SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A chorus of poverty experts says that new data from the Census Bureau show the human cost of putting safety net programs like food stamps and unemployment insurance on the chopping block as austerity-pushers warn of the so-called "fiscal cliff."

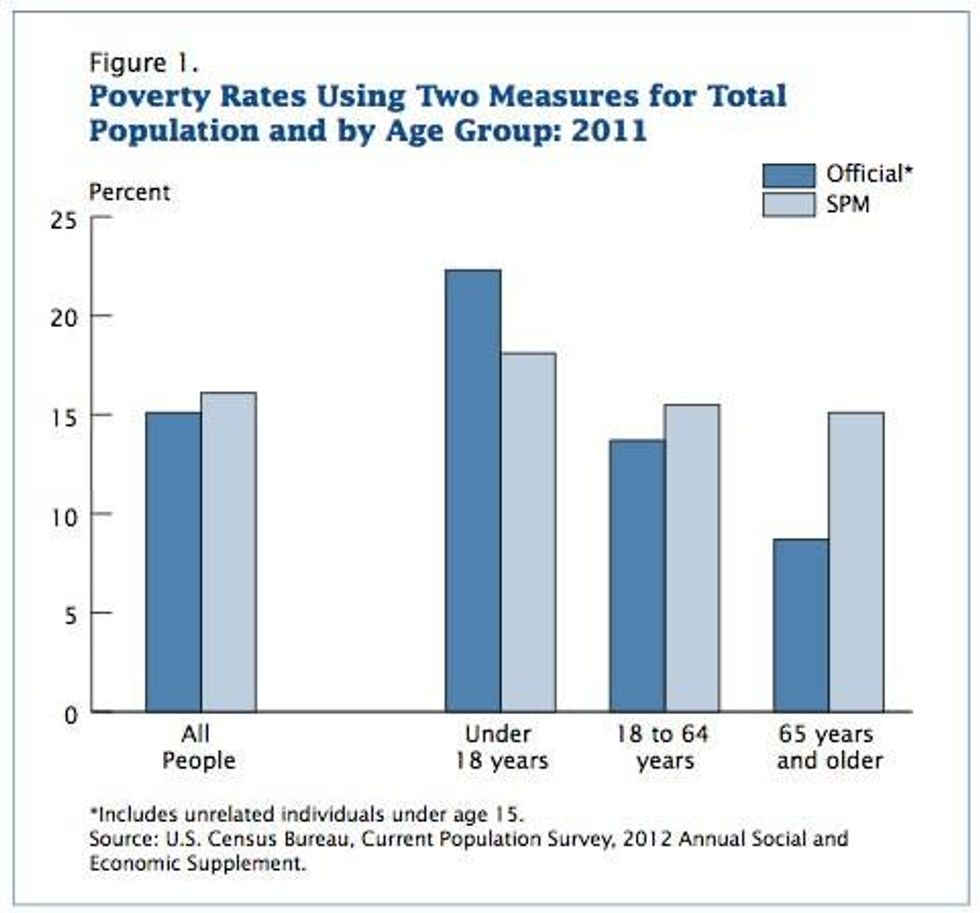

