average wage earner as well as its very real damage to taxpayers in high-cost states."

"Whatever the Republicans' protestations," the Times concluded, "this malodorous loophole is further confirmation that congressional leaders are doing everything they can to maximize benefits for the wealthy at the expense of almost everybody else."