Senate Minority Leader Mitch McConnell was "dead wrong" during a recent interview on ABC, Bernie Sanders stated Monday. In the clip, McConnell declares that "the tax issue is finished" and the only way to move forward in debt ceiling negotiations will not be to increase revenue, but to make major spending cuts to programs like Social Security, Medicare and Medicaid.

Instead, Sanders argues, corporations and wealthy Americans should pay their fair share in taxes, which would increase greatly needed revenue and erase any fabricated need for austerity. Further spending cuts to the already starving social services would only hurt lower income and middle class families and would do greater harm to the country than McConnell's proclamations admit.

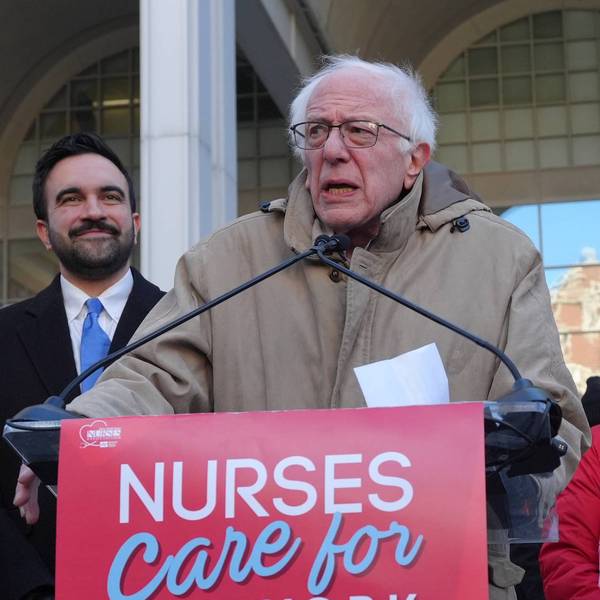

Sanders stated:

The fact of the matter is that tax revenue today amounts to only 15.7 percent of GDP, nearly the lowest in 60 years. Despite Sen. McConnell's position, the lack of revenue coming into the federal government must be addressed.

Today corporate profits are at an all-time high, while corporate income tax revenue as a percentage of GDP is near a record low.

At 1.6 percent, corporate revenue as a percentage of GDP is lower than any other major country in the Organization for Economic Cooperation and Development, including Britain, Germany, France, Japan, Canada, Norway, Australia, South Korea, Switzerland, Norway, Italy, Ireland, Poland, and Iceland.

According to Sanders, the average corporation paid a mere 12 per cent of profits in taxes in 2011--the lowest level since 1972--and in 2005 one out of every four corporations paid absolutely no income taxes at all despite massive profits.

Additionally, "large corporations and the wealthy" skip out on over $100 billion taxes per year through tax avoidance schemes such as offshore tax havens.

All of this, Sanders notes, comes in stark contrast to McConnell's declaration that "the biggest problem we have at the moment is spending."

Sanders continues:

I look forward to a serious debate in the Senate about how we do deficit reduction in a way that is fair. At a time when the middle class is disappearing and the number of people living in poverty is at an all-time high, do we cut programs that working families desperately depend upon, or do we ask the wealthiest people and largest corporations -- all of whom are doing phenomenally well--to start paying their fair share of taxes?