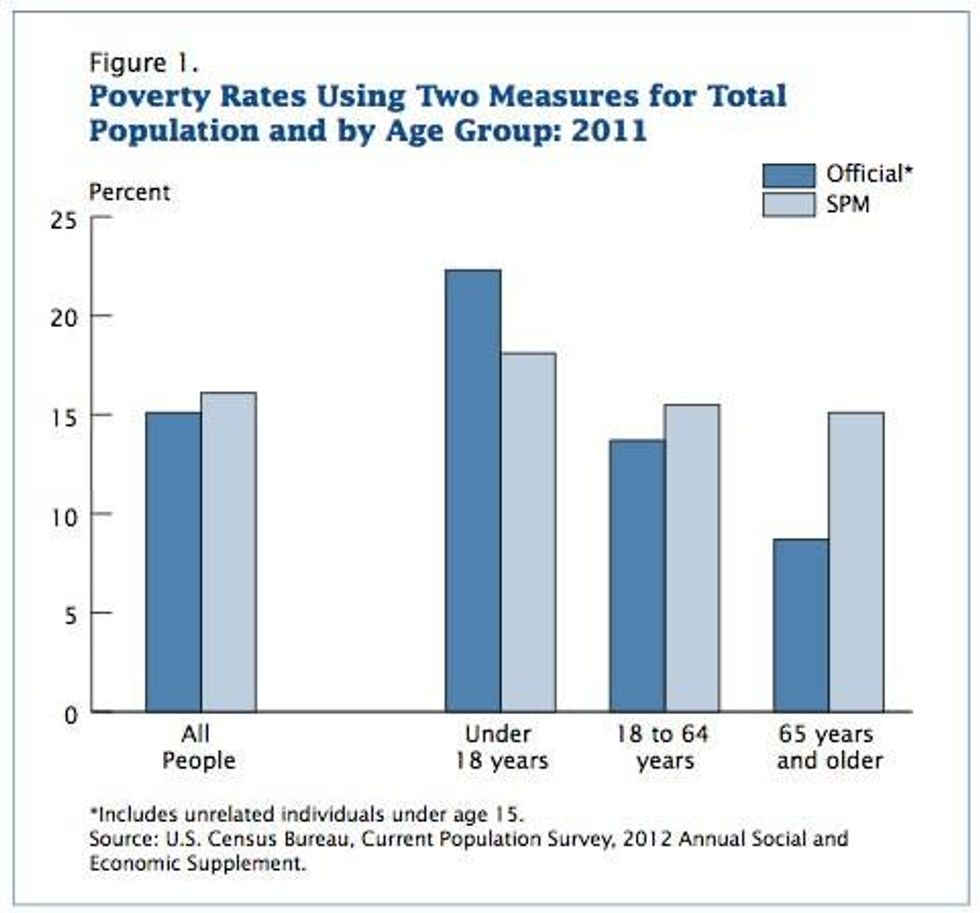

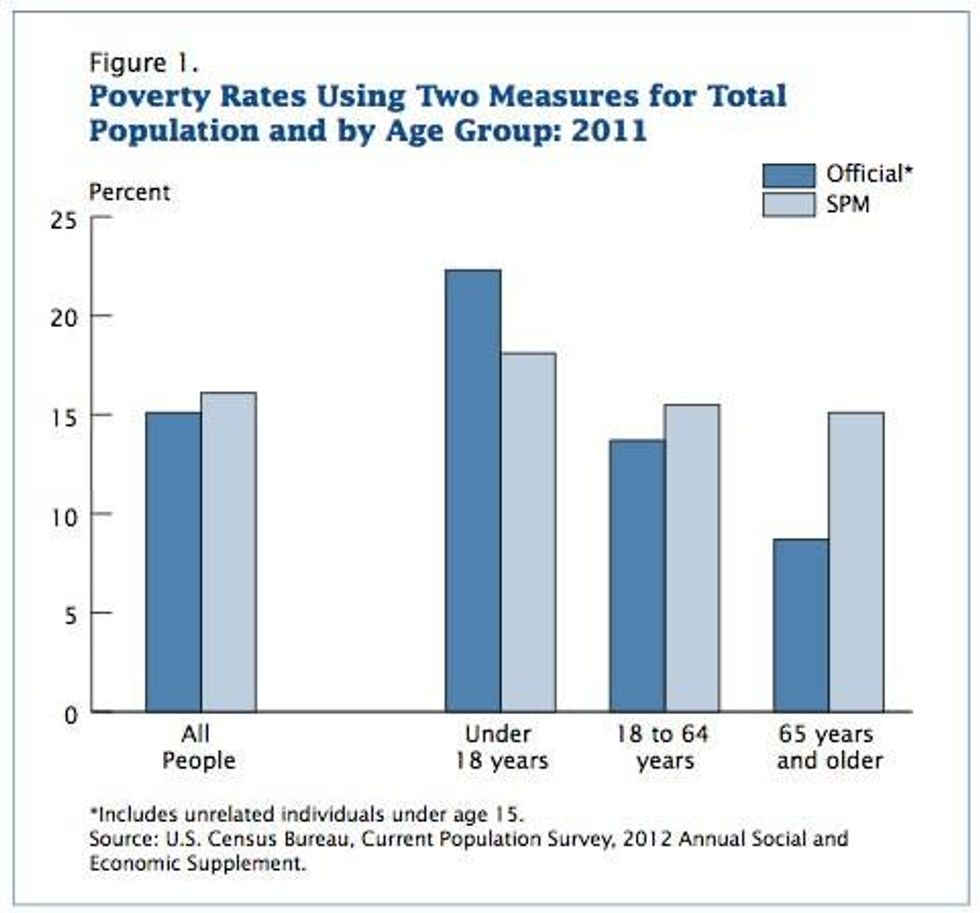

The new Supplemental Poverty Measure (SPM) released Wednesday from the U.S. Census Bureau shows 49.7 million Amerians living in poverty -- an increase from the 46.6 million reported in poverty in the Bureau's official estimate from September.

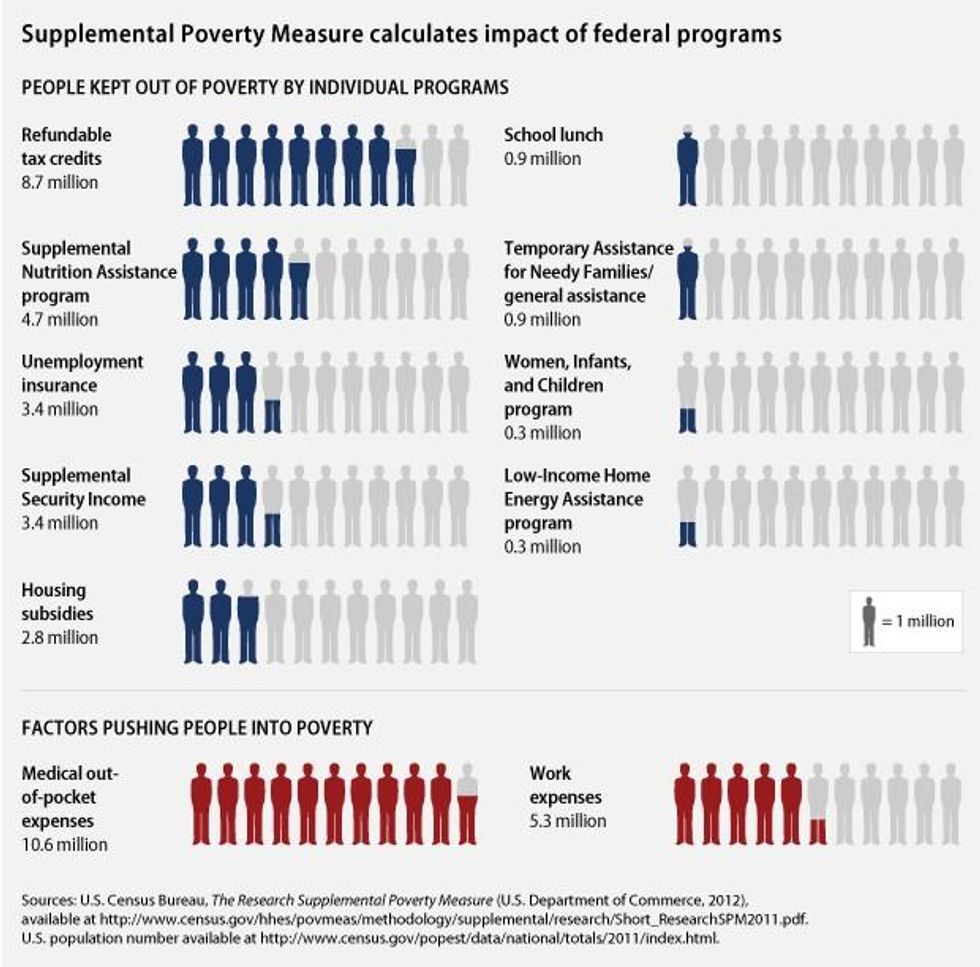

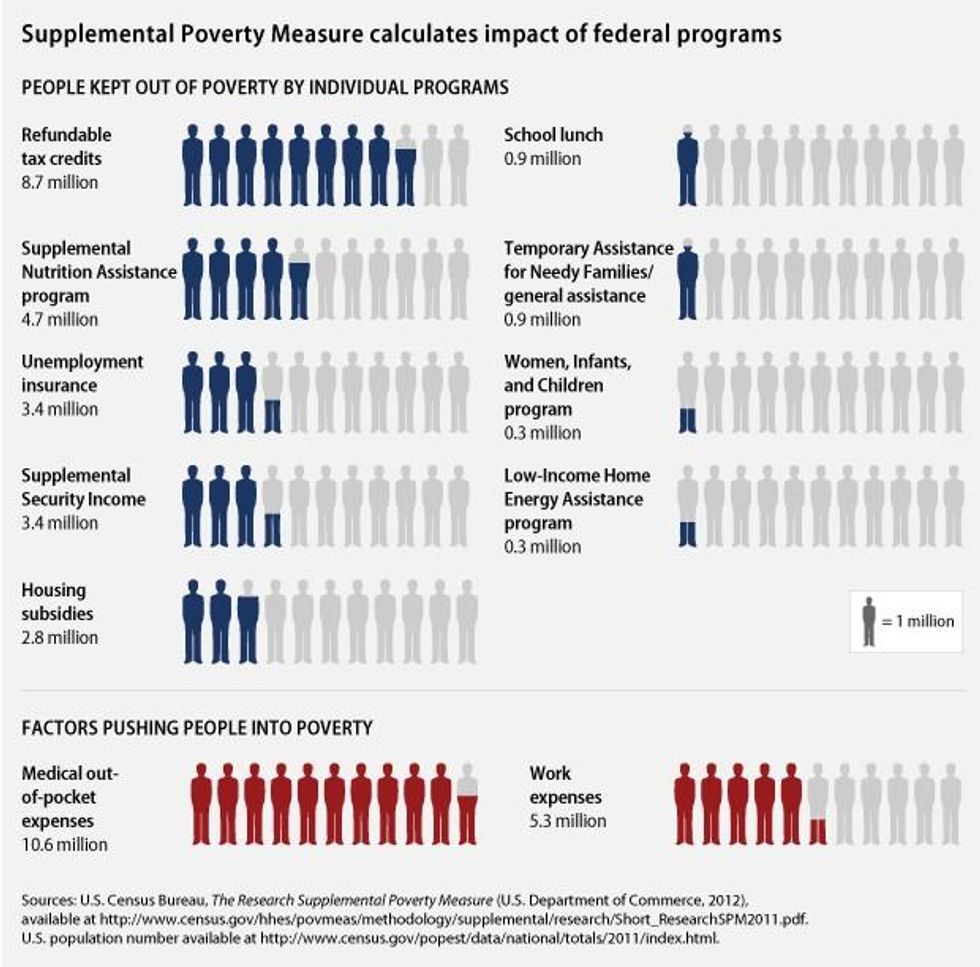

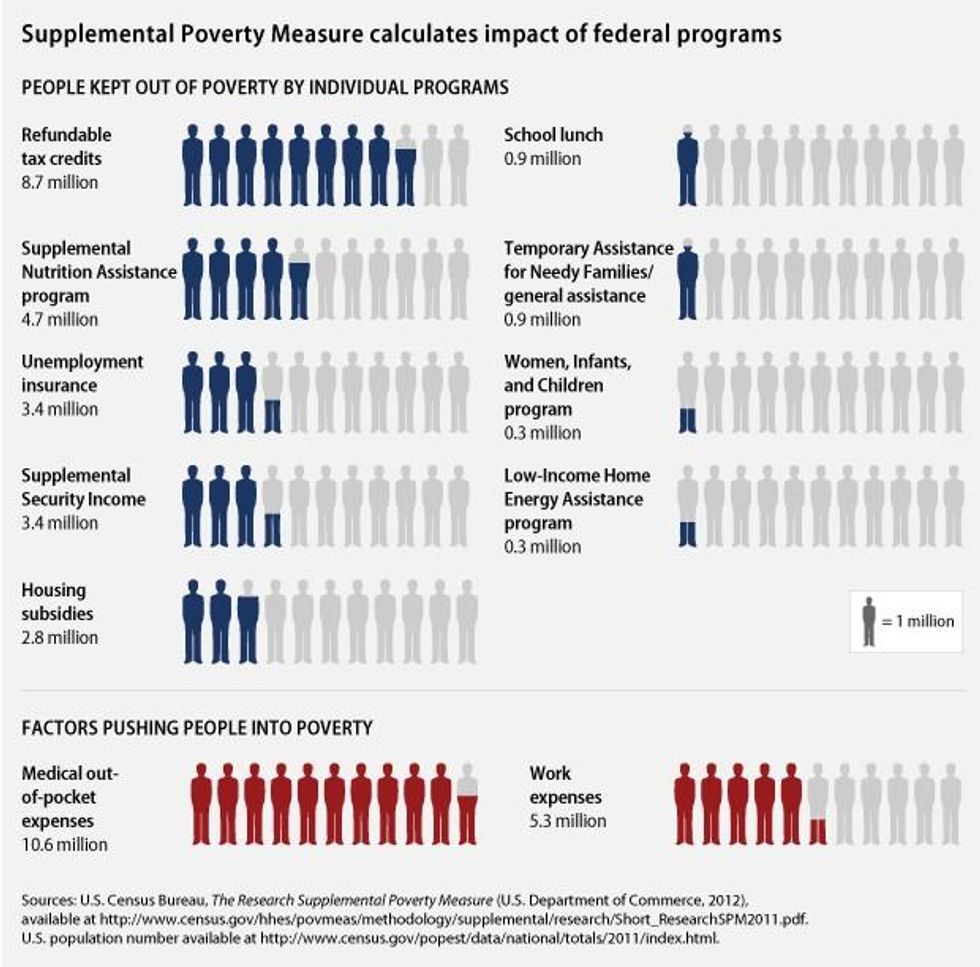

What the data also show is how government safety programs have kept millions from heading into poverty.

In contrast to the federal poverty figures released by the Census Bureau roughly two months ago, the SPM offers a more holistic look at poverty, explains Melissa Boteach, Director of the Poverty and Prosperity Program for Center for American Progress and Director of Half in Ten, "by taking into account factors such as work expenses and medical costs that push families into poverty. They also provide crucial information on the effectiveness of work and income supports in lifting families above the poverty line."

The fact that the SPM shows these programs keep people out of poverty proves austerity-pushing voices like that of Paul Ryan wrong, says Greg Kaufmann, whose blog on The Nation focuses on poverty. Kaufmann says that "Paul Ryan says we don't look at whether programs are working, we just throw money at problems. He's wrong. SPM is an example of how we look at whether programs are working and find that poverty would be much worse without SNAP (food stamps), child tax credits, the Earned Income Tax Credit (EITC), unemployment insurance, etc. -- all of the things the GOP and some democrats will attack during 'cliff' negotiations."

Boteach points out the millions who've escaped poverty through safety net programs, as shown in the new SPM:

Refundable tax credits for working families such as the earned income and child tax credits, for example, lifted 8.7 million people out of poverty in 2011, and the child poverty rate would have been 6.3 percentage points higher without them. Similarly, the Supplemental Nutrition Assistance Program lifted 4.7 million people out of poverty in 2011. Without it, the child poverty rate would have been 2.9 percentage points higher.

David Cooper, an economic analyst at the left-leaning Economic Policy Institute writes that that figures offer a blunt reminder of the human toll cuts to safety net government programs would have:

As Congress debates how to address the looming "fiscal obstacle course," [Wednesday's] release is a stark reminder of what is at stake. Budgetary decisions have real world consequences. Lawmakers must remember that the choices they make are not simply reconciling numbers in the federal ledger; for millions of Americans, these decisions are the difference between meeting their family's basic needs and falling into poverty.

The SPM's documentation of the poverty-saving benefits of these safety nets couldn't be more timely, Arloc Sherman, a senior researcher at the Center on Budget and Policy Priorities adds:

First, in coming weeks policymakers will likely consider deep program cuts as part of major budget negotiations. Second, key measures that account for part of the safety net's large anti-poverty impact are poised to expire. These include federal emergency unemployment insurance and the 2009 Recovery Act's improvements in refundable tax credits like the EITC. Third, this is all happening at a time when joblessness - particularly long-term joblessness - remains elevated and the need for safety net programs remains strong, both to reduce hardship for jobless households and to maintain the strength of the economy overall.

The SPM makes clear that, to help avert any rise in poverty going forward, federal and state policymakers need to protect programs like unemployment insurance, housing assistance, and nutrition programs. And they should extend key recent, recession-related improvements to these programs, such as those in unemployment benefits and working-family tax credits like the EITC.

Also included in this more comprehensive measure of poverty is Medical Out-of-Pocket Expenses (MOOP), which, as the graphic below shows, is pushing millions into poverty, a fact that would be eliminated by a national, single-payer health program.

* * *

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A chorus of poverty experts says that new data from the Census Bureau show the human cost of putting safety net programs like food stamps and unemployment insurance on the chopping block as austerity-pushers warn of the so-called "fiscal cliff."

The new Supplemental Poverty Measure (SPM) released Wednesday from the U.S. Census Bureau shows 49.7 million Amerians living in poverty -- an increase from the 46.6 million reported in poverty in the Bureau's official estimate from September.

What the data also show is how government safety programs have kept millions from heading into poverty.

In contrast to the federal poverty figures released by the Census Bureau roughly two months ago, the SPM offers a more holistic look at poverty, explains Melissa Boteach, Director of the Poverty and Prosperity Program for Center for American Progress and Director of Half in Ten, "by taking into account factors such as work expenses and medical costs that push families into poverty. They also provide crucial information on the effectiveness of work and income supports in lifting families above the poverty line."

The fact that the SPM shows these programs keep people out of poverty proves austerity-pushing voices like that of Paul Ryan wrong, says Greg Kaufmann, whose blog on The Nation focuses on poverty. Kaufmann says that "Paul Ryan says we don't look at whether programs are working, we just throw money at problems. He's wrong. SPM is an example of how we look at whether programs are working and find that poverty would be much worse without SNAP (food stamps), child tax credits, the Earned Income Tax Credit (EITC), unemployment insurance, etc. -- all of the things the GOP and some democrats will attack during 'cliff' negotiations."

Boteach points out the millions who've escaped poverty through safety net programs, as shown in the new SPM:

Refundable tax credits for working families such as the earned income and child tax credits, for example, lifted 8.7 million people out of poverty in 2011, and the child poverty rate would have been 6.3 percentage points higher without them. Similarly, the Supplemental Nutrition Assistance Program lifted 4.7 million people out of poverty in 2011. Without it, the child poverty rate would have been 2.9 percentage points higher.

David Cooper, an economic analyst at the left-leaning Economic Policy Institute writes that that figures offer a blunt reminder of the human toll cuts to safety net government programs would have:

As Congress debates how to address the looming "fiscal obstacle course," [Wednesday's] release is a stark reminder of what is at stake. Budgetary decisions have real world consequences. Lawmakers must remember that the choices they make are not simply reconciling numbers in the federal ledger; for millions of Americans, these decisions are the difference between meeting their family's basic needs and falling into poverty.

The SPM's documentation of the poverty-saving benefits of these safety nets couldn't be more timely, Arloc Sherman, a senior researcher at the Center on Budget and Policy Priorities adds:

First, in coming weeks policymakers will likely consider deep program cuts as part of major budget negotiations. Second, key measures that account for part of the safety net's large anti-poverty impact are poised to expire. These include federal emergency unemployment insurance and the 2009 Recovery Act's improvements in refundable tax credits like the EITC. Third, this is all happening at a time when joblessness - particularly long-term joblessness - remains elevated and the need for safety net programs remains strong, both to reduce hardship for jobless households and to maintain the strength of the economy overall.

The SPM makes clear that, to help avert any rise in poverty going forward, federal and state policymakers need to protect programs like unemployment insurance, housing assistance, and nutrition programs. And they should extend key recent, recession-related improvements to these programs, such as those in unemployment benefits and working-family tax credits like the EITC.

Also included in this more comprehensive measure of poverty is Medical Out-of-Pocket Expenses (MOOP), which, as the graphic below shows, is pushing millions into poverty, a fact that would be eliminated by a national, single-payer health program.

* * *

A chorus of poverty experts says that new data from the Census Bureau show the human cost of putting safety net programs like food stamps and unemployment insurance on the chopping block as austerity-pushers warn of the so-called "fiscal cliff."

The new Supplemental Poverty Measure (SPM) released Wednesday from the U.S. Census Bureau shows 49.7 million Amerians living in poverty -- an increase from the 46.6 million reported in poverty in the Bureau's official estimate from September.

What the data also show is how government safety programs have kept millions from heading into poverty.

In contrast to the federal poverty figures released by the Census Bureau roughly two months ago, the SPM offers a more holistic look at poverty, explains Melissa Boteach, Director of the Poverty and Prosperity Program for Center for American Progress and Director of Half in Ten, "by taking into account factors such as work expenses and medical costs that push families into poverty. They also provide crucial information on the effectiveness of work and income supports in lifting families above the poverty line."

The fact that the SPM shows these programs keep people out of poverty proves austerity-pushing voices like that of Paul Ryan wrong, says Greg Kaufmann, whose blog on The Nation focuses on poverty. Kaufmann says that "Paul Ryan says we don't look at whether programs are working, we just throw money at problems. He's wrong. SPM is an example of how we look at whether programs are working and find that poverty would be much worse without SNAP (food stamps), child tax credits, the Earned Income Tax Credit (EITC), unemployment insurance, etc. -- all of the things the GOP and some democrats will attack during 'cliff' negotiations."

Boteach points out the millions who've escaped poverty through safety net programs, as shown in the new SPM:

Refundable tax credits for working families such as the earned income and child tax credits, for example, lifted 8.7 million people out of poverty in 2011, and the child poverty rate would have been 6.3 percentage points higher without them. Similarly, the Supplemental Nutrition Assistance Program lifted 4.7 million people out of poverty in 2011. Without it, the child poverty rate would have been 2.9 percentage points higher.

David Cooper, an economic analyst at the left-leaning Economic Policy Institute writes that that figures offer a blunt reminder of the human toll cuts to safety net government programs would have:

As Congress debates how to address the looming "fiscal obstacle course," [Wednesday's] release is a stark reminder of what is at stake. Budgetary decisions have real world consequences. Lawmakers must remember that the choices they make are not simply reconciling numbers in the federal ledger; for millions of Americans, these decisions are the difference between meeting their family's basic needs and falling into poverty.

The SPM's documentation of the poverty-saving benefits of these safety nets couldn't be more timely, Arloc Sherman, a senior researcher at the Center on Budget and Policy Priorities adds:

First, in coming weeks policymakers will likely consider deep program cuts as part of major budget negotiations. Second, key measures that account for part of the safety net's large anti-poverty impact are poised to expire. These include federal emergency unemployment insurance and the 2009 Recovery Act's improvements in refundable tax credits like the EITC. Third, this is all happening at a time when joblessness - particularly long-term joblessness - remains elevated and the need for safety net programs remains strong, both to reduce hardship for jobless households and to maintain the strength of the economy overall.

The SPM makes clear that, to help avert any rise in poverty going forward, federal and state policymakers need to protect programs like unemployment insurance, housing assistance, and nutrition programs. And they should extend key recent, recession-related improvements to these programs, such as those in unemployment benefits and working-family tax credits like the EITC.

Also included in this more comprehensive measure of poverty is Medical Out-of-Pocket Expenses (MOOP), which, as the graphic below shows, is pushing millions into poverty, a fact that would be eliminated by a national, single-payer health program.

* * *